The Challenge for Cashless Consumption

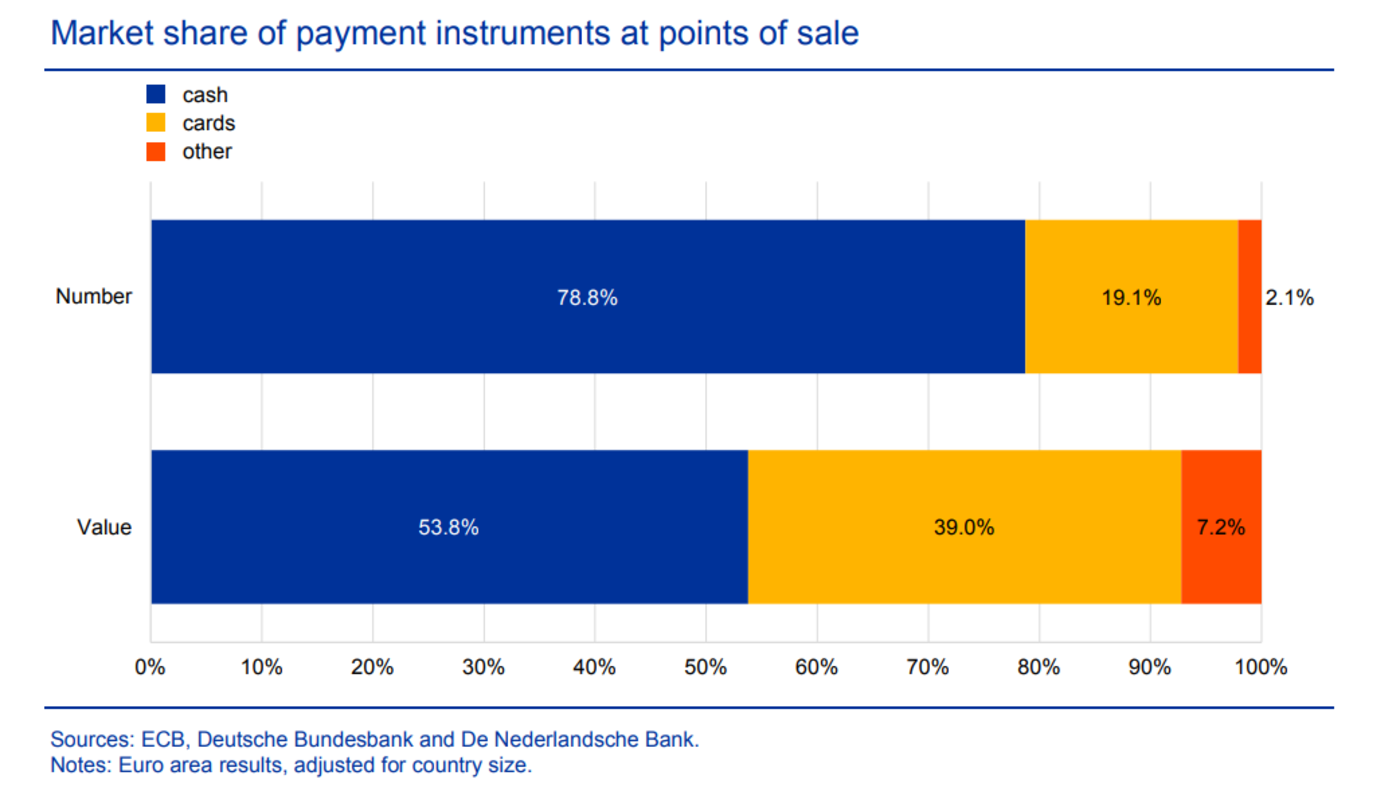

Despite the ubiquitous nature of smartphones in much of Europe coupled with a digital payment system that is (in my opinion) superior to what is available in the United States, consumers in the Eurozone still use an awful lot more cash than one would expect.

ECB study shows most point-of-sale payments in the euro area are cash, but more people say they prefer to pay by card.

So are those crazy Europeans financial Luddites? After all, it is certainly much easier to pay for purchases with one’s fingerprint or a simple glance at one’s smartphone than to have to keep hitting the ATM and risk misplacing your cash.

For those of you who have spent significant time in the Eurozone, the answer to this riddle is probably intuitive. Hello VAT! The dreaded Value Added Tax is likely the culprit here. It is akin to a sales tax and in most Eurozone countries is well over 20%! How do you get around such a painful tax burden? Cash. In my second home of Italy, it is common practice to pay for dinner at a restaurant at which you are a frequent guest in cash, paying less in the process.

There is also in some parts of Europe greater concern with protecting privacy when it comes to where one spends and upon what. Nations that have lived under totalitarian dictatorships tend to be more wary of the consequences of having much of one’s live known to those in positions of power.

While today cash is the workaround to high tax burdens, serving as a headwind to our Cashless Consumption investing theme. This is unlikely to remain the case for long as cryptocurrencies become increasingly mainstream. These solutions are able to provide the privacy of cash with the convenience of cashless payment systems and are even able to provide benefits far beyond what is possible with today’s payment systems.

Be sure to keep an eye out as we delve further into the possibilities and evolution of these new forms of currency and blockchain technology.

Source: Europeans Still Love Paying Cash, Even if They Don’t Know It – Bloomberg