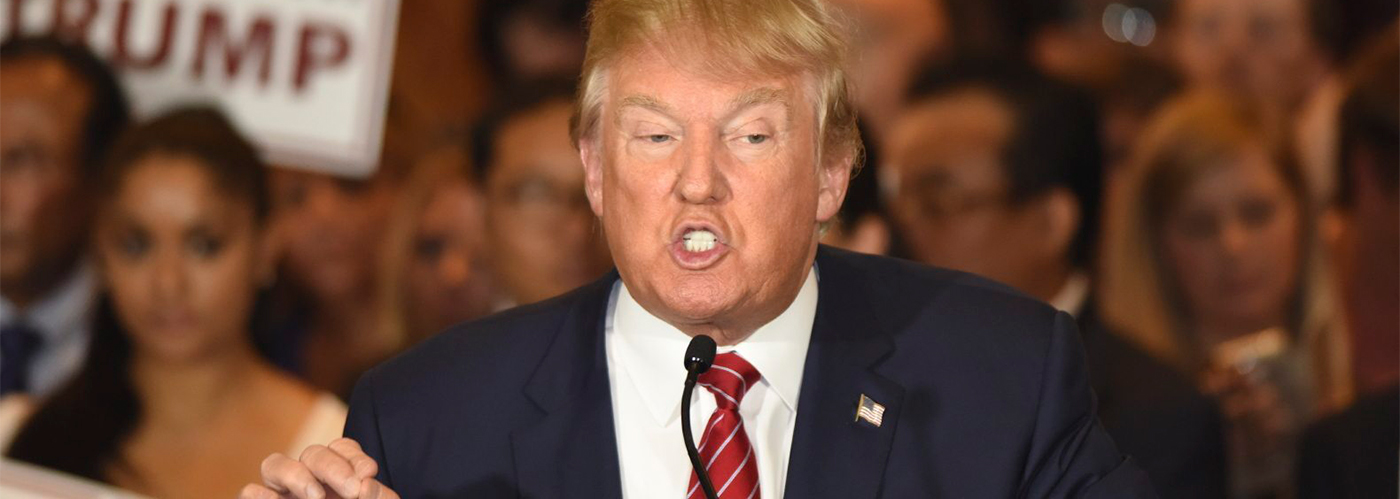

Which Sectors Should Investors Avoid Thanks to President Trump?

Recently, in preparing for a TV interview, I was asked by the producer of the show,

Which sectors will President Trump help and which ones will he hurt?

Ugh.

If I had a nickel for every time I’ve been asked the question “which sectors do you like?” … well, then I would probably be sitting on a beach somewhere a long way from my computer typing this note to you.

It seems that at least once or twice per week I am asked, in some form or another, one of the following questions:

What sectors do you rate as a buy right now?

Do you like Financials? What about Technology?

What is going to be the next big sector?

What sectors do you think are best in bull markets?

And which ones are best for sheltering gains in bear markets?

My short answer to any sector questions is simple: I like none of them.

But, at the same time, I can also say I like all sectors.

Or more specifically, I like certain aspects of every sector, while I also dislike aspects of all sectors.

Confused?

Guess it’s not so simple of an answer . . . such is the life of a thematic investor.

A Better Approach to Sector Investing

In my view, thinking of investments from a sector perspective is out-dated at best, and fatally flawed at worst.

Today’s business environment has made it impossible to identify any one or two sectors as having the most potential. For the lack of a better word, a new paradigm is required to successfully analyze the market . . .

With our ever-changing technology and the fast pace at which trends are emerging and spreading globally, it’s oversimplifying to identify any one or two sectors as having the most potential. In any sector, there will be some companies that seize on a new opportunity faster than others as new trends or themes emerge in today’s world.

And then there are those companies that will literally jump sectors as a trend emerges — does anyone think of Alphabet (formerly Google) as an auto company? Well, they very well could be in the next several years if its self-driving project is successful.

What sector does Amazon (AMZN) fall into? Sure, it’s operations make it the giant gorilla of the eCommerce space — so much so that we are starting to wonder if the Justice Department will start poking around from an anti-trust perspective. But most of Amazon’s profits are derived from the company’s cloud web services group, so does that make it a technology-sector company, not a retailer?

For reasons such as these and many others, traditional sector-based investing doesn’t fit into our mindset at all at my research firm, Tematica Research. When we analyze the market landscape, we instead approach it from an entirely different perspective.

Here’s what I mean . . .

In a traditional sector-based view of investing, Apple (AAPL), Alphabet (GOOGL) and Facebook (FB), would be slotted into Technology, Internet Software and Media sectors respectively. So, an investor could think, “Apple’s stock seems to be struggling lately, and so the Technology sector is probably a little over-heated and maybe we should move away from that.”

To view Apple as a technology-sector company, however, would potentially lead an investor to be overly consumed with simply the latest iPhone sales figures. A sector-based lens would fail to see, let alone understand how Apple isn’t just shipping out hardware, but is actually re-shaping the media we consume (Apple Music and AppleTV), the services we are utilizing (through its billions of app downloads) and how we are paying for those purchases that we make (Apple Pay).

The same can be said for Alphabet (formerly Google) and Facebook — a sector-based lens would fail to see how these two apparent “media-sector” companies are pushing into retail sales and financial services and are poised to change how we shop, how we pay, and how we save. And then there’s the automotive category, mentioned above, where both Apple and Alphabet are beginning to throw their weight around.

This new perspective, or “paradigm shift” — a phrase we agree is grossly over and misused, but happens to fit well in this situation— is what is called thematic investing. It’s an investment approach that looks to identify structural changes that are emerging economically, politically and socially around the globe, and then seeks to determine which companies will be impacted by it — both those that stand to benefit from the tidal wave, and those that will be drowned out by it.

A Thematic View of the Market

Going back to the questions at the beginning of this conversation, given this new paradigm, I see as far better questions to ask rather than “which sectors do you currently like” would be:

- In today’s world where mobile devices are altering the way consumers and businesses interact and transact, which companies or business models are poised to be at the forefront of this movement, and which ones are looking like they will be left behind? We don’t necessarily see the answer being within the Telecom sector.

- With all the data showing that China is shifting towards a more Western diet, what will the be impact on life-expectancy for the world’s largest population and which companies are poised to gain (or lose) from that, whether it’s housing, financial services or healthcare? And if the continue to follow the path of the American population, which now boasts 1/3 of its population as being obese, what will that mean for everything from the health complications of expanding waistlines, to the clothes they purchase and the foods they eat? Is this a healthcare sector issue, a hospitality sector issue or a clothing and textile trend?

- The Cord-cutting phenomenon —an emerging trend where households are moving away from traditional broadcast models of cable or satellite TV, towards on-demand and streaming services — leads us to ask which players in the space are actually creating the most popular content currently being streamed? Which ones are doing the best job of delivering the content? And which types of businesses and services could emerge as the cord cutting occurs and which ones are enabling the trend to even happen? Over the years of tracking this trend, this has led us into some sectors most investors would never imagine.

How We Identity Investment Themes at Tematica Research

As with all investment strategies, success with a thematic approach ultimately comes down to the underlying principle of investing: identifying which securities within an emerging theme are mispriced or undervalued relative to the business opportunities ahead as a result of the sea change presenting itself through a theme.

The thematic approach, however, makes this entire process clearer. Simpler. And in most cases, more likely to be right. Let me explain . . .

An investment theme, at its core, identifies the underlying drivers of future value (or risk), and thus provides a forward-looking, longer-term lens to making investment decisions, rather than focusing solely on what’s happening right now.

We identify such themes — or thematics as we refer to them at Tematica — by looking at the intersection of shifting economics, demographics, psychographics, technologies, mixed in with regulatory mandates and other forces. To put it more simply, we look at the real world that companies are operating in, and try and understand what’s happening and why.

By examining these thematic tailwinds, our goal is to identify mispriced securities relative to the business opportunities ahead and avoid those that are overly valued and or staring into the face of significant headwinds. In our experience, the most attractive opportunities can be found when the business model for a company cuts across multiple themes that converge and reinforce one another.

Going back to Apple, Google and Facebook, at Tematica we see each one as a player in our Connected Society investment theme — each in their own way shaping the landscape of how we as a society interact and engage electronically with one another, as well as with businesses.

Those three same companies are also having a profound influence on what we call Cashless Consumption, which is the electronic payment world with services such Apple Pay, Android Pay, and Facebook buy buttons that are in testing.

Some businesses will adapt to these new realities, while others will leap frog ahead, riding these thematic tailwinds to profits and significant share price movements. And sadly, there will be those left floundering too.

For every Apple, there is a Palm and Blackberry.

For every Facebook, a MySpace or Friendster.

For every Tesla Motors, a Hummer.

For every Netflix, a Blockbuster.

The list goes on and on, across all sectors and categories. But it’s only when we look at the landscape through a thematic lens that we are able to see whether it is company A or company B that has legs, and then it’s within the stock fundamentals of each that drives us to identify the risk-to-reward ratio and determines whether we rate each one as either a buy or sell.

How can you put a thematic investment approach to work for you?

When I speak at conferences or a large group of investors, I always tell folks that thematic investing begins with looking around you and taking notice of what’s going on. Here’s that I mean . . .

Go to the shopping mall, grab a seat somewhere and just watch people. How may bags are people carrying? Which store names are on those bags? What are they doing as they walk around? Are they talking on their phone or looking down and texting? Which phone are they using? Are they carrying a coffee, a soda or a bottle of water? The type of beverage they are carrying is a prime driver behind both our Food with Integrity and Guilty Pleasure investment theme.

As you drive around your neighborhood, if you see a FedEx or UPS delivery man, what companies are the boxes from? Chances are you’ll see plenty of Amazon Prime boxes and is the reason why Amazon has been on our Tematica Select Investment List and performed quite nicely!

One thing we can tell you, the answers to these types of questions change over time.

We came to this point of view of the world after decades of analyzing industries and companies combined with our Wall Street equity research experience. We realized that the shortcoming of industry or sector-focused thinking is that it leads to investing with blinders on. It fails to understand the underpinnings of why certain companies are poised to explode, while others are ready to implode.

To put it simply, why did MySpace crash and burn and why not only is Facebook still here, but poised to be around for a long, long time.

That’s a taste of how we think about the world.

If you’re thinking there is a lot to look at, let’s just say we’re not apt to be lying by the pool eating bonbons. Well, at least not without a laptop or tablet reader pouring through financial filings, company as well as industry reports and all sorts of articles looking to piece together the puzzle of a current or emerging theme.

Each week we publish the Tematica Investing newsletter, which I am the Editor in Chief of, as well as the Monday Morning Kickoff and the Thematic Signals report. I could go on and on about what a great publication I think all of these are, in particular, Tematica Investing — and some say I do just that in each weekly issue, which can be as long as 10 to 12 pages — but the proof, as they say, is in the pudding.

I’ve asked my team at Tematica Research to set up a special opportunity for a two-week free trial to the newsletter.

All you need to do is sign-up for a one year Tematica Individual Membership and you’ll get a two-week long boot camp into the world of thematic investing.

You pay nothing today, but you will receive two weeks of Tematica Investing, plus 2 weeks of the Monday Morning Kickoff eLetter and 2 weeks of Thematic Signals weekend reading report that comes out each Friday all as part of your free trial. It’s everything that current subscribers receive.

Believe me, after two weeks you’ll be fully up to speed with how we see the world and I am confident you’ll love it and stick with it.

But, if for some reason you don’t like it, then all you need to do is log into your account on our website and cancel your membership before your free trial period ends and your credit card is charged. No annoying sales people to deal with when canceling, no hurdles to jump over, or gotchas. Nothing, just log into TematicaRearch.com, click on “My Account” and press the cancel button for your subscription. Done.

Or if you prefer to call and cancel that’s fine too. We’re not a big company, in some cases when you call you might even get me on the phone.

To sign-up for this special offer, just click here and sign-up.

Or if you have questions, or just prefer to handle this type of thing over the phone, you can call us at:

(571) 293-1977

If we’re not able to take your call as we’re busy talking with other customers, just leave a message and we’ll get right back to you.

I hope you take advantage of this opportunity as even if you just try it for two weeks, I think the exposure to the world of thematic investing will change your approach to your investments forever.

Thank you very much!

Chris Versace

Chief Investing Officer, Tematica Research, LLC

Editor in Chief, Tematica Investing