Roughly a million Americans have dropped out of the job market altogether over the past two months. That is the only reason why the headline unemployment rate is not exploding to a post-war high. The share of the US working-age population with jobs in June actually fell from 58.7% to 58.5%. This is the real stress indicator. The ratio was 63% three years ago. Eight million jobs have been lost.

The unemployment rate dropped unexpectedly to 9.5%, but this was not received positively by markets as it was largely the result of a decline in the participation rate. As the unemployed grow frustrated and stop looking for work, they are removed from the unemployment rate calculation. Had the participation rate remained at April’s levels, the unemployment rate would be 9.9%.

The average time needed to find a job has risen to a record 35.2 weeks. Nothing like this has been seen before in the post-war era. Jeff Weniger, of Harris Private Bank, said this compares with a peak of 21.2 weeks in the Volcker recession of the early 1980s.

The number of workers that have been unemployed for more than 6 months is at 6.75%, a record 4.39% of the civilian work force.

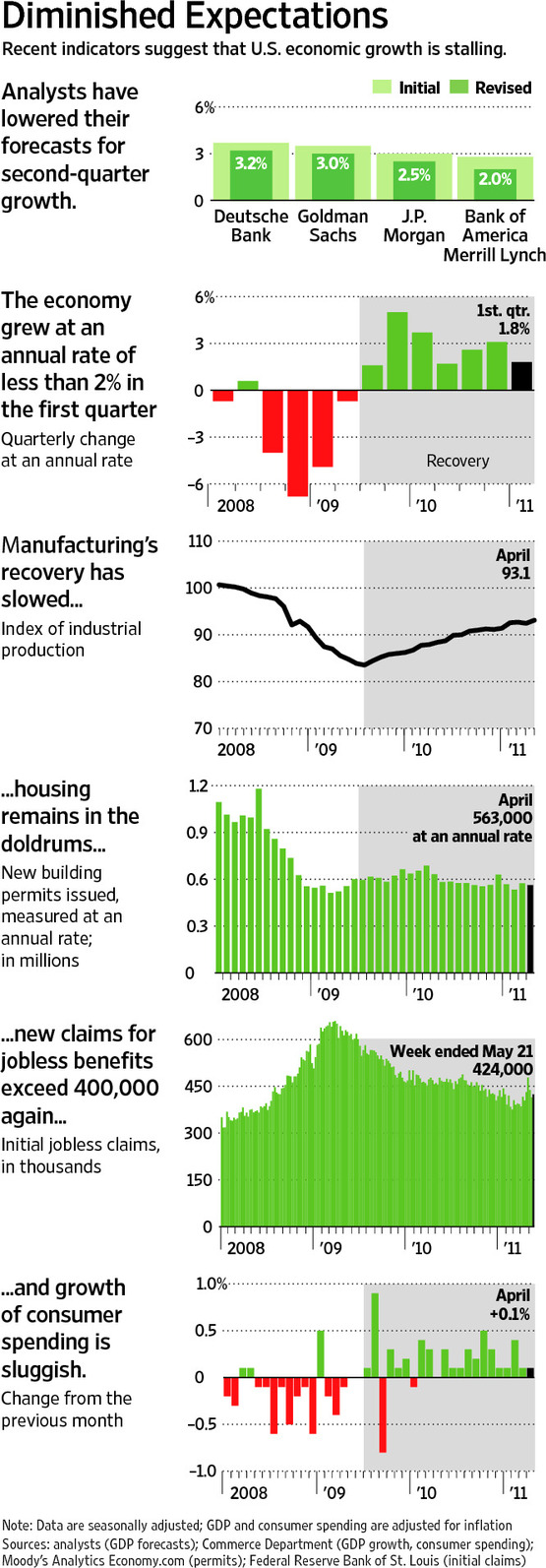

Washington’s fiscal stimulus is draining away. It peaked in the first quarter, yet even then the economy eked out a growth rate of just 2.7%. This compares with 5.1%, 9.3%, 8.1% and 8.5% in the four quarters coming off recession in the early 1980s.

There is considerable controversy these days over what kind of GDP growth we will see in the second half of 2010. It is going to be awfully tough to have a significant rebound in the economy with unemployment levels looking so grim. We may very well have considerable volatility in the markets, but don’t mistake volatility for true growth! For solid economic growth, people need jobs. To have job growth, businesses need to want to hire. For businesses to hire, they need to be confident and optimistic about the future. So far, the theme is more about hunkering down and delveraging rather than preparing for growth.