Weekly Issue: As Global Economy Slows, Investors Switch into Fear Mode

Key points inside this issue

- The global economy continued to slow in August

- Uncertainty has investors in Extreme Fear mode

- Trade remains the focus of the stock market

- Boosting our Disney (DIS) price target following D23’s Disney+ focus

- Items to watch this week

The stock market has been a more volatile than usual over the last few weeks as investors:

- Contend with the latest global economic data

- Eye the yield curve

- Question what the Fed will do next

- Brace for the next round of trade talks

As if that wasn’t enough, we’ve also witnessed mixed June quarter retail earnings, which are now getting factored into second half of 2019 earnings-per-share expectations for the S&P 500. At the same time, the velocity of corporate buybacks has slowed, Washington is scrutinizing tech companies, and consumer confidence is waning.

All in all, these issues weighing on investors minds have led to swings in the market based on the most recent headlines, and that can make for a challenging time in the market and for investors.

The global economy continued to slow in August

Last Thursday morning, we received the first meaningful piece of August economic data in the form of the IHS Markit Flash PMI data for the month, and in aggregate, it confirms the global economic slowdown. To date, the U.S. has been the best house on the slowing economic block, but Thursday’s data, which showed the domestic manufacturing sector contracting for the first time in a decade means the trade war and uncertain environment are weighing on the economy.

During periods of uncertainty, whether we’re talking about companies or people, the natural instinct is to pull

Aside from the headline, U.S. Flash Manufacturing PMI hit 49.9, marking a 119-month low; the index’s new orders component put in its weakest reading since 2009. Per the report, “Survey respondents often cited subdued corporate spending in response to softer business conditions and concerns about the global economic outlook.”

But as we saw with the July Retail Sales report, consumers continue to spend, despite rising debt levels and banks are starting to report a pick-up in delinquency rates. The question that is coming to the forefront of investor minds is whether consumers will be able to spend and keep the economy chugging along during the all- important holiday shopping season that will soon be upon us? Given the continued increase in consumer debt levels and news that Citibank (C), JPMorgan Chase (JPM), Bank of America (BAC) and other banks are reporting rising credit card delinquency rates we could be starting to see the consumer spending breaking point.

Looking at the August Flash PMI data for the eurozone, the slowdown continued as well, but the report also registered a “sizeable drop in confidence regarding the 12-month outlook” with sentiment down to its lowest level since May 2013. Digging into that report we find new order growth in Germany, the largest economy in the eurozone, falling to its weakest levels since early 2013. The August data for the region confirms current forecasts the region is likely to hit just 0.1%-0.2% Gross Domestic Product in the current quarter. Another round of weak data, and odds are we’ll soon see recession fears rising ahead of the European Central Banks upcoming mid-September monetary policy meeting.

Uncertainty has investors in Extreme Fear mode

If we were to step back and look at the data, what we are seeing is data that points to a continued slowdown with some bright spots. Granted those bright spots are also somewhat mixed and there are reasons to be concerned over the sustainability of those bright spots. Is it any wonder then that the CNN Money Fear & Greed Index has been firmly in “Extreme Fear” for the last week? In a word, no.

During periods of Extreme Fear, the jittery market is bound to overreact. Add in the fact that we are in one of the seasonally slowest times of the year for trading volumes means market reactions will be even more extreme one way or another. The danger for investors is to get caught up in the turbulence, and it can be rather easy to do, especially if one is looking to pile onto a money-making trade, be it a long or short one. This makes headline-grabbing, bold assertions increasingly digestible, like the one from hedge fund hired-gun Harry Markopolos on General Electric (GE) or rumor

Rumors and assertions are tricky things, and while some may turn out to be true, others may only have a whisper of truth, if any at all. In the case of Markopolos, he’s working with an unnamed hedge fund partner, and while it would be wrong to cast wide dispersion on the industry, the reality is it is hurting. In 2018, eVestment hedge fund performance data showed the overall hedge fund industry returned negative 5.08%. While the industry is in positive territory on a year-to-date basis this year, it still meaningfully lags the major market indexes.

The bottom line is that in a market environment that is teaming with uncertainty on several sides, it is even more important that investors continue to focus on the data rather than be led astray by rumors and conjecture. Whether it is digging into a company’s financial filings; cross referencing conference call transcripts across a company’s competitors, customers and suppliers; or wading deep into the economic data, now more than ever it is important to do the homework rather than simply piling onto an idea that could simply be one person talking his or her trade book. In our case, we’ll continue to assess and revisit the tailwinds that powers each of our investing themes each week through Thematic Signals and our Thematic Reading as well as our Thematic Signals podcast.

Along the way, we may find something that helps put some of those potentially over-the- top assertions into perspective. One such example is found in the work by Bronte Capital that took Markopolos’ assertion that GE’s industrial margins near 15% are “too good to be true” to task by comparing them with similar margins at Honeywell (HON), Emerson Electric (EMR) and others. Once again, digging into the data adds that layer of context and perspective that is both helpful and insightful to investors.

In my experience, making a trade without doing the homework first and getting conviction on the thesis rarely yields the hopium expected. If the homework checks out, it offers confidence and conviction in the position. Periodically checking the data to determine if that thesis remains on track can either keep one’s conviction running high or alert to a potential issue. Not doing the homework leaves one vulnerable to a change they might not even known was coming.

Trade remains the focus on the stock market

As we approached the end of last week, the stock market was poised to move higher week over week, but as we saw it finished up on a very different note given all of Friday’s news. That news spanned from China threatening countermeasures on tariffs set to be instilled on Sept. 1, to the Fed being ready to extend the current recovery even though it remains upbeat about the domestic economy, to President Trump “ordering” U.S. companies to look for “alternative to China” and then raising tariffs on China after the market close.

There was little question, we were once again seeing U.S.-China trade tensions escalate, raising questions as to what it could mean for the next round of trade talks. In other words, as we headed into one of the last summer weekends, U.S.-China trade uncertainty continued. While the market absorbed China’s escalation and Fed Chair Powell’s “at the ready when needed” comment, it was Trump’s latest trade salvo that reversed the market’s direction for the week leading all the major stock indices to finish down for the week. Trump said he would raise existing duties on $250 billion in Chinese products to 30% from 25% on October 1 and increase the 10% tariff on another $300 billion of Chinese goods set to take effect on September 1 to 15%.

The trade drama at the G-7 meeting continued over the weekend, and it appeared the market was going to start this week off with more than a whimper given that last night US stock market futures were down more than 1%. However, like any good drama that has a number of twists, this morning President Trump shared that China wants to make a trade deal, which served to walk back last week’s jump in trade tensions.

My stance on the trade war has been a combination of hope, patience and details. Hope for a trade deal, patience realizing it would take time to come together and that the details of any trade agreement matter. Despite the purported trade related developments today, my stance remains unchanged.

Boosting our Disney price target following D23’s Disney+ focus

While many were watching the political and trade events unfold at the G-7 meeting over the weekend, there was another gathering of note – D23 2019 at which Walt Disney (DIS) shared quite a bit about its upcoming Disney+ service that is set to launch on November 12. As I’ve said before, that service not only grows Disney’s exposure to our Digital Lifestyle investing theme, it’s also going to change how Wall Street values both DIS shares as well as those for Netflix (NFLX).

On its own Disney+ will cost users $6.99 a month, or $69.99 for a full year, but together with ESPN+ and ad-supported Hulu the bundle will run customers $12.99 per month, which is on par with the standard plan offered by Netflix that allows for two screens to be watching at the same time. The starter price for Disney+ allows for up to support for four simultaneous streams with 4K included. That’s quite a difference, and one that runs the risk of eating into Netflix’s business, particularly at the margin as Middle-class Squeeze consumers tally up how much they are spending on all of their streaming video and music as well as other subscription services

During D23 Disney showcased a plethora of Disney+ exclusive content ranging from its Star Wars to Marvel universes. On the Marvel front, Disney+ will include seven live action programs that are expected to tie into the active Marvel Cinematic Universe (MCU) that span existing characters and introduce new ones as well. While some may be missing the original Marvel streaming content that was found on Netflix, the upcoming Marvel content on Disney+ will continue the interlocking nature of the box office films that culminated in this summer’s blockbuster Avengers: Endgame.

The original programming will be dribbled out over the coming quarters, but at launch Disney+ is expected to contain approximately 7,000 episodes of television series and 400 to 500 movies. According to Disney CEO Bob Iger, almost every single movie in the Disney catalog will eventually be available on the service. That is expected to pale in comparison to the sheer volume of content found on Netflix, which according to Ampere Analysis will be roughly eight times bigger than Disney+’s launch lineup. That may help explain the initial price point for Disney+ but what the service has going for it is it will be the only place one can find some of the biggest franchises in entertainment. That’s very much a page out of the Disney park playbook, and the odds are certainly high that Disney will leverage the content found on Disney+ across its merchandising and park businesses. It was also revealed that Disney and Target (TGT) will partner to open Disney shops inside Target locations, which should only add to the Disney merchandizing business.

The looming question is to what degree will Disney+ attract subscribers? A far better sense will be had once the service goes live, but that hasn’t stopped Wall Street for putting forth expectations. Wedbush expects Disney to add between 10 million and 15 million subscribers to its service each year until they reach around 45 million. For context, that compares to roughly 60 million Netflix US subscribers and other firms are calling for a faster sign-up rate at Disney+ given the combination of cost and content.

- With details surrounding Disney+ becoming clearer, we are boosting our price target on Walt Disney (DIS) shares to $150 from $125. As subscriber data for Disney+ is shared, we’ll continue to refine our price target.

What to watch this week

On the corporate earnings front this week, the parade of retail earnings will continue with J.Jill (JILL), Chico’s FAS (CHS), Tiffany & Co. (TIF), Best Buy (BBY), Ulta Beauty (ULTA), and Dollar Tree (DLTR) on tap to report, among others. In each of those reports, I’ll be looking for signals relating to our Living the Life, Digital Lifestyle, Aging of the Population, and Middle-class Squeeze investing themes.

Beyond that cohort, we also have Sanderson Farms (SAFM) reporting and it will be interesting to see what it says about the growing prevalence of meat alternatives that are part of our Cleaner Living investing theme. . Yesterday, Cleaner Living Index company Beyond Meat (BYND) announced it will start testing plant-based fried chicken with YUM Brand’s (YUM) KFC in Atlanta beginning today, August 27. In keeping with that theme, we’ll be comparing and contrasting results at Campbell Soup (CPG) and Hain Celestial (HAIN) given the shifting preference among consumers for healthier foods and snacks.

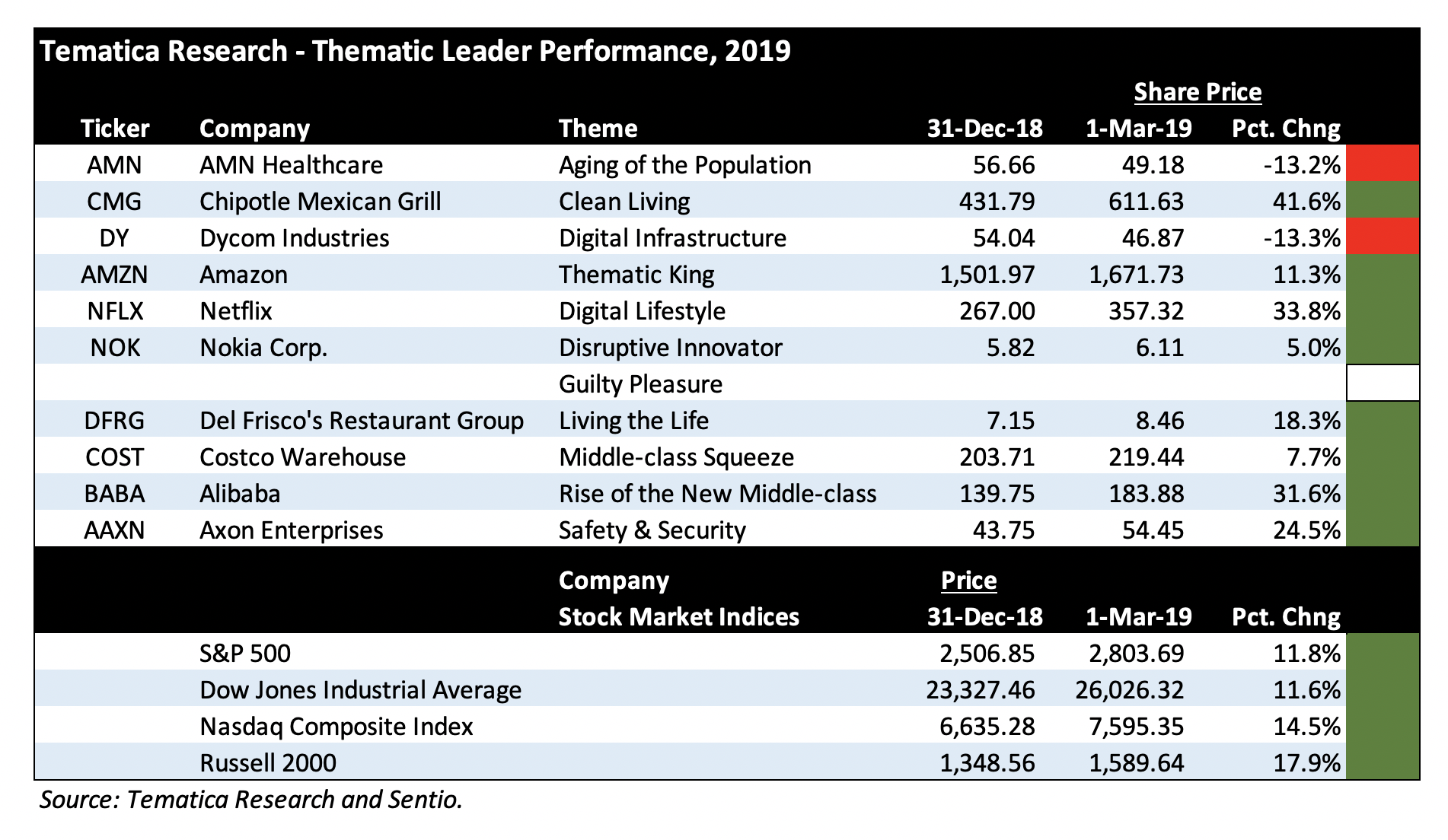

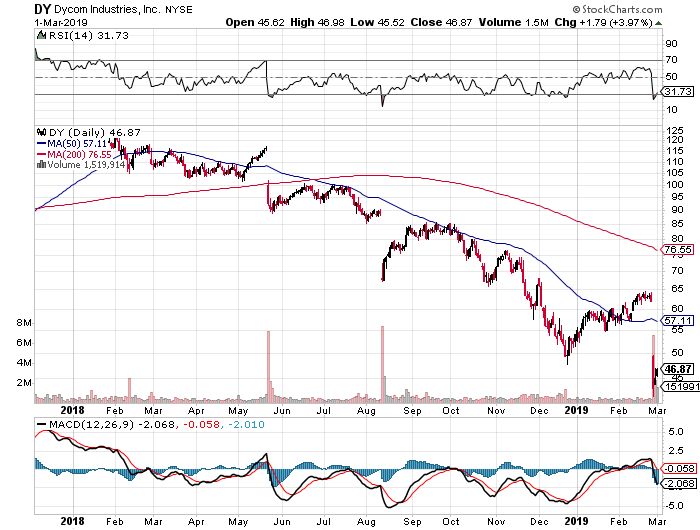

Also this week, specialty contractor and one-time Digital Infrastructure Thematic Leader Dycom Industries (DY) will issue its quarterly results and guidance, both of which should offer a view on 5G network buildout for its key customers that include AT&T (T) and Verizon (VZ). Given that Nokia (NOK) shares on the Select List, this will be a report worth digging into.

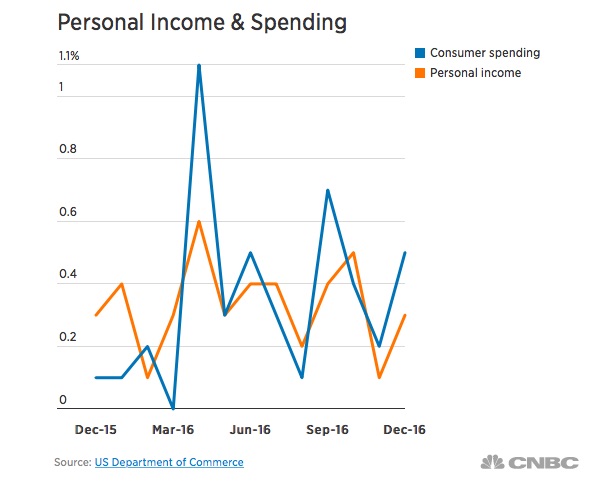

While the number of economic data release last week were relatively light, they did pack quite a punch and that continued today with the July Durable Orders Report. While its headline figure showed a better than expected increase, excluding transportation, aircraft and defense to focus on core capital goods the data revealed a 0.4% increase in July, which followed the 0.9% increase in June. Sucking some of the air out of that improvement, core capital goods shipments in July dropped 0.7%, which will weigh on September quarter GDP forecasts. Over the coming days, we’ll get several other pieces of economic July data including trade inventories and Personal Income & Spending reports.

Coming off a better-than-expected July Retail Sales report, we expect investors will be closely watching the July Personal Income & Spending report to gauge the degree to which consumers can be counted on to power the economy in the second half of the year. In addition to the usual monthly economic data, this week will also bring us the second GDP estimate for the June quarter. As focused as some might be on that revision, we here at Tematica far more focused on what the continued slowdown in the current quarter means for the market and investors.