Weekly Issue: Looking Around the Bend of the Current Rebound Rally

Stock futures are surging this morning in a move that has all the major domestic stock market indices pointing up between 1.5% for the S&P 500 to 2.2% for the Nasdaq Composite Index. This surge follows the G20 Summit meeting of President Trump and Chinese President Xi Jinping news that the US and China will hold off on additional tariffs on each other’s goods at the start of 2019 with trade talks to continue. What this means is for a period of time as the two countries look to hammer out a trade deal during the March quarter, the US will leave existing tariffs of 10% on more than $200 million worth of Chinese products in place rather than increase them to 25%. If after 90 days the two countries are unable to reach an agreement, the tariff rate will be raised to 25% percent.

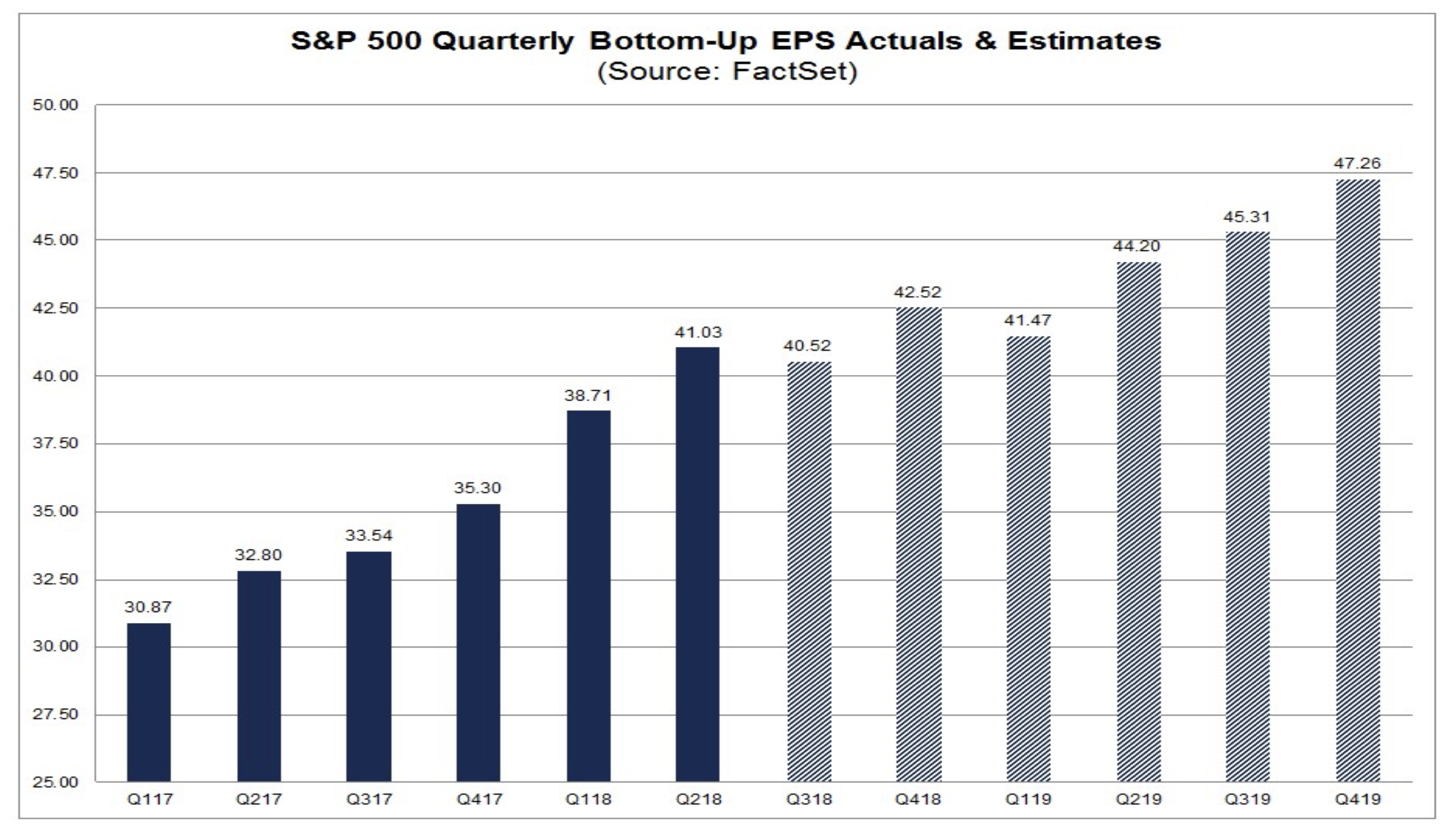

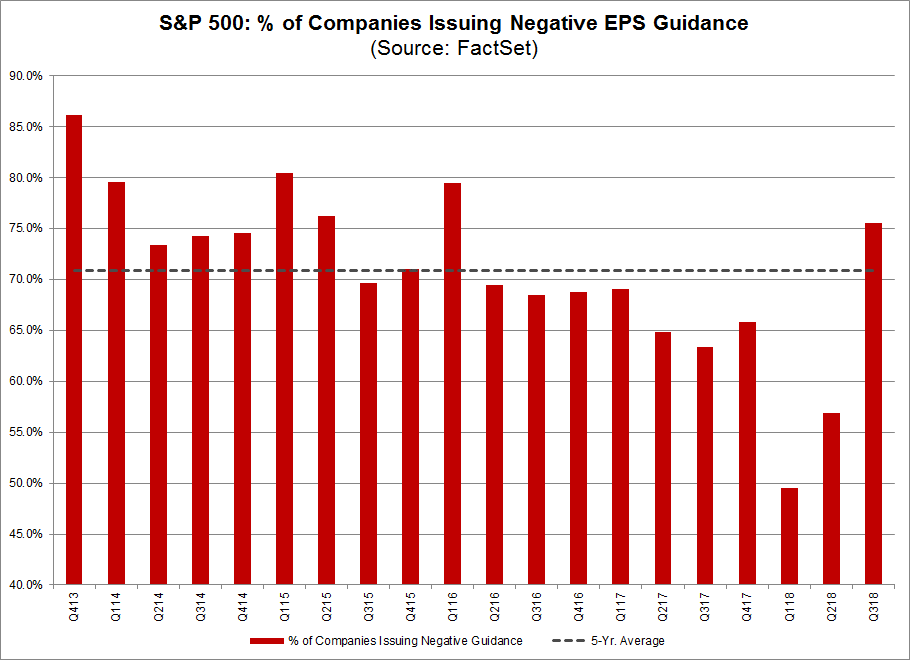

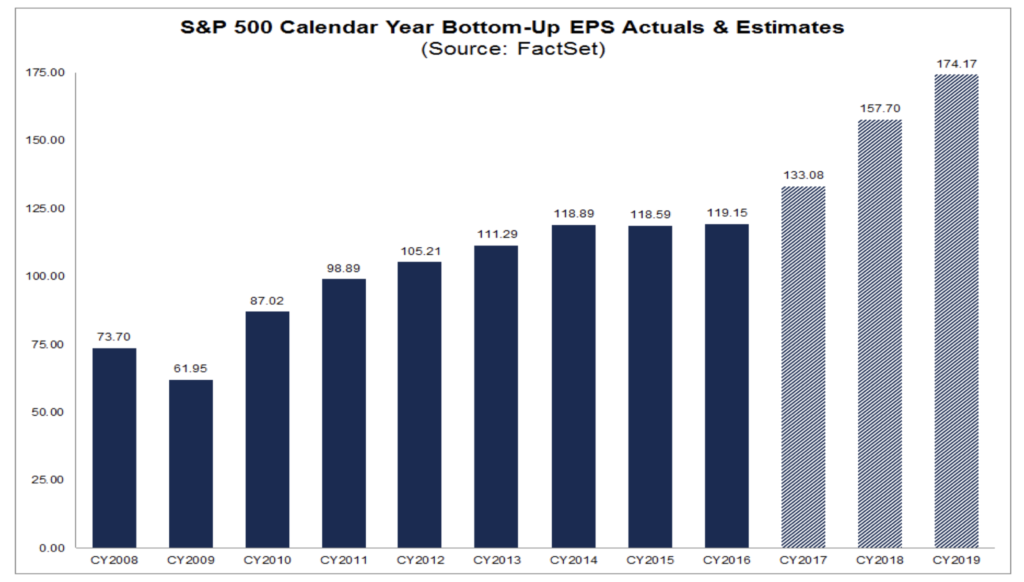

In my view, what we are seeing this morning is in our view similar to what we saw last week when Fed Chair Powell served up some dovish comments regarding the speed of interest rate hikes over the coming year – a sigh of relief in the stock market as expected drags on the economy may not be the headwinds previously expected. On the trade front, it’s that tariffs won’t escalate at the end of 2018 and at least for now it means one less negative revision to 2019 EPS expectations. In recent weeks, we’ve started to see the market price in the slowing economy and potential tariff hikes as 2019 EPS expectations for the S&P 500 slipped over the last two months from 10%+ EPS growth in 2019 to “just” 8.7% year over year. That’s down considerably from the now expected EPS growth of 21.6% this year vs. 2017, but we have to remember the benefit of tax reform will fade as it anniversaries. I expect this to ignite a question of what the appropriate market multiple should be for the 2019 rate of EPS growth as investors look past trade and the Fed in the coming weeks. More on that as it develops.

For now, I’ll take the positive performance these two events will have on the Thematic Leaders and the Select List; however, it should not be lost on us that issues remain. These include the slowing global economy that is allowing the Fed more breathing room in the pace of interest rate hikes as well as pending Brexit issues and the ongoing Italy-EU drama. New findings from Lending Tree (TREE) point to consumer debt hitting $4 trillion by the end of 2018, $1 trillion higher than less five years ago and at interest rates that are higher than five years ago. Talk about a confirming data point for our Middle-class Squeeze investing theme. And while oil prices have collapsed, offering a respite at the gas pump, we are seeing more signs of wage inflation that along with other input and freight costs will put a crimp in margins in the coming quarters. In other words, headwinds to the economy and corporate earnings persist.

On the US-China trade front, the new timeline equates to three months to negotiate a number of issues that have proved difficult in the past. These include forced technology transfer by U.S. companies doing business in China; intellectual-property protection that the U.S. wants China to strengthen; nontariff barriers that impede U.S. access to Chinese markets; and cyberespionage.

So, while the market gaps up today in its second sigh of relief in as many weeks, I’ll continue to be prudent with the portfolio and deploying capital in the near-term. At the end of the day, what we need to see on the trade front is results – that better deal President Trump keeps talking about – rather than promises and platitudes. Until then, the existing tariffs will remain, and we run the risk of their eventual escalation if promises and platitudes do not progress into results.

The Stock Market Last Week

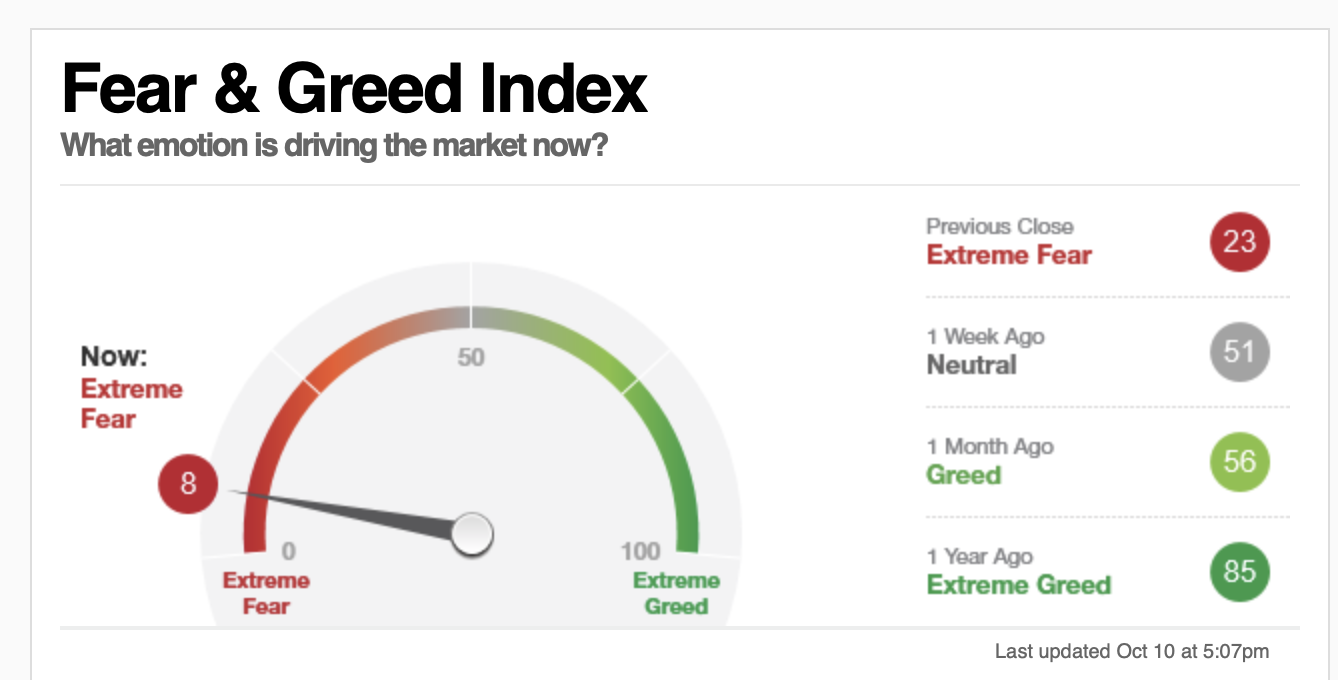

Last week we closed the books on November, and as we did that the stock market received a life preserver from Federal Reserve Chair Powell, which rescued them from turning in a largely across-the-board negative performance for the month. Powell’s comments eased the market’s concern over the pace of rate hikes in 2019 and the subsequent Fed November FOMC meeting minutes served to reaffirm that. As we shared Thursday, we see recent economic data, which has painted a picture of a slowing domestic as well as global economy, giving the Fed ample room to slow its pace of rate hikes.

While expectations still call for a rate increase later this month, for 2019 the consensus is now looking for one to two hikes compared to the prior expectation of up to four. As we watch the velocity of the economy, we’ll also continue to watch the inflation front carefully given recent declines in the PCE Price Index on a year-over-year basis vs. wage growth and other areas that are ripe for inflation.

Despite Powell’s late-month “rescue,” quarter to date, the stock market is still well in the red no matter which major market index one chooses to look at. And as much as we like the action of the past week, the decline this quarter has erased much of the 2018 year-to-date gains.

Holiday Shopping 2018 embraces the Digital Lifestyle

Also last week, we had the conclusion of the official kickoff to the 2018 holiday shopping season that spanned Thanksgiving to Cyber Monday, and in some cases “extended Tuesday.” The short version is consumers did open their wallets over those several days, but as expected, there was a pronounced shift to online and mobile shopping this year, while bricks-and-mortar traffic continued to suffer.

According to ShopperTrak, shopper visits were down 1% for the two-day period compared to last year, with a 1.7% decline in traffic on Black Friday and versus 2017. Another firm, RetailNext, found traffic to U.S. stores fell between 5% and 9% during Thanksgiving and Black Friday compared with the same days last year. For the Thanksgiving to Sunday 2018 period, RetailNext’s traffic tally fell 6.6% year over year.

Where were shoppers? Sitting at home or elsewhere as they shopped on their computers, tablets and increasingly their mobile devices. According to the National Retail Federation, 41.4 million people shopped only online from Thanksgiving Day to Cyber Monday. That’s 6.4 million more than the 34.7 million who shopped exclusively in stores. Thanksgiving 2018 was also the first day in 2018 to see $1 billion in sales from smartphones, according to Adobe, with shoppers spending 8% more online on Thursday compared with a year ago. Per Adobe, Black Friday online sales hit $6.22 billion, an increase of 23.7% from 2017, of which roughly 33% were made on smartphones, up from 29% in 2017.

The most popular day to shop online was Cyber Monday, cited by 67.4 million shoppers, followed by Black Friday with 65.2 million shoppers. On Cyber Monday alone, mobile transactions surged more than 55%, helping make the day the single largest online shopping day of all time in the United States at $7.9 billion, up 19% year over year. It also smashed the smartphone shopping record set on Thanksgiving as sales coming from smartphones hit $2 billion.

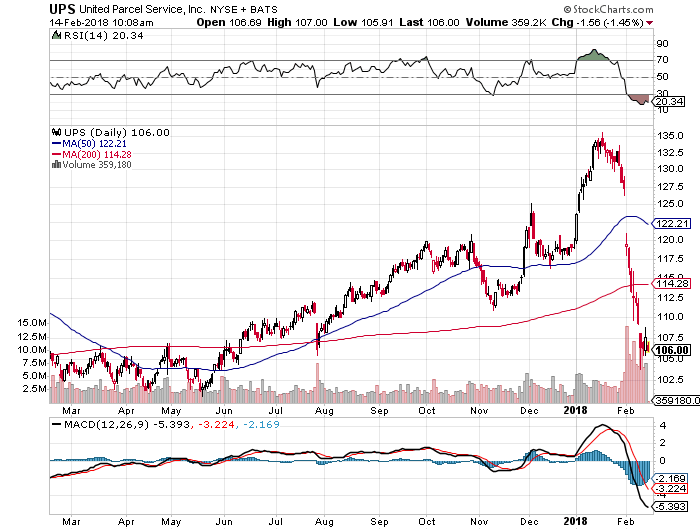

As Lenore Hawkins, Tematica’s Chief Macro Strategist, and I discussed on last week’s Cocktail Investing podcast, the holiday shopping happenings were very confirming for our Digital Lifestyle investing theme. It was also served to deliver positive data points for several positions on the Select List and the Thematic Leader that is Amazon (AMZN). These include United Parcel Service (UPS), which I have long viewed as a “second derivative” play on the shift to digital shopping, but also Costco Wholesale (COST) and Alphabet/Google (GOOGL). Let’s remember that while we love McCormick & Co. (MKC) for “season’s eatings” the same can be said for Costco given its food offering, both fresh and packaged, as well as its beer and wine selection. For Google, as more consumers shop online it means utilizing its search features that also drive its core advertising business.

As we inch toward the Christmas holiday, I expect more data points to emerge as well as more deals from brick & mortar retailers in a bid to capture what consumer spending they can. The risk I see for those is profitless sales given rising labor and freight costs but also the investments in digital commerce they have made to fend off Amazon. Sales are great, but it has to translate into profits, which are the mother’s milk of EPS, and that as we know is one of the core drivers to stock prices.

Marriott hack reminds of cyber spending needs

Also last week, we learned of one of the larger cyber attacks in recent history as Marriott (MAR) shared that up to 500 million guests saw their personal information ranging from passport numbers, travel details and payment card data hacked at its Starwood business. As I wrote in the Thematic Signal in which I discussed this attack, it is the latest reminder in the need for companies to continually beef up their cybersecurity, and this is a profound tailwind for our Safety & Security investing theme as well as the ETFMG Prime Cyber Security ETF (HACK) shares that are on the Select List.

The Week Ahead

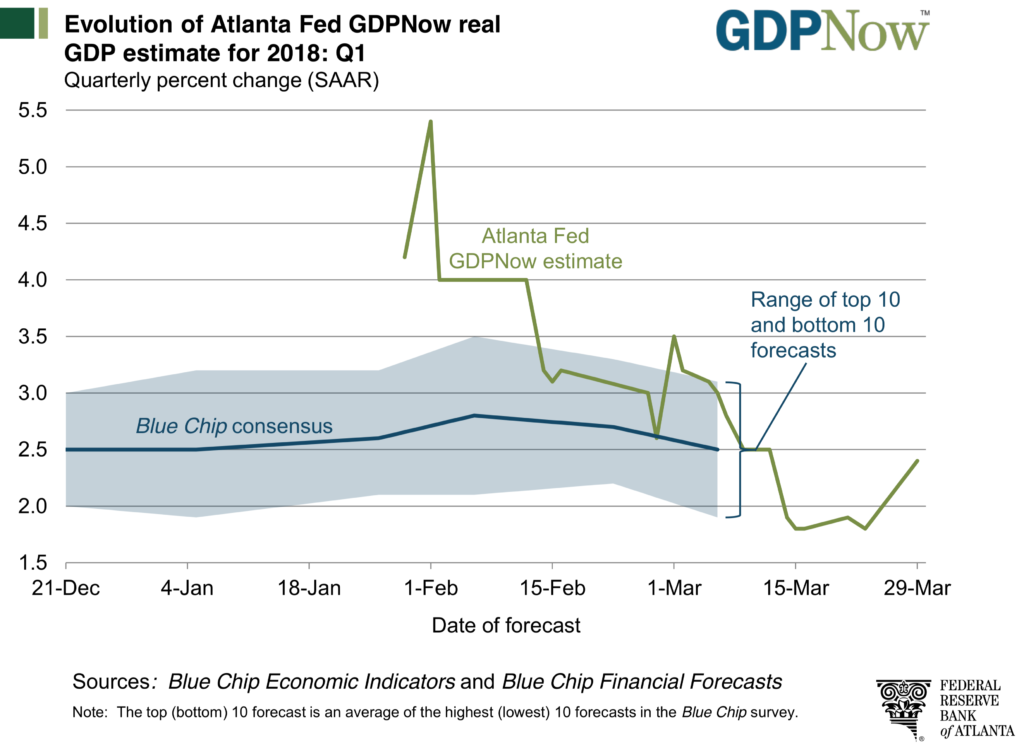

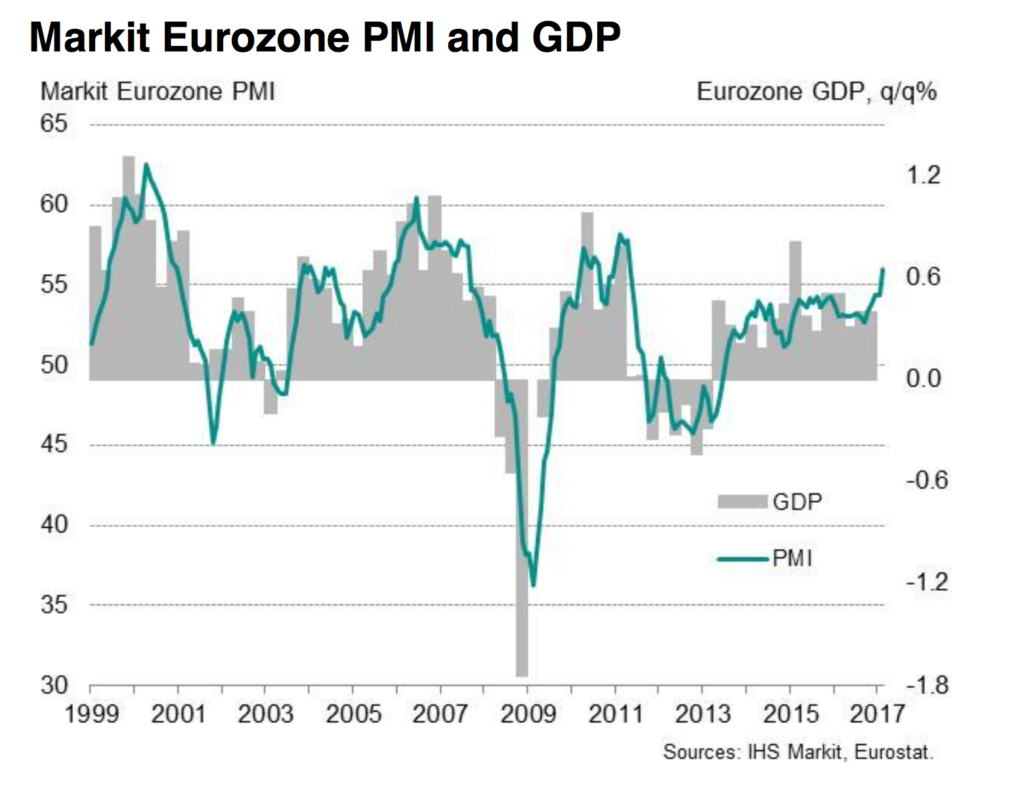

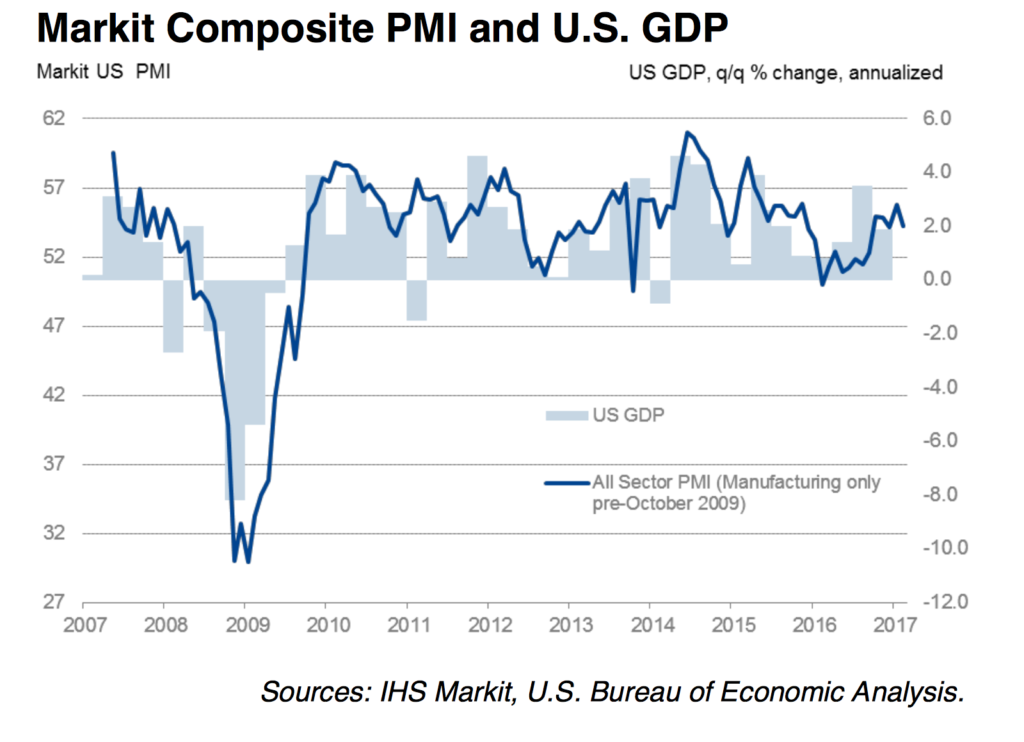

Today, we enter the final month of 2018, and given the performance of the stock market so far in the December quarter it could very well be a photo finish to determine how the market finishes for the year. Helping determine that will not only be the outcome of the weekend’s G-20 summit, but the start of November economic data that begins with today’s ISM Manufacturing Index and the IHS Markit PMI data, and ends the week with the monthly Employment Report. Inside those two reports, we here at Tematica be assessing the speed of the economy in terms of order growth and job creation, as well as inflation in the form of wage growth. These data points and the others to be had in the coming weeks will help firm up current quarter consensus GDP expectations of 2.6%, per The Wall Street Journal’s Economic Forecasting Survey that is based on more than 60 economists, vs. 3.5% in the September quarter.

Ahead of Wednesday’s testimony by Federal Reserve Chair Powell on “The Economic Outlook” before Congress’s Joint Economic Committee, we’ll have several Fed heads making the rounds and giving speeches. Odds are they will reinforce the comments made by Powell and the November Fed FOMC meeting minutes that we talked about above. During Powell’s testimony, we can expect investors to parse his words in order to have a clear sense as to what the Fed’s view is on the speed of the economy, inflation and the need to adjust monetary policy, in terms of both the speed of future rate hikes and unwinding its balance sheet. Based on what we learn, Powell’s comments could either lead the market higher or douse this week’s sharp move higher in the stock market with cold water.

On the earnings front this week, we have no Thematic Leaders or Select List companies reporting but I’ll be monitoring results from Toll Brothers (TOL), American Eagle (AEO), Lululemon Athletica (LULU), Broadcom (AVGO) and Kroger (KR), among others. Toll Brothers should help us understand the demand for higher-end homes, something to watch relating to our Living the Life investing theme, while American Eagle and lululemon’s comments will no doubt offer some insight to the holiday shopping season. With Broadcom, we’ll be looking at its demand outlook to get a better handle on smartphone demand as well as the timing of 5G infrastructure deployments that are part of our Disruptive Innovators investing theme. Finally, with Kroger, it’s all about our Clean Living investing theme and to what degree Kroger is capturing that tailwind.