100 Years of the Federal Reserve

There was a time when no one, outside perhaps the most esoteric economic geek circles, could name the current Chairman of the Federal Reserve. Those days are now long gone as the Fed has taken a much more active role in the economy and the various Fed Presidents and Chairman have evolved into media cult figures, perhaps less riveting than the latest Kardashian marriage collapse, but financially far more provocative.

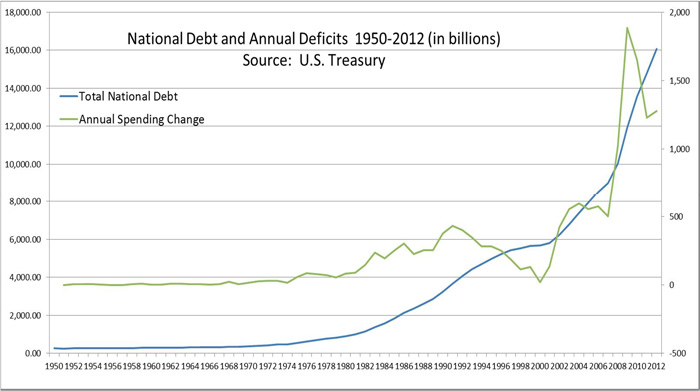

The Fed’s current focus is clearly helping Uncle Sam reflate out of the government’s enormous mountain of debt. The chart on the next page shows the mountain of debt that has been created by impressive levels of spending from both sides of the aisle for a truly bi-partisan mess. The deficit is now almost three times what it was seven years ago, while debt service costs are at about the same level, thanks to Fed sponsored suppression of interest rates. The Fed effectively has complete control of the market for longer-dated Treasuries, with its holdings of bonds with a maturity greater than 10 years increasing by $154 billion through June of this year, (latest data available from the Fed) to a total of over $500 billion. Meanwhile the total outstanding level of such debt, privately held interest-bearing, grew a measly $9.6 billion for a total of $809 billion.

For those of you who enjoy a monetary policy geek-fest, the following summary of comments from the various speakers at the Cato Institute’s Monetary Policy Conference on November 14th, including current Philadelphia Fed President Charles Plosser may be of great interest. I’ll do my best to keep it lively.

Charles Plosser opened the conference with a discussion of how many of the both implicit and explicit limits on central banks around the world have been challenged over the past few decades and most dramatically since the financial crisis. He believes the Fed entered into the realm of fiscal policy when it began purchasing non-Treasury securities such as mortgage-backed securities and referenced Milton Friedman’s warning in 1967 that, “We are in danger of assigning to Monetary Policy a greater task than it can accomplish.” Over the past 40 years, it is clear that we have failed to heed Friedman’s warning, with the Fed doing a poor job of aligning expectations with what it is actually capable of accomplishing. Plosser warned that increasing the scope of the Fed’s mandate opens the door for highly discretionary policies, acknowledging that a rules-based approach is unattractive for the majority of policy makers as it ties their hands.,Discretion is the antithesis of commitment, something most politicians loathe. If the Fed gave itself less discretion, it would be held more accountable. He pointed out that the current climate of guess-my-mood communication on the Fed’s part leads investors to make unwise gambles, as they try to read the mysterious tea leaves of Fed speak, such as the recent market tumult over taper talk.

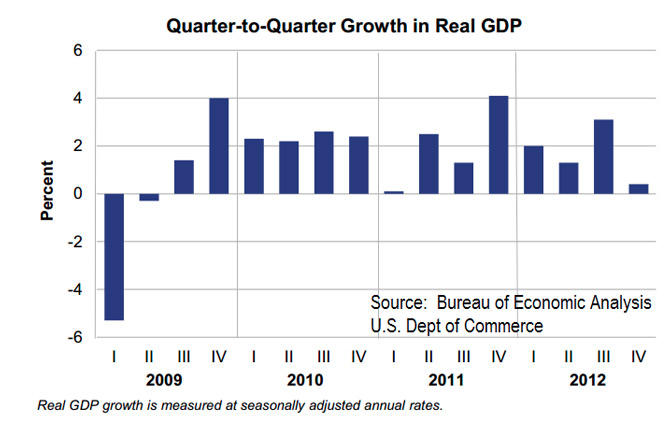

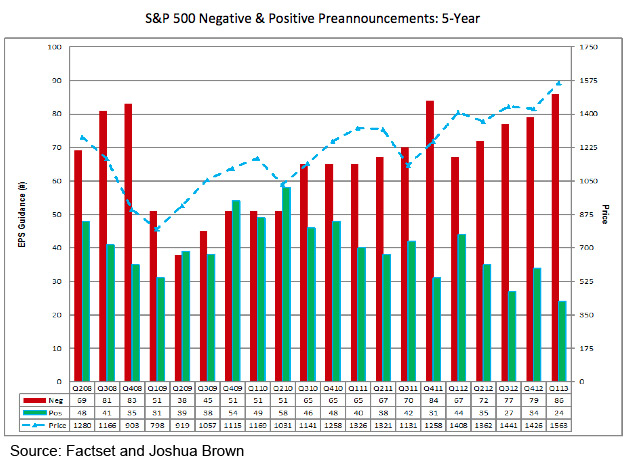

Jerry Jordan, the former President of the Cleveland Federal Reserve expanded on Plosser’s comments, pointing out that the existence of a Central Bank with discretionary power essentially guarantees the emergence of moral hazard with the resulting power to grant permission and regulate with discretion, opening the door to crony capitalism. To large banks, their PACs, (Political Action Committees) are often more impactful on their bottom line than their own management. (Shocker, businesses as well as individuals respond to incentives!) He referenced the Fed’s recent report on the impact of quantitative easing on the economy stating that if there is any relationship between economic growth and quantitative easing, it is a remarkably well kept secret, instigating a round of chuckles from the audience. He pointed out that most economists understand that monetary policy cannot correct the mistakes of the rest of government, even though the Fed is currently doing its best to defy that assessment. He argued that central bank independence is a myth, at least during a financial crisis, because once a central bank takes its first steps to support the economy, there is no way out that does not involve collateral damage. That, by definition, prompts pressure from bureaucrats. He believes that exiting the current zero interest rate regime will be exceedingly complex and it will be impossible to escape without considerable financial market volatility. He seconded Plosser’s assessment of the Fed’s move into fiscal policy, asserting that traditional views of monetary policy and its impact are no longer useful as monetary policy has become fiscal policy. This move into fiscal policy has served to increase market volatility as no one can say with certainty, which entities will receive support during a crisis and for how long. Once again, discretion comes at a price.

Cato President and CEO John Allison, (former CEO of BB&T Corp, a U.S bank with over $180 billion in assets) discussed the impact he saw of government actions on his former bank. He pointed out that the Patriot Act and the federal privacy policy are in conflict with each other, leading to discretionary enforcement and application by regulators, which opens the door for corruption. He observed one of the great fallacies of current conventional wisdom is that there was financial deregulation under President George W. Bush which led to the crisis. Instead, Allison stated that there was actually a net increase in regulation if you look at the quantity and complexity of the regulations before and after his term. He believes that regulators greatly exacerbated the panic that hit the markets during the financial crisis by effectively suspending the rule of law and greatly increasing their level of discretion. No one had confidence in just what were the rules of the game, nor was there any clarity on who would be bailed out, who wouldn’t, and at what cost and for how long.

Kevin Dowd, Professor of Finance and Economics, Durham University, reinforced John Allison’s assertions, pointing out that the original Federal Reserve Act is about 32 pages long. The Glass-Steagall Act is under 40 pages long. The Volker Rule is just under 550 pages. Dodd-Frank, so far, is nearly 850 pages with most expecting it to total around 20,000 pages or more when all the discretionary bits are worked out. Notice a trend in the timeline here? The more complex the regulations, the more costly it is to enforce them, and to comply with them, creating a bias towards ever larger financial institutions, and increasing the opportunity for corruption.

For those of you who’d like a bit more, aside from suggesting you look into therapy as my family reiterates every holiday, I recommend going to this site to watch clips of some of the presentations. Despite the gloomy potential, there were frequent rounds of boisterous laughter, albeit the geeky economist style which I enjoy more than I ought to admit.