Betting on Central Banks as it Gets Plain Ugly

In this week’s piece

- The Central Bank Prayer

- Labor Markets Take a Dive

- Global Wobbles

- Geopolitical Angst

- Definitive Proof of Peak

Central Bank Prayer

The market is hoping, praying and pricing for a Federal Reserve rate cut ostensibly driven by the now dual trade wars, which means the actions of the president are driving both monetary and fiscal policy – surely this will not end well. That is not a political statement as in this game one cannot afford (literally) to be influence by biases towards either the left or right, but it is rather a lesson of history. One individual driving both fiscal and monetary policy for a nation has never come to a utopic end.

The market participants, however, have learned their lesson over the past 10+ years, weak fundamentals are meaningless, trivial details in the face of the power of the world’s major central banks. Or are they? It has been said that something that cannot go on forever, won’t. I know, I know, this time it’s different.

This week Federal Reserve officials gathered in Chicago for a research conference and signaled in interviews and speeches that they are aware of the rising risk of a weaker-than-expected economy. According to the CME Group, traders in futures markets have placed about a 25% chance of a rate cut at the Federal Reserve’s June 18-19 meeting and a 75% chance of at least one cut by the July 30-31 meeting. Chairman Powell on Tuesday stated that, “We do not know how or when these trade issues will be resolved…We are closely monitoring the implications of these development for the US economic outlook and, as always, will act as appropriate to sustain the expansion.”

Across the pond, European Central Bank president Mario Draghi, while wearing the bright blue tie that has often accompanied unexpected stimulus announcements, surprised markets on Thursday by making it clear that the ECB expects rates to stay at their current levels until at least mid-2020. That is longer than had previously been indicated which pushed the euro unexpectedly higher. Investors back in the States ought to take note that central bankers may not be quite as eager as the market hopes to provide immediate support upon signs of weakness. In the US, the issue may very well be complicated by one of the drivers of the weakness – the trade war. One can imagine that as Fed officials ponder the data coming in, the question could arise, “Would it be wise to use stimulus to counter the effects of trade negotiating tactics? Where might that road lead?”

In the Fed’s most recent Beige Book the word ‘uncertain’ appears 21 times, a 6-year high. For a longer-term perspective, in data going back to 1996, that word only appeared more between 2011 and 2013 during the debt ceiling drama, the US debt downgrade, two rounds of quantitative easing and the euro area recession. Uncertainty, you think?

Labor Markets Take a Dive

It was a dour week for labor market data as our Middle-Class Squeeze investing theme came to the forefront.

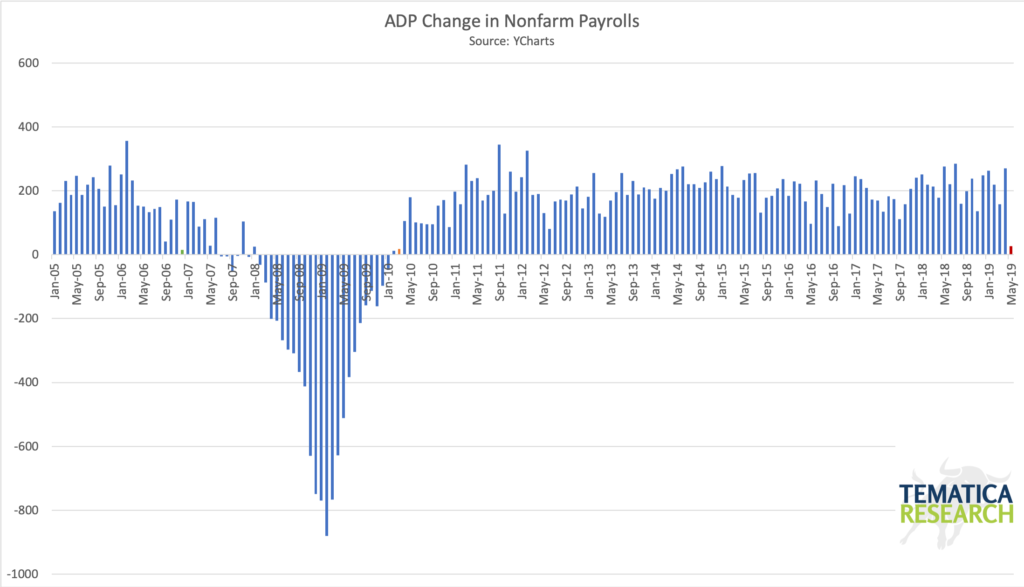

This week’s ADP

The day after the ADP report, the Challenger, Gray & Christmas Job Cut report revealed that US-based employers announced plans to cut 58,577 jobs from their payrolls in May, a 46% increase from April and an 86% increase from May of 2018. Year-to-date cuts are up 39% over the same period from last year with most of the cuts coming from the tech sector. Cuts in the Auto industry for the first five months of 2019 are 211% higher than 2018 and have hit the highest 5-month total since 2009. Keep in mind this sector is highly sensitive to the business cycle.

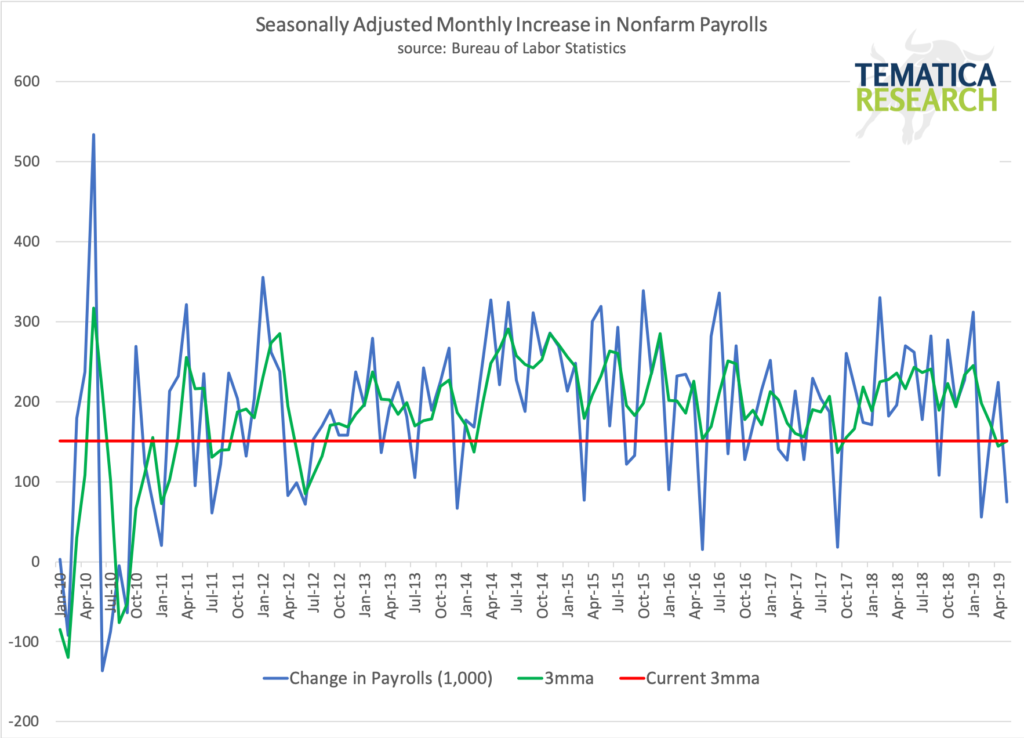

Those that were looking for the Bureau of Labor Statistic’s Nonfarm Payroll report to contradict ADP’s report from earlier in the week were stunned on Friday to see the economy added just 75k jobs in May versus expectations for 175k.

Average hourly earnings rose just 0.2% month-over-month versus the 0.3% expected. More concerning is that while net new jobs were just 75k, the number of persons employed part time for economic reasons (meaning they cannot get a full-time job) declined by 299k, meaning these people lost the only work they could find. So far monthly job gains have averaged 164k in 2019 versus 223k in 2018.

Global Wobbles

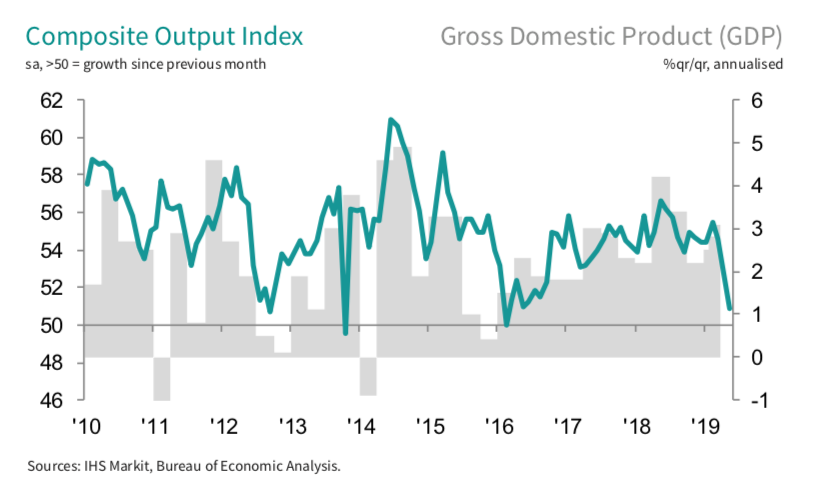

The JPMorgan Global Manufacturing PMI dropped from 50.4 in April to 49.8 in May, the lowest reading since October 2012. The slowdown has been broad – Austria, Canada, Czech Republic, Denmark, Germany, Japan, Italy, Malaysia, Poland, Russia, Switzerland, Taiwan, Turkey, and the U.K. are all in contraction. Germany, the main horsepower for the EU, experienced the biggest drop in Industrial Output in four years, down -1.9% in April versus expectations for -0.5%. US exports of capital goods (ex. Autos) fell by 5.7%, the sharpest decline since September 2008, while imports fell 3.0%. Capex momentum has left the building. In the US the HIS Markit Composite PMI Index (Manufacturing and Services) saw activity drop to its lowest level since May 2016.

Geopolitical Angst

With the drama of the trade wars dominating headlines, it would be easy for US-based investors to miss the fireworks going on elsewhere. Here’s a quick rundown:

- The recent European Parliament elections saw the coalition of center-left and center-right parties lose its majority for the first time ever. The Greens group became the fourth-largest voting block and the far-right (anti-euro and anti-immigration) gained ground, but less than expected. Silvio Berlusconi (who has become the unbeatable mole in the game of political

whac-a-mole ) managed to get elected as a member of the European Parliament for his Forza Italia party, go figure. Bottom Line: The widening political divide we see in the US is happening in Europe as well, with those against the EU gaining ground andcommon ground becoming a lot less common. - Friday Theresa May formally steps down as leader of the Conservative Party in the UK. She will remain prime minister of record until undoubtedly. The betting markets currently have Boris Johnson in the lead by a material margin. Now this matters because Boris and the EU don’t exactly get along. Given the ugly relationship there it is unlikely that the European Union would grant him a Brexit deal that would be more attractive to the UK than the one they gave May. Bottom Line: Brexit is becoming more of a barbell with the most likely outcomes either a hard exit (brutal for both the UK and the European Union) or not exit at all.

- This week the European Commission issued a report that Italy has missed targets to rein in public spending and having failed to put its sovereign debt on a diet, is set to break through a cornerstone rule requiring deficits to remain below 3% of GDP. Within Italy, the leader of the far-right, Matteo Salvini, has been gaining political ground, setting the stage for one hell of a showdown. His tweet below says, “The only way to cut debt generated in the past is to cut taxes via the flat tax and allow Italians to work more and better. With the cuts, the sanctions and austerity, the only things that have grown are debt, poverty, temp-employment, and unemployment, we must do the opposite.” I’m getting out the popcorn for this battle! By the way, for those who think President Trump tweets a lot for someone with a full-time job, check out Salvini’s feed. My twitter feed is telling me that I clearly do not drink nearly enough coffee.

- While the trade wars between China and now Mexico are taking much of the headlines, many of you might have been hearing how China is facing pressures internally from its banking sector. Recently Baoshang Bank was taken over by China’s banking and insurance regulator, the first such takeover in nearly 20 years. This may be just the tip of the banking iceberg. While China and India sit comfortably in our New Global Middle Class Investing themes, that growth is anything but linear and the level of debt China has been taking on to fuel growth has many very concerned. Remember that during the Great Recession, China served as the buyer of last resort, putting a floor under global demand. Its public/private sector balance sheet is a lot less attractive today.

Definitive Proof of Peak

Finally, if you aren’t yet convinced that we have already hit the peak of the economic cycle with the major economic risks now to the downside as we look forward, consider