Exiting WMT Calls, and staying put with UPS and GLW calls

Key Points from this Post:

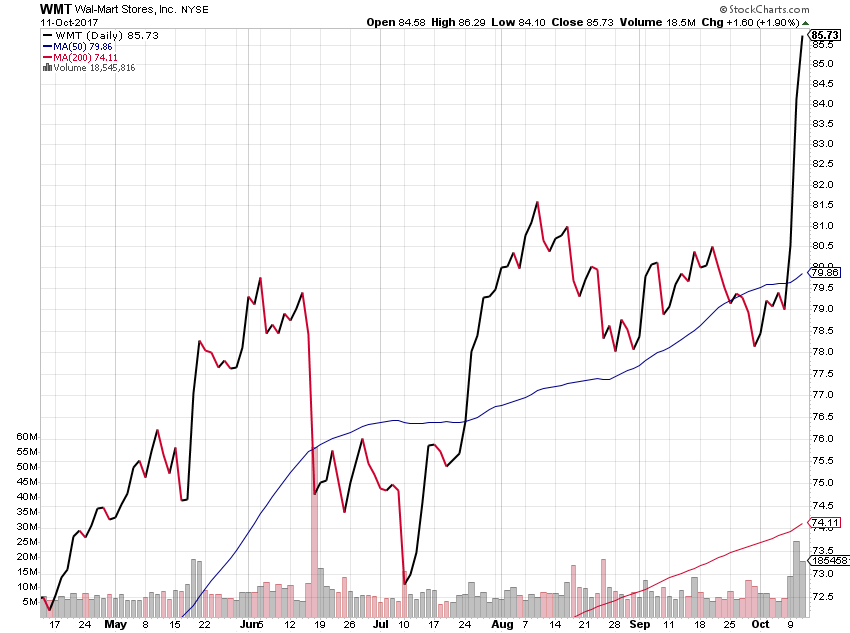

- Following yesterday’s trimming of the Walmart (WMT) Jan 2018 80.000 calls (WMT180119C00080000) calls same Walmart calls, which delivered a 155% return, today we are selling the remaining calls at market this morning. Those calls closed last night at 6.86 vs. our initial buy-in at 2.31.

- At the same time, we are holding steady with the United Parcel Service (UPS) Jan 2018 130.000 calls (UPS180119C00130000 on the Tematica Options+ Select List ahead of UPS reporting its 3Q 2017 earnings on October 26.

- Ahead of the October 24 earnings report date, we continue to keep the Corning (GLW) November 17, 2017, $31 calls (GLW171117C00031000) on the Tematica Options+ Select List, but we are also keeping our 0.25 stop loss intact.

Yesterday, we issued a special alert in which we trimmed back the Walmart (WMT) Jan 2018 80.000 calls (WMT180119C00080000) on the Tematica Options+ Select List. After we issued that alert, the underlying Walmart shares received a boost from Telsey Advisory Group, which boosted their price target to $92 from $88 alongside bullish comments spinning out of Walmart’s analyst day on Tuesday. This led WMT shares to climb another 2%, which translated to another 22% move the WMT Jan2018 80 calls yesterday.

The pop in the shares over the last few days has landed the underlying WMT shares in overbought territory – no surprise given vector and velocity of the recent move. What this means is WMT shares are likely to either give some of the big gains back in the coming days or they will trade sideways. With either scenario, it means we could see the WMT Jan 2018 80 calls trade sideways to down from current levels.

As we are about to see corporate earnings kick into high gear next week and then explode higher over the following weeks, we are going to take the prudent route and exit the Walmart (WMT) Jan 2018 80.000 calls (WMT180119C00080000). We realize that yesterday we said we were inclined to be patient with the position, but that was before the shares popped into overbought territory. We continue to see the company as a wallet share winner this holiday season and longer-term as one of the retail winners as the brick & mortar retail industry shakes out even further in 2018 and 2019. As such, we’ll continue to keep tabs on other WMT call option positions as we navigate through the 3Q 2017 earnings season.

- We are exiting the Walmart (WMT) Jan 2018 80.000 calls (WMT180119C00080000) calls that closed last night at 6.86 vs. our initial buy-in at 2.31.

- Following yesterday’s trimming that delivered a 155% return, we are selling the remaining calls at market this morning.

Our $0.02 on UPS, and why we’re sticking with the call position

Last week we added the United Parcel Service (UPS) Jan 2018 130.000 calls (UPS180119C00130000) and they closed trading last night at 0.55, down just over 23% from our 0.72 buy-in. As we signaled when we added the position, we see it benefitting from the accelerating shift toward digital commerce this holiday shopping season.

The recent knock on the underlying shares that has weighed on our call position is the Amazon (AMZN) threat, but as much as we love Amazon, the poster child for thematic investing, we have two thoughts on this. First, even if Amazon is inclined to replicate and build out a delivery system to consumer homes, it will take time and cost big time. There is no realistic way Amazon could complete such a move before January. This gives UPS plenty of room to move in the up and coming holiday season. Second, what little UPS may lose this holiday season from Amazon, odds are it will gain from other retailers that are embracing digital commerce and direct to consumer (D2C) strategies to battle Amazon.

- This has us holding steady with the United Parcel Service (UPS) Jan 2018 130.000 calls (UPS180119C00130000 on the Tematica Options+ Select List ahead of UPS reporting its 3Q 2017 earnings on October 26.

Meaningful dates for Corning calls

The Corning (GLW) November 17, 2017, $31 calls (GLW171117C00031000) have dribbled lower over the last week, closing last night at 0.39 – down 38% vs. our 0.63 buy-in price on September 21. Even though the pace of earnings will pick up next week, the next catalyst for the GLW calls will be October 24 when the company reports its quarterly results. A few days later (October 27), Apple (AAPL) will begin taking orders for its iPhone X smartphone and the device will begin shipping on November 3.

Given the incremental glass used in the new iPhone 8, 8s and X models as well as larger smartphone sizes and ramp in demand for larger format TVs this holiday season, we see GLW management offering a bright outlook when it reports its quarterly results. For this reason, we will continue to hold these GLW calls near-term.

- Ahead of the October 24 earnings report date, we continue to keep the Corning (GLW) November 17, 2017, $31 calls (GLW171117C00031000) on the Tematica Options+ Select List.

- As we do this, we are keeping our 0.25 stop loss intact.