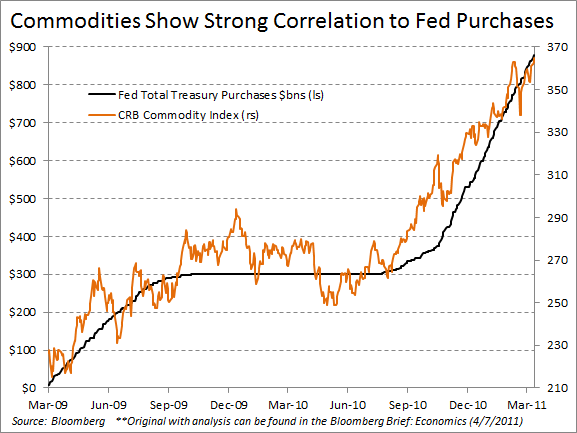

Fed Policy Highly Correlated to Commodity Prices

This week will be full of market and economic information, (Consumer Confidence, the Richmond Fed Manufacturing Index, the MBA Mortgage Applications Index, weekly initial jobless claims, pending home sales, the 1Q Employment Cost Index, personal income and spending, the Chicago Purchasing Managers Index, and the final University of Michigan Consumer Sentiment Index) with center stage featuring Wednesday’s conclusion of the two-day Federal Open Market Committee (FOMC) meeting and the first post-statement news conference and Q&A session led by Fed Chairman Ben Bernanke. Friday we’ll receive the first reading of 2011’s Q1 GDP, expected to come in under 2% quarter-over-quarter at an annualized rate, slowing from 3.1% in the fourth quarter of 2010.

We expect that the Fed will announce no changes to the fed funds target rate, currently between 0-0.25%. The Fed has consistently stated that their policy has not driven up commodity prices, but the chart below, courtesy of Bloomberg, shows a striking correlation between the Fed’s purchase of bonds and the CRB Commodity Index. Correlation is not necessarily indicative of causation, but this chart does give one pause.

Bottom Line: It is important to keep in mind this high degree of correlation as QE2.0 comes to a close in June as it will most likely result in a decline in commodity prices. UNLESS… and we think this is likely, the Fed uses the maturing mortgage-backed securities (MBS) on its books to fund further purchases of Treasuries post QE2.0, allowing for a less official version of QE3.0.

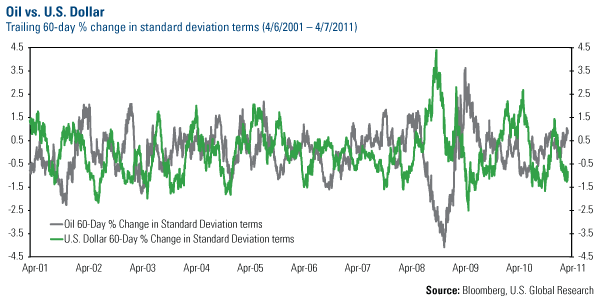

So what about oil? The chart below shows that the price of oil and the dollar are historically negatively correlated, meaning that a rise in oil prices generally coincides with a decline in the dollar, and vice versa.

Bottom Line: Without some strengthening in the dollar, we do not expect to see any sustained, significant drop in the price of oil. (For dollar strength trends, see our April 21st post.)

Bottom Line: Without some strengthening in the dollar, we do not expect to see any sustained, significant drop in the price of oil. (For dollar strength trends, see our April 21st post.)