Bulls v Bears: Accelerating with the Brakes On

It is no wonder the stock market has been having fits given we have fiscal policy stepping on the accelerator while monetary policy looks to be putting both feet squarely on the breaks. On the fiscal side, we have a roughly $1.5 trillion tax cut with an additional $300 billion spending plan which is looking to take the deficit to $1.2 trillion or about 5.4% of GDP. President Trump proposed today a $4.4 trillion budget that would widen the federal deficit to $984 billion in the next fiscal year, which begins September 30th. Analysts estimate that after tax cuts and the two-year budget deal, the deficit will be above $1 trillion next year.

On the monetary policy side, in December the market was pricing in 3 hikes during 2018 at just 30%. That’s increased to about 70%. The Federal Reserve is unwinding its massive balance sheet on top of those rate hikes, which means not only will Fed rates be higher, but the supply of bonds in the marketplace will be increasing both from the deficit spending as well as the Fed’s balance sheet unwind. The new Federal Reserve Chair Powell is giving signals that he is unlikely to provide quite the safety blanket that Chair Yellen did for asset prices.

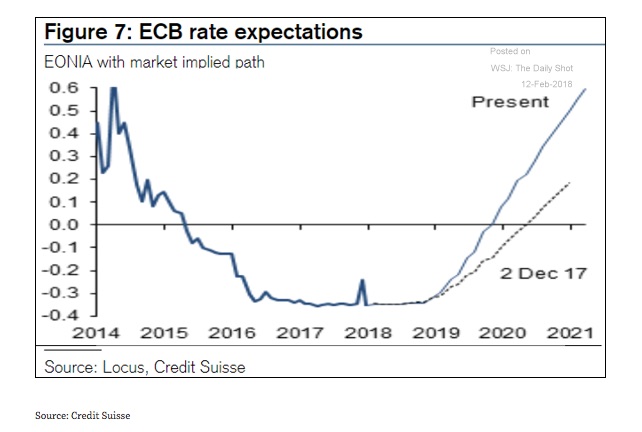

The monetary brakes aren’t just here in the U.S. The Bank of England is set to increase rates at a less gradual pace with the European Central Bank not to far behind and shortly to be (most likely) run by a German instead of an Italian – a meaningful difference. In Japan the economy appears to have escaped deflation and is expanding, making the 10-year Japanese bond yield at zero difficult to maintain for much longer.

(Hat tip to WSJ The Daily Shot for chart below)

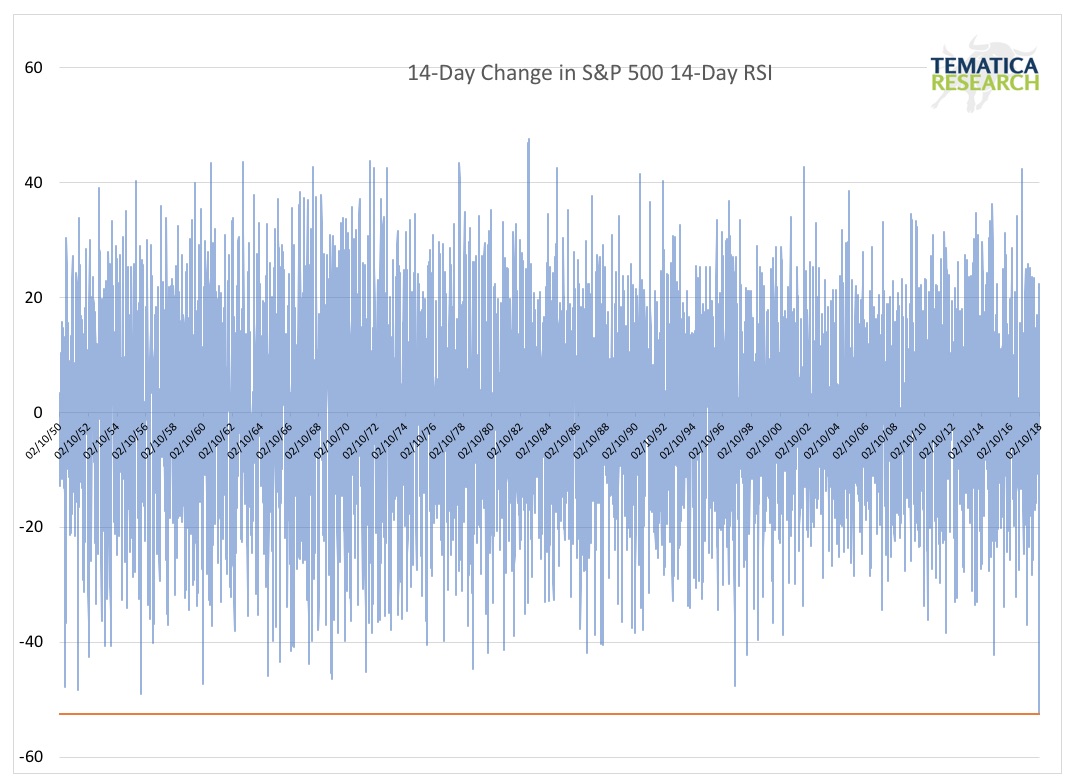

Add in that we’ve seen record flows into equity ETFs recently, many in the markets today have never experienced a real downturn and the market has been trained, for nearly a decade, to buy the dips as central bankers will always step in to push asset prices back up, and it is no wonder the 14-day change in the 14-day RSI was the biggest in recorded history. Volatility is coming back to play!