Entering Choppy Waters as Earnings Velocity Picks Up

Earnings season kicks into high gear this week. Despite the headline print of the Dow Jones Industrial Average, which has climbed just over 1 percent over the last week given the moves in the 30 stocks that comprise the index, we’re seeing choppy waters emerge following March quarter results from Netflix (NFLX), IBM (IBM) and Intel (INTC). Intel in particular shared it will cut 11 percent of its workforce as it shifts focus from PCs to other markets including data centers and the Internet of Things. To us here at Tematica, that means Intel is finally catching up with what is driving the Connected Society.

Intel is not alone in announcing layoffs — also this week Nordstrom (JWN) shared it will cut 400 jobs at its corporate headquarters, which raises questions over spending habits of more well off consumers. To us, it means consumers are turning elsewhere to shop —another confirming datapoint of not just our Cashstrapped Consumer thematic, but also the Connected Society — and we continue to see Amazon (AMZN) as a primary beneficiary (see more on this below). We’ve also started to see more ratings downgrades on the likes of Boeing (BA), Bloomin Brands (BLMN), Intel, Badger Meter (BMI), Spirit Airlines (SAVE) and Toll Brothers (TOL) to name a few.

In short, we expect the volatility of the markets to once again be upon us, not just because the S&P Short Range Oscillator closed yesterday at 9.2 percent —compared to 3.9 percent just a week ago — but because that Oscillator is now back to 2x overbought levels.

To us this means, continuing to hold onto our heeding positions that are our inverse ETFs — ProShares Short Dow30 ETF (DOG), ProShares Short S&P 500 (DOG) and ProShares Short Russell2000 (RWM) — as well as our more defensive positions in Health Care Select Sector SPDR ETF (XLV) and iShares Barclays 20+ Year Treasury Bond ETF (TLT).

Adding Disney Calls and Another Call Trade on the House of Mouse, Marvel, Lucas

Despite the growing gloom, there are still bull markets to be had with companies poised to benefit. One of those is easily found in our Content is King investing theme and in yesterday’s Tematica Investing we added shares of content and merchandising champ Disney (DIS) to the Tematica Select List. If you missed it, you can read it here, but in a nutshell Disney has several powerful catalysts that have started to kick in thus far in 2016 with several more coming over the next several quarters. The more well known ones are found on the upcoming slate of Marvel, Lucasfilm, and Pixar movies that range from Captain America, Dr. Strange, Star Wars and Finding Dory. Those films will drive merchandizing and other key content platforms, such as gaming and music to name a few. Disney has also adopted surge pricing at its existing theme parks and in June it will open its largest park in China dubbed Shanghai China.

From our perspective these layered catalysts kick in over the next few months, and while we see DIS shares as a core holding for our Content is King investing theme, we see each catalyst adding to the share price.

In order to capture greater returns, we’re adding the DIS May $105 calls(DIS160520C00105000) that closed last night at $1.57 to the Tematica Pro Select List. We are comfortable buying these calls up to $1.85; to limit downside in the position, we are setting a stop loss at $1.15.

Adding a Multi-Thematic ETF Call

Also in yesterday’s Tematica Investing we shared another way to invest and capture the upside we see in DIS shares — through the Consumer Discretionary SPDR ETF (XLY), which counts DIS shares as its third largest holding behind Amazon.com (AMZN) and Home Depot (HD). In addition to meaningful upside to be had with DIS shares, we see Amazon benefitting from the continued shift to online and mobile shopping that is a key tenant of our Connected Society investing theme, while Home Depot is a natural beneficiary of the spring season. Other key holdings of XLY include Comcast (CMSCA), McDonald’s (MCD) and Starbucks (SBUX) and each of these are potential candidates in our Connected Society, Fattening of the Population and Affordable Luxury/Guilty Pleasure investing themes, respectively.

Given the upside to be had at Disney and these other core holdings, we are adding the XLY May $80 calls (XLY160520C00080000) that closed last night at $1.24 to the Tematica Pro Select List. We would be comfortable adding to the position up to $1.50; to manage downside risk, we are setting a stop loss at $1.00.

Rush Enterprises to Give Direction on Paccar Short

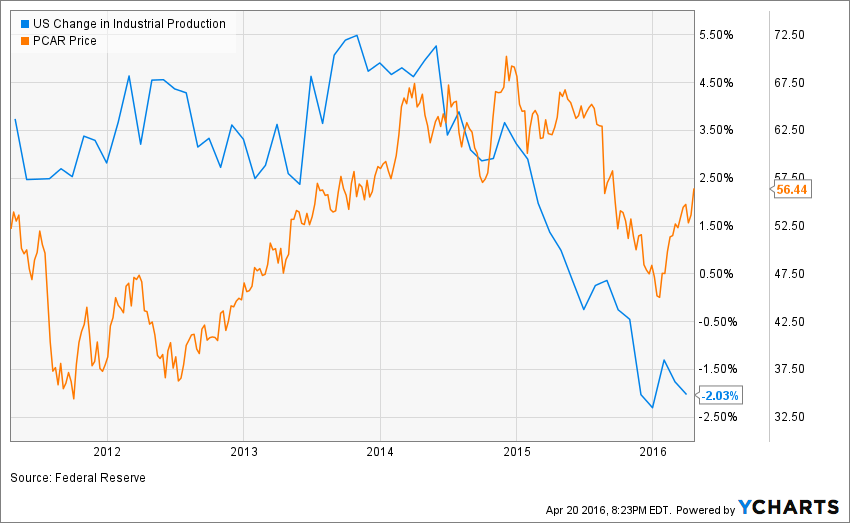

Along with the market melt up, we’ve witnessed the short in heavy truck company Paccar (PCAR) move against us these last several days despite weak fundamentals. The most notable was the disappointing March Industrial Production reading, which marked the 6th month of contrition out of the last 7 months. In the below chart, we see the historically tight correlation between the year over year change in Industrial Production has diverged in 2016, but as we have seen time and time again, at some point fundamentals catch up with a climbing stock price.

We see the weakening fundamentals for Paccar that include lackluster economic activity, falling heavy truck orders and weak guidance from Paccar competitor Navistar (NAV) all weighing on Paccar’s March quarter performance and current quarter outlook.

We will get further insight into the tone of the heavy truck market and Paccar’s prospects this morning when Rush Enterprises (RUSHA), a retailer of commercial vehicles and related services, which includes a network of commercial vehicle dealerships, reports its March quarter earnings. In the company’s 2015 10-K filing with the SEC, Rush notes that “We are dependent upon PACCAR for the supply of Peterbilt trucks and parts, the sale of which generates the majority of our revenues.” As such, we see Rush’s results as a guiding hand for what Paccar will likely say when it reports its March quarter results next Tuesday (April 28).

After analyzing Rush’s quarterly results and digesting comments on its related earnings conference call, we will assess the prospects of adding to our Paccar short position and/or revisiting a put position in PCAR shares. Should we make any such additions to the Tematica Select List we will issue a special alert detailing the specifics of our actions.

Recap of Action Items from this Week

- Continue to Hold inverse ETF’s DOG, SH and RWM, as well as defensive ETF TLT.

- Adding DIS May $105 calls (DIS160520C00105000) up to $1.85 with a stop loss at $1.15.

- Adding XLY May $80 calls (XLY160520C00080000) up to $1.50 with a stop loss at $1.00.

- Continue to Hold short position in PCAR