Fed’s Yellen boosts expectations of March rate rise

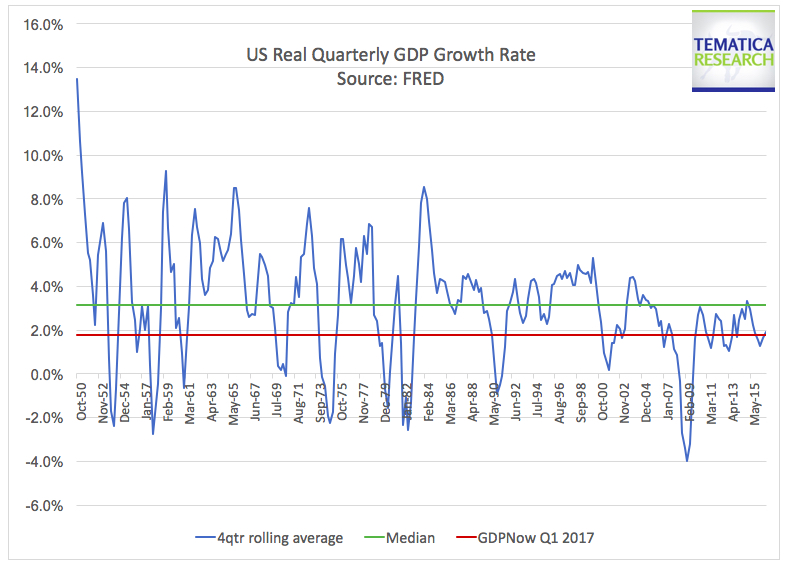

As the Federal Reserve’s GDPNow revises estimates for the first quarter 2017 GDP growth down to a decidedly unimpressive 1.8 percent, today Fed Chair Janet Yellen gave an audience in Chicago a quasi-definitive on a March hike.

Following a week of hawkish messages from top US rate setters, the Fed chair told an audience in Chicago on Friday that a further increase in short-term interest rates was likely to be “appropriate” at the Fed’s policy meeting on March 14-15 if employment and inflation stay in line with officials’ expectations.

So let me get this straight, one of the Fed’s own is expecting GDP for the first quarter of 2017 to be even weaker than last quarter’s abysmal 1.9 percent, both of which are well below the 3.2 percent median of the longer-term, 4-quarter rolling average. So naturally, they ought to raise rates, something that is done to cool an overheating economy. Cue eye roll.

Clearly, there must be something else to this. Perhaps….?

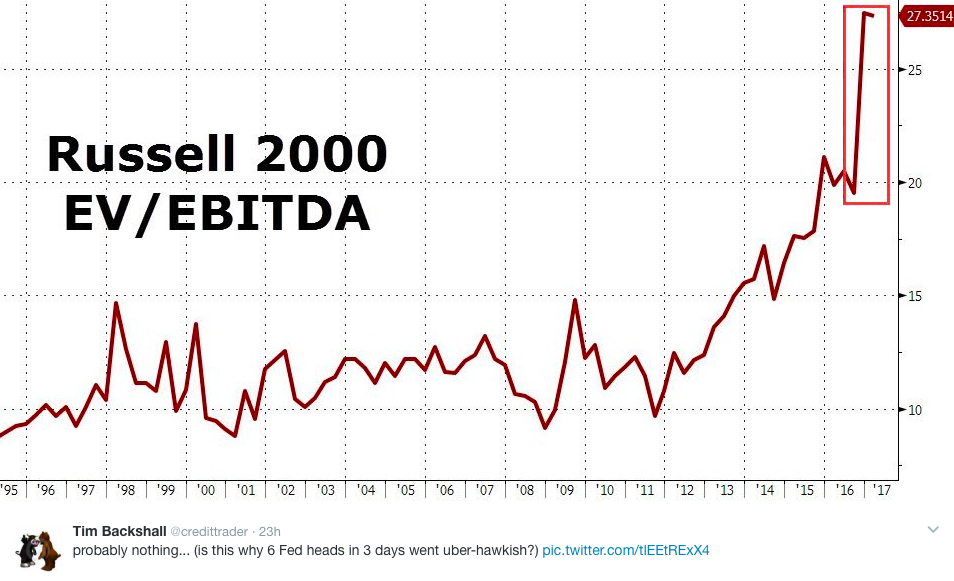

Side note – here’s a great explanation for why EV/EBITDA is a fantastic valuation tool.

Wouldn’t be a shocker to us if the Fed is taking action based on their fears of what a seroiusly overheating equity market could do given that since the financial crisis, the Fed has been increasingly using Wall Street as a barometer for success. Oddly, we can find no such missive in any of the Fed’s marching orders, but hey, that’s just us. We’re sure this little experiment will be pulled off without a hitch… cue second eye roll.

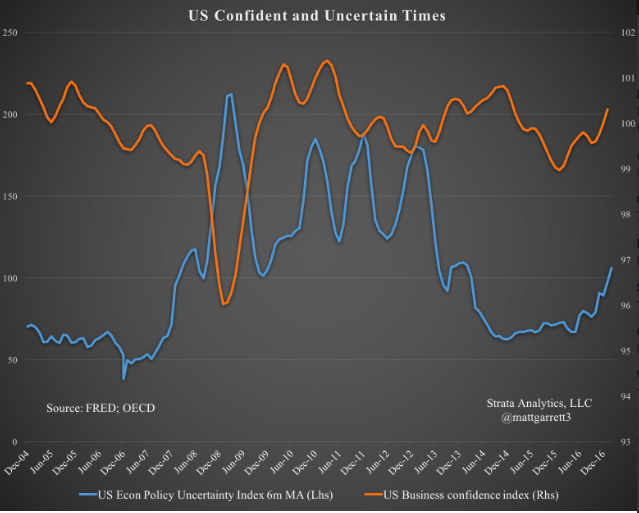

We are moving further into unchartered territory with those in D.C., which makes for a fascinating divergence between optimism and uncertainty, which are normally more inversly correlated for obvious reasons.

Bubble, bubble toil and trouble dear Janet!