WEEKLY ISSUE: Confirming Data Points for Apple and Universal Display

Key points inside this issue:

- The Business Roundtable and recent data suggest trade worries are growing.

- Our price target on Costco Wholesale (COST) shares remains $250.

- Our price target on Apple (AAPL) and Universal Display (OLED) shares remain $225 and $150, respectively.

- Changes afoot at S&P, but they still lag our thematic investing approach

While investors and the stock market have largely shaken off concerns of a trade war thus far, this week the stakes moved higher. The U.S. initiated the second leg of its tariffs on China, slapping on $200 billion of tariffs on Chinese imports of food ingredients, auto parts, art, chemicals, paper products, apparel, refrigerators, air conditioners, toys, furniture, handbags, and electronics.

China responded, not only by canceling expected trade talks, but by also implementing tariffs of its own to the tune of $60 billion on U.S. exports to China. Those tariffs include medium-sized aircraft, metals, tires, golf clubs, crude oil and liquified natural gas (LNG). Factoring in those latest steps, there are tariffs on nearly half of all U.S. imports from China and over 50% of U.S. export to China.

Should President Trump take the next stated step and put tariffs on an additional $267 billion of products, it would basically cover all U.S. imports from China. In terms of timing, let’s remember that we have the U.S. mid-term elections coming up before too long — and one risk we see here at Tematica is China holding off trade talks until after those elections.

On Monday, the latest Business Roundtable survey found that two-thirds of chief executives believed recent tariffs and future trade tension would have a negative impact on their capital investment decisions over the next six months. Roughly one-third expected no impact on their business, while only 2% forecast a positive effect.

That news echoed the recent September Flash U.S. PMI reading from IHS Markit, which included the following commentary:

“The escalation of trade wars, and the accompanying rise in prices, contributed to a darkening of the outlook, with business expectations for the year ahead dropping sharply during the month. While business activity may rebound after the storms, the drop in optimism suggests the longer term outlook has deteriorated, at least in the sense that growth may have peaked.”

Also found in the IHS Markit report:

“Manufacturers widely noted that trade tariffs had led to higher prices for metals and encouraged the forward purchasing of materials… Future expectations meanwhile fell to the lowest so far in 2018, and the second-lowest in over two years, as optimism deteriorated in both the manufacturing and service sectors.”

As if those growing worries weren’t enough, there has been a continued rise in oil prices as OPEC ruled out any immediate increase in production, the latest round of political intrigue inside the Washington Beltway, the growing spending struggle for the coming Italian government budget and Brexit.

Any of these on their own could lead to a reversal in the CNN Money Fear & Greed Index, which has been hanging out in “Greed” territory for the better part of the last month. Taken together, though, it could lead companies to be conservative in terms of guidance in the soon-to-arrive September quarter earnings season, despite the benefits of tax reform on their businesses and on consumer wallets. In other words, these mounting headwinds could weigh on stocks and lead investors to question growth expectations for the fourth quarter.

What’s more, even though S&P 500 EPS expectations still call for 22% EPS growth in 2018 vs. 2017, we’ve started to see some downward revisions in projections for the September and December quarters, which have softened 2018 EPS estimates to $162.01, down from $162.60 several weeks ago. Not a huge drop, but when looking at the current stock market valuation of 18x expected 2018 EPS, remember those expectations hinge on the S&P 500 group of companies growing their EPS more than 21% year over year in the second half of 2018.

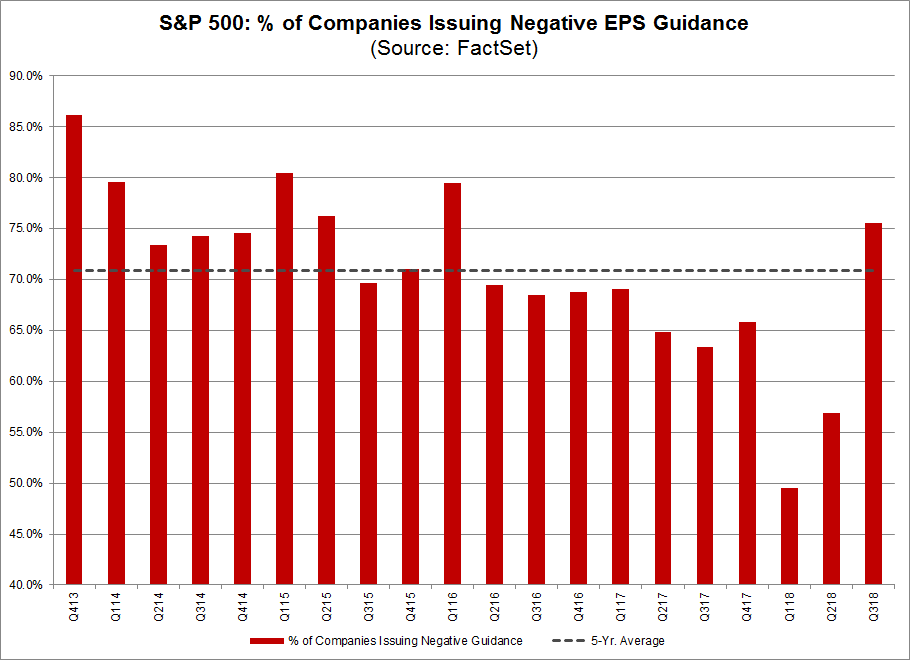

Any and all of the above factors could weigh on corporate guidance or just rattle investor’s nerves and likely means a bumpy ride over the ensuing weeks as trade and political headlines heat up. As it stands right now, according to data tabulated from FactSet, heading into September quarter earnings, 74 of 98 companies in the S&P 500 that issued guidance, issued negative guidance marking the highest percentage (76%) since 1Q 2016 and compares to the five year average of 71%.

Not alarmingly high, but still higher than the norm, which means I’ll be paying even closer than usual attention to what is said over the coming weeks ahead of the “official” start to September quarter earnings that is Alcoa’s (AA) results on Oct. 17 and what it means for both the Thematic Leaders and the other positions on the Select List.

Today is Fed Day

This afternoon the Fed’s FOMC will break from its September meeting, and it is widely expected to boost interest rates. No surprise there, but given what we’ve seen on the trade front and in hard economic data of late, my attention will be on what is said during the post-meeting press conference and what’s contained in the Fed’s updated economic forecast. The big risk I see in the coming months on the Fed front is should the escalating tariff situation lead to a pick-up in inflation, the Fed could feel it is behind the interest rate hike curve leading to not only a more hawkish tone but a quicker pace of rate hikes than is currently expected.

We here at Tematica have talked quite a bit over consumer debt levels and the recent climb in both oil and gas prices is likely putting some extra squeeze on consumers, especially those that fall into our Middle-Class Squeeze investing theme. Any pick up in Fed rate hikes means higher interest costs for consumers, taking a bigger bite out of disposable income, which means a step up in their effort to stretch spending dollars. Despite its recent sell-off, I continue to see Costco Wholesale (COST) as extremely well positioned to grab more share of those cash-strapped wallets, particularly as it continues to open new warehouse locations.

- Our price target on Costco Wholesale (COST) shares remains $250.

Favorable Apple and Universal Display News

Outside of those positions, we’d note some favorable news for our Apple (AAPL) shares in the last 24 hours. First, the iPhone XS Max OLED display has reclaimed the “Best Smartphone Display” crown for Apple, which in our view augurs well for other smartphone vendors adopting the technology. This is also a good thing for our Universal Display (OLED) shares as organic light emitting diode displays are present in two-thirds of the new iPhone offerings. In addition to Apple and other smartphone vendors adopting the technology, we are also seeing more TV models adoption it as well. We are also starting to see ultra high-end cars include the technology, which means we are at the beginning of a long adoption road into the automotive lighting market. We see this confirming Universal’s view that demand for the technology and its chemicals bottomed during the June quarter. As a reminder, that view includes 2018 revenue guidance of $280 million-$310 million vs. the $99.7 million recorded in the first half of the year.

Second, Apple has partnered with Salesforce (CRM) as part of the latest step in Apple’s move to leverage the iPhone and iPad in the enterprise market. Other partners for this strategy include IBM (IBM), Cisco Systems (CSCO), Accenture (ACN) CDW Corp. (CDW) and Deloitte. I see this as Apple continuing to chip away at the enterprise market, one that it historically has had limited exposure.

- Our price target on Apple (AAPL) and Universal Display (OLED) shares remain $225 and $150, respectively.

Changes afoot at S&P, but they still lag our thematic investing approach

Before we close out this week’s issue, I wanted to address something big that is happening in markets that I suspect most individuals have not focused on. This week, S&P will roll out the largest revision to its Global Industry Classification Standard (GICS) since 1999. Before we dismiss it as yet another piece of Wall Street lingo, it’s important to know that GICS is widely used by portfolio managers and investors to classify companies across 11 sectors. With the inclusion of a new category – Communication Services – it means big changes that can alter an investor’s holdings in a mutual fund or ETF that tracks one of several indices. That shifting of trillions of dollars makes it a pretty big deal on a number of fronts, but it also confirms the shortcomings associated with sector-based investing that we here at Tematica have been calling out for quite some time.

The new GICS category, Communications Services, will replace the Telecom Sector category and include companies that are seen as providing platforms for communication. It will also include companies in the Consumer Discretionary Sector that have been classified in the Media and Internet & Direct Marketing Retail subindustries and some companies from the Information Technology sector. According to S&P, 16 Consumer Discretionary stocks (22% of the sector) will be reclassified as Communications Services as will 7 Information Technology stocks (20% of that sector) as will AT&T (T), Verizon (VZ) and CenturyLink (CTL). Other companies that are folded in include Apple (AAPL), Google (GOOGL), Disney (DIS), Twitter (TWTR), Snap (SNAP), Netflix (NFLX), Comcast (CMCSA), and DISH Network (DISH) among others.

After these maneuverings are complete, it’s estimated Communication services will be the largest category in the S&P 500 at around 10% of the index leaving weightings for the other 11 sectors in a very different place compared to their history. In other words, some 50 companies are moving into this category and out of others. That will have meaningful implications for mutual funds and ETFs that track these various index components and could lead to some extra volatility as investors and management companies make their adjustments. For example, the Technology Select Sector SPDR ETF (XLK), which tracks the S&P Technology Select Sector Index, contained 10 companies among its 74 holdings that are being rechristened as part of Communications Services. It so happens that XLK is one of the two largest sector funds by assets under management – the other one is the Consumer Discretionary Select Sector SPDR Fund (XLY), which had exposure to 16 companies that are moving into Communications Services.

So what are these moves really trying to accomplish?

The simple answer is they taking an out-of-date classification system of 11 sectors – and are attempting to make them more relevant to changes and developments that have occurred over the last 20 years. For example:

- Was Apple a smartphone company 20 years ago? No.

- Did Netflix exist 20 years ago? No.

- Did Amazon have Amazon Prime Video let alone Amazon Prime 20 year ago? No.

- Was Facebook around back then? Nope. Should it have been in Consumer Discretionary, to begin with alongside McDonald’s (MCD) and Ralph Lauren (RL)? Certainly not.

- Did Verizon even consider owning Yahoo or AOL in 1999? Probably not.

What we’ve seen with these companies and others has been a morphing of their business models as the various economic, technological, psychographic, demographic and other landscapes around them have changed. It’s what they should be doing, and is the basis for our thematic investment approach — the strong companies will adapt to these evolving tailwinds, while others will sadly fall by the wayside.

These changes, however, expose the shortcomings of sector-based investing. Simply viewing the market through a sector lens fails to capture the real world tailwinds and catalysts that are driving structural changes inside industries, forcing companies to adapt. That’s far better captured in thematic investing, which focuses on those changing landscapes and the tailwinds as well as headwinds that arise and are driving not just sales but operating profit inside of companies.

For example, under the new schema, Microsoft (MSFT) will be in the Communications Services category, but the vast majority of its sales and profits are derived from Office. While Disney owns ESPN and is embarking on its own streaming services, both are far from generating the lion’s share of sales and profits. This likely means their movement into Communications Services is cosmetic in nature and could be premature. This echoes recent concern over the recent changes in the S&P 500 and S&P 100 indices, which have been criticized as S&P trying to make them more relevant than actually reflecting their stated investment strategy. For the S&P 500 that is being a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value.

As much as we could find fault with the changes, we can’t help it if those institutions, at their core, stick to their outdated thinking. As I have said before about other companies, change is difficult and takes time. And to be fair, for what they do, S&P is good at it, which is why we use them to calculate the NJCU New Jersey 50 Index as part of my work New Jersey City University.

Is this reclassification to update GICS and corresponding indices a step in the right direction?

It is, but it is more like a half step or even a quarter step. There is far more work to be done to make GICS as relevant as it needs to be, not just in today’s world, but the one we are moving into. For that, I’ll continue to stick with our thematic lens-based approach.