The Best Stock for 2017

DOWNLOAD THIS WEEK’S ISSUE

The full content of Tematica Investing is below; however downloading the full issue provides detailed performance tables and charts.Click here to download.

We’re back! We hope you enjoyed Christmas and the year-end holidays.

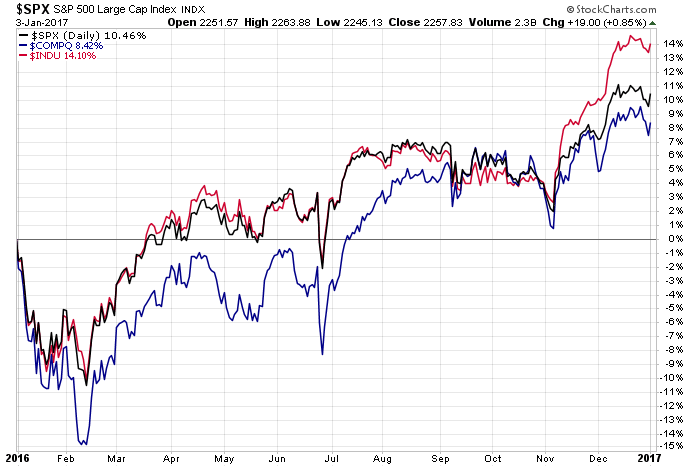

We’ve closed the books on 2016 and thanks to the push higher since early November, the S&P 500 closed the year up 9.5 percent. The other major market indices — the Dow Jones Industrial Average and the Nasdaq Composite Index — also finished out 2016 up more than 13 percent and 7 percent, respectively. That’s far better than most thought the market would do back some 11 months ago and certainly much better than what we were looking at towards the end of last summer.

Even with those year-end results, we can’t lose sight of the fact the market has faded as we closed out 2016. While there was fervent hope around mid-December that the Dow would cross the 20K line before year’s end, the index faltered as of late, which could be attributed to a combination of profit taking and a sobering view over how far, how fast the stock market has moved since the election in November.

Before we jump on the 2017 train,

let’s take a moment to look back at 2016

In hindsight, 2016 was quite a year with Greek debt relief, the EU’s tax crackdown, the sale of Yahoo (YHOO) and rumored takeover of Twitter (TWTR), the unexpected Brexit vote and British Pound Sterling’s plunge, the Italian referendum and the troubled Monte dei Paschi (BMDPY) bailout, Russian hacking, OPEC’s deal to cut output, and one of the most vicious presidential campaigns that culminated with Donald Trump’s election, and was followed by the Fed’s lone rate hike in 2016 and a surge in the US dollar. We think we would be hard-pressed to find many that predicted all of those happenings this time last year.

The Resiliency of the Markets

Despite all of those happenings, the Dow, S&P 500 and Nasdaq all hit historic highs during the year, even though 2016 earnings expectations were dialed back throughout the year. At the start of 2016, analysts were projecting year-over-year earnings growth of 5.3 percent on revenue growth of 4.4 percent for the year. As we all know by now, during the first half of the year the S&P 500 companies reported falling revenues and earnings, with the second half delivering better performance. Sifting through that performance data, however, we find 4Q 2016 earnings will dip following the 6.4 percent sequential increase achieved in 3Q 2016.

The bottom line is earnings delivered by the S&P 500 group of companies is likely to have increased less than 1 percent in 2016 compared to 2015, leaving S&P 500 earnings relatively unchanged since 2014. To be fair, there have been several drags on those results, including big earnings declines from energy companies as well as other such contractions at telecom, industrials and materials companies. While there are prospects for a reversal at energy companies over the coming quarters, the reality is the S&P 500 is closing 2016 with a P/E ratio near 18.9 — remember that number.

Looking back, the S&P 500 peaked on December 13th, following investor enthusiasm for potential tax cuts, deregulation and fiscal spending that on a combined basis would jump-start economic growth. Since December 13th, however, the S&P 500 was trading sideways until last week when it fell roughly 1 percent. We see this cooling off as reflection of the sobering view that not only has the market move been too far, too fast, as well as the growing realization that not only did the pace of economic growth slip in the fourth quarter, but odds are the impact of Trump policies will not be felt until at least the second half of 2017 at the earliest.

We’d note the Tematica Select List had several positions that handily beat the S&P 500’s December quarter return of 3.3 percent. We had strong showings during the December quarter from our AMN Healthcare (AMN; Aging of the Population), AT&T (T; Connected Society), Disney (DIS; Content is King), Dycom Industries (DY; Connected Society), and United Natural Foods (UNFI; Food with Integrity) positions.

The Latest Set of Expectations from Wall Street Strategists for 2017

As a whole, the strategists on Wall Street see the S&P 500 climbing to the 2,300 to 2,500 range, for a potential increase of 2.5 to 11.5 percent in 2017. The range for expected 2017 S&P 500 company earnings spans from a low of $123.90 to a high of $134 per share.

Averaging out those 15 forecasts, the consensus price target for the S&P 500 is 2,356 and consensus earnings expectations for the S&P 500 group of companies lands at $127.46, up 5 percent and 7.4 percent, respectively.

Based on those averages, the P/E multiple accorded to the S&P 500 to hit that average price target is 18.5x. Given that expected modest contraction from the current 18.9x multiple (remember, that’s the number we said to keep in mind), this tells us one of the key drivers of stock prices next year will be earnings growth. As such, we’ll continue to focus on those companies that are poised to grow their earnings faster than the S&P 500. By this, we mean real earnings growth, not spanx-led earnings growth that hinges more on buybacks, which give a cursory appearance of improved fundamentals rather than true operating profit growth and margin expansion. In other words, we’ll be seeking growth in 2017 and beyond, much like we have with a number of our existing positions.

As we sharpen our pencil to kickoff 2017, the vast, vast majority of companies have yet to deliver their December quarter results, which are likely to include some initial or updated views on what they see coming over the coming quarters. We’ve already heard several mention the potential impact of continued dollar strength, and we suspect we are bound to hear more about the impact of higher energy costs that will flow through to higher gas prices should OPEC production cuts stick. We also expect to hear more on the impact of higher minimum wages given that 19 states are boosting minimum wages in 2017.

What the Data is Telling Us

Towards the end of 2016 in the Monday Morning Kickoff, we touched on the negative revisions in the Atlanta Fed’s GDP Now 4Q 2016 forecast to 2.5 percent, and pointed out that even after that downtick it stood well above the 4Q 2016 forecast offers by the NY Fed and several investment banks. Last week it was rather quiet on the data front, but the data we did get — November Pending Home Sales and the December Chicago PMI — both missed expectations. While the December Chicago PMI dipped in December to 54.6 from November’s 57.6, we’d note its fourth quarter average of 54.3 is the highest it has been in two years.

What we found most interesting in the December Chicago PMI report was the findings from a “special question” that pertains to the outlook for 2017 — over half the respondents said they expect their business “to prosper, aided by tax reforms and deregulation.” Not to be overly cynical, but the risk we see is those expectations being ahead of themselves vs. what we’re likely to see near-term. The likely reality is those expectation hinge on policies President-elect Trump has yet to flesh out fully, and while we too are optimistic, we see a two steps forward, one step back kind of progress in the coming months for the economy and the stock market.

As you can imagine, we’re rather curious to see the Atlanta Fed’s next update to GDP Now that lands on Jan. 6 as well as updates for those other GDP forecasts. Odds are we will still see a downtick in 4Q 2016 GDP expectations compared to 3Q 2016, but we’ll have a better sense after this week’s usual start of the month data. In this case, it will include the December ISM indices as well as the December PMI readings from Markit Economics and the usual Employment Data build up that culminates with the December Employment Report. In other words, by the end of next week, we should have a pretty good feel for 4Q 2016 GDP. We’ll also get some insight into the Fed’s December rate hike as we digest those FOMC meeting minutes next week.

While Lite on Earnings, the week ahead includes two key events

From an earnings perspective, things are rather lite this week, but we do have the Citi 2017 Internet, Media & Telecommunications Conference, which is likely to have some commentary relevant to our Amazon (AMZN) shares. Also, this week is CES 2017, the annual global consumer electronics and consumer technology tradeshow, that should generate quite a bit of news surrounding new gadgets and technologies. In the past, this annual conference has shed some light on what’s coming for our Connected Society and Disruptive Technology investment themes and we see that happening once again.

Among the CES news flow, we’ll be listening for any and all commentary regarding organic light emitting diode demand, and what that means for our Universal Display (OLED) shares — more on why further down. Comments on wireless/wireline network build outs and 5G deployments at the show as well as those for the Connected Car should bode well for our Dycom Industries (DY) and CalAmp (CAMP) shares.

- All three stocks — OLED, DY and CAMP — are rated buys at current levels.

Also on the dais at CES will be Amazon (AMZN) as well as Under Armour (UAA) — not your typical presenters at the largest electronics show in the world. Amazon will be taking the stage to discuss artificial intelligence, digital assistants and its Alexa family of products. Ahead of tomorrow’s conference kickoff, Lenovo has announced it has partnered with Amazon to offer up the Alexa digital assistant in its own digital assistant device called Smart Assistant. We’ve noted a similar deal with Hyundai in the past that puts Alexa into the car, and suspect we will be hearing more such announcements in the coming months.

Under Armour CEO Kevin Plank, on the other hand, will give a keynote at CES 2017 that will likely discuss connected fitness, including UA’s UA Record, MapMyFitness, Endomondo, and MyFitnessPal, all of which have been unified to run on Amazon Web Services… yeah, that company again.

- We continue to rate both AMZN and UAA shares buy at current levels.

As that event dies down, the North American International Auto Show of Detroit 2017 will soon take its place only to be followed by the presidential inauguration on Jan. 20th. At that show, we’ll be listening for developments on the Connected Car, Connected Truck and telematics front and what it may mean for our CalAmp shares. Also too, we’ll be eyeing new car models to see if they are incorporating OLED technology for in-car lighting and instrumentation panel displays.

If you were expecting a calm before the 4Q 2016 earnings storm, our advice to you is enjoy the quiet while it lasts. As 2016 moves further and further into our rearview mirror, and we’ll be looking ahead in the coming weeks to take advantage of any near-term pullback in the market as expectations come to grips with near-term economic reality. We suspect this means we’ll find share prices of companies we want to own at better prices than we’ve seen in recent weeks.

This has us excited to enter 2017 and we hope you are too.

Tematica Best Pick for 2017

As we begin 2017, several positions on our select list have been named “best picks for 2017” at several bulge bracket Wall Street firms:

- Amazon (AMZN; Connected Society) – Top Pick for 2017 at Evercore

- Facebook (FB; Connected Society) – Top Pick for 2017 at Evercore

- Alphabet (GOOGL: Asset Lite) – Top Pick for 2017 at Evercore

- Starbucks (SBUX; Guilty Pleasure) – Top Restaurant Pick for 2017 at Nomura

As much as we’d like to claim surprise, we have to admit that we’re not. We just wonder if those firms are starting to recognize the thematic drivers behind those companies and their businesses that led us to add them to our select list in the first place.

Ever since the 2016 presidential election, the domestic stock market has been on fire, which means we need to look past the current market move and any pullback that is likely to happen as 2017 gets underway. Given our thematic way of looking the world, instead of the herd centric sector perspective, we see a number of tailwinds powering on in 2017. For example, we don’t see any slowdown in the shift toward digital commerce, nor do we see it abating for the growing consumer preference toward streaming media. Both of those, as well as other drivers, will continue to pressure already capacity restrained mobile and broadband networks.

That’s certainly an enticing opportunity for investors, but as we move into 2017 we are also at a key tipping point for organic light emitting diode (OLED) display technologies. In the past we’ve seen the impact of similar Disruptive Technologies thematic companies as we call them when TV moved from bulky and hot cathode ray tube displays to much sleeker liquid crystal display (LCD) screens and then again when light emitting diodes became the backlight source of choice for LCD TVs, collapsing their thickness and heat emission in the process. We’ve already started to see OLED technology replace LCD displays in the smartphone market, helping improve thickness and battery life in Samsung’s smartphone models.

In 2017, more smartphone companies, including those based in China as well as Apple (AAPL) are poised to replace existing smartphone displays with OLED based ones. A recent Wall Street Journal article that said, “Analysts widely expect the next iPhone to adopt a technology called organic light-emitting diode, at least for high-end versions. OLED displays, which are thinner, more flexible and give better contrast, will eventually replace the current liquid-crystal displays, or LCDs.”

Outside of Apple speculation, we continue to hear more reports of increasing industry capacity to meet rising demand from smartphone, TV, wearables and other markets that are set to adopt OLED technology. Both LG and Sony (SNE) recently announced they will be bringing its first OLED-based TV to market, debuting the products at 2017 CES in January. If history holds, it means a slew of competitive responses from Samsung, and other mainstays in the TV market. Soon after we have the North American International Auto Show (Jan. 8-22) and we’ll be looking for a variety of used of OLEDs at the show including lighting and instrumentation.

To date, industry manufacturing capacity for organic light emitting diodes has been constrained industry, but existing players such as Samsung and LG as well as newer entrants are adding organic light-emitting diode capacity to meet demand from the smartphone market as well as new applications that include OLED TVs, wearables, virtual reality and augmented reality, and for emerging opportunities including automotive OLED display and lighting.

OLED technology is poised to hit a tipping point during 2017

Signposts to watch include orders for semiconductor capital equipment that are used in manufacturing OLED displays. Simply put, the industry has to enough manufacturing capacity in place to meeting expected demand. Breaking down new order flow at companies like Applied Materials (AMAT), Veeco Instruments (VECO) and Aixtron AG (AIXG) reveals these orders have already begun to mount. More evidence that 2017 is poised to be the OLED tipping point.

From an investor perspective, those three capital equipment companies are not pure-plays on the OLED tipping point, just beneficiaries. Much the way Cree Inc (CREE) was the pure play on the light emitting diode (LED) wave of disruptive technology, Universal Display (OLED) is the OLED pure-play. Much the way Qualcomm (QCOM) has a push-pull between its chip and higher margin licensing business, so too does Universal Display with its OLED chemicals and licensing business. Moreover, Universal already counts the big players in the OLED industry — Samsung and LG — as customers. As their capacity and capacity from others ramps, so too should demand for Universal’s chemical business.

We see several catalysts coming in the first half of 2017, including the aforementioned 2017 CES as well soon to follow events such as Mobile World Congress 2017 and CeBIT 2017, which should propel OLED shares higher. As products announced at those events launch we are apt to see the Wall Street following grow for OLED shares, especially once we learn Apple’s plans for its next iPhone. Keep in mind the Apple halo cuts both ways, which means OLED shares could be volatile, but we would use that to build the position throughout 2017 given that 2018 looks to be a better volume year.

Adjusting the Contender List

Over the last few weeks, we’ve been reflecting not only on our select list positions, but also the Tematica Contender List. Given the way stocks have run over the last eight weeks and prospects for a pullback, odds are there will be more than a few we’ll want to add. That means making some room on the contender list. As such, we’re removing Verizon (VZ), EPR Properties (EPR), Lifelock (LOCK), Immersion (IMMR) and comscore (SCOR) from the list of prospects. While it’s never fun to ship off your toys, we know that at some point there’s a pretty good chance they could one day make their way back onto the contender list and perhaps even the select list.

Click here to see the full Contender List (listed below the current holdings)

Tematica at Business Insider

We hope you enjoyed the break over the holidays, but we were a tad busy spreading the word on thematic investing, which included a new article we penned for Business Insider. If you missed, “Here’s how thematic investing really works” you can read it by clicking here. It offers some insight into how we think not only about some of our existing themes, but also sheds some light on how we think about potential ones. We also point out some of the faults we find with would be thematic ETFs. Give it a read, we’ll think you’ll enjoy it.