Weekly Issue: A market that could turn on a tweet, makes for difficult options trading environment

Key points in this issue

- Trade uncertainties continue to boil stoking concerns that have yet to be fully reflected in 2019 earnings expectations and economic projections.

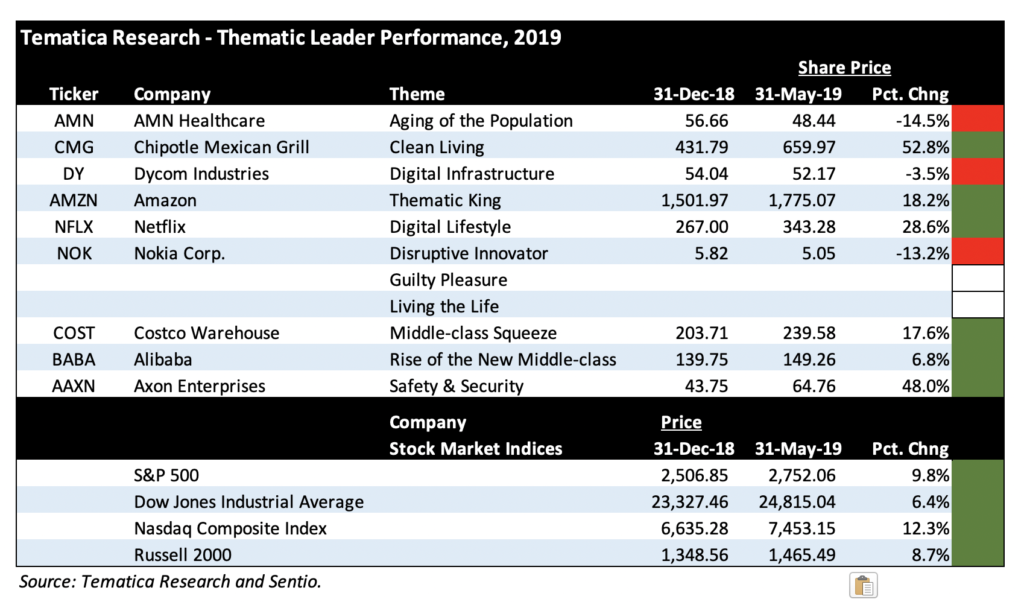

- As trade uncertainties and their repercussions grip the stock market, we’ll continue to heed the signs and signals that power our thematic investing lens that has led to a favorable performance with the Thematic Leaders thus far in 2019.

- An uncertain stock market that could turn on a tweet or a headline, makes for difficult options trading environment, which is why we’re sitting on the sidelines near-term.

Trade uncertainties continue to rise…

Last week, U.S. trade tensions expanded past China and potentially the eurozone to include Mexico. Meanwhile, retailer earnings continued to be disappointing and reported economic data reinforced the prevailing narrative of a slowing global economy. On Friday, China’s manufacturing data for May not only registered in contraction territory but came in weaker than expected, adding to those global growth concerns, while President Trump’s surprise Mexican import tariffs applied yet another of layer uncertainty for investors and the stock market to grapple with. For the week in full, all the major stock market indices declined, erasing any gains they had on a quarter-to-date basis coming into the shortened trading week.

Over the weekend, China’s retaliatory tariffs kicked in on the $60 billion target list of imported U.S. goods. Ahead of that, on Friday China threatened to unveil an unprecedented hit-list of “unreliable” foreign firms, groups and individuals that harm the interests of Chinese companies. In addition to those tariffs, over the weekend, China released a white paper saying global trade problems were started by the United States, and the United States “has been unreliable during talks.” This is looking more and more like that playground drama and finger pointing that I was worried about.

The culmination of that plus potential tariffs on Mexico, the removal of India from special trade status and potential trade issues with the eurozone has companies from Walmart (WMT) and Middle-Class Squeeze Thematic Leader Costco Wholesale (COST) to Clean Living Thematic Leader Chipotle Mexican Grill (CMG) talking about potentially higher costs. And yes, this is at a time when the latest economic data points to a slowing global and US economy. As we exit May, the Atlanta Fed Now survey pegs current quarter GDP at 1.2%, while the New York Fed Nowcast is calling for 1.5%. Both forecasts are well below the most recent 3.1% revision for March quarter GDP.

The week ahead will bring several pieces of May data that we will assess to determine the velocity tied to that slowing vector. These include the usual monthly PMI reports for China, Japan, the eurozone and the U.S., as well as the May ISM Reports for manufacturing and nonmanufacturing, and several looks at May job creation. Also this week, we’ll get the April consumer credit report data, and I expect to look through this carefully given our Middle-Class Squeeze investing theme and my growing concern over the consumer’s ability to spend. If there is data inside that report which points to climbing consumer debt, it would likely mean an intensifying headwind for the domestic economy.

… and have yet to be reflected in earnings expectations

Last week, we noted that as the velocity of earnings slows, it will be replaced by a flurry of investor conferences. As this happens, we will be parsing company comments at these events to determine what, if anything, has changed since they reported their March-quarter results. This goes for the current quarter as well as the back half of the year.

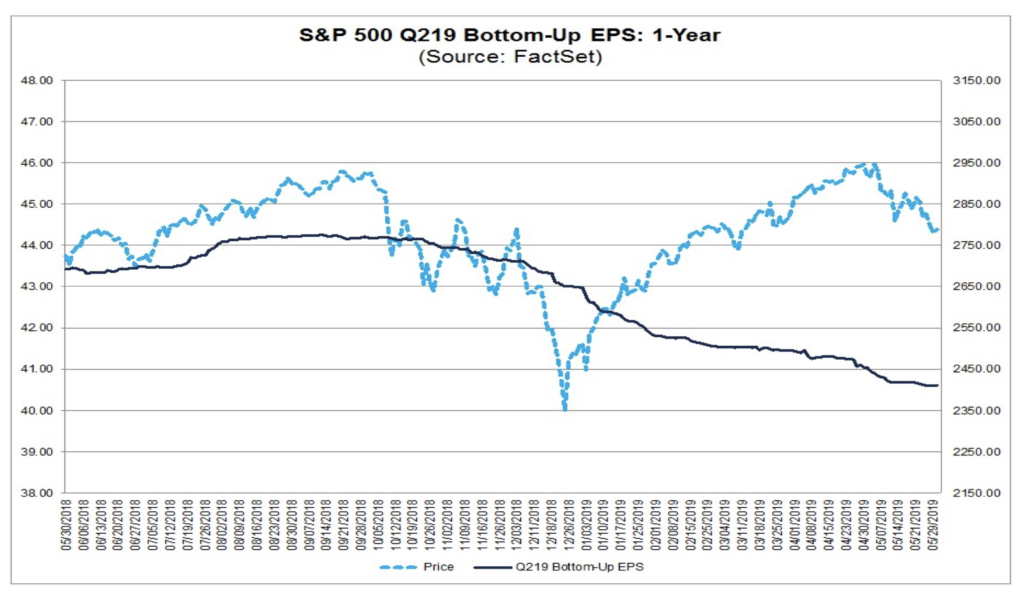

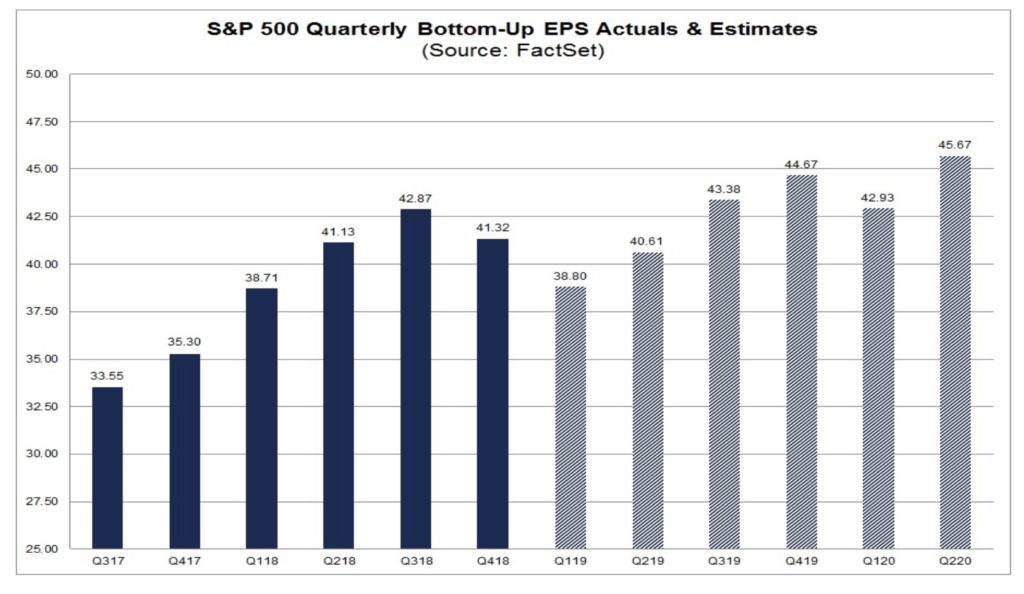

We’ve already seen current quarter EPS estimates for the S&P 500 group of companies fall over the last several weeks but expectations for the second half of the year are still looking for 11% growth compared to the first half. In my view, these mounting trade and economic concerns have yet to play out on second half expectations, which means they will likely come into greater focus in the coming weeks. The likely narrative to be had will be tariff related cost increases that will not only pressure margins and earnings but also stoke inflation as well. Should that come about, it will be a very different story than the one the stock market has been used to and as we know, a change in the expected story is not met with sunshine and candy.

Barring any forward progress on the trade front, given the outlook and increasing uncertainty there is far greater risk in my opinion to the downside for those expectations. And while some may hold out hopes for a trade deal at the G-20 meeting later this month, both J.P. Morgan and Morgan Stanley say it’s looking likely that there will not be a deal at the G-20 summit in Japan this month.

The bottom line is this – we are likely in for a bumpy stock market ride in the coming weeks with the day to day movement reflecting the latest trade and tariff comments.

Tematica Investing

Given the current and likely near-term environment, we will continue to follow the signs and signals that power our thematic investing lens. While the market uncertainty has brought some short-term lumps for AMN Healthcare (AMN), comments continue to point to the 5G buildout and network deployment to be had. That along with the pressure being placed on Chinese telecom company Huawei should keep us bullish on Digital Infrastructure leader Dycom Industries (DY) as well as Disruptive Innovator leader Nokia Corp. (NOK).

The last two weeks have been a tough time for retailer stocks given for the most part falling same-store comparisons. In the face of that, which is due in part to the ongoing shift to digital shopping that is helping power Thematic King Amazon (AMZN), I continue to favor Middle-Class Squeeze leader Costco Wholesale (COST) given its membership business model that continues to grow as the company expands its warehouse footprint.

Later today, Apple (AAPL) will hold the keynote address at its 2019 World Wide Developer Conference. Historically this event has previewed a number of new products, both hardware and software, that will be coming from Apple late this year. At a minimum, we expect updates on all of the company’s operating systems, and perhaps further clues on soon to be rolled out services such as AppleTV+. With the latter in mind, I’ll be watching is shared with an eye for Digital Lifestyle leader Netflix (NFLX).

Tematica Options+

Last week we added a put position in The Gap, and the company’s dismal quarterly earnings report popped that trade nicely. At the same time, our Del Frisco’s call option trade that was predicated on intensifying takeout chatter was stopped out as the stock market fell apart late last week. Here’s the thing, both of those positions were held for only a few days each before being stopped out with gain in the Gap puts offsetting the declines in the Del Frisco calls.

To me the wide swings in the market and increasing uncertainty epitomizes the challenges of trading options in the near-term. While it may not be a popular decision, this week we’re going to stick with one of Warren Buffet’s key investing rules – “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1” and stay on the sidelines.

Could we put on a new call or put trade, sure we could but we run the risk of the market pivoting on the latest tweet or trade headline that could lead to the demise of that position in relatively short order. Let’s preserve capital and live to trade another day, when the outlook is devoid of as many potential landmines that we have today.