Adding more defense on the back of Yellen’s rally as fundamentals erode.

We’d remind you that these folks were, in our view, not eyeing the mounting data that we’ve been reporting to you the past several weeks. Again, for those that might have missed it, earlier this week the Atlanta Fed published it’s latest GDPNow view on domestic GDP for the current quarter and now sees it clocking in around 0.6%, down from 1.4% last week and more than 2% just a few weeks ago. Other data, including Retail Sales, Durable Orders as well as the March Flash PMI all point to a challenging global economic landscape.This did wonders for our Health Care Select Sector SPDR ETF ([stock_quote symbol=”XLV”]) shares as well as our iShares Barclays 20+ Year Treasury Bond ETF (TLT) shares and the April $130 calls, which have climbed back strong over the last few days. We continue to see each of those positions moving higher in the coming days with the next catalyst being tomorrow’s rash of March PMI reports from Markit Economics for the four economic horsemen that are China, the Eurozone, Japan and, of course, the US.

Also tomorrow, we get the March Employment Report and if we read between Yellen’s comments earlier this week, it sounds more like that report will underwhelm rather than knock it out of the park. If that’s the case, it will reinforce the growing view the Fed may only boost rates just once more if at all in 2016. That would be welcomed news for our XLV and TLT positions. You should continue to hold all of them.

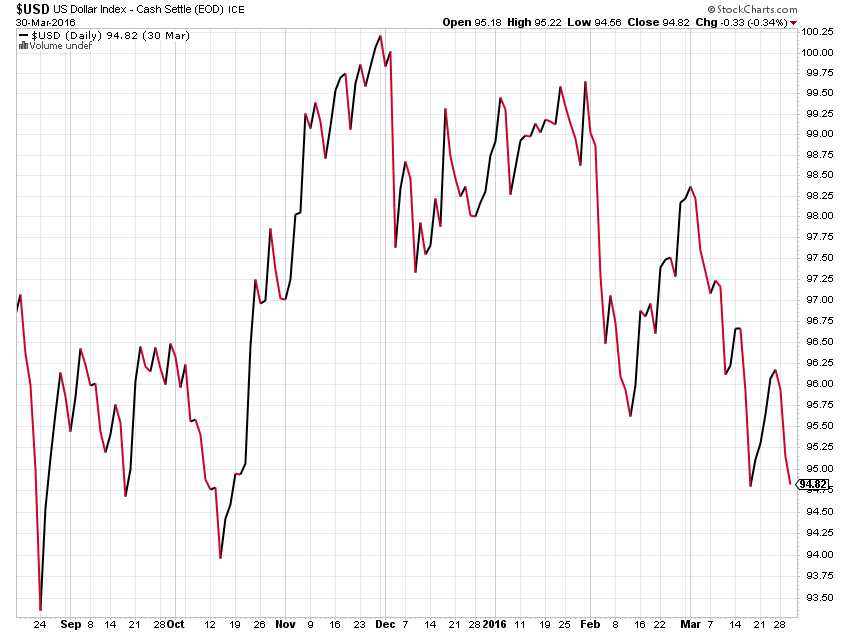

Yellen’s comments, which were echoed yesterday by Chicago Fed President Charles Evans, fueled the 1.3 percent move in the S&P 500 over the last week and led to a reversal in the US dollar from last week. Unfortunately, that move in the market led to our being stopped out of our Paccar (PCAR) April $50 puts as they cross below the recommended $0.18 stop. With the realization that an interest rate hike is off the table for the near-term, the US dollar has retreated, which pulled down our PowerShares DB Us Dollar Bullish ETF (UUP) shares and corresponding calls – the UUP April $25 calls and the UUP June $25 calls. With the European Central Bank beginning its additional monetary stimulus moves in the coming days and growing chatter of additional stimulus in China and Japans, we will keep all UUP positions on the Tematica Pro Select List for now.

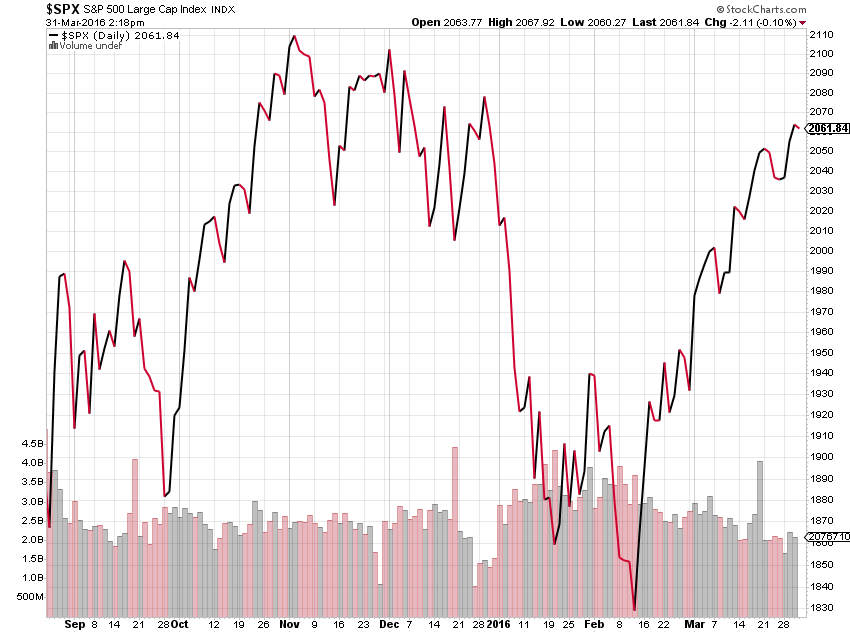

As you are likely picking up in our comments and tone this week, after the continued move up in the market, due in part of this week’s Yellen led rally, this risk to reward to have in the stock market is skewing increasingly to the risk side of the equation as the economic data continues to point toward a weaker landscape and in our view it’s only a matter of time until earnings expectations and the stock market catch up to economic reality.Over the last several weeks, the S&P 500 has climbed more than 12.8% – very far, very fast – and as we close the quarter today, end of quarter window dressing as well as corporate buy-back activity will come to a close as companies enter their ahead of earnings quiet periods. That continued move in the market has stretched the market valuation even further as 2016 earnings expectations have fallen since the start of the year. As of last night’s market close, the S&P 500 was trading at 17.1x 2016 expectations, which not only call for just 2.8% earning growth year over year, but in our view continue to have overly aggressive second half expectations relative to the first half of 2016.

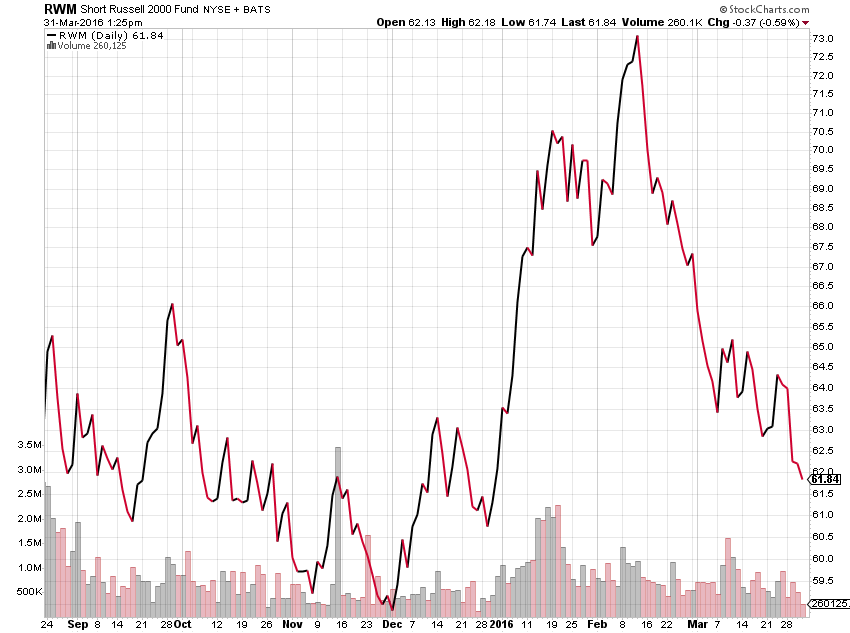

This combination has us holding steady in our ProShares Short S&P 500 ETF (SH) and ProShares Short Dow30 ETF (DOG) positions as well as our short position in heavy truck manufacturer Paccar (PCAR). We recommend you do the same, and also add ProShares Short Russell2000 (RWM) shares as we add them to the Tematica Pro Select List. If you have not added those three positions to your holdings, current levels for each remain attractive.

So why RMW shares?

ProShares Short Russell2000 (RWM) seeks daily investment results that correspond to the inverse (opposite) of the daily performance of the Russell 2000 Index. For those unfamiliar with the Russell 2000, it is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index and is the most common benchmark for mutual funds that identify themselves as “small-cap” just as the the S&P 500 index is used primarily for large capitalization stocks. While the S&P 500 has risen more than 12.8% since bottoming earlier this year, the Russell 2000, as depicted by iShares Russell 2000 Index (IWM)has climbed more than 16.5% since February 11. Given the velocity of that move, we see far more risk than reward given what we talked about above and in other commentary we’ve shared of late hence the position in RMW shares. Our price target on this inverse ETF is $67, and would recommend initiating a positon below $63.

Normally we would look for a viable option play on RWM shares, but the volumes associated with existing call options are, in our view, way too thinly traded. The last thing we want is what we call a roach motel situation – opening an option trade that we can’t get out of or it simply costs so much to get out of it wrecks our returns. We will continue to evaluate potential option positons that correspond to existing and potential defensive positions on the Tematica Pro Select List.