Macy’s Margins Harbinger of What’s to Come as Amazon Flexes Its Apparel Muscles

Yesterday Macy’s (M) warned that its gross margins are likely to come under pressure in the balance of 2017, which in our view serves as a reminder of the more than challenging retail environment that is a direct fallout of our Connected Society and Cash-Strapped Consumer investing themes. With many households living paycheck to paycheck, consumers want the best price possible and the Connected Society makes price comparison easier than ever, leaving retailers with less and less pricing power while at the same time minimum wage hikes shrink margins even further.

We’ve had other reminders in the last few days of the profound impact of these themes, including Sears (SHLD) closing an additional 72 locations on top of the 180 it announced earlier this year. In sum, these closures will shrink the Sears footprint to roughly 1,200 locations compared to 2,073 five years ago. One-time high flying Affordable Luxury investment theme retailer Michael Kors (KORS) not only recently shared it would shut 125 full-price locations over the next two years, but it guided same-store comps and revenues lower for the coming quarters due to decreased mall traffic and increased promotional activity.

We’ve had other reminders in the last few days of the profound impact of these themes, including Sears (SHLD) closing an additional 72 locations on top of the 180 it announced earlier this year. In sum, these closures will shrink the Sears footprint to roughly 1,200 locations compared to 2,073 five years ago. One-time high flying Affordable Luxury investment theme retailer Michael Kors (KORS) not only recently shared it would shut 125 full-price locations over the next two years, but it guided same-store comps and revenues lower for the coming quarters due to decreased mall traffic and increased promotional activity.

These are just the latest in a series of data points that confirm the current bout of “retail-megaddon” has legs into the all-important holiday-filled second half of the year. Those same data points also confirm our short position thesis in Simon Property Group (SPG). Over the last few years, we’ve seen shoppers increasingly switch to digital commerce, with both online and mobile shopping, at the expense of brick & mortar retailers. While many will rightfully jump to Amazon and its Prime service that has compressed delivery time to customer significantly, other retailers ranging from Nike (NKE) to Under Armour (UA), Williams Sonoma (WSM) and Nordstrom (JWN) are embracing the direct to consumer (DTC) model — some with more success than others.

Yet Another Thematic Tailwind for Amazon

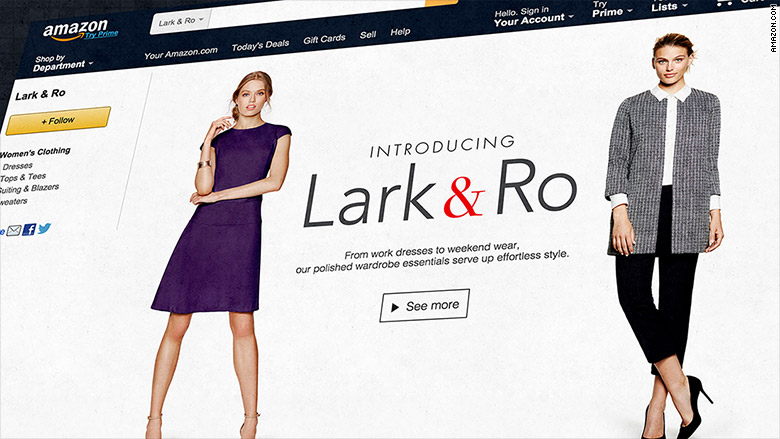

We expect to see a continued shift in retailers from brick & mortar to digital, much like we’ve seen at Macy’s and others, but here’s the thing that is likely to hit apparel retailers – Amazon flexing its muscles as it moves into apparel. Even though Amazon has cancelled its Style Code Live show, which served to tout products for shoppers to buy on Amazon, in 2016 it registered the most apparel sales of any online retailer in the US for the 18–34 demographic with more than double the market share of second place Nordstrom.

Clearly, Amazon is looking to leverage the reasons cited by shoppers for switching to Amazon – Prime, convenience, customer service, and reviews – and earlier this year it launched several private label apparel brands with products in men’s accessories, women’s dresses, and handbags followed by its own line of lingerie in April. The company’s latest effort to goose its apparel position can be found in its latest Alexa powered device, the Echo Look, which is, “a gadget with a built-in camera that is being marketed as a way to photograph, organize and get recommendations on outfits.” As part of its recommendation services, no doubt the Echo Look will recommend not only brands that can be bought on Amazon, but more than likely it will include its private label products as well.

To us, the question is not will Amazon succeed in apparel, but rather, is it tracking ahead of expectations? Research firm Cowen & Co. shared its expectations for Amazon apparel sales to account for 8.2 percent of the domestic apparel market this year, up from 6.6 percent in 2016, and 16.2 percent by 2021. To help put some context in and around those percentages, apparel is one of the biggest US retail categories with estimates sizing it up as high as $300 billion. Each market share point gain by Amazon equates to an additional $3 billion in annual revenue for the company — yes, that’s billion with a b.

And while that $ 3 billion in revenue equates to 1.5 to 1.8 percent of expected 2017-2018 revenue for Amazon, it also equates to:

- 12 percent of Macy’s (M) total expected revenue this year

- Roughly half of what Wall Street expects Dillard’s (DDS) to generate in revenue this year

- More revenue than Bon-Ton Stores (BONT) is forecasted to collect this entire year across is 270 stores and 25 million square feet.

Again, that’s each market share point, and Cowen’s forecast calls for Amazon to gain more than 1.5 percentage points in 2017 alone. To paraphrase one time presidential candidate Ross Perot, that giant sucking sound you are hearing is brick & mortar retailers going down the drain.

Back to the topic at hand, the bottom line is Amazon’s apparel market share gains, revenues and profits as part of our Connected Society and Cash-Strapped Consumer investing themes will only exacerbate retail-meggadon, likely leading to even more vacant retail space in malls across the U.S. Spurring this along is a consumer that is increasingly strapped with high and likely raising debt levels combined with little in the way of wage gains. This one-two combination of our Cash-strapped Consumer and Connected Society investing themes paints a not so pleasant picture of fewer retailers and empty storefronts with potentially more people unemployed.

Lastly, as retailers go down the drain, our thematic lens also looks to what could also be washed down with it. We’re talking about the large chain restaurants that tend to favor retail centers, the likes of Darden Restaurants (DRI), Brinker International (EAT) and Bravo Brio Restaurant Group (BBRG) just to name a couple. How those groups pivot to attract diners when malls are increasingly closing or are near empty will be critical as they attempt to avoid “restaurant-mageddon”. Haven’t heard that one yet? We’re already starting to see the Thematic Signals point to it as lunchtime meals have plunged and restaurant sales are showing signs of peaking.

Lastly, as retailers go down the drain, our thematic lens also looks to what could also be washed down with it. We’re talking about the large chain restaurants that tend to favor retail centers, the likes of Darden Restaurants (DRI), Brinker International (EAT) and Bravo Brio Restaurant Group (BBRG) just to name a couple. How those groups pivot to attract diners when malls are increasingly closing or are near empty will be critical as they attempt to avoid “restaurant-mageddon”. Haven’t heard that one yet? We’re already starting to see the Thematic Signals point to it as lunchtime meals have plunged and restaurant sales are showing signs of peaking.

The good news is, we all have to eat, and several restaurant chains are turning to mobile ordering (good news for our Cashless Consumption theme) and new, more healthy menu options that is part of our Foods with Integrity theme. But that’s all for another story, literally.