September’s Start Gives Investors Whiplash

The markets closed last week in a bullish mood on the news that (stop me if you’ve heard this one before) the US and China will be back at the negotiating table in October. You don’t say! Oh but this time we have schedules and a list of attendees so it is totally different.

The past three days of bullishness have been in sharp contrast to the chaos of August during which global stock markets lost around $3 trillion in market cap thanks to the ongoing trade wars and more data pointing to global slowing. As of Friday’s close, over the past year, the S&P 500 is up 3.7%, the Nasdaq 2.5%, Dow Jones Industrial Average up 3.4%, the NYSE Composite Index up 0.17% and the Russell 2000 is down -12.1%. During August 2,930 acted as a resistance level for the S&P 500 multiple times, but the index managed to break through that level last week, which is typically a bullish signal.

As the markets have taken an immediate about-face on the reignited hopes for progress in the trade wars, we’ve seen a profound flip-flop in equity performance which gave many a portfolio whiplash.

- Those stocks with the lowest P/E ratios that were pummeled in August are up an average of 5.3% since last Tuesday’s close.

- The stocks that held up best in August are barely breakeven over the final three trading days last week while those that were soundly beaten down in August are up the most so far in September.

- Stocks with the most international revenue exposure are materially outperforming those with primarily domestic revenue exposure.

While corporate buybacks have been a major source of support for share prices in recent years, corporate insiders have been big sellers in 2019 selling an average of $600 million worth of stock every trading day in August, per TrimTabs Investment Research. Insider selling has totaled over $10 billion in five out of the first eight months of 2019. The only other time we’ve seen so much insider selling was in 2006 and 2007.

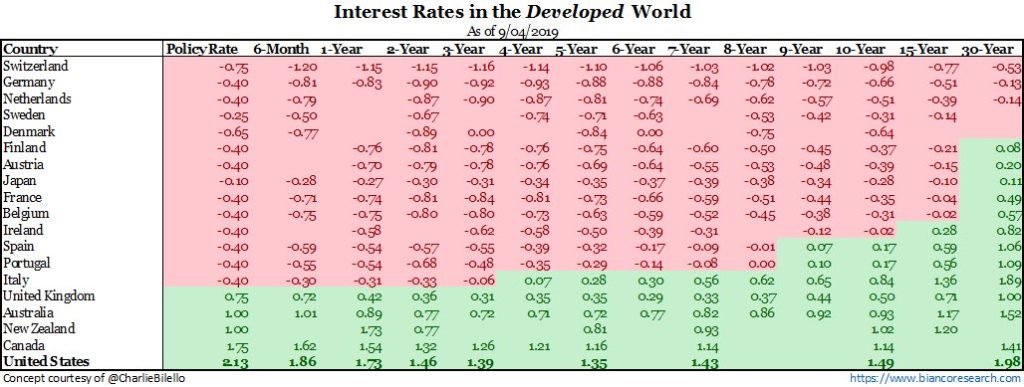

Bonds

August saw an additional $3 trillion of bonds drop into negative territory. We are now up to $17 trillion in negative-yielding bonds globally, with $1 trillion of that corporate bonds – talk about weak growth expectations! We also saw the yield on the 30-year Treasury bond drop below the dividend yield for the S&P 500 recently. The last time that happened was in 2008.

The yield on the 10-year Treasury dipped below the 2-year multiple times during the trading day in August but closed for the first time inverted on August 26th. August 27th the spread between the 10-year Treasury yield and the 2-year rate fell to negative 5 basis points, its lowest level since 2007. Overall the yield on the 10-year Treasury note fell 52 basis points during the month of August – that’s a big deal. The last time we saw a fall of that magnitude in such a short period of time was in 2011 when fears of a double-dip recession were on the table. Currently, the real yield on US 10-year is sitting in negative territory which says a lot about the bond market’s expectations for growth in the coming years. Keep that in mind as you look at the PE multiple for the S&P 500 after having two consecutive quarters of contracting EPS.

A growing number of countries have their 10-year dropping into negative territory:

- Switzerland first in January 2015

- Japan in February 2016

- Germany and Netherlands in the Summer of 2016

- Finland and Denmark in

the Fall of 2016 - Ireland, Latvia, Slovakia, Belgium, Sweden, Austria, France all negative

The US is now the only nation in the developed world with any sovereign rate above 2% (h/t @Charlie Bilello). My bets are that we are the outlier that won’t stay an outlier indefinitely.

Recently the Italian 10-year bond dropped to new all-time lows as Cinque Stelle (5 Star) movement managed to team up with the center-left Democratic Party of former Prime Minister Matteo Renzi. Don’t expect this new odd-couple coalition to last long as these two parties have basically nothing in common save for their loathing of Matteo Salvini and the League, but for now, the markets have been pacified. These two parties detest one another and were trading insults via Twitter up until about a month ago. This marriage of convenience is unlikely to last long.

The European Central Bank meets on September 12th, giving them one week head start versus the Federal Reserve’s Open Market Committee meeting, which is September 17th & 18th, kicking off the next round of the central bank race to the bottom. The ECB needs to pull out some serious moves to prop up Eurozone banks, which are near all-time lows relative to the broader market. We’ll next hear from the eternally-pushing-on-a-string Bank of Japan on September 19th.

Currency

Dollar Strength continues to be a problem across the globe. The US Trade Weighted Broad Dollar Index recently reached new all-time highs, something I have warned about in prior Context & Perspective pieces as being highly likely. It’s happened and this is big – really big when you consider the sheer volume of dollar-denominated debt coming due in the next few years and that this recent move is likely setting the stage for significant further moves to the upside.

In the context of the ongoing trade war with China, the renminbi dropped 3.7% against the dollar in August, putting it on track for the biggest monthly drop in more than a quarter of a century as Beijing is likely hunkering down for a protracted trade war with the US, despite what the sporadically hopefully headlines may say.

Make no mistake, this is about a lot more than just terms of trade. This is about China reestablishing itself as a major player on the world stage if not the dominant one. For much of the past two millennia, China and India together accounted for at least half of global GDP. The past few centuries of western dominance have been a historical aberration.

As the uncertainty around Brexit continues to worsen (more on this later), the British pound last week dropped to its lowest level against the dollar in 35 years, apart from a brief plunge in 2016 likely for technical reasons.

Domestic Economy

The US economy continues to flash warning signs, but there remain some areas of strength.

The Good:

- Consumer Spending rose +0.4% month-over-month in July, beating expectations for an increase of +0.3%.

- Average hourly earnings for August increased by 0.4% month-over-month and 3.2% year-over-year, each beat expectations by 0.1%.

- ADP private nonfarm payrolls increased by 195,000 in August versus expectations for 148,000.

- Unemployment rates for black and Hispanic workers hit record lows.

- The prime-age (25-54) employment-population ratio hit a new high for this business cycle, still below the peak of both the prior and 1990s expansion peaks, but still an improvement.

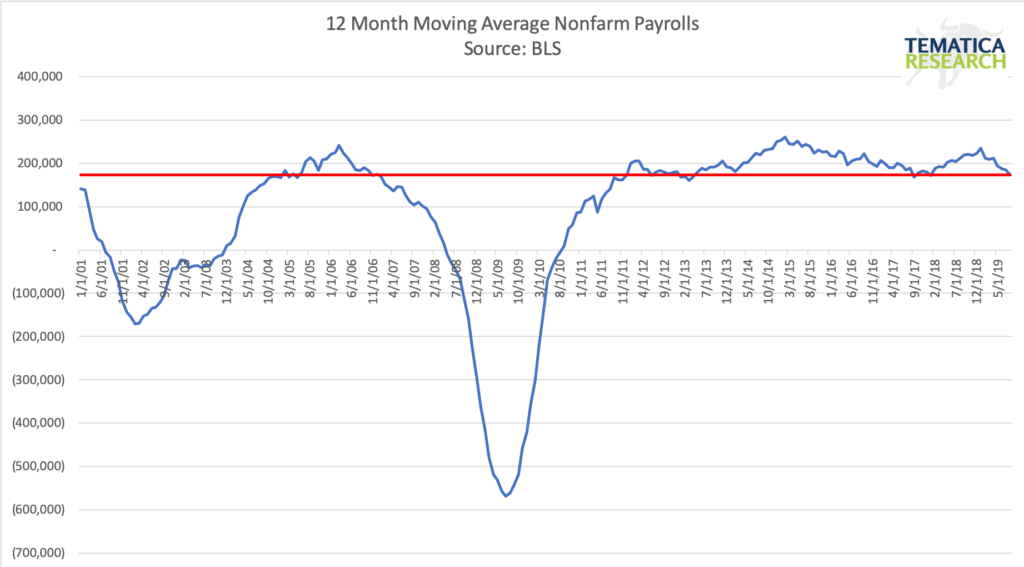

- While employment growth is slowing, jobs continue to grow faster than the population.

- Despite the weakest ISM Manufacturing report in years, the ISM Non-Manufacturing report painted a much rosier picture of at least the service sector. While expectations were for an increase to 54.0 from 53.7 in July, the actual reading came in well above at 56.4. In contra

s t to the ISM Manufacturing report, New Orders were much stronger than the prior month and only slightly below the year-ago level. - The Citi Economic Surprise Index (CESI) has continued to recover, moving above zero (meaning more surprises to the upside than down) for the first time in 140 days after having been in negative territory for a record 357 days.

The Bad:

- Nonfarm payrolls increased by only 130,000 versus consensus estimates for 163,000 and only 96,000 of those jobs came from the private sector – the

s lowest pace since February. Both July and June job figures have been revised lower, which is basically what we have been seeing in 2019. A long string of revisions to the downside means there is a material shift in the labor market. Total nonfarm payroll employment increased by 130,000 in August. - Job growth has averaged 158,000 per month in 2019, below the average monthly gain of 223,000 in 2018.

- University of Michigan Consumer Confidence survey total contradicted the Conference Board’s findings with its main index falling the most since 2012 in August, dropping to the lowest level since President Trump took office. Concerns over tariffs were spontaneously mentioned by 1/3 of the respondents. The most concerning data from the survey where Household Expectations for personal finances one year from now experienced the biggest one month drop since 1978, falling 14 points.

- Consumer spending doesn’t look so great when you look at the drop in the Personal Savings rate from 8.0% in June to 7.7% in July, which means that 75% of the increase in spending was at the cost of savings. Net income only rose 0.1% in nominal terms in July versus expectations for a 0.3% increase – not at all consistent with the narrative of a strong labor market.

- The Chicago Fed’s Midwest state economy survey found that the number of firms cutting jobs rose to 21% in August from just 6% in July while those hiring dropped to 25% from 36%.

- The Quinnipiac University poll found that for the first time since President Trump took office, more Americans believe the economy is getting worse (37%) than believe it is improving (31%).

- Camper van sales dropped 23% year-over-year in July. This has historically been a pretty accurate leading indicator of future consumer spending.

- The Duncan Leading Indicator (by Wallace Duncan of the Dallas Fed in 1977) has turned negative year-over-year for the first time since 2010. A Morgan Stanley study found that when this indicator has turned negative, a recession began on average four quarters later, with only one false positive out of seven going back to the late 1960s.

- While expectations were for the ISM Manufacturing Index to increase from 51.2 to 51.3 in August, the reading came in at 49.1 (below 50 indicates contraction), the fifth consecutive monthly decline in the index and the first time the index has dropped into contraction in three years. Even worse, the only sub-index not in contraction was supplier deliveries. New Orders (the most forward-looking of all sub-indices) hasn’t been this weak since April 2009.

- Durable Goods New Orders and Sales are improving but remain in contraction territory while Inventories are rising at around a 5% annual pace – that’s a problem.

- US Producer Prices experienced their first decline in 18 months.

- The Atlanta Fed’s GDPNow estimate for the third quarter has fallen to 1.5%.

The Ugly:

- US Freight rates have fallen 20% from the June 2018 high. Even more dire warning comes from freight orders, which dropped 69% in June from June 2018.

Europe

That nation that has been the region’s strongest economy is struggling as the fallout from the US-China trade war expands around the world.

- The

- German retail sales took a bigger battering than expected in July, falling 2.2% from June to reveal the biggest drop this year in the latest indication that Europe’s largest economy may well slide into recession. Since February, monthly retail sales figures have either declined or been flat, with the exception of the 3% gain in June.

- A recent survey revealed that employers are posting fewer jobs, intensifying fears that the downturn in the country’s manufacturing industry has spread into the wider economy.

- Manufacturing orders came in weaker than expected, declining -5.6% versus expectations for -4.2%.

- Construction activity has contracted at the fastest rate since June 2014.

- Germany’s export-dependent economy shrank 0.1% in the second quarter while the central bank warned this month that a recession is likely.

The rest of Europe continues to weaken.

- Italian industrial orders fell -0.9% in June, making for a -4.8% year-over-year contraction

- French consumer spending is up all of +0.1% year-over-year.

- Spain’s flash CPI has fallen from 0.5% year-over-year in July to 0.3% in August year-over-year.

- Switzerland’s year-over-year-GDP growth has fallen to 0.2% versus expectations for 0.9% – treading water here.

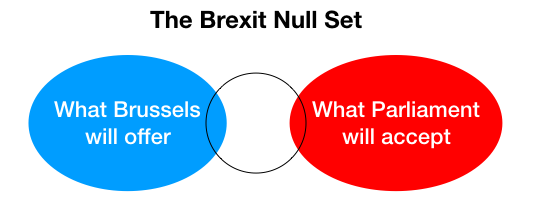

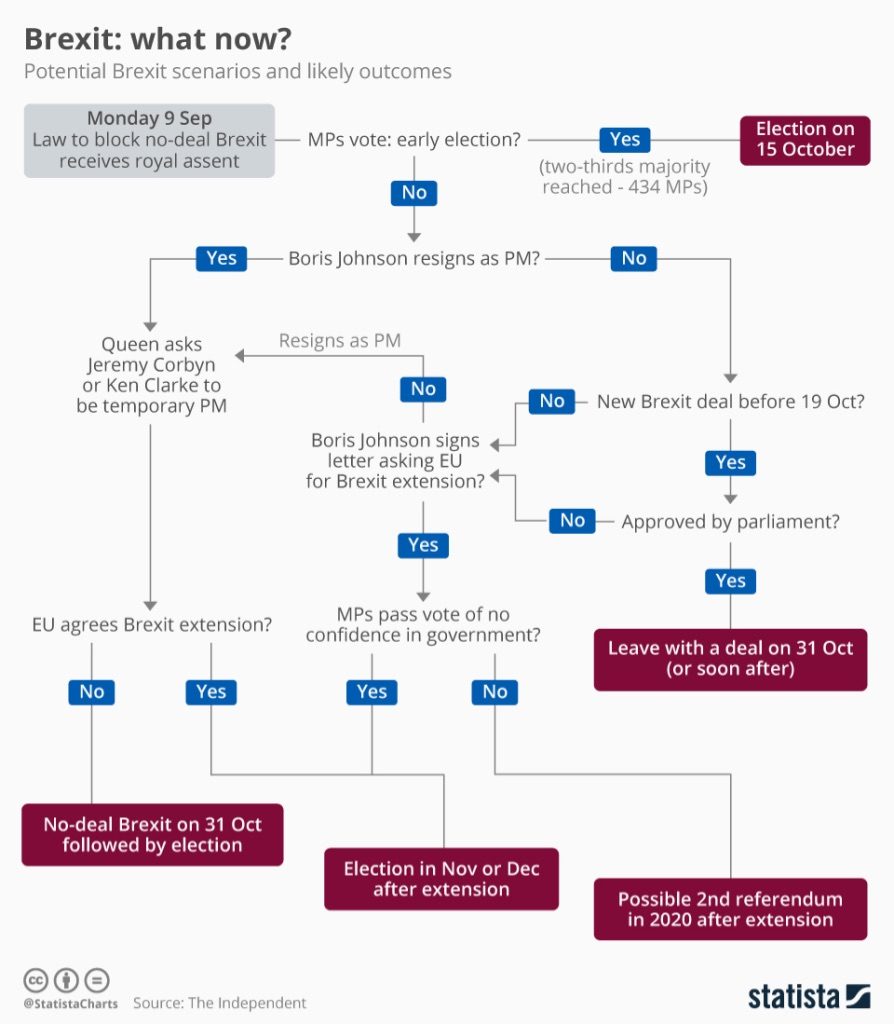

- Brexit has turned into an utter mess as Prime Minister Boris Johnson has lost his majority in Parliament. Novels could and likely will be written on this mind-boggling drama in what was once one of the most stable democracies in the world. Rather than put you through that, as they say, a picture is worth a thousand words.

The challenge for anyone negotiating terms for Brexit with the Eurozone basically comes down to this.

Understanding this impossible reality, here is what to expect in the coming weeks.

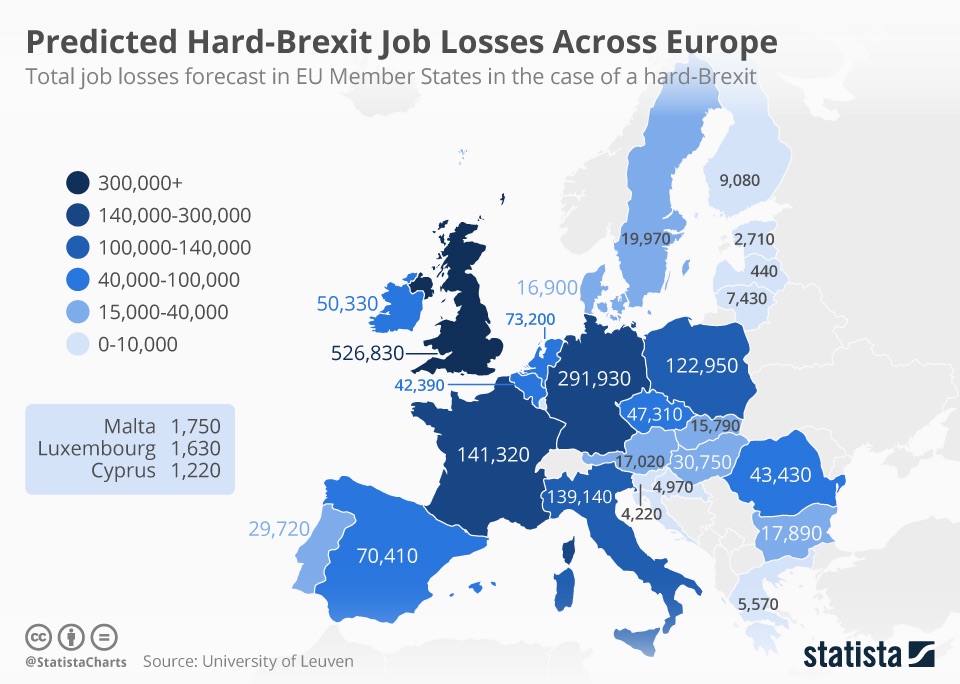

For those who may not be convinced that this is a material problem, this is an estimate of the impact of a hard Brexit on the Eurozone alone.

Bottom Line

Around 70% of the world’s major economies have their Purchasing Managers Index in contraction territory (below 50) – that is a lot of slowing going on. Much of the world is drowning in debt with excess productive capacity – a highly deflationary combination.

We are witnessing a major turning point in the global economy and geopolitical landscape. The past 60 post-WWII years have primarily consisted of US economic and military dominance, increasing levels of globalization and relatively low levels of geopolitical tension.

Today we are seeing a shift away from an optimistic world of highly interconnected global supply chains towards one driven by xenophobia and nationalism. We are seeing rising economic and political tensions between not only traditional rivals but also between long-term allies. In the coming decades, the US economy will no longer be the singular global economic and military powerhouse, which will have a material impact on the world’s geopolitical balance of power.

The big question facing investors is whether the US and much of the rest of the world are heading into a recession. Many leading indicators that have proven themselves reliable in the past indicate that this is highly likely but today really is different.

Never before in modern history have we had these levels and types of central bank influence. Never before have we had such a long expansion period. Never before have we had this much debt, particularly at the corporate level. Never before have we had such profound demographic headwinds. On top of all that, we have a directional shift away from globalization that is forcibly dismantling international supply chains that were decades in the making with no clarity on future trade rules.

Will central bankers be able to engineer a way to extend this expansion? No one who is intellectually honest can answer that question with a high level of confidence as we are in completely uncharted territory. This means investors need to be agile and put on portfolio protection while it remains relatively cheap thanks to historically low volatility levels.

I’ll leave you with a more upbeat note, my favorite headline of the week.