Sometimes the market moves against us even when the data says we’re right

Yesterday we were stopped out of our Paccar (PCAR) May $55 put option as the company reported mixed March quarter results — revenue dropping 12% year over year, but EPS for the quarter ahead of expectations due in part to the lower share count year over year in the quarter — that led to short covering. The ensuing 5% move in the shares led to the put tripping our $1.15 stop loss; the use of that risk management tool limited our loss on the position to 23 percent, which is far more palatable than the 76 percent drop that unfolded in the PCAR May $55 puts yesterday.

Earnings season with anywhere from a few hundred to more than a 1,000 companies reporting their results makes for a volatile time with investors shooting first as results hit the tape and asking questions over the quality of those earnings later. In the case of Paccar, despite the March quarter performance the company cut its outlook for heavy truck (Class 8) industry retail sales in the US and Canada this year to 220,000-250,000 units, down from its early January forecast of 230,000-260,000 units.

In comparing Paccar’s 2016 outlook to others it’s apparent that Paccar’s outlook is more than optimistic: ACT Research calls for US Class 8 retail sales to be 207,000 this year (down 18% year over year) and truck retailer Rush Enterprises (RUSHA) that sees it falling even more year over year. With retail sales of heavy truck sales clocking in around 53,200 for the March quarter, we would need to see a modest pick up to meet the low end of Paccar’s 2016 forecast and a more pronounced rebound to hit even the midpoint of that revised forecast.

Color us skeptical.

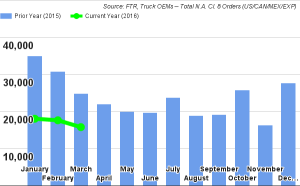

Adding support to our skepticism, research firm FTR released preliminary data showing March 2016 North American Class 8 truck net orders fell for the third consecutive month to 15,800 units, the lowest level since September 2012. Month over month, March 2016 orders fell 12 percent and were down a steeper 37 percent when compared with March 2015 orders. With orders dropping, truck manufacturers are reducing production rates as they contend with high inventory levels. Historically this tends to lead to aggressive pricing, margin compression and falling earnings.

As if that isn’t enough, with truck tonnage falling 4.5 percent in March and continued declines in Industrial Production and weak core capital goods orders the vector and velocity of the economy are at odds with the move in Paccar’s share prices.

As such, even though we were stopped out of our Paccar put, we will maintain the short position on Paccar shares in the Tematica Pro Select List.