Checking the 2017 Corn Harvest and our Teucrium Corn Fund shares

Key Points from This Post:

-

We remain long-term bullish on Teucrium Corn Fund (CORN) shares given a new China-related wrinkle that could reshape supply-demand dynamics for corn.

-

Near-term, we are entering the peak harvest season for Corn, and we’re watching the weather in the western domestic corn region that could crimp this year’s harvest, which is already shaping up to be the weakest in the last four years.

-

Our long-term price target on CORN shares remains $25

In mid-July, we added shares of the Teucrium Corn Fund (CORN) to the Tematica Investing Select List as a Rise & Fall of the Middle Class and Scarce Resource investment theme play on one of the most widely used and consumed commodities – corn. Since that addition of those CORN shares, even though they are off their late August bottom at $17.13, the position is still down 11.5% as of last night’s market close. While we are patient investors, we are human (yes, it’s true!) and that can lead to bouts of frustration with a position. When that happens, being the professional investors that we are, we turn back to the investing premise that led to adding the shares in the first place, checking the data along the way to determine if the thesis remains intact. If it is, then we will remain patient; if not, then we have some decisions to make.

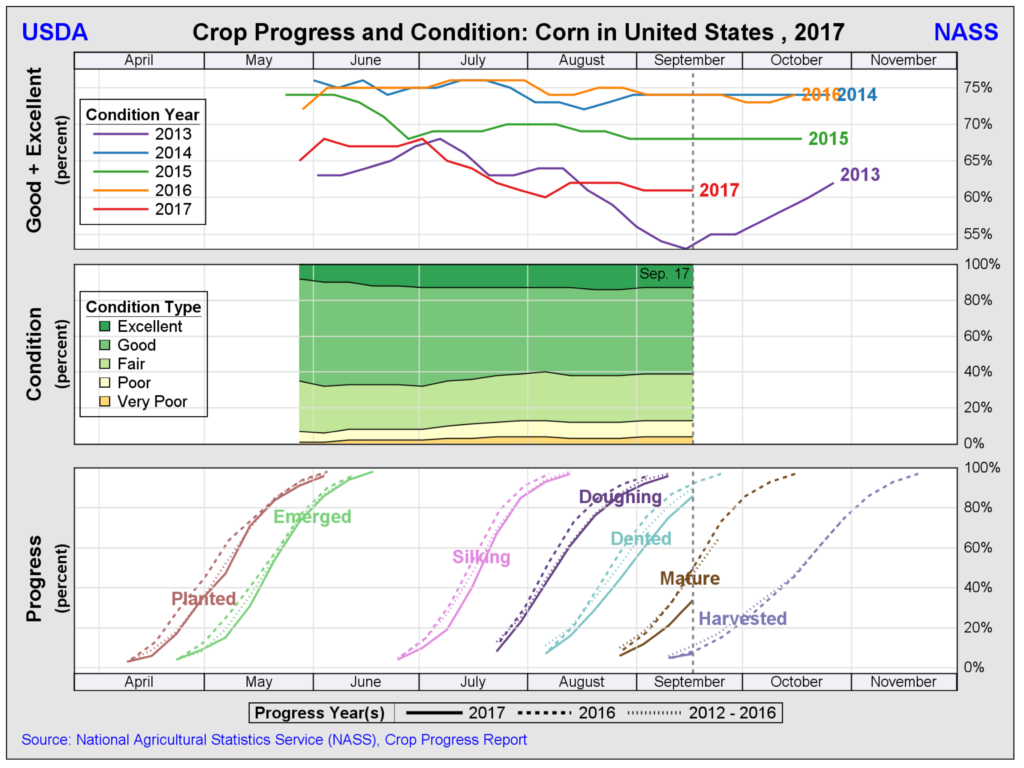

In the case of corn supply-demand dynamics, the below chart is the latest data from the Crop Progress Report published by the U.S. Department of Agriculture’s National Agriculture Statistics Service (NASS):

What the data above depicts is the current corn crop is shaping up to be the weakest in the last four years. The same data set shows a growing percentage of the current corn crop is in Poor or Very Poor condition. If this condition persists, let alone rises, it will impact the coming harvest. Simple supply-demand dynamics means a weaker than expected supply will likely lead to higher corn prices.

What this means is we’ll be watching the progress of the 2017 harvest, and September-October is the peak time for that activity. As of this past Sunday night, just 7% of the U.S. corn crop had been harvested vs. the 5-year average of 11%. While that may seem like a small percentage difference, remember that’s on a base of millions of metric tons.

What’s likely to hamper the harvest and its yield this year is the weather. While the weather in the eastern corn-growing region of the U.S. is looking favorable with dryer, warmer weather, it’s looking rather different in the western corn belt that is the eastern Dakotas, Minnesota, and northern Iowa. In that region, forecasts are calling for dramatically cooler temperatures that could result in scattered frost next week. If that happens, we are likely to see the percentage of the current corn crop that is Poor/Very Poor climb past the current 39% level. Such a move would boost corn prices as well as our CORN shares.

Further complicating the corn supply-demand equation in the medium to longer-term is news that China plans to dramatically boost ethanol use in its gasoline supply, moving to E10 blends by 2020 to help combat pollution and smog. If this move comes to pass, it could lead to a meaningful shift in corn demand dynamics given that China is the world’s largest car market, but is the third largest consumer of ethanol fuel. According to S&P Global Platts, China has the “capacity to produce maybe a billion gallons of ethanol, and that would have to be increased ten-fold to get to this E-10 mandate.” That sound you just heard was eyebrows being popped higher on what that could mean for corn prices.

Near-term we will continue to monitor the weather and what it means to the current corn crop. Should milder than expected weather emerge, and weigh on corn prices in the coming weeks, we’ll look to use that weakness to improve our long-term position in CORN shares given the potential game changer in corn demand in the medium-term.