In this Week’s Issue:

-

Adding Some CORN to the Select List

-

Amazon – More Than Prime Day this Week

-

What PepsiCo Says About Our Foods With Integrity Investing Theme

-

The Wall Street Journal Serves up a Bullish Case for our AMAT Shares

-

USA Technologies: Arming Itself for the Growing Cashless Consumption Opportunity

We’re several days into 3Q2017 and while we’re waiting for 2Q 2017 earnings to kick into gear, we’re once again seeing Washington and all Trump-related shenanigans dominate the headlines. Amid the bluster of renewed chatter among Trump-related ties to Russia, we found more interesting a comment from Treasury Secretary Steve Mnuchin. Mnuchin stated, “the Trump administration hopes to roll out its “full-blown” tax reform plan in early September and sign it into law by the end of the year.” While we are all for tax reform, the issue is the timetable as this, too, has now slipped past the original August deadline.

Yesterday, Senate Majority Leader Mitch McConnell has delayed the start of the August Senate recess until the third week in August in order to allow more time for “work on health care reform” among other tasks. Put together, it continues to look like we should see a reset in GDP expectations as well as earnings expectations for the back half of the year.

This week there are just a handful of S&P 500 companies reporting, and as we discussed in this week’s Monday Morning Kickoff, that will change beginning next week with the up-tempo velocity lasting through August 4. We’re sharpening our pencils and getting ready for the onslaught. Before then, we’re adding a new Scarce Resource play onto the Tematica Select List this week as well as sharing our take on this week’s news for Amazon (AMZN), McCormick & Co. (MKC), International Flavors & Fragrances (IFF), Amplify Snacks (BETR), Applied Materials (AMAT) and Universal Display (OLED).

Adding Some CORN to the Select List

Several weeks back, we spoke with Sal Gilbertie, President, Chief Investment Office and co-founder of Teucrium Trading about his commodity-based ETFs, which include the:

- Teucrium Corn Fund (CORN)

- Teucrium Wheat Fund (WEAT)

- Teucrium Soybean Fund (SOYB)

- Teucrium Sugar Fund (CANE)

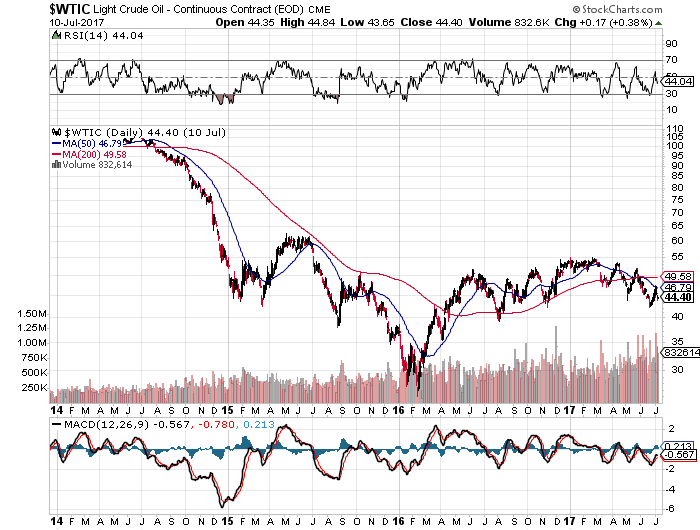

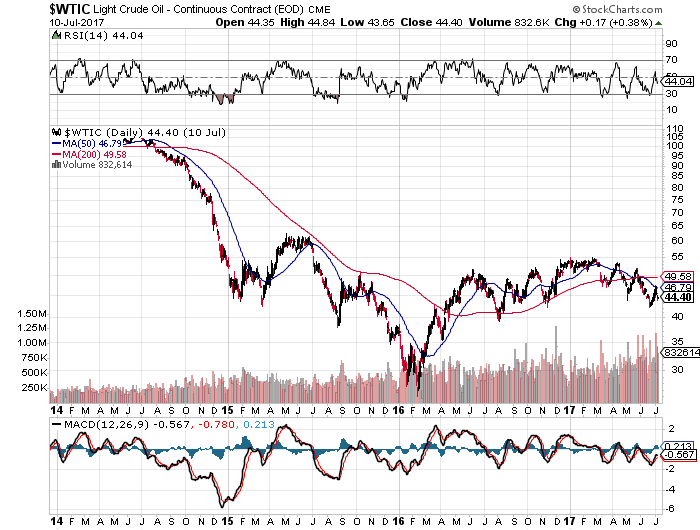

Given our past lives that looked at agricultural equipment companies, we were more than familiar with the supply-demand dynamics of commodities before we spoke with Sal. Sometimes it’s either the supply side or demand side of the equation in the driver seat, but from time to time both levers are being pulled, much like we are seeing with oil these days where there is both rising supply and weakening demand. The windup is oil prices have been under pressure and we continue to expect oil earnings to be reset given that price falloff.

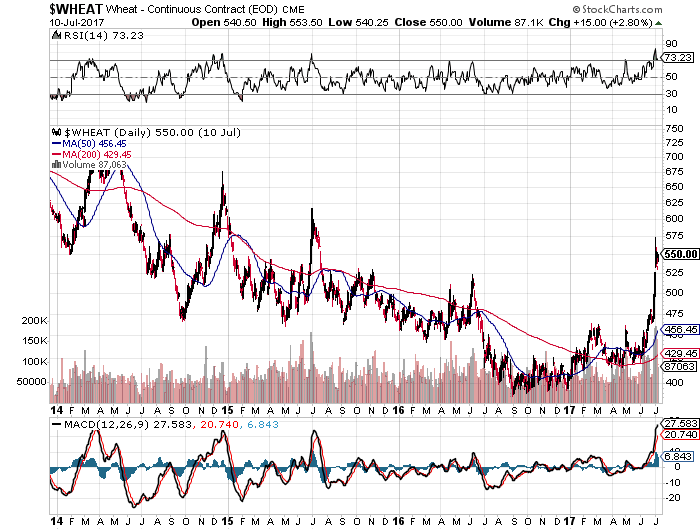

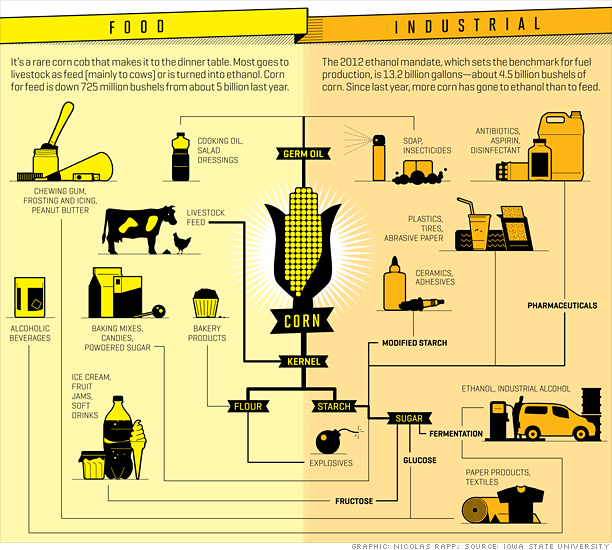

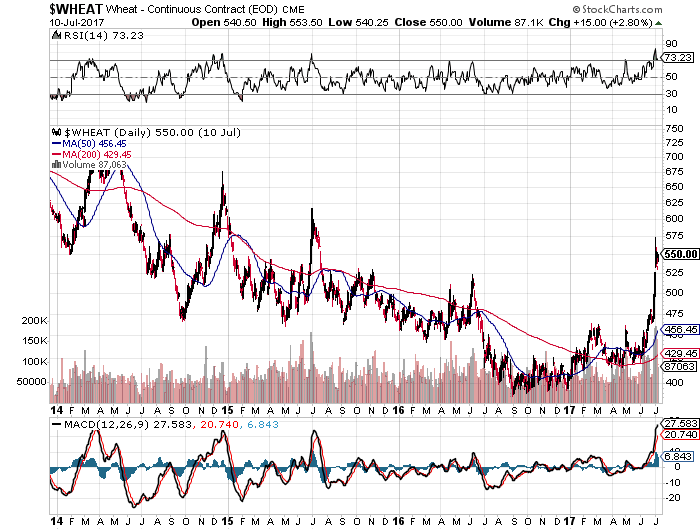

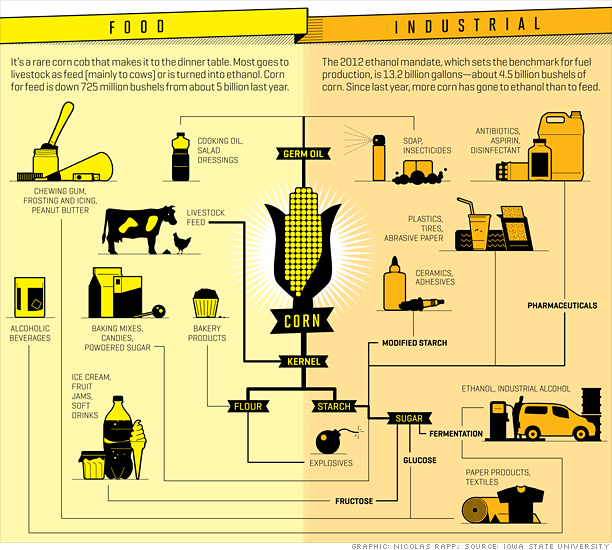

We’re seeing something very different when it comes to the agricultural commodities, especially corn and wheat as prices for both have been climbing of late. What’s at work here is steadily rising demand associated in part with the “rise” aspect of our Rise & Fall of the Middle-Class that is spurring demand for the protein complex and other food stuffs. There is also the influence of our investing theme given that the world’s population continues to grow and now exceeds 7.4 billion people. Roughly every three months, there are around 20 million more people on our planet, which means that since 2013 there are around 320 million more mouths to feed. We’d also point out that these agriculture commodities are consumables, meaning that once they are eaten they are gone and need to be purchased again. That is especially true with corn given the plethora of uses that span a multitude of food and industrial products including starch, sweeteners, corn oil, beverage and industrial alcohol, and fuel ethanol.

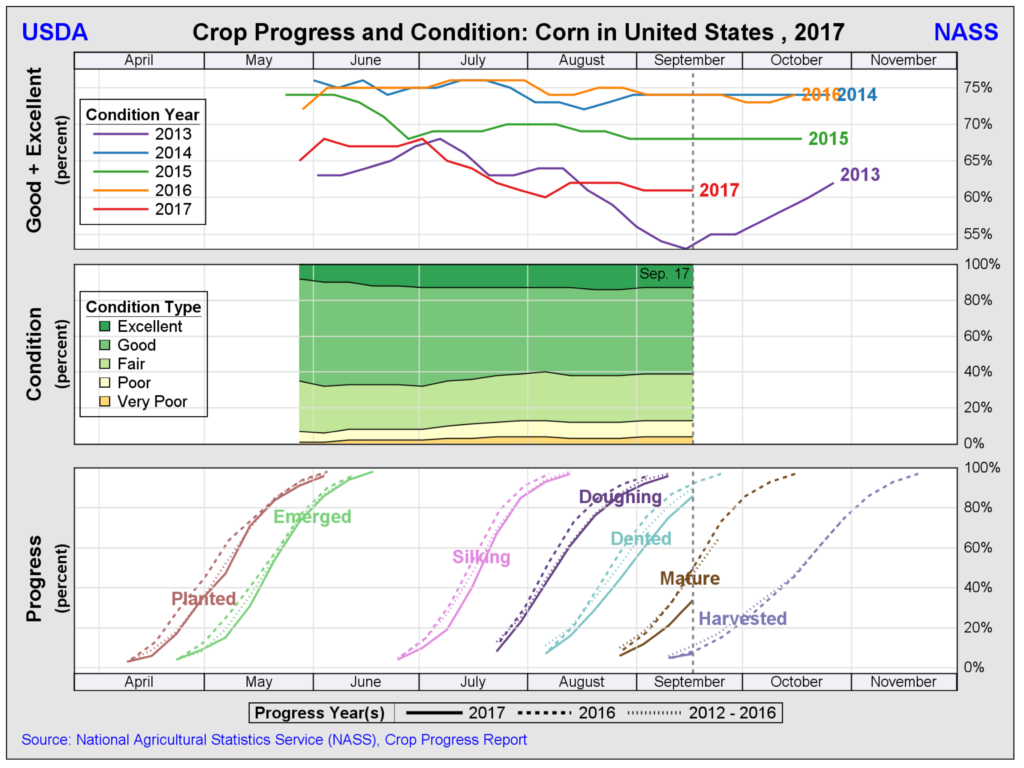

What explains the rise in corn and wheat prices, however, is the supply side. Over the past four years from 2013-2016, crop yields in the U.S. were at record levels, and inventories rose and that led US farmers to plant fewer acres this year. In turn, at the start of 2017, the U.S. Department of Agriculture projected that the 2017 crop would be more than a billion bushels smaller than the 2016 crop.

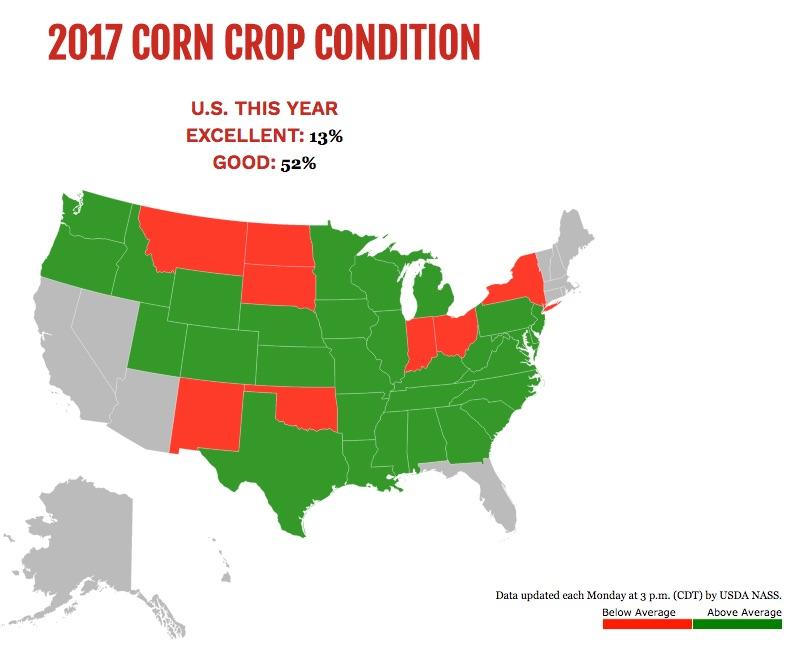

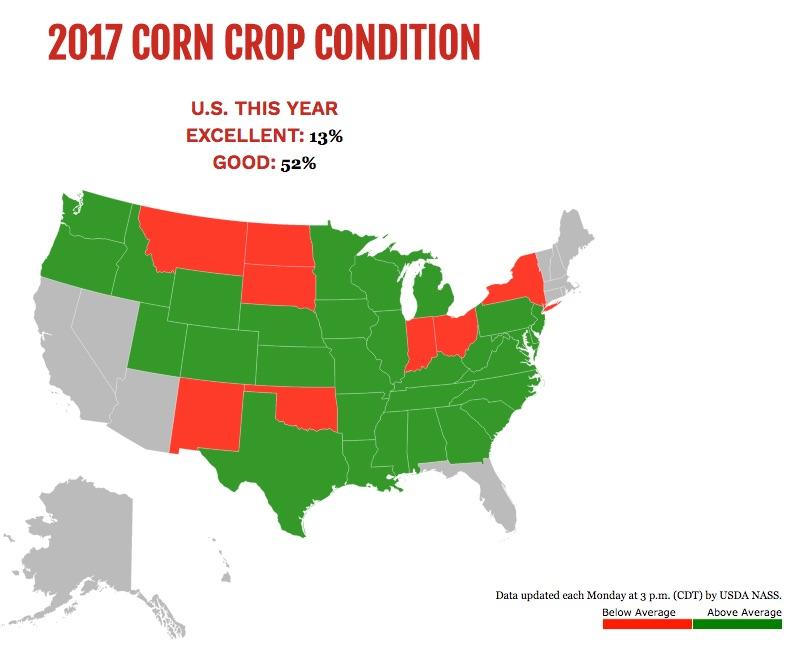

Flash forward to the last week of June and we are witnessing a developing drought across North Dakota, South Dakota and Montana, which is boosting grain prices. That drought has led to deteriorating corn crop conditions year over year with 65 percent of the U.S. corn crop being rated good/excellent vs. 68 percent a year ago at this time. While the overall drought situation in the US is far better than this time a year ago per data furnished by the US Drought Monitor, drought conditions have been on the rise, particularly in key corn regions that are North Dakota, Iowa and the Northern Plains.

At the same time, we are hearing reports of horrific weather in China that is driving down forecasts for its corn crop. Why do we mention China? Per data tabulated by WorldAtlas, China is the second largest producer of corn behind the US with Brazil a very distant third. Here’s the thing, China recently slashed its 2017/18 corn output forecast to the lowest level in four years after drought and hail hit plantings. Following those events, Chinese Agricultural Supply and Demand Estimates (CASDE) shared that farmers in parts of China’s northeast corn belt regions switched to soybeans and substitute grains after drought made it hard to plant corn, leading to a drop in corn acreage.

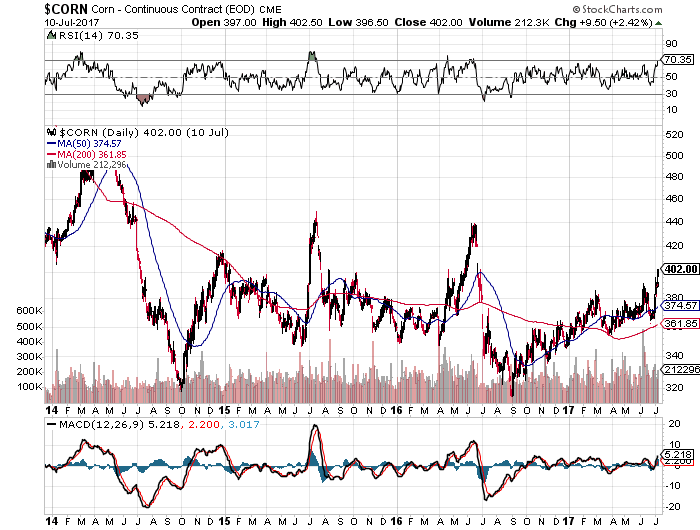

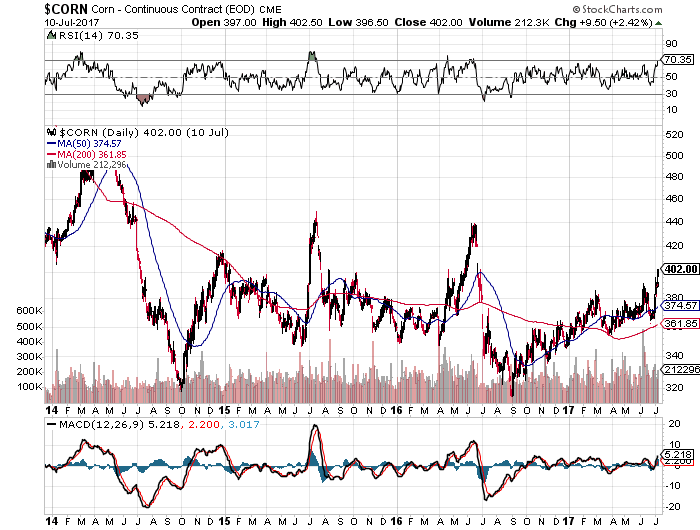

Putting it all together, we are seeing a supply-demand imbalance shaping up for corn and that makes it a viable prospect for our Scarce Resources investing theme. While there are a number of indirect beneficiaries to rising corn prices, as well as number that will feel the pinch of rising input costs, the Teucrium Corn Fund (CORN), which reflects corn futures contracts, is the purest play on rising corn prices. We’ll continue to monitor US drought conditions but with The Weather Network forecasting “normal or warmer than normal temperatures during the summer” odds are we could see more supply constraints ahead and that would bode well for CORN shares. We’d note the last time there was a significant drought in the US was 2012, when corn reached a high of $8.4375 per bushel in August 2012 up from roughly $3.30-$3.40 in May 2010. Currently, the spot price for corn price is hovering near $3.85 per bushel.

The Bottomline on CORN:

- We are adding Teucrium Corn Fund (CORN) shares to the Tematica Select List with a $25 price target.

- This is a new Scarce Resources position, and we are holding off with a stop-loss at this time as our strategy would be to opportunistically increase the Select Lists exposure while improving the overall cost basis.

Amazon – More Than Prime Day this Week

We are in the afterglow of Amazon’s (AMZN) Prime Day 2017, which concluded early this morning. The company trotted out all sorts of deals, especially on its own products and services, and while we’re still shifting through the day-after data that Amazon management is putting out, by all accounts this year’s event blew the last two years out of the water with the company claiming it took in 6,000 Amazon Prime orders per minute and over $1 billion in sales from this newly created “holiday” event.

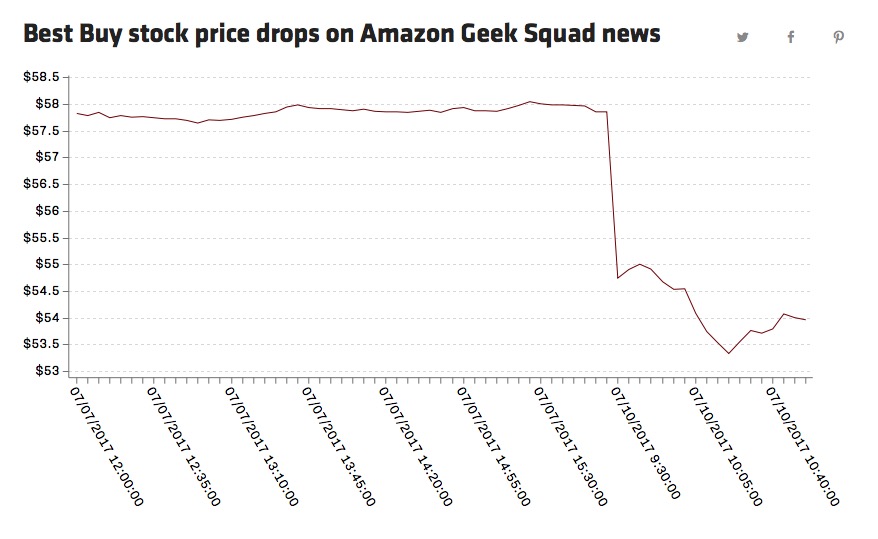

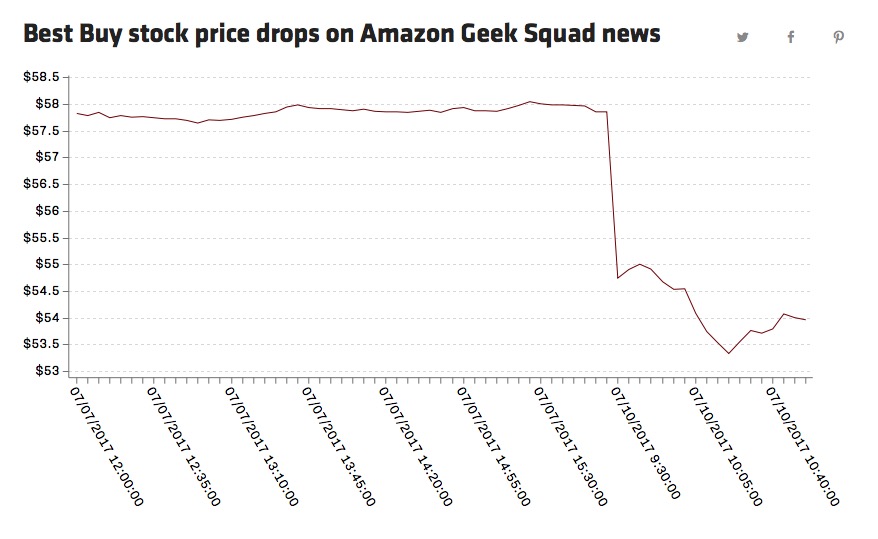

Behind the noise of Prime Day, Amazon once again quietly expanded its footprint. The two latest announcements include talk of it is forming its own Geek Squad like offering — a service it is currently testing in several cities out west. That news sent Best Buy (BBY) shares tumbling on Monday, taking nearly $1 billion off the company’s market cap in a single day. And yes, the irony of Amazon raking in the same amount of sales on Tuesday that Best Buy lost in market cap on Monday isn’t lost on us — it’s one of the clearest depictions of how thematic tailwinds for one company become headwinds for another.

The second announcement comes in the form of Amazon partnering with King Vintners, a subsidiary of Oregon’s King Estate Winery, for its NEXT private label wine offering. This move continues Amazon’s move into private label products, which tend to carry better margins. As a reminder, Amazon is also expanding its private label business in the food and apparel categories as well. We see Amazon clearly positioning itself to capture greater consumer wallet share as we head into the back half of the shopping year.

Getting back to Prime Day, it’s actually more like 30 hours, which we suspect Amazon is doing to expand its reach across the globe. We also suspect one of the key strategies behind Prime Day is to hook shoppers with either Prime services or entice them with unbundled and discounted Amazon services in order to upsell them to Prime later on. Of course, there is the goosing of its digital sales as well. Early reports from Amazon state that the best-selling Prime Day item thus far is the Amazon Echo smart speaker – talk about a potential Trojan horse to other Amazon offerings. We’ll be watching over the day as more Prime Day data pours out and we try to assess the contribution from outside the US, which in our view offers ample growth opportunities for Amazon. We’d do so over a glass of Amazon’s NEXT wine, but they, unfortunately, don’t ship to Virginia yet — our loss.

- As a reminder, we currently rate Amazon shares as a Hold — they are shares to own, not trade.

- Our price target remains $1,100.

What PepsiCo Says About Our Foods With Integrity Investing Theme

Shifting gears, yesterday morning PepsiCo (PEP) reported its 2Q 2017 earnings this morning with organic revenue growth clocking in just over 3 percent. At first blush, we would note this is a positive for our McCormick & Co. (MKC) shares given that PepsiCo is McCormick’s largest Industrial Segment customer. The same can be said for Tematica Select List company International Flavors & Fragrances (IFF), as PepsiCo is one of its larger customers as well. So you can see why were so keen to see what Pepsi had to say about its second quarter performance.

Digging below headlines and listening in on the PepsiCo’s 2Q 2017 earnings call we find even more confirming reasons to be bullish on these two Select List holdings:

“…we continue to transform our beverage portfolio to offer more non-carbonated options and reducing sugar levels across the portfolio.”

“We have reduced added sugars, saturated fat and sodium in many of our products, while continuing to expand our lineup of nutritious foods and beverages to meet growing consumer demand.”

“Lipton tea, over the years we have not only added more variety but we have strengthened the brand by introducing increasingly premium offerings, first with Pure Leaf and more recently with the Tea House Collection, resulting in the leading share position we enjoy today. Or Mountain Dew, where over time we have expanded the trademark from traditional green-bottle Dew and Diet Dew to exciting line extensions like Code Red, White Out and Voltage, and our very successful Kickstart lineup. Or Doritos, where our loyal consumers have embraced flavor extensions to the core product and innovations we have taken to foodservice and quick serve restaurants. Or Quaker, where we have provided increasing portability and convenience to a hearty, healthy breakfast through the introduction of Breakfast Squares and Breakfast Flats.”

“Our product transformation efforts to date have resulted in a portfolio where we now derive approximately 45 percent of our net revenue from products that we refer to as guilt-free. These products include diet and other beverages that contain 70 calories or less from added sugar per 12-ounce serving and snacks with low levels of sodium and saturated fat…”

In sum, PepsiCo’s comments confirm the shift toward healthier, “food that is good for you” products and beverages, which is a key aspect of our Foods with Integrity investing theme. Those same comments also confirm the shift away from unhealthy ingredients that is spurring demand for flavoring solutions at both McCormick & Co. as well as International Flavors & Fragrances — because, after all, once you remove all the sugar and artificial flavors, it still needs to taste good in order to sell. As this tailwind continues to blow, another beneficiary to be had is Amplify Snacks (BETR).

The bottom line as we see it with all this Foods with Integrity news:

- Our price target on McCormick & Co. (MKC), International Flavors & Fragrances (IFF) and Amplify Snacks (BETR) shares remain $110, $145 and $11, respectively.

- To date, ETF holdings in each of these three stocks is insufficient, but we will continue to revisit potential ETFs that mesh with our Foods with Integrity investing theme.

The Wall Street Journal Serves up a Bullish Case for our AMAT Shares

Yesterday, we had positive confirmation on one of the several aspects of our investment thesis in Applied Materials (AMAT) from an article in the Wall Street Journal. The article reminds us of the ramping semiconductor market in China and how that is fueling demand for semiconductor capital equipment at Applied and others.

Per data from Gartner, currently China consumes half the world’s chips, but only produces less than 10 percent of those chips – and this is something China is looking to change as it spends up to $108 billion over the next 10 yeas on its own chip-making industry. According to industry group SEMI, at least 20 fabs are currently under construction in China.

That clearly makes the “China factor” one to watch, but there is also rising demand for memory and other chips as we move deeper into our increasingly Connected Society with the Connected Car, Connected Home, wearable and other connected devices as well as the more industrial focused Internet of Things. The next catalyst to watch will be earnings from Taiwan Semiconductor (TSM), one of largest semiconductor manufacturers, that will be reported tomorrow. Inside those results, we’ll be scrutinizing TMS’s capital spending plans for the coming quarters and what it means for semiconductor capital equipment orders.

Let’s remember too, Applied Materials has other tailwinds on its business, including ramping demand for the capacity constrained organic light emitting diode display industry that is also propelling demand at Universal Display (OLED) as well as demand. While Apple (AAPL) has yet to say a word about its next iPhone model, a growing number of reports project that Apple will have more than half of its iPhones using organic light emitting diode displays by 2020. That action will spur adoption among other smartphone vendors, including lower cost Chinese vendors. In short, we continue to see a strong ramp in demand subsequently capacity for organic light emitting diode displays.

- Our price target on Applied Materials (AMAT) shares remains $55.

- In reviewing potential ETF plays that hold AMAT shares, the one with the largest exposure to AMAT shares is First Trust Nasdaq Semiconductor ETF (FTXL), which has more than 8 percent of its assets in Applied Materials. As enticing as that sounds, FTXL’s market cap is just over $20 million and average daily trading volume is thin as a pancake at just under 6,000 shares per day. An option with far greater liquidity would be the VanEck Vectors Semiconductor ETF (SMH), which holds just under 5 percent of its assets in AMAT shares.

- With the recent slip lower, based on yesterday’s market close we see just over 14 percent upside to our $125 price target for Universal Display (OLED) shares.

USA Technologies:

Arming Itself for the Growing Cashless Consumption Opportunity

Cashless Consumption company USA Technologies (USAT) saw its shares come under some pressure earlier this week when it filed an S-1 registration statement to offer $34.5 million in common stock with an overallotment option of up to another $5.2 million. If the full amount were sold, another 8 million or so USAT shares could potentially enter the market and there likely would be some EPS dilution, that’s the reason USAT shares moved 10 percent lower over the last week. From a business perspective little has changed in the course of a week, in fact, the outlook for our Cashless Consumption theme in many respects has never looked better.

Google (GOOGL) is preparing to enter the mobile payment space in India, and the latest figures show the Chinese spent $5.5 trillion through mobile payment platforms last year. After launching in Singapore, Australia and Mexico last year, Citibank MasterCard (MA) customers in the US can now begin using Citi Pay, the mobile tap-and-pay service, here in the U.S. More specific to USA Technologies, it recently expanded its merchant services relationship with JPMorgan Chase (JPM).

As shareholders, we may not love the move by USAT and its new stock offering, but it will provide the company with additional firepower in this quickly expanding market. Fundamentally speaking, we continue to like the company’s position as mobile payments grow across the globe. We are also seeing M&A chatter around the Cashless Consumption theme, with some suggesting that PayPal (PYPL) should acquire Square (SQ). With an arguably fragmented playing field that spans software, hardware, services and geographic opportunities there is little question in our minds that we will see consolidation activity in the coming quarters. We continue to see USA Technologies as a prime target.

- We will continue to monitor USAT shares closely, with an eye to expand our position size closer to $4.50 or below given our initial buy-in price of $4.50.

- Subscribers looking for an ETF play on our Cashless Consumptioninvesting theme should examine the PureFunds ISE Mobile Payments ETF (IPAY). While it catches our Cashless Consumptioninvesting theme, in our view, the average daily volume is too low to make it a viable recommendation at this time, but we’ll keep it on our radar for when average trading volume hits over 100,000 shares per day.