Drop in Coffee Prices create an opportunity for Starbucks (SBX)

In yesterday’s Tematica Investing we added shares of Connected Society company Amazon (AMZN) to the Tematica Select List. Normally, we’d be tempted to add call options for companies that we consider to have strong upside in the share price over the coming months. For example, as consumers increasingly shift their purchasing online, we’d like to capture any and all key spending events, like Back to School, Halloween, Thanksgiving and Christmas holidays, that are likely to help spur that spending shift. The issue with Amazon calls, however, is the high sticker price associated with them.

With the end of trading yesterday, the AMZN October 2016 $710 calls closed at $54.67 and the AMZN January 2017 $710 calls closed at $72.44. Given the latter includes more of the year-end holiday spend, our preference would be for the January 2017 calls, but the price tag on both of those strike dates is essentially cost prohibitive if we were looking to have a position of size.

Another strategy is to look at ETFs that have significant exposure to Amazon. The one with the largest position size, clocking in at roughly 12 percent, is the Consumer Discretionary Select Sector SPDR Fund (XLY). In ferreting out XLY’s holding in AMZN shares, we also noticed the ETF has significant positions in Tematica Investing Select List holdings Disney (DIS) and Nike (NKE). For those that don’t want to go fumbling looking for which themes those two companies are benefiting form, they are Content is King and Rise & Fall of the Middle Class positions, respectively.

Other key XLY holdings, such as Comcast (CMCSA) and Home Depot (HD) are benefitting from spending on the experience economy. Rounding out the top 7 XLY positions is Starbucks (SBUX), which is benefiting from a strong drop in coffee prices and sits at the intersection of our Guilty Pleasure, Rise & Fall of the Middle Class and Fattening of the Population themes, and McDonald’s (MCD), clearly a Fattening of the Population company if ever there was one.

All told, those top 7 positions account for nearly 43% of XLY’s holdings, and as you can see there are a number of demonstrative tailwinds pushing them along. As such, we’ll not only add the XLY shares to the Tematica Select Pro List, but also the XLY Dec 2016 78.000 call (XLY161216C00078000) that closed last night at $3.80. This strike data affords us the greatest exposure to all the major spending holidays through the balance of 2016, and the strike price is less than that for the XLY December 2016 80 calls.

Given the volatile nature of call options, we’d be comfortable buying this call option up to $4.40. On the downside, we have ample time to September strike and as such would look to build exposure on weakness. That said, we’ll continue to be prudent and that has us setting a protective stop loss at $2.30.

Getting a Shot of Starbucks

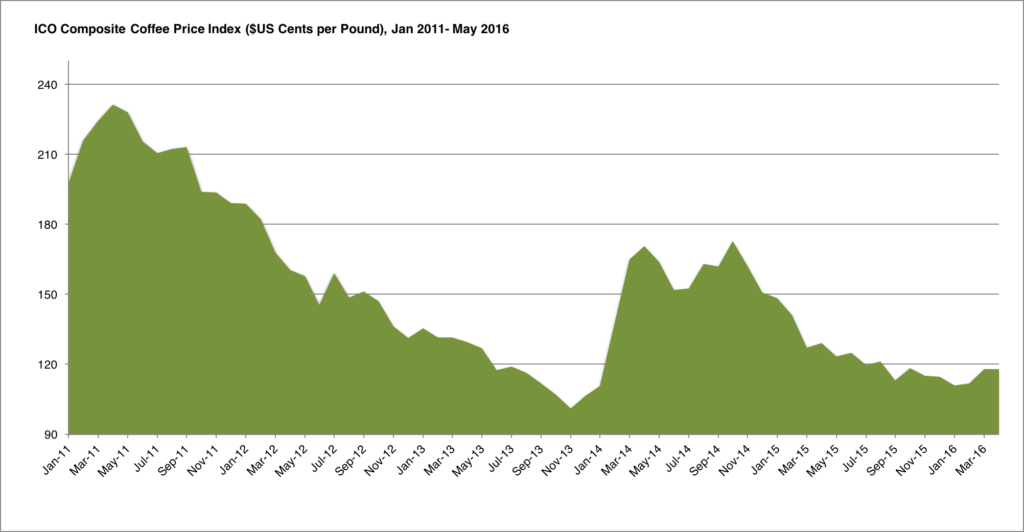

A few paragraphs above we mentioned Starbucks shares and the recent drop in coffee prices. In the below chart, you can see that coffee prices have fallen significantly year over year over the last several months. We’d point out that the data in the chart is for coffee spot prices.

Turning our gaze to the future prices, we find they are demonstratively lower at 121.40-123.35 between July-September 2016 per ICE Futures. Furthermore, JM Smucker Company (SJM), a major US coffee retailer, announced it will drop prices by 6 percent for its flagship packaged coffee products , which include Folgers and Dunkin Donuts brands, due to falling commodity coffee prices.

This drop will surely benefit Starbucks as well, and looks similar to the move in the share price the last time we saw a significant drop in coffee prices. From March 2011 to November 2013, coffee prices fell 55 percent. During that same period, SBUX shares rose to $39.35 from $17.17 exiting March 2011. What’s different this time is Starbucks has stepped up its attack on the food and international markets, and is slowly making progress with its Starbucks After Dark effort.

Over the last month, Starbucks shares have shed more than 9 percent, with no discernible move in earnings expectations despite the move in coffee prices. In our view the move in the shares is overdone. Taking a longer view, consumers will continue to flock to this Guilty Pleasure company with teas and frappacinos during what’s expected to be another hot and humid summer. Come fall, people will be slurping down the usual kicked up lattes and other hot beverages. As they flock to these beverages, Starbucks will see the incremental leverage associated with those falling coffee prices.

Given limited downside and prospects for multiple expansion as the positive influence of falling input costs drops to the company’s bottom line, we are issuing a BUY rating on Starbucks (SBUX) Oct 2016 60.000 call (SBUX161021C00060000) that closed last night at $1.03. We’d look to buy the calls up to $1.20 and are setting a protective stop loss at $0.70.

Costco Wholesale Beats on the Bottom Line, Misses on the Top Line

Late last night Costco Wholesale (COST) reported May 2016 quarter earnings of $1.24 per share, beating Wall Street expectations of $1.22 per share and up 6 percent year over year. Total revenue for the quarter rose 2.6% year over year to $26.8 billion for the quarter, but fell short of Wall Street expectations that called for the company to deliver $27.1 billion in revenue.

Management will hold a conference call at 11 AM ET this morning, which will shed more light on the quarter, as well as offer insight on the current quarter’s tone. The initial read on May same-store sales saw an uptick in the all three reportable territories (US, Canada, Other International) month over month excluding the negative impacts from gasoline price deflation and foreign exchange. We continue to have a protective stop loss set at $135 for COST shares on the Tematica Pro Select List. Following today’s earnings call, should we opt to add to the position, we will issue a special alert spelling out the specifics.

Housekeeping

Over the last week, all the major market indices have rallied with the S&P 500 up just over 2 percent in the last five trading sessions. As you would expect this has weighed on our inverse ETF positions. The same move, however, has not only been on modest volume, but has occurred as investors have continued to pull funds from the market. This does not exude confidence in the recent market move. As such we will continue to keep our protective insurance positions — ProShares Short S&P500 ETF (SH), ProShares Short Dow30 ETF (DOG) and ProShares Short Russell2000 ETF (RWM) — in place for now.

Recap of Actions from this week:

- Issuing a BUY rating on the Consumer Discretionary Select Sector SPDR Fund (XLY).

- Issuing a BUY rating on the XLY Dec 2016 78.000 call (XLY161216C00078000) up to $4.40. On the downside, setting a protective stop loss at $2.30.

- Issuing a BUY rating on Starbucks (SBUX) Oct 2016 60.000 call (SBUX161021C00060000) up to $1.20, setting a protective stop loss at $0.70.

- Continue to keep ProShares Short Russell 2000 (RWM), ProShares Short Dow30 ETF (DOG) and ProShares Short S&P500 (SH) on the Tematica Pro Select List.