Weekly Issue: Here Comes the Fed

Key point in this Issue

- And here comes the Fed

- Institutional investors get cautious

- Revisiting and revising stop loss levels for the Thematic Leaders

Today is the day the stock market has been looking forward to with the results of the Federal Reserve’s latest monetary policy meeting, which will not only include a press conference with Fed Chairman Powell, but also the publication of the Fed’s latest economic projections. Given the data of late as evidenced that have led the Atlanta Fed and the New York Fed to revise current quarter GDP expectations lower, odds are the Fed’s economic projections, at least for 2019, will inch lower as well.

As I shared on last week’s Thematic Signals podcast, I expect the Fed to wait until next week’s G20 summit in Japan comes and goes before doing anything on the interest rate front.

If President Trump and China’s President can once again jumpstart trade talks, odds are the Fed will not trim interest rates at the July monetary policy meeting. However, if that encounter leads to more tariffs then I fully expect the Fed will cut interest rates in the coming weeks.

But the Fed doesn’t like to surprise the markets, which means watching the language it uses in today’s policy statement as well as that used by Powell during the press conference. What we’re looking for is a softening of that language, and perhaps the removal of “patient” in the context of “the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support” its goal of a “sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective…”

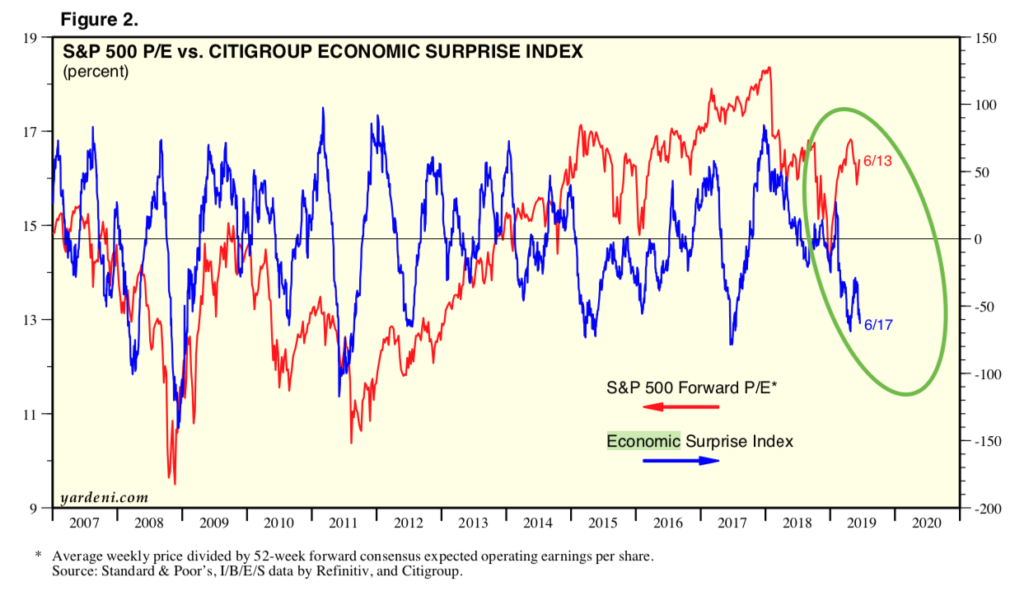

If you’re thinking this means the next few weeks will set up the balance of 2019, I would tend to agree with you. The overhanging issue is the disconnect between the economic data, which has been coming in below expectations, and the stock market’s march higher even as earnings expectations have moved lower. And by the stock market’s move higher, I mean just a few percentage points from its high. What this in effect means is we are paying more for slower earnings growth.

Institutional investors get cautious

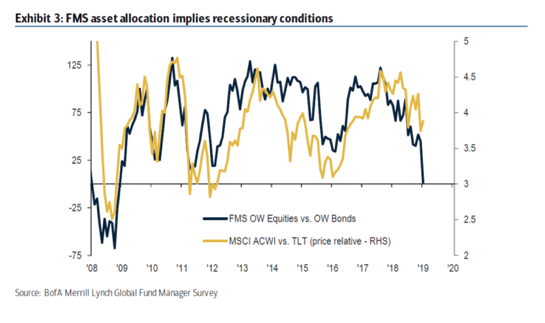

This has led to a sentiment shift among institutional investors according to the findings of the June Bank of America Merrill Lunch survey of money managers. According to the survey findings, concerns about the trade war, a recession and “monetary policy impotence” all contributed to the bearish sentiment and led to the second-biggest drop in equity allocations since the survey was started. Cash holdings, however, jumped by the most since the 2011 debt-ceiling crisis.

Clearly, the investor base is getting nervous and after today the focus will be on what does or doesn’t happen at next week’s summit. I’ll be factoring those developments into my thinking – no question about it – but I will continue to focus on the structural and transformational changes occurring around us and are captured in our 10 investing themes. While the trade war and economic slowdown could curb the rate of change associated with our themes, the tailwinds are poised to persist, nonetheless. From the G20 fallout to the June quarter earnings season, the coming weeks could be ones that bring opportunity to revisit several of the existing Thematic Leaders at better prices as well as round out that group with some new ones.

Tematica Investing

Revisiting and revising stop loss levels for the Thematic Leaders

Year to date, we’ve enjoyed, for the most part, pronounced moves higher in the Thematic Leaders and a number of residents on the Tematica Select List. These include the near 70% move in Chipotle Mexican Grill (CMG) shares year to date as well as the market-beating double-digit moves in Amazon (AMZN), Netflix (NFLX), Costco Wholesale (COST), Alibaba (BABA) and Axon Enterprises (AAXN). Outside of the Leaders, we’ve enjoyed pronounced gains with McCormick & Co. (MKC), Alphabet/Google (GOOGL), USA Technologies (USAT), Disney (DIS) and ETFMG Prime Cyber Security ETF (HACK) shares. Make no mistake, there have been some

In aggregate, we’ve done pretty well so far this year, but given what’s ahead, I’m going to install or update stop- loss levels for the Thematic Leaders as follows:

- AMN Healthcare (AMN) – $43

- Chipotle Mexican Grill (CMG) – $585

- Dycom Industries (DY) – $45

- Amazon (AMZN) – $1,520

- Netflix (NFLX) – $340

- Nokia Corp. (NOK) – $4

- Costco Wholesale (COST) – $210

- Alibaba (BABA) – $135

- Axon Enterprises (AAXN) – $52

Next week, we’ll have an earlier than usual issue of Tematica Investing in which I’ll share revised stop loss levels for the Select List.