As earnings move into the fast lane, things are likely to get bumpier

Over the last two weeks, we’ve seen the stock market bounce up and down with both oil and gold prices doing the same. The latest blow in oil prices comes following a report on Tuesday that “U.S. crude stockpiles fell less than expected in the latest week while gasoline stockpiles grew unseasonably” — not exactly something we want to hear as economists and others trim back their GDP forecasts.

Peering below the headlines, we saw the first dip in the manufacturing component of the monthly Industrial Production report in March. Even if we exclude the step-down in the production of motor vehicles and parts, March manufacturing output still declined. Furthermore, revisions to January and February meant manufacturing activity was weaker than previously thought.

Yes, we realize that we have been talking about this for several weeks, and while we take solace in knowing that once again the herd is catching up to us, we’re not exactly thrilled the latest data suggests there is more revising to be done. As this is happening, we are also seeing a drop in Fed interest rate hike expectations. Just a few weeks ago, 57 percent of traders expected the Fed to boost interest rates two more times this year. As of last night, that expectation fell to 36 percent according to CME Group’s FedWatch program.

Tracing back the market’s up and downs over the past month or so tells us investors continue to look for some direction, and in our view, the coming days are likely to offer the road map. The issue is, the road ahead may not be the one that most are hoping to take and its guide will be the plethora of earnings reports we get not just this week, but increasing pace over the next two weeks. Compared to some 300 reports this week — the vast majority of which will hit after tonight’s market close — next week has more than 990 companies reporting followed by another 1,269 during the first week of May.

As this pace picks up, we’re seeing more political drama unfold in Washington, and when we put it all together it tells us there is more risk to be had in the near-term than reward. While we recognize we are likely preaching to the choir at this point, the simple truth is corporate expectations needs to be reset given the economic climate and as that happens we are likely to see more wind taken out of the stock market’s sales.

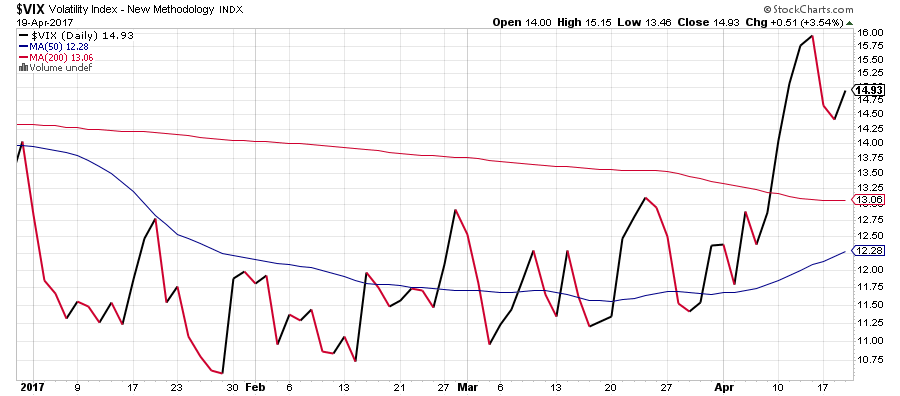

In looking at the recent move in the Volatility Index (VIX), which recently hit its highest level since before the November election, the market is on edge as earnings ramp up. Adding to this is some new findings from the Bank of America Merrill Lynch monthly fund manager survey that shows some 83 percent of fund managers believe U.S. stocks are overvalued. As always we try to put data like this into perspective, and in doing so we find that 83 percent is a record number for data that reach back to 1999.

Now that certainly tells several things, but the one we are zeroing in on is the simple fact that in a nervous market, investors are likely to shoot first and ask questions later when faced with a barrage of earnings reports.

- For these reasons, we will continue to stick with all of our inverse stock market ETFs — the ProShares Short S&P500 (SH), ProShares Short Russell 2000 (RWM) and ProShares Short Dow30 (DOG), all of which climbed higher over the last two weeks — for at least the next several weeks.

Turning to Our Short Positions in

General Motors (GM) and Simon Property Group (SPG)

The March Retail Sales report confirmed our concern over the consumer’s ability and willingness to spend. The fact that 1Q 2017 was the worst quarter for restaurant traffic in three years is yet another confirming sign of that fact. As earnings reports roll in, we’ll take stock in what Visa (V) and MasterCard (MA)have to say about consumer spending, but with more than $1 trillion in consumer credit card debt, we are inclined to keep our short position in GM and SPG shares intact.

- We continue to have a Sell rating on GM shares with a price target of $30.

- Our buy stop order on GM remains at $40. As the shares continue to move lower, we’ll look to revisit our buy-stop loss further with a goal of using it to lock in position profits.

- With retail pain likely to intensify, we continue to have a bearish view on SPG shares. Our price target on SPG remains $150 and our buy stop order remains at $190.

- As SPG shares move lower, we’ll continue to ratchet down this buy stop order as well.

That Brings Us to Our One Long Position — Facebook

The Facebook (FB) May 2017 $150 calls (FB170519C00150000), closed last night at $1.10, modestly above our $1.00 stop loss level. The calls have traded off over the last two days and we can understand why. We have to say we were somewhat underwhelmed by this year’s annual developer conference, better known as F8, that spanned the last two days. CEO Mark Zuckerberg has announced a series of new features covering augmented reality, artificial intelligence bots, and more far-fetched plans to close the gap between humans and machines. In particular, Zuckerberg wants Facebook users to be able to “type with their brains and hear with their skin.”

If you thought you heard our eyes roll, you were correct.

Each of these announced initiatives will take Facebook time to develop and then, in turn, it will be even more time for them to have a meaningful impact on the company’s business model — far more time than we have with our May calls.

That said, given Alphabet’s (GOOGL) recent snafu with YouTube and advertisers, we suspect Facebook saw a bump in advertising that should help it keep its earnings beating track record intact. With the company set to report its 1Q 2017 earnings on May 3, we’ll use the recent pullback in the calls to scale into the position, reducing our cost basis along the way. As we do this, we will drop our protective stop loss to $0.75 as well.

- We are scaling into Facebook (FB) May 2017 $150 calls (FB170519C00150000), which closed last night at $1.10

- We are reducing our stop loss on the calls to $0.70 from $1.00

- We would be buyers of the calls up to $1.30.