Retail Sales Data for the Month of May Confirms Several Thematic Investment Themes

This morning we received the May Retail Sales Report, which missed headline expectations (-0.3% month over month vs. the +0.1% consensus) as well as adjusted figures that exclude autos sales for the month (-0.3% month over month vs. +0.2% consensus). Despite the usual holiday promotional activity, retail sales in May were the weakest in 16 months due in part to lower gasoline prices, which had their biggest drop in over a year. In our view, the report confirms the challenging environment for brick & mortar retailers, despite those lower gas prices, while also affirms our decision not to participate in the space with the Tematica Select List as there were some bright spots below that headline miss.

Almost across the board, all retail categories were either essentially flat or down in May compared to April. The exception? Nonstore retail sales, clothing, and furniture — and nonstore obviously mostly comprised of online retailers since the Sears catalog isn’t in the mailbox too often these days. Comparing May 2017 retail sales to year-ago levels offers a different picture – nearly all categories were up with a couple of exceptions, the most notable being department stores. Again, more confirmation to the “why” behind recent news from mainstays of U.S. mall retailers like Macy’s (M), Michael Kors (KORS), Gymboree Corp. (GYMB) and Sears (SHLD).

Some interesting callouts from the report include that year over year, nonstore retail sales rose 10.2% percent, which brings the trailing 3-month year over year comparison for the category to 11.4%. This data simply confirms the continued shift toward digital commerce that is part of our Connected Society investing theme and is a big positive for our positions in Amazon (AMZN), Alphabet (GOOGL) and United Parcel Service (UPS).

We only see this shift to digital accelerating even more as we head into Back to School shopping season in the coming weeks and before too long the year-end holiday shopping season. While it is way early for a guesstimate on year-end holiday spending, eMarketer has published its view on Back to School spending this year and calls for it to grow 4 percent year over year to $857.2 billion. If that forecast holds, it will mean Back to School spending will account for roughly 17 percent of eMarketer’s 2017 retail sales forecast for all of 2017.

Not ones to be satiated with just the headlines, digging into the report we find more confirmation for our Connected Society investing theme – eMarketer sees e-commerce related Back to School shopping growing far faster, increasing 14.8% to $74.03 billion in 2017. As we like to say, perspective and context are essential, and in this case, should that e-commerce forecast hold it would mean Back to School e-commerce sales would account for 8.6% of total retail sales (online and offline) for the period, up from 7.8% last year.

The Connected Society Won’t Be the Only Theme In Play for Back to School Shopping

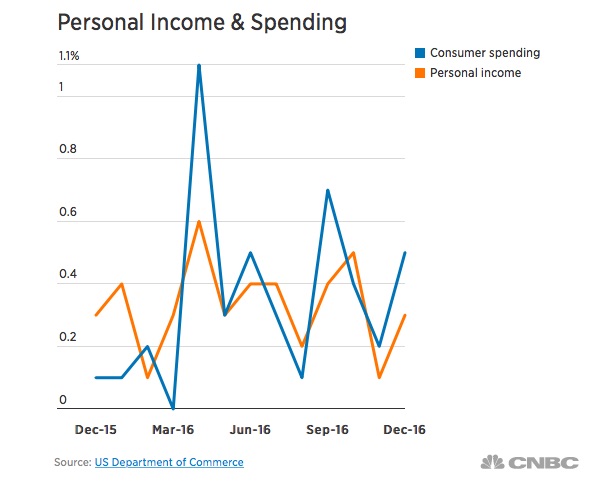

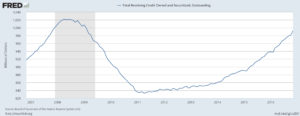

Given the last several monthly retail sales reports, as well as the increasing debt load carried by consumers, we strongly suspect our Cash-strapped Consumer theme will also be at play this Back to School shopping season, just like it was last year. In its 2016 findings, the National Retail Federation found that “48% of surveyed parents said they were influenced by coupons, up five percentage points from the prior year, while others said they planned to take advantage of in-store promotions and advertising inserts, and 53% said they would head to discount stores to finish prepping for the new school year.”

With consumer credit card debt topping $1 trillion, consumers are likely to once again use coupons, shop sales and hunt for deals, and that bodes very well for the shift to digital shopping. With Amazon increasingly becoming the go-to destination for accessories, books and video, computers and electronics, office equipment, sporting goods and increasingly apparel, we see it continuing to gain wallet share over the coming months.

Food with Integrity Theme Seen in Retail Sales Report As Well

Getting back to the May Retail Sales report, another positive was the 2.2% year on year increase in grocery stores compared to data published by the National Restaurant Association that paints a rather difficult environment for restaurant companies. The latest BlackBox snapshot report, which is based on weekly sales data from over 27,000 restaurant units, and 155 brands) found May was another disappointing month for chain restaurants across the board. Per the report, May same-store sales were down -1.1% and traffic dropped by 3.0% in May. With that in mind, we’d mention that last night Cheesecake Factory (CAKE) lowered its Q2 same restaurant comp guidance to down approximately -1%. This is a reduction from prior guidance of between 1% and 2%.

Stepping back and putting these datasets together, we continue to feel very good about our position in Food with Integrity company Amplify Snacks (BETR), as well as spice maker McCormicks & Co (MKS) as more people are eating at home, shopping either at grocery stores or online via Amazon Fresh and other grocery services. Paired with the shifting consumer preference for “better for you” snacks and food paves the way for Amplify as it broadens its product offering and expands its reach past the United States. As we shared in yesterday’s weekly update, United Natural Foods (UNFI) should also be enjoying this wave, but the company recently lowered its revenue guidance, so we’re putting UNFI under the microscope as we speak and we could very well be shifting our capital soon.