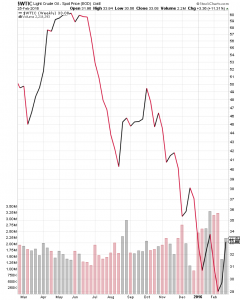

From a market perspective, this holiday-shortened trading week certainly started off on a high note, reflecting what appeared to be progress in stabilizing oil prices in an OPEC and non-OPEC production deal. As more details became clear, however, it appeared there were cracks already in the works as oil production levels were to be frozen at January 2016 levels. Soon thereafter, we learned that Iran would be able to continue ramping up its production, which raised eyebrows over the likelihood that this deal would have even more problems. As we’ve seen in the past when oil prices collapse, these agreements tend to be fraught with side dealings. Time will tell if that once again turns out to be the case.

After two more days of an up market that built on Friday’s strong move, which was mostly oil and buyback-upsizing driven, we were reminded that there is still much uncertainty out there. I’m not referring to the 2016 presidential election, although as we inch closer and closer, it is becoming harder to guess who will be facing off with whom this fall.

No, I’m taking about the rash of news that hit on Thursday in the form of:

- The U.S. Energy Information Administration (EIA) showing that U.S. crude stockpiles rose by 2.1 million barrels.

- And then also this from the EIA — “U.S. Gulf of Mexico (GOM) crude-oil production is estimated to increase to record high levels in 2017 even as oil prices remain low. The EIA projects GOM production will average 1.63 million barrels per day in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude-oil production in 2016 and 2017, respectively.”

- Finally, the Organization for Economic Cooperation and Development (OECD) cut its 2016 economic-growth forecast once again. The group lowered its 2016 global-growth forecast by 0.3 percentage points to 3% for the year. That’s the second cut since October, when the OECD pegged 2016 growth at 3.6%.

Of course, government statistics and forecasts like the OECD’s tend to be a beat or two behind what’s happening on the economic dance floor, so you should keep tabs on other indicators in addition to these.

Candidly, that announcement was hardly surprising given the economic data we’ve been getting, and even that has been teed up by other data that I’ve been watching.

Chinese manufacturing remained slack in January, including the weakest reading for the government’s official purchasing managers’ index since August 2012. Longtime readers know that one data point I closely follow is the Association of American Railroads’ (AAR) weekly reading on U.S. railcar traffic and loadings. Let’s just say that if you’ve been paying attention to this indicator in the year-to-date period, the recent contracting regional Fed manufacturing reports haven’t been much of a surprise.

The AAR reported this week that U.S. weekly rail traffic totaled 505,148 carloads and intermodal units in the seven days ending Feb. 13. That’s down 3.8% from the same period last year. But a single week doesn’t make a trend, so we need to look at year-to-date data. On that basis, combined U.S. traffic for 2016’s first six weeks has fallen 5.8% year over year to 3,017,321 carloads and intermodal units. A similar drop has occurred in truck tonnage, the Dry Baltic Index and the Cass Freight Index, which combine to indicate that products, assemblies and parts are not moving to where they are needed. As we all know, that is not a good sign for the economy.

Add in the contractionary readings for the Philly Fed and Empire Manufacturing indices this week for February and it lets us know the domestic economy is not rebounding.

Now you might think that was it, but it wasn’t. Yesterday, heavy equipment company Caterpillar ([stock_quote symbol=”CAT”]) presented at the Barclays Investor Conference and shared the following information:

- CAT expects sales and revenue to be about 10% below 2015.

- CAT also said it’s seeing a lot of global market uncertainty, as well as overall weak industry demand. Management added that global economic growth is slowing, which generally drives weak industry performance in CAT’s markets.

It looks to me like the OECD may have another round of cuts to make to its 2016 forecast

For those who were hoping the consumer aspect of our economy would provide some needed lift, I’m sad to say that the details from the earnings reports for both Wal-Mart ([stock_quote symbo=l”WMT”]) and Nordstrom ([stock_quote symbol=”JWN”]) tell us something different.

While Wal-Mart reported a beat on fiscal fourth-quarter earnings with $1.49 per share during the latest quarter vs. the $1.46 expected, the chain also issued a lighter-than-expected outlook, including virtually no revenue growth this year.

“Net sales growth is now expected to be relatively flat, which compares to the previous estimate for growth of 3% to 4% on a constant-currency basis,” WMT reported in a statement. “This change reflects the impact from recently announced store closures globally, as well as the continued strengthening of the U.S. dollar.”

Last night, shares of retailer Nordstrom fell 8% following the company’s weaker-than-expected December-quarter results. It posted earnings per share of $1.17 on $4.19 billion in revenue; the consensus estimates from Thomson Reuters called for EPS of $1.22 on $4.22 billion in revenue. Guidance was weaker than the market was expecting.

Taken together, these two retail reports are likely to be harbingers of what’s to come as more retailers begin reporting their last-quarter results. To me, it says the Cash Strapped Consumer theme is alive and well.

Needless to say, I’m glad we have no industrial or retail names inside our current Tematica Select List holdings. In fact, the weak economic news is actually good news for our dividend-heavy holdings, and here’s why — Federal Reserve Bank of St. Louis President James Bullard is saying it would be “unwise” for the central bank to raise rates near-term. That comment is interesting, given that Bullard was one of those supporting rate hikes during most of 2015.

Also, Fed watcher Jon Hilsenrath of The Wall Street Journal is saying what more and more people are coming to realize: The Fed is unlikely to boost rates in the year’s first half. He said the central bank prefers to wait and measure the economy’s vector and velocity over the coming months. Depending on what the Fed finds, we could see one or two rate increases during 2016’s back half.

This combination of slower economic growth, uncertainty and the increasingly likelihood that the Fed rate hike will be pushed out means our dividend-heavy portfolio should continue to prosper in the coming weeks.

As we keep the current course steady, I’m going to start filling our shopping list. I shared some prospects in the last issue of the newsletter, but I have a few more, including one that should benefit from the continued shift in advertising dollars from traditional media to online and mobile. Given that it is an election year and we have the Olympics, this one sure is looking to be a winner. I’ll share my recommendation once I’ve completed my analysis.

Enjoy your weekend and I’ll see you back here next week.