Key points in this issue:

- The market hits new records, but the corporate warnings are growing

- We are using the recent fall-off in both Rise of the New Middle-Class investment theme company Alibaba (BABA) and Guilty Pleasure theme company Del Frisco’s (DRFG) to scale into both positions. Our price targets remain $230 and $14, respectively.

- We’re putting some perspective around the National Retail Federation’s 2018 Holiday Shopping forecast that was published yesterday.

- As more holiday shopping forecasts emerge, and we progress through the upcoming earnings season I plan on revisiting our current $2,250 price target for Amazon (AMZN) shares. More details on the pending acquisition of PillPack are also a catalyst for us, as well as Wall Street, to boost that target.

- Heading into the holiday shopping season, our price target on UPS shares remains $130.

- We continue to see Costco Wholesale (COST) a prime beneficiary of the Middle-class Squeeze. Our price target on the shares remains $250.

- What to watch in tomorrow’s September Employment Report? Wage growth.

The market hits new records, but the corporate warnings are growing

While we’ve seen new records for the stock market indices this week, we’ve also seen the S&P 500 little changed amid fresh September data that in aggregate points to a solid US economy. This week we received some favorable September economic news in the form of the ADP Employment Report as well as the ISM Services Index with both crushing expectations. Despite these reports, the S&P 500 has barely budged this week, which suggests to me investors are expecting a sloppy September quarter earnings season. No doubt there will be some bright spots, but in aggregate we are seeing a number of headwinds compared to this time last year that could weigh on corporate outlooks.

Already we’ve had a number of companies issuing softer than expected outlooks due to rising input and transportation costs, trade and tariffs, political wrangling ahead of the upcoming mid-term elections, renewed concerns over Italy and the eurozone, and the slower speed of the economy compared to the June quarter. A great example of that was had yesterday when shares of lighting and building management company Acuity Brands (AYI) fell more than 13% after it reported fiscal fourth-quarter profit that beat expectations, but margins fell amid a sharp rise in input costs. The company said costs were “well higher” for items such as electronic components, freight, wages, and certain commodity-related items, such as steel, due to “several economic factors, including previously announced and enacted tariffs and wage inflation due to the tight labor market…”

Acuity is not the first company to report this and odds are it will not be the last one as September quarter earnings begin to heat up next week. As the velocity of reports picks up, we could be in for a bumpy ride as investors reset their growth and profit expectations for the December quarter and 2019. The good news is we are our eyes are wide open and we will be prepared to use any meaningful moves lower to scale into our Thematic Leader positions or other positions on the Select List provided our investment thesis remains intact. Pretty much what we’re doing this morning with Alibaba (BABA) and Del Frisco’s Restaurant (DFRG) shares. As I watch the earnings maelstrom unfold, I’ll also be keeping an eye on inflation-related comments to determine if the Fed might be falling behind the interest rate hike curve.

Adding to our Alibaba and Del Frisco Restaurant Thematic Leader Positions

This morning we are putting some capital to work, scaling into and improving the respective cost basis for Alibaba (BABA) and Del Frisco’s Restaurant Group (DFRG), the Rise of the New Middle-Class and Guilty Pleasure Thematic Leader holdings.

Earlier this week, the administration inked a trade deal between the US-Mexico-Canada that has some incremental benefits, not yuuuuuuuge ones. But in the administration’s view, a win is a win and with that odds are the Trump administration will focus on making some progress with China trade talks. Per the recent Business Roundtable survey findings

As that happens we should see some of that overhang on BABA shares begin to fade, allowing the factors behind our original thesis to shine through. Before too long, we’ll be on the cusp of the upcoming Chinese New Year, the largest gift-giving holiday in the country, and as know from our own holiday shopping here in the US, consumer spending picks up ahead of the actual holiday.

We’re also seeing Wall Street turn more bullish on BABA shares – yesterday, they received a price target upgrade to $247 from $241 at Goldman Sachs that in its view reflects Alibaba’s expanding total addressable market with continued growth in its cloud business. We view this as more people coming around to our way of thinking on Alibaba’s business model, which closely resembles that of Amazon (AMZN) from several years ago. In short, the accelerating adoption of Alibaba’s digital platform along with the same for its cloud, streaming and mobile payment services should expand margins at the core shopping business and propel its other businesses into the black. Again, just like we’ve seen at Amazon and that has propelled the shares meaningfully higher.

Could we be early with BABA? Yes, but better to be early and patient than late is my thinking.

- We will use the pullback in Alibaba (BABA) shares to improve our cost basis in this Rise of the New Middle-class position. Our price target on Alibaba shares remains $230.

Turning to Del Frisco’s, we have fresh signs that beef prices will trend lower over the next few years as beef production begins to climb. In the recently released Baseline Update for U.S. Agricultural Markets, projections through 2023, the Food and Agricultural Policy Institute (FAPRI) at the University of Missouri estimated the average price of a 600-to 650-pound feeder steer (basis Oklahoma City) at $158.51 per hundredweight (cwt) this year, and then declining to as low as $141.06 in 2020.

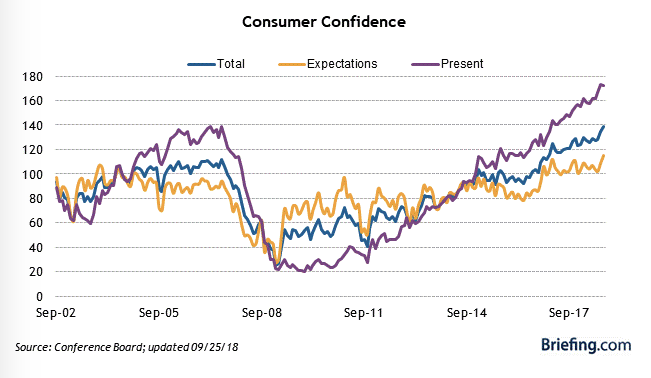

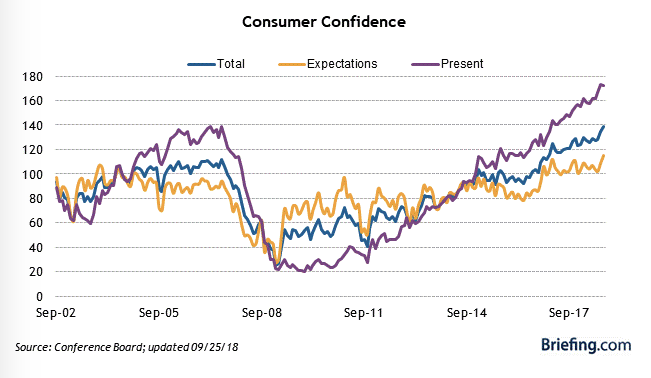

As a reminder, beef prices are the biggest impact on the company’s margin profile, and falling beef prices bode extremely well for better profits ahead. Even if we see a fickle consumer emerge, which is possible, but in my view has a low probability of happening given the increase in Consumer Confidence levels, especially for the expectation component, those falling beef prices should cushion the blow.

- We are adding to our position in Guilty Pleasure company Del Frisco’s (DFRG), which at current levels will improve our cost basis. Our price target remains $14.

The NRF introduces its 2018 Holiday Shopping Forecast

Yesterday, the National Retail Federation published its 2018 holiday retail sales forecast, which covers the November and December time frame and excludes automobiles, gasoline, and restaurants sales. On that basis, the NRF expects an increase between 4.3%-$4.8% over 2017 for a total of $717.45- $720.89 billion. I’d note that while the NRF tried to put a sunny outlook on that forecast by saying it compares to “an average annual increase of 3.9% over the past five years” what it did not say is its 2018 forecast calls for slower growth compared to last year’s holiday shopping increase of 5.3%.

That could be some conservatism on their part or it could reflect their concerns over gas prices and other aspects of inflation as well as higher interest costs vs. a year ago that could sap consumer buying power this holiday season. Last October the NRF expected 2017 holiday sales to grow 3.6%-4.0% year over year, well short of the 5.3% gain that was recorded so it is possible they are once again underestimating the extent to which consumers will open their wallets this holiday season. And if you’re thinking about the chart on Consumer Confidence above and what I said in regard to our adding more DFRG shares, so am I.

While I am bullish, we can’t rule out there are consumer-facing headwinds on the rise, and that is likely to accelerate the shift to digital shopping this holiday season, especially as more retailers prime the digital sales pump. As Tematica’s Chief Macro Strategist, Lenore Hawkins, is fond of saying – Amazon is the deflationary Death Star, which to me supports the notion that consumers, especially those caught in our Middle-class Squeeze investing theme, will use digital shopping to offset any pinch they are feeling at the gas pump. It also means saving some dollars by not going to the mall – a double benefit if you ask me, and that’s before we even get to the time spent at the mall.

On its own Amazon would be a natural beneficiary of the seasonal pick up in shopping, but as I’ve shared before it has been not so quietly growing its private label businesses and staking out its place in the fashion and apparel industry. These moves as well as Amazon’s ability to competitively price product, plus the myriad way it makes money off its listed products and the companies behind them, mean we are entering into what should be a very profitable time of year for Amazon and its shareholders.

- As more holiday shopping forecasts emerge, and we progress through the upcoming earnings season I plan on revisiting our current $2,250 price target for Amazon (AMZN) shares. More details on the pending acquisition of PillPack are also a catalyst for us, as well as Wall Street, to boost that target.

I’ve long said that United Parcel Service (UPS) shares are a natural beneficiary of the shift to digital shopping. With a seasonal pickup once again expected that has more companies offering digital shopping and more consumers shopping that way, odds are package volumes will once again outpace overall holiday shopping growth year over year. From a financial perspective, that means a disproportionate share of revenue and earnings are to be had at UPS, and from an investor’s perspective, that means multiple expansion is likely to be had.

- As we head into the holiday shopping season, our price target on UPS shares remains $130.

Coming up – Costco earnings and the September Employment Report

After tonight’s market close, Middle-class Squeeze company Costco Wholesale (COST) will issue its latest quarterly results. Given the monthly reports that it issues, which has seen clear consumer wallet share gains in recent months and confirmed the brisk pace of new warehouse openings, we should see results tonight. As you are probably thinking, and correctly so, we are entering one of the strongest periods of the year for Costco, and that means watching not only its outlook, relative to the holiday shopping forecast we discussed above, but its membership comments and new warehouse location plans ahead of Black Friday. Two other factors to watch will be its comments on beef prices – the company is one of the largest sellers of beef in the world – and where it is seeing inflation forces at work.

In terms of consensus expectations for the quarter to be reported, Wall Street sees Costco serving up EPS of $2.36, up more than 13% year over year, on revenue of $44.27 billion, up 4.7% from the year ago quarter.

- We continue to see Costco Wholesale (COST) a prime beneficiary of the Middle-class Squeeze. Our price target on the shares remains $250.

Tomorrow’s September Employment Report will cap the data filled week off. Following the blowout September ADP Employment Report, expectations for tomorrow’s report have inched up. While the number of jobs created is something to watch, the two key factors that I’ll be watching will be the payroll to population figure and wage data. The former will clue us into if we are seeing a greater portion of the US population working, while any meaningful movement in the latter will be fuel for inflation hawks. If the report’s figures for job creation and wage gains come in hotter than expected, we very well could see good news be viewed as concerning as investors connect the dots that call for potentially greater rate hike action by the Fed.

Let’s see what the report brings, and Lenore will no doubt touch on it as part of her next missive.