Market finally catches up to reality — something we’ve warned about since the Trump Trade took off

Monday was the start of spring, which usually brings in some milder weather and a breath of fresh air. The latter was certainly what the stock market received yesterday when it had its worst day in a number of weeks.

For us here at Tematica, we’ve been talking about the growing disconnect between the stock market, the real speed of the economy and the growing likelihood that President Trump’s stimulative policies will arrive far later than the mainstream expected. The fact that there are several other snafus helping to deter progress is Washington — like the FBI investigation into potential links with Russia, judicial pushback on the second attempted travel ban and an attempt to repeal the Affordable Care Act that doesn’t have full support of Republicans in the House and Senate — are pushing out the focus on infrastructure spending and tax reform.

The good news is that once again the herd is catching up to what we’ve been saying. The not so good news is it means we’re likely to see the stock market give back some of its 2017 gains as these GDP expectations and subsequent earnings expectations get reset. If we look at several companies that reported earnings this week, including Rise & Fall of the Middle-Class contender Nike (NKE), and Economic Acceleration/Deceleration players FedEx (FDX) and Actuant (ATU) each of them have given their own warning signs:

- Nike’s future orders fell 1 percent;

- FedEx missed quarterly expectations and cut its 2017 global GDP forecast to 1.6 percent from the prior 2.6 percent;

- Actuant guided its current quarter earnings and revenue below consensus and reduced the top end of its 2017 EPS guidance.

Overnight we’re also reading that Payless (PSS) may file for bankruptcy next week and Sears (SHLD) mentioned in its latest 10-K filing just a day or two ago that, “substantial doubt exists related to the company’s ability to continue as a going concern.” Candidly given the rise of Connected Society company Amazon (AMZN) in apparel, as well as its Zappos business, we’re a little surprised that Payless has hung on as long as it has.

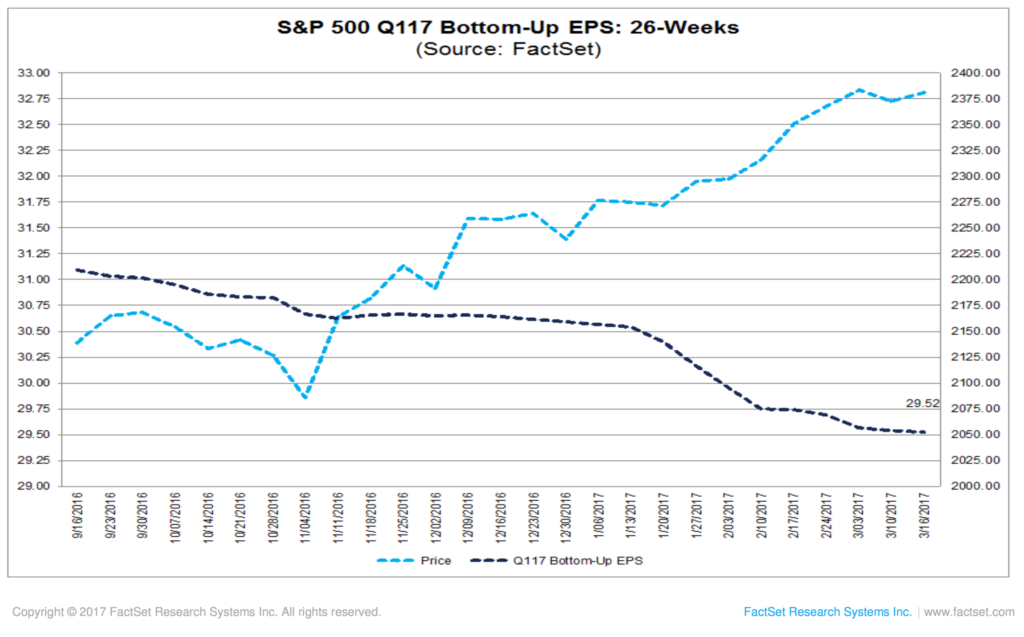

The point is we’re starting to see 2017 expectations get adjusted, and the new question we need to focus on is the degree of those negative revisions. With hindsight being 20/20, last year we saw a steady move lower in earnings expectations for the S&P 500 and we wound up seeing 2016 earnings growth come in at a whopping 0.5 percent for those 500 companies.

As we entered 2017, the expectation was those 500 companies would grow their collective earnings more than 12 percent compared to 2016. Even before we get March quarter results, the view on 2017 earnings growth for the S&P 500 has fallen to just over 10 percent. With several highly anticipated policies getting pushed out, odds are companies will have to reset EPS expectations for 2Q 2017 and most likely 3Q 2017 as well, which means we are likely to see full year 2017 expectations come down further.

As this happens, the market will likely continue to wake up to current valuation levels, especially since if the price of the S&P 500 remains steady and earnings get cut, the market valuation will climb. Odds of that happening are rather low given the market’s stretched valuation and it would mean paying more for even slower earnings growth. What this means is we’re likely to see the market move lower over the coming weeks as all of these expectations get rejiggered lower.

We’ve been patient as well as selective, and we’ll continue to do so.

The most recent addition to the Tematica Select List, the Connected Society “missing link” that is United Parcel Service (UPS), was one month ago. While we use the expected retrenchment in the market to identify new players for the Tematica Select List, we’ll continue to look for confirming data points for the existing positions. A great example was the piece we published earlier this week on Applied Materials (AMAT) and Universal Display (OLED) as well as Disney (DIS) that saw Barron’s backing our thematic rationale for having these three companies on the Select List.

With 8 trading days left in the quarter, a number of companies will soon be entering their “quiet periods” and that means we’re going to have our “scope up” as it were for potential earnings pre-announcements. If we get more negative warnings than usual, or from some larger blue chip companies, we could see the market get a little bouncy. In times like that, we’ll look to scale into positions where it makes thematic sense, especially if we can reduce the cost basis on the Tematica Select List. It’s a strategy that’s paid off for Dycom (DY), AMN Healthcare (AMN), International Flavors & Fragrances (IFF) and several others positions.

Be sure to check the website for more comments and insights, and be sure to listen to our Cocktail Investing Podcast — it’s all the insight with some good humor and more than few laughs as well.