Weekly Issue: Looking for Trump-Proof Companies

We exited last week with the market realizing there was more bark than bite associated with President Trump’s steel and aluminum tariffs. That period of relative calm, however, was short-lived as the uncertainty resumed in Washington yesterday in the form of changeups in the administration with Trump letting go Secretary of State Rex Tillerson just after agreeing to talks with North Korea, and more saber rattling with trade actions against China for technology, apparel, and other imports. This also follows Trump’s intervention in the proposed takeover of Qualcomm (QCOM) by competitor Broadcom (BRCM).

While many an investor will focus on the “new” volatility in the market, I’ll continue to use our thematic lens to look for companies that are “Trump-Proof” in the short-term. That’s not a political statement, but rather a reflection of the reality that the modus operandi of President Trump and his Twitter habit often cause significant swings in the market as the media attempts to digest and interpret his comments.

How will we find these so-called Trump-proof companies? By continuing to use our thematic lens to uncover well-positioned companies that are benefitting from thematic tailwinds that alter the existing playing field, regardless of the latest noise from Washington politicians.

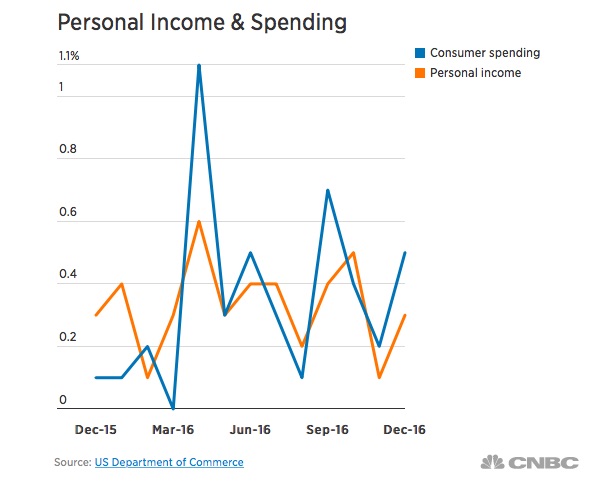

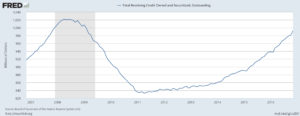

At least for now, volatility is back in vogue and that is bound to drive headlines and other noise. I’ll continue to focus on the data, and if you read this week’s Monday Morning Kickoff you know we are in the midst of a whopper of a data week. While the Consumer Price Index (CPI) for February was in line with expectations, and on a year over year basis core rose 1.8% — the same as in January — which should take some wind out of the inflation mongers. This morning we have the February Retail Sales report, which in my view should once again serve up confirming data for our positions in Amazon (AMZN) and Costco Wholesale (COST), which continue to benefit from our Connected Society and Cash-strapped Consumer investing themes. Later in the week, the February reading on Industrial Production should confirm the demands that are exacerbating the current heavy truck shortage here in the U.S. – good news for the Paccar (PCAR)shares on the Tematica Investing Select List.

An Update on Our Once Star Performer, Universal Display (OLED)

A few weeks ago, I shared an update on Universal Display (OLED) shares, which have been essentially treading water following the company’s December quarter results. Later today, the management team will be presenting at the Susquehanna’s Seventh Annual Semi, Storage & Tech Conference. Odds are the management team will reiterate its view on market digesting the organic light emitting diode capacity additions made over the last several quarters, but I expect they will also describe the growing number of applications that will come on stream in the next 3-6 quarters. As of late February, Susquehanna had a positive rating on OLED shares with a price target of $200 and I suspect they will have some bullish comments following today’s presentation.

Considering the ripples to be had with the latest Connected Society victim, Toys R Us

Over the weekend we were reminded of the situation facing many brick & mortar retailers that are failing to adapt their business to ride our Connected Society investing theme. I’m referring to toy and game retailer Toys R Us, the one-time Dick’s Sporting Goods (DKS) or Home Depot (HD) of its industry. Like several sporting goods retailers and electronic & appliance retailers such as Sports Authority, Sports Chalet, and HH Gregg that have gone belly up, if Toys R Us doesn’t get a last-minute lifeline or find a buyer it will likely file Chapter 7.

It’s been a rocky road for the one-time toy supermarket company as it entered bankruptcy in September, aiming to emerge with a leaner business model and more manageable debt. The company obtained a new $3.1 billion loan to keep the stores open during the turnaround effort, but results worsened more than expected during the holidays, casting doubt on the chain’s viability. The company entered this year with more than 800 stores in the U.S. — under both the Toys “R” Us and Babies “R” Us brands, but by January, it announced the shuttering of 180 locations.

The pending bankruptcy to be had at Toys R Us is but the latest in the retail industry, but it’s not likely to be the last. Claire’s Stores Inc., the fashion accessories chain with a debt load of $2 billion, is also preparing to file for bankruptcy in the coming weeks as is Walking Co. Holdings Inc.

What these all have in common is the increasing shift by consumers to digital commerce and the growing reliance on retailers for what is termed the direct to consumer (D2C) business model. Certain branded apparel, footwear, and other consumer product companies, like Nike (NKE) have embraced Amazon’s formidable logistics capabilities and this has benefitted our United Parcel Service (UPS) shares. As we have said before, and we recognize it sounds rather simplistic, when you order products online they have to get to where they are being sent. Hello UPS!

Now let’s consider the ripple effect of the pending Toys R Us bankruptcy.

When events such as this occur, there is a liquidation effect and a subsequent void. As we saw when Sports Authority went bankrupt, the businesses at Nike and Under Armour (UAA) were impacted by liquidation sales in the short term. At the same time, both lost the recurring sales associated with Sports Authority. Odds are we will see the same happen with Toys R Us with companies like Mattel (MAT) and Hasbro (HAS) taking it on the chin. In my view these companies are already struggling as teens, tweens and kids of all ages shift to digital games, apps and e-gaming, which are aspects of our Connected Society and Content

In my view these companies are already struggling as teens, tweens and kids of all ages shift to digital games, apps and e-gaming, which are aspects of our Connected Society and Content is King themes. When was the last time you saw an elementary schooler play with Ken or Barbie? More likely they are on an iPad or Microsoft (MSFT) Xbox while their older siblings are playing the new craze sweeping the nation – Fortnite. And yes, that it appears the rumors are true and Fornite will soon be available across Apple’s iDevices.

Looking at the financial performance of Mattel, not even the all mighty Star Wars franchise could save them from delivering declining revenue and earnings this past holiday shopping season. On the liquidation front, we are likely to see the toys businesses at Target (TGT) as well as Walmart (WMT) take the brunt of the blow. But here too this is likely just another hit as these two retailers have already been dealing with falling revenue at Mattel and Hasbro. Walmart is the largest customer for Mattel and Hasbro, accounting for about 20% of total sales for each toy maker. Both toy companies get nearly 10% of their revenue from Target too.

One of the investing strategies that I employ with the Select List is “buy the bullets, not the guns” which refers to buying well-positioned suppliers that serve a variety of customers. In situations like what we are seeing in the brick & mortar retail sector, we can turn that strategy upside down and uncover those companies, like Mattel and Hasbro, that we as investors should avoid given the multiple direct and indirect headwinds they are currently facing or about to.