WEEKLY ISSUE: Companies continue to serve up weaker guidance

Key points inside this issue

- The outlook for earnings continues to wane even as the trade-related market melt-up continues.

- Our price target on Amazon (AMZN) shares remains $2,250.

- Our price target on Alphabet (GOOGL) shares remains$1,300.

- Our price target on Costco Wholesale (COST) shares remains $250.

- Our price target on Universal Display (OLED) shares remains $125.

- Our price target on Nokia (NOK) shares remains $8.50

The outlook for earnings continues to wane even as the trade-related market melt-up continues

Domestic stocks continued to trend higher last week as the December-quarter issues that plagued them continued to be dialed back. Said another way, the expected concerns — the Fed, the economy, the government shutdown, geopolitical issues in the eurozone, and U.S.-China trade talks — haven’t been as bad as feared a few months ago.

In recent weeks, we have seen the Fed take a more dovish approach and last week’s data, which included benign inflation numbers and fresh concerns over the speed of the economy following the headline December Retail Sales Report and Friday’s manufacturing-led contraction in the January Industrial Production Index, reaffirm the central bank is likely to stand pat on interest rate hikes. We see both of those reports, however, feeding worries over increasing debt-laden consumers and a slowing U.S. economy.

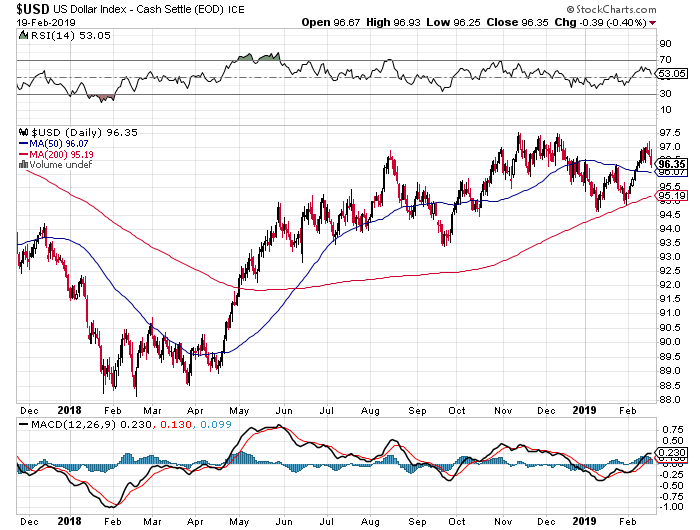

Granted, economic data from around the globe suggest the U.S. economy remains one of the more vibrant ones on a relative basis, which also helps explain both the melt-up in both the domestic stock market as well as the dollar. On Thursday we learned that economic growth in the eurozone was basically flat on a sequential basis in the December quarter, rising a meager 0.2%. Year-over-year growth stood at just 1.2% for the final quarter of 2018. This came after news that the eurozone economic powerhouse that is Germany had no growth itself in the fourth quarter after a contraction of 0.2% in the third quarter. Italy experienced its second consecutive quarter of economic contraction, putting it in a technical recession.

All of this put further downward pressure on the euro versus the U.S. dollar, which means dollar headwinds remain for multinational companies. And we still have another major headwind that is the lack of any Brexit deal. With three pro-EU Conservatives having resigned this morning from Prime Minister Theresa May’s party to join a new group in Parliament, there is no an even slimmer chance of Brexit deal being put in place ahead of next week.

So, what has been fueling the rebound in the stock market?

Among other factors, the deal to avoid another federal government shutdown, which was followed by the “national emergency” declaration that will potentially give President Trump access to roughly $8 billion to fund a border wall. We’ll see how this all plays out in the coming days, alongside the next step in U.S.-China trade talks that are being held this week in Washington. While “much work remains” on the working Memorandum of Understanding, trade discussions last week focused on several of the larger structural issues that we’ve been more concerned about — forced technology transfer, intellectual property rights, cyber theft, and currency.

Early this morning, it’s being reported that President Trump is softening on the March 1 phase in date for the next round of tariff increases, which is likely to give the market some additional trade optimism and see it move higher. We remain hopeful, but we expect there to be several additional steps to go that will set the stage for any final agreement that will likely be consummated at a meeting between Presidents Trump and Xi. And yes, the final details will matter and will determine if we get a “buy the rumor, sell the news” event.

Even as the trade war continues at least for now, we continue to see companies positioning themselves for the tailwinds associated with Living the Life and New Global Middle-class investing theme opportunities to be had in China. If you missed a recent Thematic Signal discussing how Hilton (HLT) is doing just that, you can find it here.

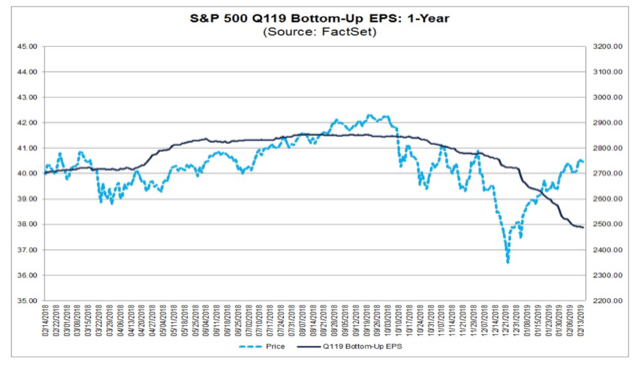

And then there are earnings

Over the last several weeks, we’ve been tracking and sharing the declining outlook for S&P 500 earnings for 2019. As we closed last week, roughly 80% of the S&P 500 companies had reported their quarterly earnings and issued outlooks. In aggregating the data, the new consensus calls for a 2.2% year-over-year decline in earnings for the current quarter, low single-digit earnings growth in the June and September quarters, and 9.1% growth in the December quarter. In full, the S&P 500 group of companies are now expected to grow their collective 2019 EPS by 5% to $169.53, which means that as those expectations have fallen over the last several months, the 2019 move in the market has made the stock market that much more expensive.

In my view, we are once again seeing a potentially optimistic perspective on earnings for the second half of the year. While a U.S.-China trade deal and infrastructure spending bill could very well lead to a better second half of 2019 from an earnings perspective, the unknown remains the vector and velocity of the rest of the global economy. As discussed above, the US is looking like the best house on the economic block, but as I share below there are valid reasons to think that it too continues to slow.

Last week I touched on a Thematic Signal about the record level of auto loan delinquencies, and in the last few days, we’ve learned that student-loan delinquencies surged last year, hitting consecutive records of $166.3 billion in the September 2018 quarter and $166.4 billion in the December 2018 one. I’ve also noticed an uptick in credit-card delinquencies this past January as companies ranging from American Express (AXP) to JPMorgan (JPM) and other credit card issuers reported their monthly data. What I find really concerning is this record level of delinquencies is occurring even as the unemployment rate remains at multi-year lows, which suggests more consumers are seeing their disposable income pressured. While this isn’t a good sign for a consumer-led economy, it certainly confirms the tailwind associated with our Middle-class Squeeze investing theme.

Tematica Investing

December Retail Sales shock some, confirm Costco and others

December Retail Sales have been published by the Commerce Department and to say the results were different than most were expecting is an understatement. And that’s even for those of us that were watching data of the kind I mentioned above. Normally, holiday shopping tends to build as we close out the year, but according to the report, consumers pulled back in December as monthly retail sales fell 1.3% compared to November.

Yes, you read that right – they fell month over month, but as we know that is only one way to read the data. And while sequential comparisons are helpful, they do little to help us track year over year growth. From that perspective, retail sales in December 2018 rose 2.1% year over year with stronger gains registered at Clothing & Clothing Accessories Stores (+4.7%), Food Services & Drinking Places (+4.0%), Nonstore retailers (+3.7%) and Auto & other motor vehicles (+3.4%). That’s not to say there weren’t some sore spots in the report – there were, but there are also the ones that have been taking lumps for most of 2018. Sporting goods, hobby, musical instrument, & book stores fell 13% year over year in December, bringing the December quarter drop to 11% overall. Department Stores also took it on the chin in December as their retail sales fell 2.8% year over year. These declines are largely due to the accelerating shopping shift to digital from brick & mortar that are associated with our Digital Lifestyle investing theme.

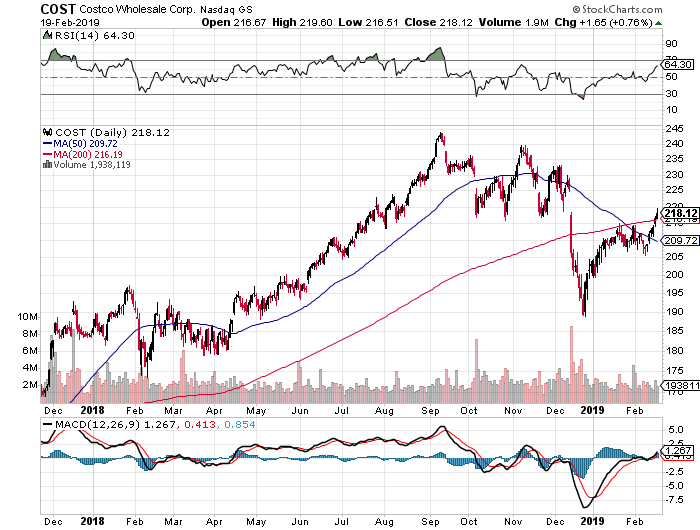

Despite the headline weakness, I once again see the report as confirming for Thematic King Amazon (AMZN) and to a lesser extent Select List resident Alphabet (GOOGL) given its Google shopping engine. Not only is Amazon benefiting from the accelerating shift to digital commerce, but also from its own private label efforts, which span basic electronic accessories to furniture and apparel. It goes without saying that comparing the December Retail Sales report with Costco Wholesale’s (COST) monthly same-store sales reports shows Costco continues to win consumer wallet share.

As a reminder, Costco’s December same-store sales rose 7.5% in December (7.1% excluding gasoline prices and foreign exchange) and 6.6% in January (7.3%). And it remains on path opening new warehouse locations with 768 exiting January, up 3.0% year over year. That should continue to spur the company’s high margin membership fee income in the coming quarters. My suspicion is others are catching onto this given the 7% increase in COST shares thus far in 2019, the vast majority of which has come in the last week. We’ll continue to hold ‘em.

As a reminder, Costco’s December same-store sales rose 7.5% in December (7.1% excluding gasoline prices and foreign exchange) and 6.6% in January (7.3%). And it remains on path opening new warehouse locations with 768 exiting January, up 3.0% year over year. That should continue to spur the company’s high margin membership fee income in the coming quarters. My suspicion is others are catching onto this given the 7% increase in COST shares thus far in 2019, the vast majority of which has come in the last week. We’ll continue to hold ‘em.

- Our price target on Amazon (AMZN) shares remains $2,250.

- Our price target on Alphabet (GOOGL) shares remains $1,300.

- Our price target on Costco Wholesale (COST) shares remains $250.

Turning to this week’s data

This week’s shortened trading week brings several additional key pieces of economic data. And following the disappointing December Retail Sales report, these reports are bound to be closely scrutinized as the investment community looks to home in on the speed of the domestic economy.

In addition to weekly mortgage applications, and oil and natural gas inventory data, tomorrow we’ll also get the December Durable Orders report and January Existing Home sales data. Given the drop-off in mortgage applications of late as well as weather issues, it’s hard to imagine a dramatic pick-up in the housing data since the end of 2018. Rounding out the economic data will be our first February look at the economy with the Philly Fed Index.

Speaking of the Fed, today we’ll see the release of the Fed’s FOMC minutes from its January meeting. Considering the comments emanating from Fed heads lately as well as the lack of inflation in the January CPI and PPI data, there should be few surprises in terms of potential interest rate hikes in the near term. The looming question is the speed at which the Fed will normalize its balance sheet, which likely means that will be an area of focus as investors parse those minutes.

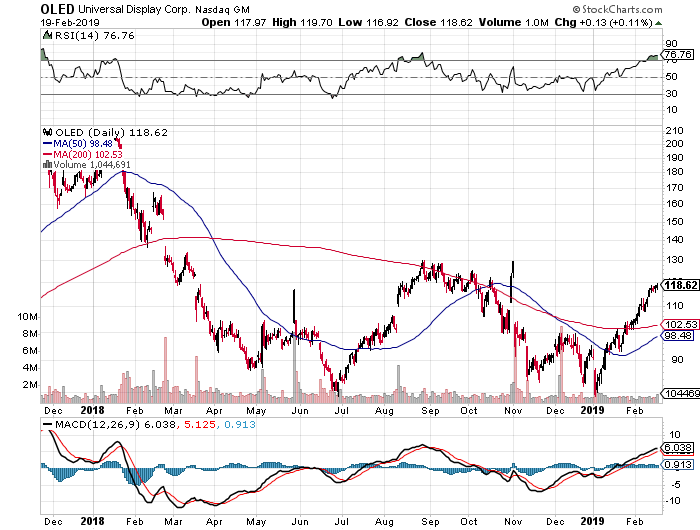

Here come Universal Display and Mobile World Congress 2019

As long as we’re looking at calendars, after Thursday’s market close Select List resident Universal Display (OLED) will report its quarterly results. To say the shares have found some legs in 2019 would be a bit of an understatement given their resurgence over the last several weeks.

We know Digital Lifestyle Select List company Apple (AAPL) has shared its plans to convert all of its iPhone models to organic light emitting diode displays by 2020, and that keeps us in the long-term game with OLED shares. Given the current tone of the smartphone market, however, we could see Universal Display serve up softer than expected guidance.

We’ll continue to hold OLED shares for the duration and look for signs that other device companies, including other smartphone vendors but other devices as well, are making the shift to organic light emitting diodes next week during Mobile World Congress 2019 (Feb. 25-28). The event is a premier one mobile industry as it tends to showcase new devices and technologies, and as you might imagine means a number of announcements. This means it’s not only one to watch for organic light emitting diode adoptions, but we are also likely to see much news on 5G virtual reality and augmented reality, key aspects of our Disruptive Innovators investing theme, as well. And with 5G in mind, we could very well hear of more 5G network launches as well, which means keeping my Nokia (NOK) and Digital Infrastructure ears open as well as my Digital Lifestyle ones.

- Our price target on Universal Display (OLED) shares remains $125.

- Our price target on Nokia (NOK) shares remains $8.50.