KEY POINTS FROM THIS POST

- As we continue to recast our investment themes here at Tematica, this week we launch a new theme — Disruptive Innovators.

- We are adding Universal Display (OLED) shares back to the Tematica Investing Select List as part of our Disruptive Innovators investing theme with a $150 price target.

Over the last few weeks, we’ve been reconstituting our collection of investment themes. Following the recent unveiling of our Digital Lifestyle theme, today we are recasting a theme we call Disruptive Innovators. If you thought disruption was only to be had from technology evolution, you’ll want to pay attention.

Every so often a new technology, business practice or other development comes along that upends the status quo: the personal computer; the internet; high speed networks; Google; Uber; the App store; Streaming; Cloud computing; Amazon Prime; mobile advertising, ordering and payments; Light Emitting Diodes (LEDs).

These are just some of the many disruptions that have changed how we think, interact, behave, conduct business, learn, shop and go about our day-to-day lives.

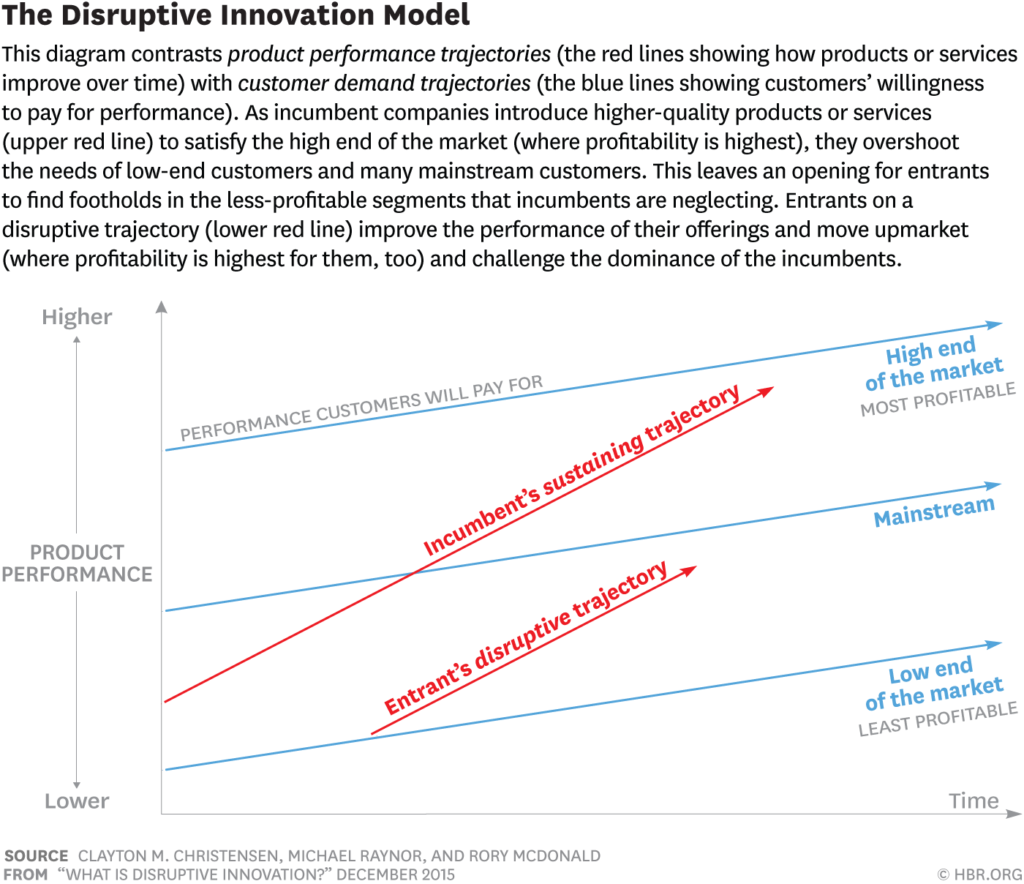

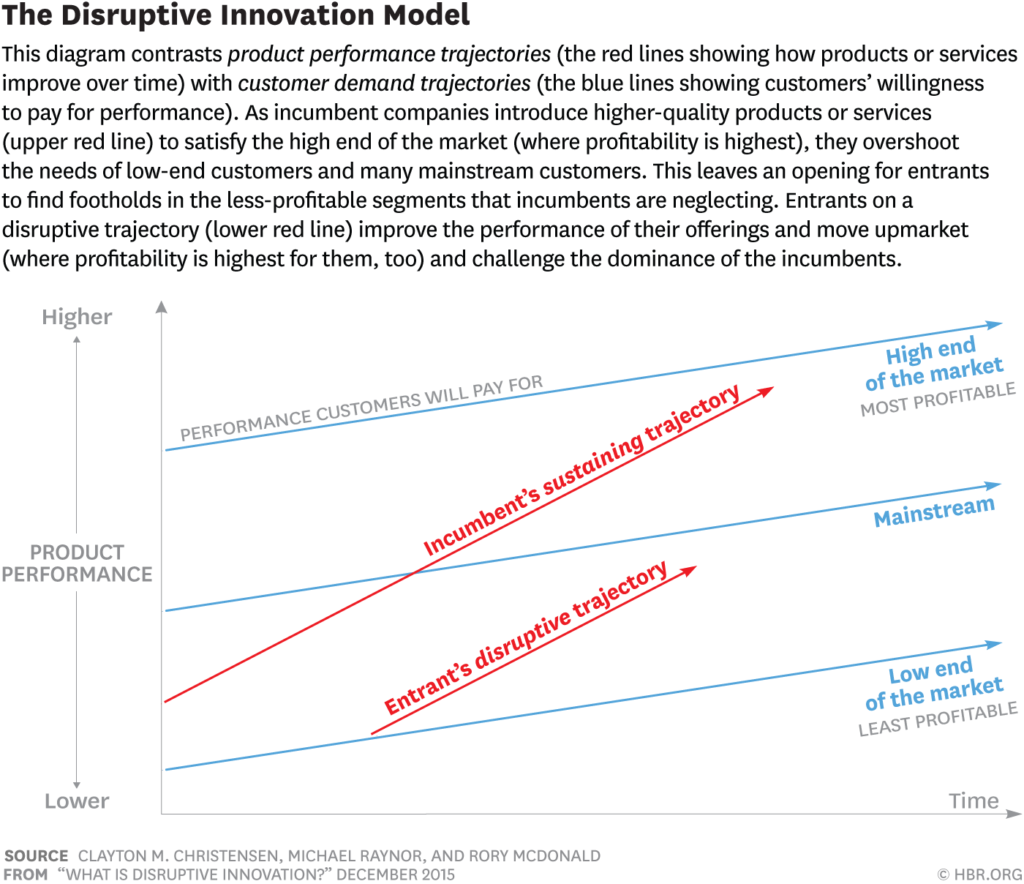

Harvard Business School professor and disruption guru Clayton Christensen says that a disruption displaces an existing market, industry, or technology and produces something new and more efficient and worthwhile. It is at once destructive and creative.

Established businesses tend to focus on improvements to their existing products and services, usually for their most demanding and most profitable customers. Their focus is on making iterative changes and adjustments along the way, which allows them to maintain their pole position in their particular category, without rocking the boat too much, safe and steady.

Disruptive solutions on the other hand not only look to rock the boat but often tip it over and completely change the lake.

Disruptors often begin by successfully targeting those overlooked customer segments — typically ones that complain about the complexity and cost of existing products and services. The goal of a disruptor is to gain a toehold in a category by removing friction. Oftentimes this could be a technological advance that makes the customer experience much better, which was the case with the introduction of the iPod into the MP3 player market. But disruption can also come in the form of removing friction from the actual process of purchasing a product or service or simply improving the customer experience.

As slow-moving incumbents focus on harvesting profits from mainstream products, disruptive entrants expand their reach and begin to move upmarket, delivering the performance that incumbents’ mainstream customers require, while preserving the advantages that drove their early success. When mainstream customers start adopting the entrants’ offerings in volume, disruption has occurred.

There are numerous examples of this disruptive process to be had, but none greater than mobile phone giant Nokia (NOK). Back in 2007, Nokia sat atop the market with its 41% global market share of the mobile phone category. The cellphone giant, however, completely misread the prospects for the smartphone, a device that reshaped not only a number of industries but one could easily argue it’s the single device that has reshaped all of our lives and is in the process of transforming frontier and emerging economies. At first, it was Blackberry and Palm that gained market share, but when Apple introduced the first iPhone — a device that featured a disruptive capacitive touchscreen and full internet browsing — the writing was on the wall for Nokia’s handset business.

Another example of the creative destruction that disruptors cause came in our media consumption habits. It really wasn’t too long ago that music, TV shows, movies, books, software and games were once sold only in physical formats. Today, in large part due to devices like the iPhone, iPad and Kindle, much of the media we engage with on a daily basis is downloaded or streamed through the internet directly to the device of choice. That change, destroyed established players such as Blockbuster Video, Borders Books and Tower Records, to name a few, and completely changed the product offering in stores like Best Buy, Target and Wal-Mart.

According to the Recording Industry Association of America, within the $8.72 billion spent in 2017 by U.S. consumers on music, streaming was the dominant growth vehicle, accounting for $5.66 billion in revenue (65%), up from 2016’s $3.96 billion. While digital downloads were hardest hit, falling 22% by volume year over year, physical album sales continued to fall vs. 2016. Underneath that disruptive shift, we find robust 4G LTE mobile networks and highspeed fiber networks as well as storage and increasing processing power.

Interface technologies have morphed from keyboard-mouse to touchpad and with the launch of Apple’s first iPhone 10-years ago capacitive touch. In 2011, Apple launched its digital voice assistant Siri that paved the way for Amazon’s Alexa and Google Home as well as a number of other virtual assistant offerings. While those digital assistants are racking up design wins in consumer appliances and cars, voice interface technology has expanded into other markets including financial services with Bank of America’s Erica, which has more than 1 million users.

At a consumer level, Amazon Prime’s two-day shipping has disrupted how the entire retail industry serves its customers. Online retailers, including Amazon, initially gained a foothold in the retail category because of their competitive advantage in two critical areas — choice and pricing. Amazon’s Prime service, however, removed the two remaining points of friction that came with online shopping — the time and cost of shipping your purchases to your doorstep and the hassle of returning items. Amazon Prime, and other online retailers that have followed Amazon’s lead, have completely removed the need to “just run to the mall” and we are now experiencing a “retailmageddon” that is disrupting the bricks and mortar landscape and transforming what a physical retailer looks like in the United States. Amazon is now looking to do the same with grocery and pharmacy given its acquisitions of Whole Foods and more recently PillPack.

Disruption Is More Than Just Technology

We now live in a time where technological disruptions are almost expected — one of the main criticisms of the latest round of iPhone’s was their lack of disruptors. But disruptions can come in all aspects of our lives.

Passersby used to hail a taxi, but now using an app they can do the same via their smartphone. Uber has transformed the task of summoning a ride into an easy, affordable proposition. Through its mobile app, users can request a ride and choose a vehicle based on luxury level and fare for their destination, a vast improvement on the old taxi model. As riders shifted from taxis to these on-demand ride services, the shares of Medallion Financial (MFIN), a finance company that focused on taxi medallion lending, saw its shares fall below $5.50 from a peak near $18 in November 2013.

Anyone who has booked a hotel knows it isn’t always an intuitive, cost-effective or pleasant experience. AirBnB has completely disrupted the industry by offering a completely different experience when visiting a new city or destination. Thanks to the company’s disruptive business model, travelers can now look beyond the hotel chains, inns or B&B’s, and rent local rooms in homes or apartments, often at a significant discount to traditional alternatives. AirBnb’s disruptive business model, of course, has the dual benefit of allowing anyone with an extra room, empty apartment, or house to earn a profit from their unused asset.

While those are more recent examples, there are numerous others to be had over the past decades and in each case, a new technology, service or capability has altered the competitive landscape.

The Disruptors Don’t Always Emerge as the Winner

Of course, not every would-be disruptor gains sufficient footing that its business model or technology becomes sustainable. For example, any number of internet-based retailers pursued disruptive paths in the late 1990s, but only a small number prospered. Pets.com, Webvan, eToys, Drkoop.com, and GeoCities are just a few examples of those that failed.

More recent examples of questionable disruptors include subscription-based movie ticketing service MoviePass and ingredient and recipe meal kit service Blue Apron (APRN). While both are attempting to alter their respective landscapes, MoviePass is contending with the accelerating adoption of streaming video services and fresh proprietary content as well as Hollywood studios continuing to push to offer movies in the home mere weeks after their theatrical review. With Blue Apron, numerous meal kitting companies have popped up as have similar services from the likes of Kroger (KR) and other grocery giants that have removed its early foothold.

Some technologies like 5G and organic light emitting diodes have a long runway in front of them, which necessitates tracking competitive developments and other signposts to determine when they will disrupt past disruptors 4G LTE, liquid crystal displays and LEDs. Other developments, such as augmented and virtual reality as well as drones are waiting for the spark that will stir widespread adoption across businesses and consumers alike.

Investing In Disruption

Today there are many disruptors spanning information technologies, biological sciences, material science, healthcare, energy, consumer and business services and other fields and are the basis for our Disruptive Innovators investment theme. Some of the technologies and business models we are tracking as part of this investment theme include but are not limited to:

Today there are many disruptors spanning information technologies, biological sciences, material science, healthcare, energy, consumer and business services and other fields and are the basis for our Disruptive Innovators investment theme. Some of the technologies and business models we are tracking as part of this investment theme include but are not limited to:

- 5G

- Artificial intelligence

- Autonomous vehicles

- Blockchain

- Business services

- Cloud

- Display technologies

- Drones and unmanned vehicles

- Internet of Things (IoT)

- Organic light emitting diodes

- Renewables and clean energy

- Smart manufacturing (3-D printing)

- Spatial Computing (augmented/virtual reality)

- Voice control and digital/virtual assistants

As we examine these and other disruptors, we look for the key enablers of the disruption. In some cases, this could be the service providers themselves, device/technology companies, key component vendors or in some cases intellectual property holders. Using 5G as an example, the array of contenders would include:

- AT&T (T) and Verizon Communications (VZ) as service providers;

- Ericsson (ERIC) and Nokia (NOK) as 5G infrastructure players;

- Chipset companies Qualcomm (QCOM) and Skyworks Solutions (SWKS);

- And Qualcomm again as well as InterDigital (IDCC) given their respective 5G patent portfolios.

That food chain or ecosystem view enables us to identify key customer-supplier relationships that capture the companies with the widest reach, which tends to reduce customer specific risks. As an example, because Qualcomm and Skyworks sell their chips to the who’s who in smartphones, smartphone market share shifts have a modest impact on their revenue streams.

Could we go deeper into the food chain? We could, but the further down we go, the further removed we could be from the source of disruption. Putting it all together, this investment theme focuses the major disruptive evolutions and then identifies those companies whose bottom lines are best positioned to benefit.

Our Disruptive Innovator Leader

One of the companies that match the criteria of a Disruptive Innovator and also holds prime food chain position in its category is organic light emitting diode company Universal Display (OLED). We’ve danced with this company and its shares over the last two years, riding it to heights as Apple (AAPL) prepared to launch the iPhone X that featured an OLED display supplied by Samsung, only to exit the shares as forecasts for that smartphone’s shipments were dialed back. At the time we noted that we still liked Universal’s two-pronged business model comprised of key chemical sales as well as high margin IP licensing.

The good news is that business model remains intact at Universal Display, and we are seeing rising industry capacity for its OLED screens come on line in the marketplace. That was one of the issues that plagued Apple (AAPL) — tight capacity levels that made the OLED display one of, if not the, most expensive components of the iPhone X. With Apple slated to introduce two new OLED smartphone models in a few months, odds are it has tackled those supply issues. Commentary from display equipment maker Applied Materials (AMAT) suggests that to be the case. The notion that Apple isn’t the only driver of OLED demand also remains true given other smartphone manufacturers, including Samsung, Huawei, and Xiaomi, are introducing new models that feature OLED displays, while new TV models incorporating the technology are also hitting shelves later this year. Longer-term, I continue to see OLED technology following the roadmap laid our by light emitting diodes (LEDs) into automotive, specialty lighting and ultimately general illumination replacing traditional lighting and LEDs along the way.

What this means is an expanding array of applications that will grow Universal’s addressable market for the IP business while increasing demand for its chemical business. A very nice push-pull that drives revenue and profit growth over the coming 12-24 months. As with any company, there are associated risks, and one of them for Universal Display is the risk of slower than expected adoption of OLED technology – we saw that unfold over the last nine months. Another risk is that this disruptive technology itself gets disrupted, which means keeping tabs on new display technology developments.

As we add OLED shares back to the Tematica Investing Select List, we are instilling a $150 price target. That target is based on EPS growth to $3.83 in 2019, up from $1.83 this year and $0.94 in 2015 equates to a compound annual growth rate of 37% over the 2015-2019E time frame. On a price to earnings growth basis, our $150 target equates to a multiple of 1.2x — hardly rich, but in my view one that reflects the protracted demand ramp we encountered during the first half of 2018.

That assessment doesn’t factor in the more than $9.50 per share in net cash on Universal’s balance sheet, which should grow in the coming quarters due to a combination of cash flow and licensing payments. I’d be remiss if I didn’t mention the company’s dividend, but with it clocking in around $0.06 per share per quarter, it’s not going to be a major factor in assessing the share price or for lining shareholder pockets.

- We are adding Universal Display (OLED) shares back to the Tematica Investing Select List as part of our Disruptive Innovators investing theme with a $150 price target.

Examples of companies riding the Disruptive Innovators investment theme tailwinds include:

- Amazon (AMZN)

- Applied Materials (AMAT)

- Cree (CREE)

- Dropbox (DBX)

- Grub Hub

- Interdigital (IDCC)

- Lyft

- Nokia (NOK)

- Nuance Communications (NUAN)

- Qualcomm (QCOM)

- Skyworks Solutions (SWKS)

- Spotify (SPOT)

- Stamps.com (STMP)

- Synaptics (SYNA)

- Uber

- Universal Display (OLED)

Today there are many disruptors spanning information technologies, biological sciences, material science, healthcare, energy, consumer and business services and other fields and are the basis for our Disruptive Innovators investment theme. Some of the technologies and business models we are tracking as part of this investment theme include but are not limited to:

Today there are many disruptors spanning information technologies, biological sciences, material science, healthcare, energy, consumer and business services and other fields and are the basis for our Disruptive Innovators investment theme. Some of the technologies and business models we are tracking as part of this investment theme include but are not limited to: