Apple’s negative pre-announcement serves as a reminder to the number of risks that have accumulated

We are “breaking in” to share my thoughts with you on the implications of Apple’s (AAPL) downside December quarter earnings news last night. Quickly this is exactly of what I was concerned about in early December, but rather than take a victory lap, let’s discuss what it means and what we’re going to do.

Last night we received a negative December quarter earnings preannouncement from Apple (AAPL), which is weighing on both AAPL shares as well as the overall market. It serves as a reminder to the number of risks that have accumulated during the December quarter – the slowing global economy, including here at home; the US-China trade war; Brexit and other geopolitical uncertainty in the eurozone; the strong dollar; shrinking liquidity and a Fed that looks to remain on its rate hike path while also unwinding its balance sheet. Lenore Hawkins and I talked about these at length on the Dec. 21 podcast, which you can listen to here.

In short, a growing list of worries that are fueling uncertainty in the market and in corporate boardrooms. When the outlook is less than clear, companies tend to issue conservative guidance which may conflict with Wall Street consensus expectations. In the past when that has happened, it’s led to a re-think in growth prospects for both the economy, corporate profits and earnings, the mother’s milk for stock prices.

These factors and what they are likely to mean when companies begin issuing their December quarter results and 2019 outlooks in the coming weeks, were one of the primary reasons we added the ProShares Short S&P 500 (SH) shares to our holdings in just under a month ago. While the market fell considerably during December, our SH shares rose 5% offering some respite from the market pain. As expectations get reset, and odds are they will, we will continue to focus on the thematic tailwinds and thematic signals that have been and will remain our North Star for the Thematic Leaders and the larger Select List.

What did Apple have to say?

In a letter to shareholders last night, Apple CEO Tim Cook shared that revenue for the quarter would come in near $84 billion for the quarter vs. the consensus estimate of $91.5 billion and $88.3 billion, primarily due to weaker than expected iPhone sales. In the letter, which can be read here, while Apple cited several known headwinds for the quarter that it baked into its forecast such as iPhone launch timing, the dollar, supply constraints, and growing global economic weakness, it fingered stronger than expected declines in the emerging markets and China in particular.

Per the letter, most of the “revenue shortfall to our guidance, and over 100 percent of our year-over-year worldwide revenue decline occurred in Greater China across iPhone, Mac, and iPad.”

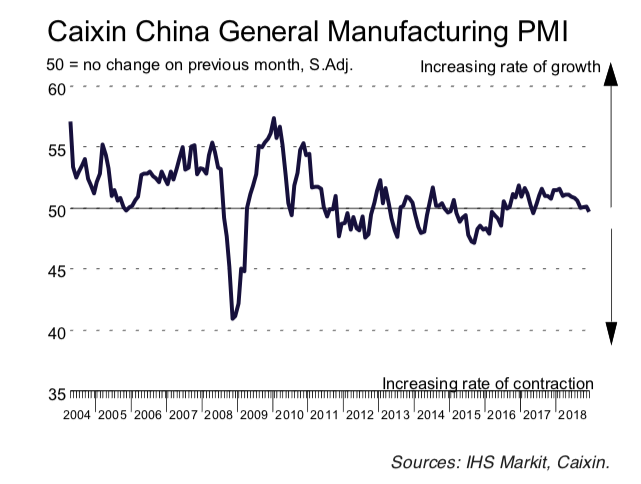

Cook went on to acknowledge the slowing China economy, which we saw evidence of in yesterday’s December Markit data for China. Per that report,

“The Caixin China General Manufacturing PMI dipped to 49.7 in December, the first time since May 2017 that the reading has been below 50, the mark that separates expansion from contraction. The sub-index for new orders slid below the breakeven point of 50 for the first time since June 2016, reflecting decreasing demand in the manufacturing sector.”

In our view here at Tematica, that fall in orders likely means China’s economy will be starting off 2019 in contraction mode. This will weigh on corporate management teams as they formulate their formal guidance to be issued during the soon to be upon us December quarter earnings season.

Also, in his letter, Cook called out the “rising trade tensions with the United States” and the impact on iPhone demand in particular.

In typical Apple fashion, it discussed the long-term opportunities, including those in China, and other positives, citing that Services, Mac, iPad, Wearables/Home/Accessories) combined to grow almost 19% year-over-year during the quarter with records being set in a number of other countries. While this along with the $130 billion in cash that Apple has on its balance sheet exiting the December quarter, bode well for the long-term as well as its burgeoning efforts in healthcare and streaming entertainment, Apple shares came under pressure last night and today.

Odds are there will more negative earnings report to come

In light of the widespread holding of Apple shares across investor portfolios, both institutional and individual, as well as its percentage in the major market indices, we’re in for some renewed market pressure. There is also the reality that Apple’s decision to call out the impact of U.S.-China trade will create a major ripple effect that will lead to investors’ renewed focus on the potential trade-related downside to many companies and on the negative effect of China’s slowing economy.

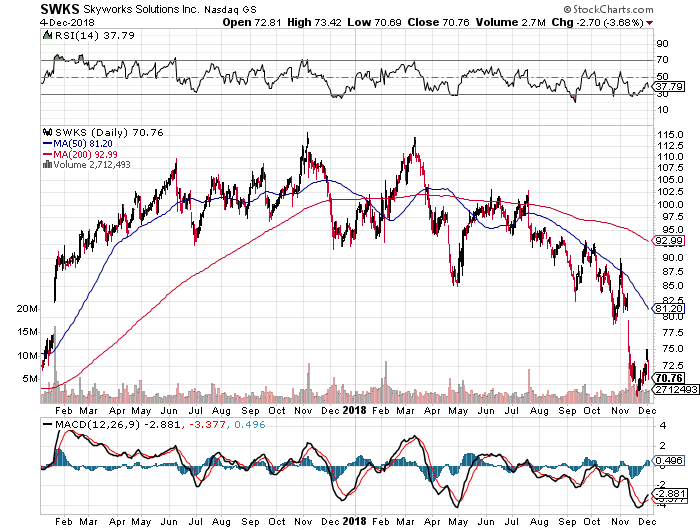

In recent months we’ve heard other companies ranging from General Motors (GM) to FedEx (FDX) express concerns over the trade impact, but Apple’s clearly calling out its impact will have reverberations on companies that serve markets tied to both the smartphone and China-related demand. Overnight we saw key smartphone suppliers ranging from Skyworks Solutions (SWKS) and Qorvo (QRVO) come under pressure, and the same can be said for luxury goods companies as well. We’d note that Skyworks and Qorvo are key customers for Select List resident AXT Inc (AXTI, which means if we follow the Apple revenue cut through the supply chain, it will land on AXT and its substrate business.

All of the issues discussed above more than likely mean Apple will not be the only company to issues conservative guidance. Buckle up, it’s going to be a volatile few weeks ahead.

Positives to watch for in the coming weeks and months

While the near-term earnings season will likely mean additional pain, there are drivers that could lift shares higher from current levels in the coming months. These include a trade deal with China that has boasts a headline win for the US, but more importantly contains positive progress on key issues such as R&D technology theft, cybercrimes and the like – in other words, some of the meaty issues. There is also the Federal Reserve and expected monetary policy path that currently calls for two rate hikes this year. If the Fed is data dependent, then it likely knows of the negative wealth effect to be had following the drop in the stock market over the last few months.

Per Moody’s economist Mark Zandi, if stocks remained where there were as of last night’s close, it would equate to a $6 trillion drop in household wealth over the last 12-15 months. Per Zani, that would trim roughly 0.5% to 2019 GDP – again if the stock market stayed at last night’s close for the coming weeks and months. As we’re seeing today, and given my comments about the upcoming earnings season, odds are that 2019 GDP cut will be somewhat larger. That would likely be an impetus for the Fed to “slow its roll” on interest rates or at least offer dovish comments when discussing the economy.

Complicating matters is the current government shutdown, which has both the Census Bureau and Bureau of Economic Analysis closed. Even though there will be some data to be had, such as tomorrow’s December 2018 Employment Report from the Labor Department, it means the usual steady flow of economic data will not be had until the government re-opens. No data makes it rather difficult to judge the speed of the economy from all of us, including the Fed.

Given all of the above, we’ll continue to keep our more defensive positions companies like McCormick & Co. (MKC), Costco Wholesale (COST), and the ProShares Short S&P 500 shares intact. We’ll continue to watch input costs and what they mean for corporate profits at the margin – case in point is Del Frisco’s (DFRG), which is benefitting from not only falling protein costs but has been approached by an activist investor that could put the company in play. With Apple, Dycom Industries (DY), and AXT, we will see 5G networks lit this year here in the US, which will soon be followed by other such networks across the globe in the coming years. Samsung, Lenovo/Motorola and others have announced 5G smartphones will be shipping by mid-2019, and we expect Apple to once again ride that tipping point in 2020. That along with its growing Services business and other efforts to increase the stickiness of iPhone (medical, health, streaming, payments services), keeps us long-term bulls on AAPL shares.

When not if but when, the stock market finds its footing, which likely won’t be until after the December quarter earnings season at the soonest, we will look to strategically scale into a number of positions for the Thematic Leaders and the Select List.