Investing herd continues to catch up to us

Over the weekend I was doing my usual reading and noticed our positions in both Costco Wholesale (COST) and Applied Materials (AMAT) received favorable mentions in Barron’s. I always say it’s nice to see the herd catching up to what we’ve been seeing and saying, and these two articles are just the latest. As we shared in this week’s Monday Morning Kickoff, we are heading hip deep into 3Q 2017 earnings season. Thus far, we have been observers, but that will change this week when a number of companies on the Tematica Investing Select List report their quarterly results and update their outlook for the current quarter.

Costco Wholesale – Oppenheimer misses the real EPS generator

In Costco: 5 Reasons to Load Up digs into Oppenheimer’s Buy rating on COST shares and its $185 price target, which is in line with our price target. Candidly, while we agree with several of the presented points, we find it somewhat confounding that Costco’s continued footprint expansion, a key driver of very profitable membership fee income was not mentioned. While we could chalk it up to not really understanding how the company derives its overall profits and EPS, we’ll take the high road and say they did focus on reasons why the recent pullback in COST shares due to the perception of e-commerce threats is overblown.

Applied Materials – Semi-cap is strong, but let’s not forget about Display

Turning to Applied Materials, it was included in 4 Cheap Stock Picks for the Impatient article even though AMAT shares have been on a tear throughout 2017. The article rightly discussed one of the key drivers of rising semiconductor capital equipment demand:

It bodes well that China is rapidly building a chip industry, and must stock its factories with new machines, while new applications, including artificial intelligence and machine learning, are expanding the world-wide market for chips.

But, the article failed to mention the growing demand for Applied’s Display Business that is benefitting from the ramp in organic light emitting diode displays, which is also benefitting our Universal Display (OLED) shares. With both businesses firing, and following an upbeat outlook from semi-cap competitor Lam Research (LRCX), we remain bullish on AMAT shares. Our price target now stands at $65, but we suspect that as demand for its products continues to climb in 2018 there is likely another price increase to be had in the coming months.

- Our price target on Applied Materials (AMAT) shares is $65.

- Our price target on Universal Display (OLED) shares is $175.

This week’s earnings calendar

As I mentioned above, we are no longer passive observers this earning season as we have 6 companies on the Tematica Select List reporting this week. Here’s a quick rundown of when those companies will report and current consensus expectations. As you might expect, we’ll have color commentary on these reports, especially those that require us to take any action.

Tuesday, October 24

Corning (GLW; Disruptive Technology) – Consensus expectations call for this glass company that serves display and fiber markets to deliver EPS of $0.41 on revenue of $2.6 billion. Our price target is $37.

Wednesday, October 25

AXT Inc. (AXTI; Disruptive Technologies): Consensus expectations call for the RF semiconductor and fiber building block company to deliver EPS of $0.09 on $27 million in revenue. Our price target is $11

Thursday, October 26

Alphabet (GOOGL; Asset-Lite) – Consensus expectations have this internet search and digital advertising company earnings EPS of $8.33 on revenue of $27.2 billion for the quarter. Our price target is $1,050.

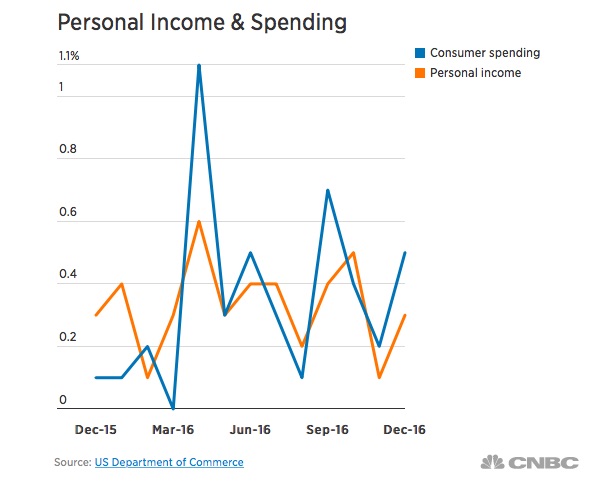

Amazon (AMZN; Connected Society) – Consensus expectations for the company we consider the poster child for thematic investing to deliver EPS of $0.03 on revenue of $42 billion, up almost 29% year over year. Our price target is $1,150.

Nokia Corp. (NOK: Asset-Lite – Consensus expectations have this wireless infrastructure, connected device and intellectual property company earnings EPS of $0.06 on revenue of $6.35 billion for 3Q 2017. Our price target stands at $8.50.

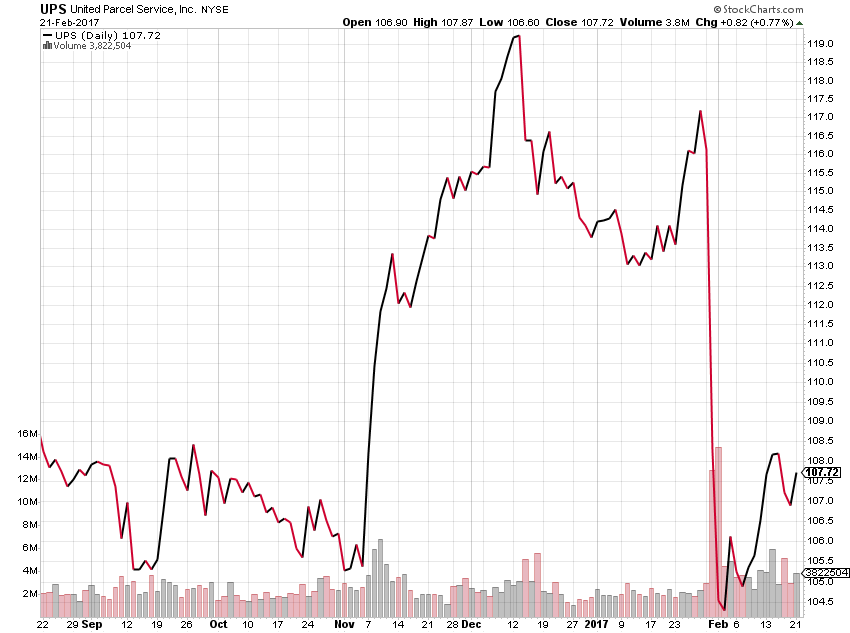

United Parcel Service (UPS; Connected Society) – This e-commerce delivery solutions company is slated to deliver EPS of $1.45 on revenue of $15.6 billion. Our price target on UPS shares remains $130.