- We are adding shares of Trade Desk (TTD), a company that straddles our Connected Society and Content is King investing themes, with an $80 price target and a Buy rating.

- Trade Desk will report its 3Q 2017 earnings after Thursday’s market close; while we don’t expect any post-earnings weakness, our strategy will be to any such development to improve our cost basis as advertising increasingly accelerates toward digital platforms.

- This is a new addition to the Select List, and at this time there is no stop loss recommendation.

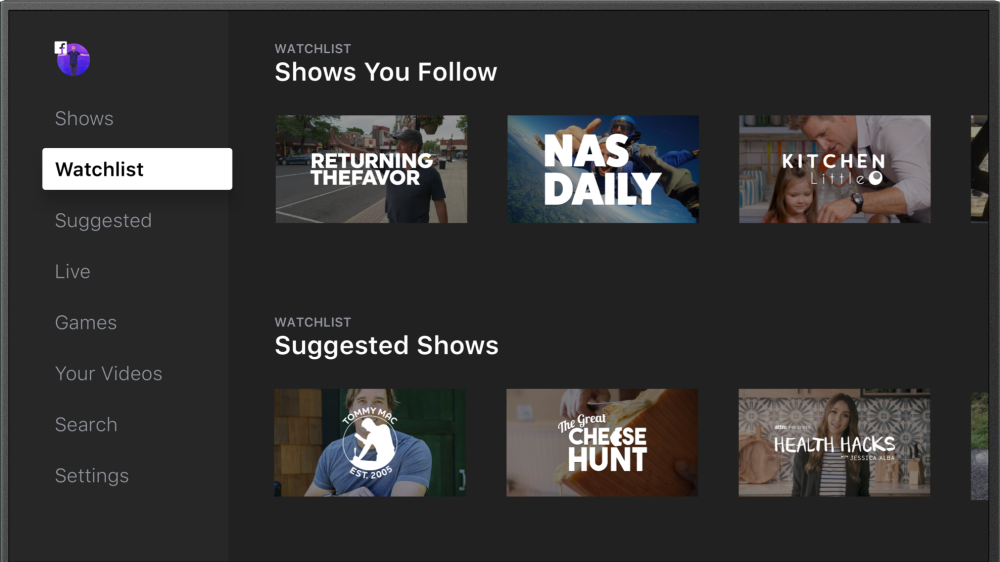

The Tematica Investing Select List has been and in our mind should continue to benefit from the accelerating shift toward digital advertising that is captured in the Facebook (FB), Alphabet (GOOGL) positions. This past earnings season was a robust one for both with advertising facing businesses growing leaps and bounds compared to year-ago levels. Let’s keep in mind, that’s before either one has put a meaningful dent in broadcast TV, the holy grail of advertising spend. The thing is both companies are focused on that with Watch at Facebook and several properties at Alphabet’s YouTube.

From the “platform to be shifted to” space, we have that pretty well covered with FB and GOOGL shares. But what about from the ad spending perspective? What tools and services are they using to help choose and optimize their advertising spend?

This brings us to Trade Desk, (TTD), a technology company that provides a self-service, cloud-based platform for ad buyers. Through this platform, which puts Trade Desk in the high-margin software as a service camp, ad buyers can create, manage, and optimize more expressive data-driven digital advertising campaigns across 500 billion digital ad opportunities per day across a variety of formats. These include display, video, audio, native and social, on a multitude of devices, including computers, mobile devices, and connected TV.

We’ve heard the cord cutting stories, the shift to mobile video consumption and how traditional cable companies are losing subscribers to streaming and other over the top services, especially with Millennials according to brand Intelligence firm Morning Consult. It’s not just the Millennials, however, given the steep costs associated with cable. The average cable bill in America is over $100 a month, which is almost 50% more than 10 years ago, and as we’ve pointed out previously debt-ridden consumers that have seen modest wage growth are looking for ways to cut back their spending. In some cases, it’s a choice between cable vs. the combination of streaming and mobile services.

What this means is Trade Desk is in the running not just for the $50 billion display advertising market or the $235 billion TV advertising market, but the $650 billion total global ad spending market. As more of that market shifts to digital platforms, which we are seeing per Facebook and Alphabet, it expands Trade Desks available market. Currently it’s estimated that only 2% of the $650 billion total global ad spending market has embraced programmatic advertising like that offered by Trade Desk. While we don’t expect programmatic advertising to become 100% of the global ad spending market any time soon, modest better growth to 4%-5% or better paves the way for significant growth ahead at Trade Desk.

We have often said that shifts like this take time to materialize, but much like a turning tanker when they pick up momentum the shift accelerates significantly. We are starting to see that in programmatic advertising and we will watch for confirmation among broadcast TV and agency advertising spend in the coming quarters.

As this occurs, Trade Desk is one of the preferred partners. Recently, the company again earned the top Net Promoter Score for Demand Side Platforms (DSP) in the latest Programmatic Intelligence Report from Advertiser Perceptions. The ranking was based on survey findings of more than 360 ad buyers at both brands and agencies. As grand as that is, we find even more solace in Trade Desk’s customer base, which coming into 2016 measured more than 560 with the top three customers being among the who’s who in advertising — Omnicom Group Inc. (OMC), WPP plc and Publicis Groupe (PUBGY) – each of which represented more than 10% of gross billings in 2016.

In reviewing 3Q 2017 results from Trade Desk’s top customers, Omnicom reported overall advertising up more than 4% on an organic basis. By comparison WPP reported its 3Q 2017 was up 1.1% year over year, with stronger growth of more than 4% for its Advertising, Media Investment Management business. Even Interpublic Group (IPG), which is not a top three Trade Desk customer, reported “advertising business had solid U.S. growth in both our larger networks and our domestic independence.”

This tells us the overall advertising market continues to grow, which is a positive for Trade Desk. What we find even more confirming for adding TTD shares is that on its earnings call, Interpublic cited significant new digital assignments during the quarter, including a new U.S. digital project from McDonald’s (MCD). Interpublic’s Chairman and CEO, Mike Roth, also shared that clients bringing their digital advertising spend in-house, which in our view bodes well for Trade Desk and its programmatic platform.

Our strategy with Trade Desk will mimic that of Apple (AAPL) – we’re adding TTD shares ahead of earnings this Thursday after the market close, and should the report disappoint we’ll look to scale into the shares given the ongoing shift toward digital advertising. Consensus expectations have it serving up EPS of $0.27 on revenue just shy of $77 million.

We’d note the favorable results at Facebook and Alphabet as well as the track record at Trade Desk for handily beating analyst expectations over the last year. That same track record has led to 2018 EPS expectations climbing to $1.70 from $1.34 a few months ago and that compares to 2017 EPS forecasts that now call for $1.43, up from $1.08 previously. To really put this into context, Trade Desk delivered EPS of $0.89 in 2016, which means its compound annual growth rate over the 2016-2018 period is significant at 38%.

Aside from actual revenue and EPS results, we’ll be assessing the mix of advertising spend, particularly between new and existing customers, as well as customer retention metrics. In the June quarter, Trade Desk had customer retention of 95% with roughly 87% of its 2Q 2917 gross spend from existing customers, which are customers that have been with Trade Desk for over a year.

In terms of the company’s balance sheet, it exited the June quarter with $27 million in debt vs. cash and short-term investments of just over $115 million. Over the past trailing 12 months ending in June, the company generated $40.4 million and $25.8 million of operating cash flow, and free cash flow respectively.

Our $80 price target on TTD shares equates to a PEG ratio of just over 1.2x when applied to the consensus 2018 EPS view of $1.70 per share. As the company continues to benefit from the accelerating shift to digital advertising, odds are we will see that PEG multiple expand as well, just like we’ve seen with Alphabet and Universal Display (OLED). That likely means we could be boosting our TTD price target several times over the coming quarters.

- We are adding shares of Trade Desk (TTD), a company that straddles our Connected Society and Content is King investing themes, with an $80 price target and a Buy rating.

- Trade Desk will report its 3Q 2017 earnings after Thursday’s market close; while we don’t expect any post earnings weakness, our strategy will be to any such development to improve our cost basis as advertising increasingly accelerates toward digital platforms.

- This is a new addition to the Select List, and at this time there is no stop loss recommendation.

You will find more statistics at Statista

You will find more statistics at Statista You will find more statistics at Statista

You will find more statistics at Statista You will find more statistics at Statista

You will find more statistics at Statista