The Stock Market Marches Higher and So Does the Tematica Select List

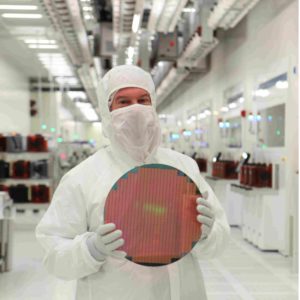

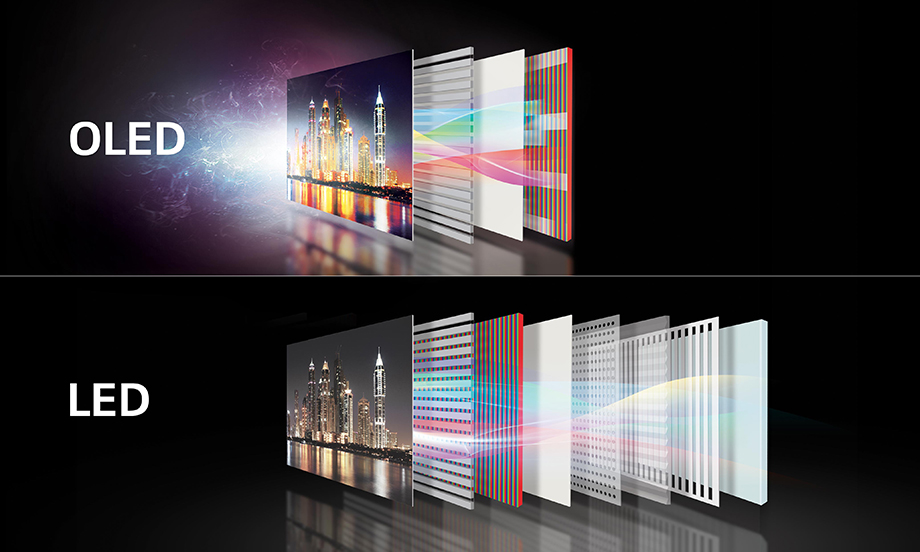

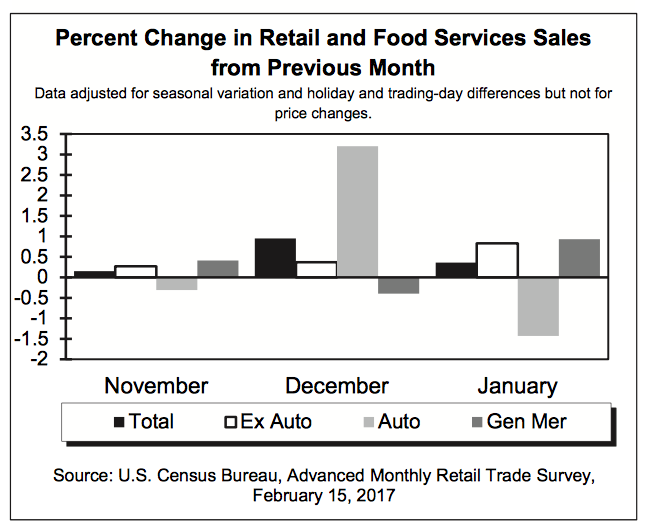

The last week has been a barn burner for a number of our positions on the Tematica Select List. We had earnings from AMN Healthcare (AMN) and International Flavors & Fragrances (IFF) that led both positions to move higher, January Retail Sales that were bullish for our Amazon (AMZN) shares and to a lesser extent our Alphabet (GOOGL) shares, and big move in our Universal Display (OLED) shares. Part of the catalyst for that move in Universal Display (OLED) shares was bullish comments from Applied Materials (AMAT) on the rising capacity for organic light emitting diode displays. On the back of that as well as accelerating growth in chip demand, we added Applied Materials shares as a Disruptive Technology play on the Tematica Select List with a $47 price target.

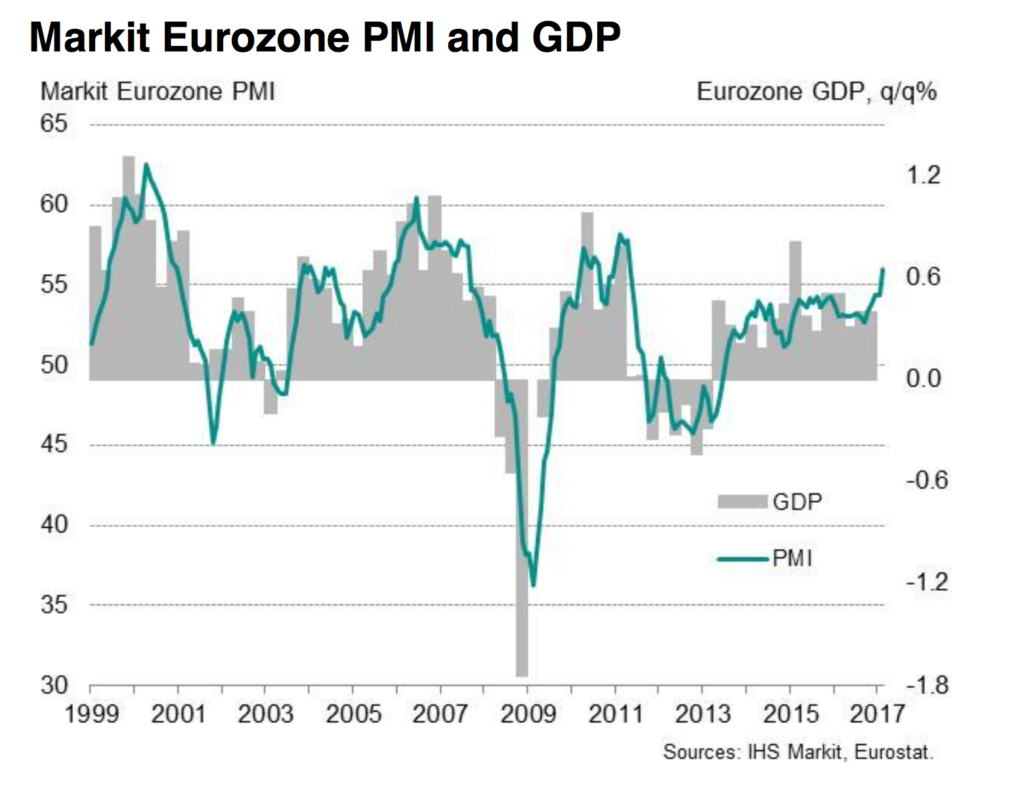

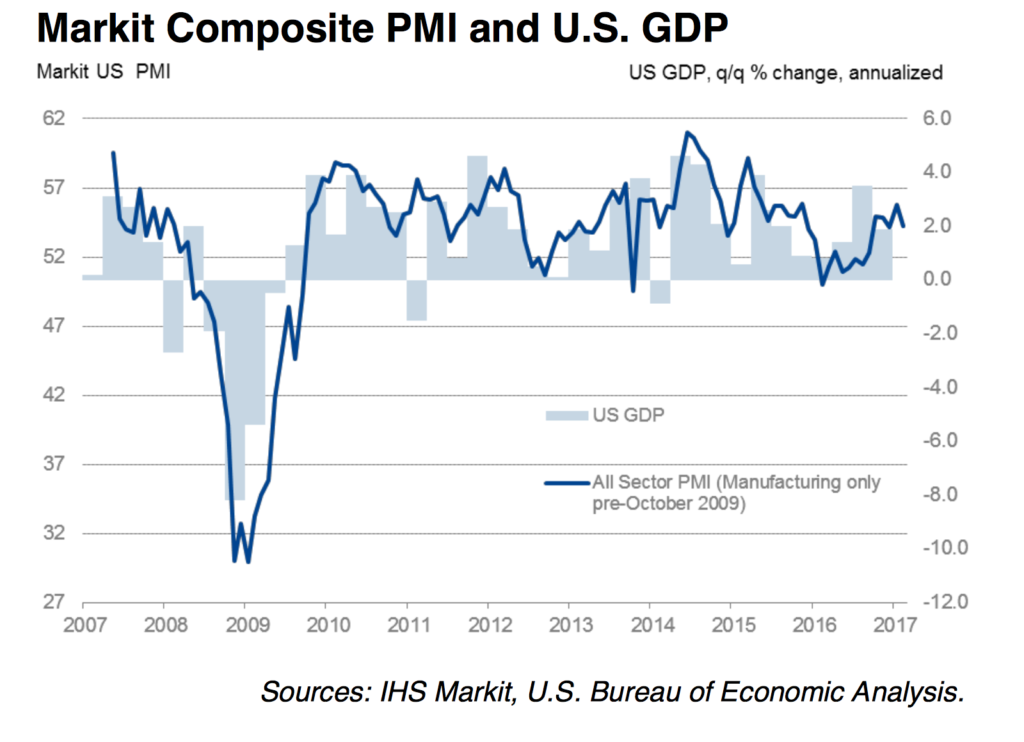

Yesterday’s Flash February PMI reports from Markit Economics point to an improving global economy complete with input prices moving higher. We suspect this will be on the Fed’s mind as we get more data ahead of the March FOMC meeting that is just a few weeks out. Our position is the Fed is likely to wait until firm details of President Trump’s economy stimulus plans and tax overhaul have been announced and digested. Given the likelihood that won’t happen ahead of the March FOMC meeting, we think there is a higher probability the next Fed rate hike will be had at its May meeting. Of course, the coming data will be key and that means pouring over the next iteration of Fed meeting minutes that will be published later today.

Later in the week, we have earnings from Universal Display (OLED). Consensus expectations for Universal’s December quarter results are EPS of $0.42 on $68.6 million in revenue. We expect a bullish outlook to be had when Universal reports its results this Thursday. Our price target on OLED shares sits at $80.

Before we get to some housekeeping items, here’s a quick recap of where our various positions sit on the Tematica Select List. Remember, our thematic style of investing is long-term in nature, which means we are inclined to use share price weakness to scale into Buy rated positions provided the thematic thesis remains intact:

Buy rated stocks on the Tematica Select List continue to be:

- Alphabet (GOOGL) – Asset-Lite Business Models

- Amazon (AMZN) – Connected Society

- Applied Materials (AMAT) – Disruptive Technology

- CalAmp Corp. (CAMP) – Connected Society

- Disney (DIS) – Content is King

- Dycom Industries (DY) – Connected Society

- Facebook (FB) – Connected Society

- International Flavors & Fragrances (IFF) – Rise & Fall of the Middle Class

- McCormick & Co, (MKC) – Rise & Fall of the Middle Class

- Nuance Communications (NUAN) – Disruptive Technology

- PureFunds ISE Cyber Security ETF (HACK) – Safety & Security

- Starbucks (SBUX) – Guilty Pleasure

- United Natural Foods (UNFI) – Foods with Integrity

Subscribers should continue to hold shares of:

- AMN Healthcare (AMN) – Aging of the Population

- AT&T (T) – Connected Society

- Costco Wholesale (COST) – Cash-strapped Consumer

- PowerShares NASDAQ Internet Portfolio ETF (PNQI – Connected Society

Remember, the full list of positions on the Tematica Select List, along with detailed price targets, recommended stop-limit prices and returns are always listed on the Holdings / Performance page you can access by clicking here or on the white and green “Select List Performance” box on the top right of this page.

Exciting Updates to Your Tematica Investing Service . . .

Amazing as it might seem, we’ve got less than one week to go until we close the book on February. We suspect you’re likely thinking that means before too long mild temperatures will be on the way, and we’re right there alongside you. Here at Tematica, we’ll be coming up on the one-year anniversary since we opted to self-publish our products. As we said at the time, we wanted more editorial control to provide the kind of service and insight we think our subscribers deserve.

Over the last year, you’ve probably noticed several happenings that build on our Monday Morning Kickoff and premium products, like Tematica Investing. We added weekly Thematic Signals, which is our Tematica take on “ripped from the headlines” but with a thematic perspective. As we see it, Thematic Signals is a constant reminder of our 17 investment themes at work in and around us each and every day. Those signals are posted to our website on nearly a daily basis and then an email is sent out summarizing all of them on Friday afternoons.

A few months ago we brought Lenore Hawkins on as Tematica’s Global Macro Strategist, and if you’re not checking out Elle’s Economy over at TematicaResearch.com on a regular basis, we have to say you’re missing out.

More recently in a move that has Chris Versace’s as happy as a dog getting his belly scratched, we are back podcasting with Lenore chiming in as well with her usual wit and insights. We’ve already had the CEO of US Concrete (USCR) on the program as well as the CEO of mobile advertising disruptor Digital2Go, and we’ve got a number of great guests coming up in the coming weeks including IBM (IBM), InterDigital (IDCC), Skyworks Solutions (SWKS), Boxed, and several cyber security companies. Versace always enjoys these conversations because you never know what useful tidbits a guest might drop. You can find the Cocktail Investing podcast each and every week right here on TematicaResearch.com

After all of that, one might think we’d take it easy for a while . . . We’re not.

Rather, we’ve kicked things up even further by sharing our thoughts on a more frequent basis. You’ve probably noticed the “Tematica Investing Posts for XX/XX/2017” that have started to hit your email. Our thinking is the stock market is a quick moving and dynamic animal, not one that should only be addressed once per week. Each day, you’ll get a mid-day recap of what we’ve published in the last 24 hours including our latest thoughts on the economy, key thematic data points, new positions on the Tematica Select List (like yesterday’s Applied Materials (AMAT) addition), and position updates.

The goal is not to overwhelm you, but rather share in real-time digestible thematic insights and action that much like the Hippocratic oath is aimed at helping you be a smarter investor without doing any harm in the process.

We’d love to hear your feedback at customerservice@tematicaresearch.com