Weekly Issue: Amazon Prime Day, Netflix Earnings, Controversy at Farmland Partners and June Retail Sales

Key points from this week’s issue:

- Amazon (AMZN): What to watch as Amazon Prime Day 2018 comes and goes; Following the strong run in Amazon (AMZN) shares over the last several weeks, our $1,900 price target is under review.

- Habit Restaurants (HABT): Our price target on Habit shares remains $11.50

- Costco (COST): We are once again boosting our price target on Costco Wholesale (COST) shares to $230 from $220.

- Netflix (NFLX): Despite 2Q 2018 earnings results, I continue to see Netflix shares rising further in the coming quarters as investors become increasingly comfortable with the company’s ability to deliver compelling content that will attract net new users, driving cash flow and bottom line profits. Our NFLX price target remains $525.

- Farmland Partners (FPI): While credibility questions will keep Farmland in the penalty box in the short term, we continue to favor the longer-term business fundamentals. Our price target on FPI shares remains $12.

Catching up with the stock market

Last week we saw a change in the domestic stock market. After being led by the technology-heavy Nasdaq Composite Index and the small-cap-laden Russell 2000 during much of 2Q 2018, last week we saw the Dow Jones Industrial Average take the pole position, handily beating the other three major market indices. As all investors know, individual stocks, as well as the overall market, fluctuate week to week, but with just over two weeks under our belt in the current quarter, all four major market indices have moved higher, shrugging off trade concerns at least for now.

Of course, those mini market rallies occurred in the calm period before the 2Q 2018 earnings storm, which kicks off in earnest tomorrow when more than 84 companies will issue their report card for the quarter. Last week’s initial earnings reports for 2Q 2018 were positive for the market as was the latest Small Business Optimism Index reported by the NFIB. Despite those positive NFIB findings, which marked the sixth highest reading in the survey’s 45-year history, business owners continue to have challenges finding qualified workers. The challenge to fill open positions is not only a headwind for growth, but also increases the prospects for wage inflation.

For context, that NFIB survey reading matched the record high set in November 2000, which helps explain the survey’s findings for more companies planning to increase compensation. That adds to the findings from the June PPI report that showed headline inflation rising to 3.4% year over year and the 2.9% year-over-year increase in the June CPI report, all of which gives the Fed ample room to continue increasing interest rates in the coming months. Granted, a portion of that inflation is due to the impact of higher oil prices, but also higher metal and other commodity costs in anticipation of tariffs being installed are contributing. Again, these data points give the Fed the cover fire it will need when it comes to raising interest rates, which at the margin means borrowing costs will inch their way higher. Here’s the thing — all of that data reflects the time-period before the tariffs.

If earnings expectations come up short, we will likely see the market trade-off. How much depends on the discrepancy between reality and projections. Also, keep in mind, the current market multiple is ahead of the market’s historical average, and a resetting of EPS expectations could trigger something similar in the market multiple. What this means is at least as we go through the next few weeks there is a greater risk to be had in the market. As we move into the back half of the September quarter, if Trump can show some progress on the trade front we could have a market rally toward the end of the year. Needless to say, I’ll continue to keep one eye on all of this while the other ferrets out signals for our thematic investing lens.

It’s that Prime Day time of year

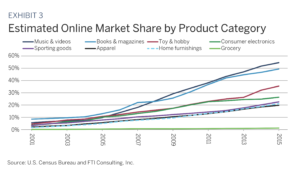

As I write this, we have passed the 24-hour mark in what is one of if not the largest self-created holidays. Better known as Amazon (AMZN) Prime Day, this made-up holiday strategically falls during one of the seasonally slowest times of the year for retailers. For those uninitiated with the day, or those who have not seen the litany of websites touting the evolving number of deals and retail steals being served up by Amazon throughout the day, Prime Day is roughly a day and a half push by Amazon to goose it sales by serving up compelling offerings and enticing non-Prime members to become ones. To put some context around it, Coresight Research forecasts Prime Day 2018 will generate $3.4 billion in sales in 36 hours — roughly 6% of the $58.06 billion Amazon is expected to report in revenue for the entire September quarter.

What separates this year’s Prime Day from prior ones isn’t the prospect for record-breaking sales, but rather the increased arsenal of private label products had by Amazon. Over the last few quarters, Amazon has expanded its reach into private label apparel and athletic wear as well as others like shoes and jewelry. All told, Amazon now sells more than 70 of its own brands, which it can price aggressively on Prime Day helping it win incremental consumer wallet share. Prime Day is also a deal bonanza for Amazon’s own line of electronic devices, ranging from FireTV products to Kindle e-readers and Echo powered digital assistants. The thing with each of those devices is they help remove friction to other Amazon products, such as its streaming TV and music services, Audible and of course its digital book service.

Unlike last year, this year’s Prime Day started off with a hitch in that soon after it began shoppers were met with the company’s standard error page because it was overwhelmed with deal seekers. Not a bad problem and certainly a great marketing story, but it raises the question as to whether Amazon will hit that $3.4 billion figure.

To me, the allure of Prime Day is the inherent stickiness it brings to Amazon as the best deals are offered only to Prime members, which historically has made converts of the previously unsubscribed. Those new additions pay their annual fee and that drives cash flow during a seasonally slow time of year for the company, while also expanding the base of users as we head into the year-end holiday shopping season before too long. Very smart, Amazon. But then again, I have long said Amazon is a company that knows how to reduce if not remove transaction friction. Two-day free Prime delivery, Amazon Alexa and Echo devices, Kindle digital downloads, and Amazon Pay are just some of the examples to be had.

Thus far in 2018, Amazon shares are up more than 58%, making them one of the best performers on the Tematica Investing Select List – hardly surprising given the number of thematic tailwinds pushing on its businesses. Even before we got to Prime Day, we’ve seen Amazon expanding its reach on a geographic and product basis, winning new business for its Amazon Web Services unit along the way. More recently, Amazon is angling to disrupt the pharmacy business with its acquisition of online pharmacy PillPack, a move that has already taken a bite out of CVS Health (CVS) and Walgreen Boots Alliance (WAB) shares. Odds are there will be more to come from Amazon on the healthcare front, and it has the potential to add to its business in a meaningful way as it once again looks to reduce transaction friction.So, what am I looking for from Amazon coming out of Prime Day 2018? Aside from maybe a few of mine own purchases, like a new Echo Spot for my desk, on the company data front, I am going to be looking for the reported number of new Prime subscribers Amazon adds to the fold. Sticking with that, I’m even more interested in the number of non-US Prime subscribers it adds, given the efforts by Amazon of late to bring 2-day Prime delivery to parts of Europe. As we here in the US have learned, once you have Prime, there is no going back.

- Following the strong run in Amazon (AMZN) shares over the last several weeks, our $1,900 price target is under review.

June Retail Sales Report is good for Habit Restaurant and Costco shares

Inside this week’s June Retail Sales Report there were several reasons for investors to take a bullish stance on consumer spending in light of the headline increase of 0.5% month-over-month. On a year-over-year basis, the June figure was an impressive 6.6%, but to get to the heart of it we need to exclude several line items that include “motor vehicles & parts” and “gas stations.” In doing so, we find June retail sales rose 6.4% year-over-year, which continues the acceleration that began in May. The strong retail sales numbers likely means upward revisions to second-quarter GDP expectations by the Atlanta Fed and N.Y. Fed. Despite the positive impact had on 2Q 2018 GDP, odds are this spending has only added to consumer debt levels which means more pressure on disposable income in the coming months as the Fed ticks interest rates higher.

Now let’s examine the meat of the June retail report and determine what it means for the Tematica Select List, in particular, our positions in Habit Restaurants Inc. (HABT) and Costco Wholesale (COST).

Digging into the report, we find retail sales at food services and drinking places rose 8.0% year-over-year in June — clearly the strongest increase over the last three months. How strong? Strong enough that it brought the quarter’s year-over-year increase to 6.1% for the category, more than double the year-over-year increase registered in the March quarter.

People clearly are back eating out and this was confirmed by the June findings from TDn2K’s Black Box Intelligence. Those findings showed that while overall restaurant sales rose 1.1% year over year in June, one of the stronger categories was the fast casual category, which benefitted from robust to-go sales. That restaurant category is the one in which Habit Restaurant competes, and the combination of these two June data points along with new store openings and higher prices increases our confidence in Habit’s second-quarter consensus revenue expectations.

- Our price target on Habit Restaurants (HABT) remains $11.50

Now let’s turn to Costco – earlier this month the warehouse retailer reported net sales of $13.55 billion for the retail month of June an increase of 11.7% from $12.13 billion last year. Compared to the June Retail Sales Report, we can easily say Costco continues to take consumer wallet share. Even after removing the influences of gas sales and foreign currency, Costco’s June sales in the US rose 7.7% year over year and not to be left out its e-commerce sales jumped nearly 28% year over year as well. Those are great metrics, but exiting June, Costco has 752 warehouse locations opened with plans to further expand its footprint in the coming months. New warehouses means new members, which should continue to drive the very profitable membership fee income in the coming months, a key driver of EPS for the company.

Over the last few weeks, COST shares have been a strong performer. After several months in which it has clearly taken consumer wallet share and continued to expand its physical locations, I’m boosting our price target on COST shares to $230 from $220, which offers roughly 7% upside from current levels before factoring in the dividend. Subscribers should not commit fresh capital at current levels but should continue to enjoy the additional melt up to be had in the shares.

- We are once again boosting our price target on Costco Wholesale (COST) shares to $230 from $220.

What to make of earnings from Netflix

Last week we added shares of Netflix (NFLX) to the Tematica Investing Select List given its leading position in streaming as well as original content, which makes it a natural for our newly recasted Digital Lifestyle investing theme, and robust upside in the share price even after climbing nearly 100% so far in 2018. As a reminder, our price target for NFLX is $525.

Earlier this week, Netflix reported its June quarter results and I had the pleasure of appearing on Cheddar to discuss the results as they hit the tape. What we learned was even though the company delivered better than expected EPS for the quarter, it missed on two key fronts for the quarter – revenue and subscriber growth. The company also lowered the bar on September quarter expectations. While NFLX shares plunged in

While NFLX shares plunged in after-market trading immediately after its earnings were announced on Monday, sliding down some 14%, yesterday the shares rallied back some to closed down a little more than 5% at the end of Tuesday’s trading session. Trading volume in NFLX shares was nearly 6x its normal levels, as the shares received several rating upgrades as well as a few downgrades and a few price target changes.

Here’s the thing, even though the company fell short of new subscriber targets for the quarter, it still grew its membership by more than 5 million in the quarter to hit 130 million memberships, an increase of 26% year over year. Combined with a 14% increase in average sales price, revenue in the quarter grew 43% year over year. Tight expense control led to the company’s operating margin to reach 11.8% in 2Q 2018, up from 4.6% in the year-ago quarter.

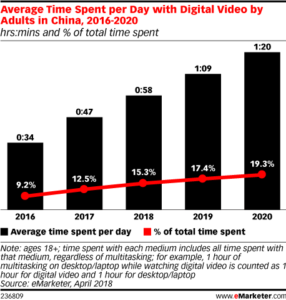

In recent quarters, the number of Netflix’s international subscribers outgrew the number of domestic ones, and that has a two-fold impact on the business. First, the company’s exposure to non-US currencies has grown to just over half of its streaming revenue and the strengthening dollar during 2Q 2018 weighed on the company’s international results. With its content production in 80 countries and expanding, Netflix will move more of its operating costs to non-US dollar currencies to put a more natural hedging strategy in place. Second, continued growth in its international markets means continuing to develop and acquire programming for those markets, which was confirmed by the company’s comments that its content cash spending will be weighted to the second half of this year.

From my perspective, the Netflix story is very much intact and the drivers we outlined have not changed in a week’s time. I continue to see Netflix shares rising further in the coming quarters as investors become increasingly comfortable with the company’s ability to deliver compelling content that will attract net new users, driving cash flow and bottom line profits.

- Despite Netflix’s (NFLX) 2Q 2018 earnings results, I continue to see Netflix shares rising further in the coming quarters as investors become increasingly comfortable with the company’s ability to deliver compelling content that will attract net new users, driving cash flow and bottom line profits. Our NFLX price target remains $525.

Checking in on Farmland Partners

Last week we saw some wide swings in shares of Farmland Partners (FPI), and given its lack of analyst coverage I wanted to tackle this head-on. Before we get underway, let’s remember that Farmland Partners is a REIT that invests in farmland and looks to increase rents over time, which means paying close attention to farmer income and trends in certain agricultural prices such as corn, wheat and soybeans.

So what happened?

Two things really. First, a bearish opinion piece on FPI shares ran on Seeking Alpha last week, which accused FPI of “artificially increasing revenues by making loans to related-party tenants who round-trip the cash back to FPI as rent; 310% of 2017 earnings could be made-up.” Also according to the article FPI “has not disclosed that most of its loans have been made to two members of the management team” and it has “significantly overpaid for properties.”

As one might suspect, that article hit FPI shares hard to the gut, dropping them some 38%. Odds are that article caught ample attention, something it was designed to do. Soon thereafter, Farmland Partners responded with the following data:

- The total notes and interest receivable under the Company’s loan program was $11.6 million, or 1.0% of the Company’s total assets, as of March 31, 2018.

- The program generated $0.5 million in net revenues, or 1.1% of total revenue, in the year ended December 31, 2017.

- The program is directed at farmers, including, as previously disclosed, tenants. It was publicly announced in August 2015, and included in the Company’s public disclosures since then. None of the borrowers under the program as of March 31, 2018 were related parties, or have other business relationships with the Company, other than as borrowers and, in some cases, tenants.

Those clarifications helped prop FPI shares up, but odds are it will take more work on the part of Farmland’s management team to fully reverse the drop in the shares.

In over two decades of investing, I’ve seen my fair share of bears extrapolate from a few, or less than few, data points to make a sweeping case against a company. When that happens, it tends to be short-lived with the effect fleeting as the company delivers in the ensuing quarters. Given the long-term prospects we discussed when we added FPI shares to the Select List, I’m rather confident over the long-term. In the short-term, the real issue we have to contend with is falling commodity prices and that brings us to our second topic of conversation.

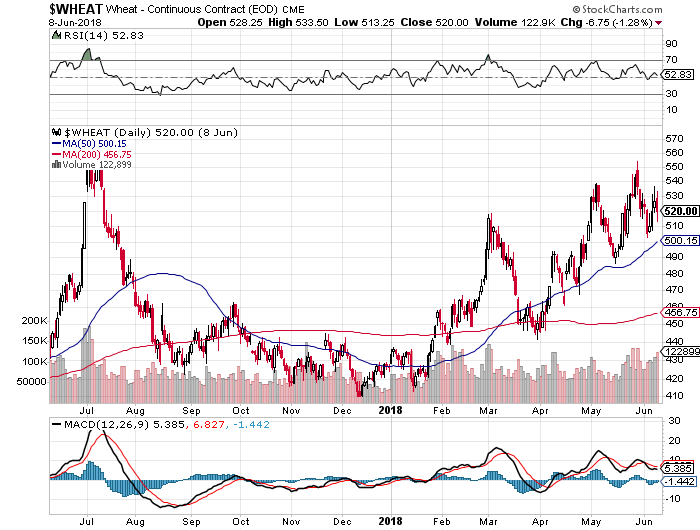

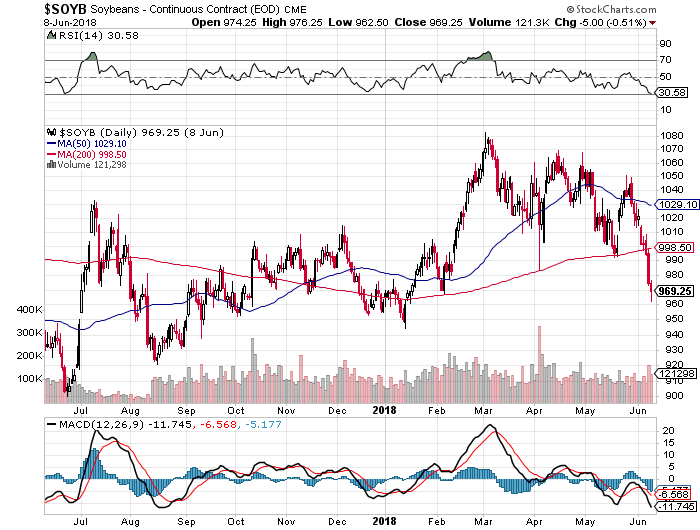

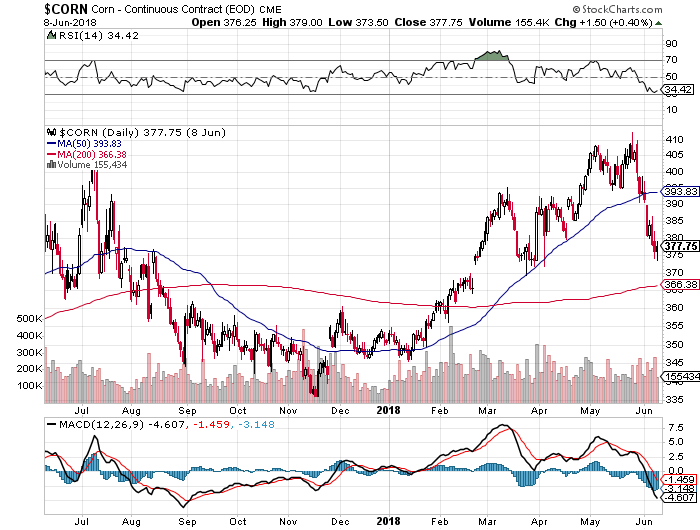

As trade and tariffs have continued to escalate, we’ve seen corn, wheat and soybean prices come under pressure. Because these are key drivers of farmer income, we can understand FPI shares coming under some pressure. However, here’s the thing – on the podcast, Lenore and I recently spoke with Sal Gilbertie of commodity trading firm Teucrium Trading, and he pointed out that not only are these commodity prices below production costs, something that historically is short-lived, but the demographic and production dynamics make the recent moves unsustainable. In short, China’s share of the global population is multiples ahead of its portion of the world’s arable land, which means that China will be forced to import corn, wheat and soybeans to not only feed its people but to feed its livestock as well. While China may be able to import from others, given the US is among the top exporters for those commodities, that can only last for a period of time.

Longer-term, the rising new middle class in China, India and other parts of greater Asia will continue to drive incremental demand for these commodities, which in the long-term view bodes well for FPI shares.

What I found rather interesting in Farmland’s press release was the following – “We are evaluating what avenues are available to the Company and its stockholders to remedy the damage inflicted.” Looks like there could be some continued drama to be had.

- While credibility questions will keep Farmland Partners (FPI) in the penalty box in the short term, we continue to favor the longer-term business fundamentals. Our price target on FPI shares remains $12.