Doubling Down on Digital Infrastructure Thematic Leader

Key point inside this issue

- We are doubling down on Dycom (DY) shares on the Thematic Leader board and adjusting our price target to $80 from $100, which still offers significant upside from our new cost basis as the 5G and gigabit fiber buildout continues over the coming quarters.

We are coming at you earlier than usual this week in part to share my thoughts on all of the economic data we received late last week.

Last week’s data confirms the US economy is slowing

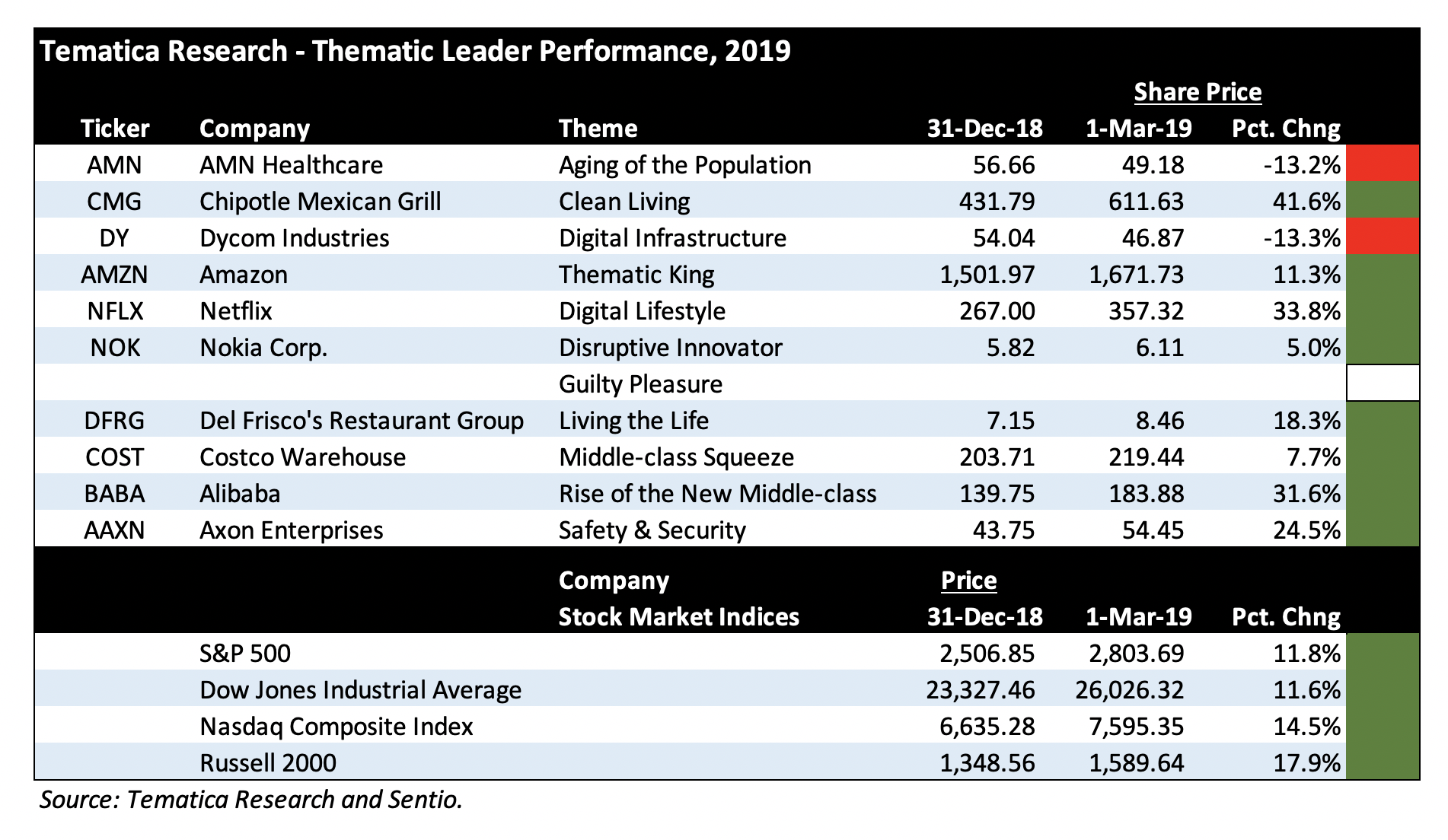

With two-thirds of the current quarter behind now in the books, the continued move higher in the markets has all the major indices up double-digits year to date, ranging from around 11.5-12.0%% for the Dow Jones Industrial Average and the S&P 500 to nearly 18% for the small-cap heavy Russell 2000. In recent weeks we have discussed my growing concerns that the market’s melt-up hinges primarily on U.S.-China trade deal prospects as earnings expectations for this year have been moving lower, dividend cuts have been growing and the global economy continues to slow. The U.S. continues to look like the best economic house on the block even though it, too, is slowing.

On Friday, a round of IHS Markit February PMI reports showed that three of the four global economic horsemen — Japan, China, and the eurozone — were in contraction territory for the month. New orders in Japan and China improved but fell in the eurozone, which likely means those economies will continue to slug it out in the near-term especially since export orders across all three regions fell month over month. December-quarter GDP was revealed to be 2.6% sequentially, which equates to a 3.1% improvement year over year but is down compared to the 3.5% GDP reading of the September quarter and 4.2% in the June one. Slower growth to be sure, but still growing in the December quarter.

Before we break out the bubbly, though, the IHS Markit February U.S. Manufacturing PMI fell to its lowest reading in 18 months as rates of output and new order growth softened as did inflationary pressures. This data suggest the U.S. manufacturing sector is growing at its slowest rate in several quarters, as did the February ISM Manufacturing Index reading, which slipped month over month and missed expectations. Declines were seen almost across the board for that ISM index save for new export orders, which grew modestly month over month. The new order component of the February ISM Manufacturing Index dropped to 55.5 from 58.2 in January, but candidly this line item has been all over the place the last few months. The January figure rebounded nicely from 51.3 in December, which was down sharply from 61.8 in November. This zig-zag pattern likely reflects growing uncertainty in the manufacturing economy given the pace of the global economy and uncertainty on the trade front. Generally speaking though, falling orders translate into a slower production and this means carefully watching both the ISM and IHS Markit data over the coming months.

In sum, the manufacturing economy across the four key economies continued to slow in February. On a wider, more global scale, J.P. Morgan’s Global Manufacturing PMI fell to 50.6 in February, its lowest level since June 2016. Per J.P. Morgan’s findings, “the rate of expansion in new orders stayed close to the stagnation mark,” which suggests we are not likely to see a pronounced rebound in the near-term. We see this as allowing the Fed to keep its dovish view, and as we discuss below odds are it will be joined by the European Central Bank this week.

Other data out Friday included the December readings for Personal Income & Spending and the January take on Personal Income. The key takeaway was personal income fell for the first time in more than three years during January, easily coming in below the gains expected by economists. Those pieces of data not only help explain the recent December Retail Sales miss but alongside reports of consumer credit card debt topping $1 trillion and record delinquencies for auto and student loans, point to more tepid consumer spending ahead. As I’ve shared before, that is a headwind for the overall US economy but also a tailwind for those companies, like Middle-class Squeeze Thematic Leader Costco Wholesale (COST), that help consumers stretch the disposable income they do have.

We have talked quite a bit in recent Tematica Investing issues about revisions to S&P 500 2019 EPS estimates, which at last count stood at +4.7% year over year, down significantly from over +11% at the start of the December quarter. Given the rash of reports last week – more than 750 in total – we will likely see that expected rate of growth tweaked a bit lower.

Putting it all together, we have a slowing U.S. and global economy, EPS cuts that are making the stock market incrementally more expensive as it has moved higher in recent weeks, and a growing number of dividend cuts. Clearly, the stock market has been melting up over the last several weeks on increasing hopes over a favorable trade deal with China, but last week we saw President Trump abruptly end the summit with North Korea’s Kim Jong Un with no joint agreement after Kim insisted all U.S. sanctions be lifted on his country. This action spooked the market, leading some to revisit the potential for a favorable trade deal between the U.S. and China.

Measuring the success of any trade agreement will hinge on the details. Should it fail to live up to expectations, which is a distinct possibility, we could very well see a “buy the rumor, sell the news” situation arise in the stock market. As I watch for these developments to unfold, given the mismatch in the stock market between earnings and dividends vs. the market’s move thus far in 2019 I will also be watching insider selling in general but also for those companies on the Thematic Leader Board as well as the Tematica Select List. While insiders can be sellers for a variety of reasons, should we see a pronounced and somewhat across the board pick up in such activity, it could be another warning sign.

What to Watch This Week

This week we will see a noticeable drop in the velocity of earnings reports, but we will still get a number of data points that investors and economists will use to triangulate the speed of the current quarter’s GDP relative to the 2.6% print for the December quarter. The consensus GDP forecast for the current quarter is for a slower economy at +2.0%, but we have started to see some economists trim their forecasts as more economic data rolls in. Because that data has fallen shy of expectations, it has led the Citibank Economic Surprise Index (CESI) to once again move into negative territory and the Atlanta Fed’s GDPNow current quarter forecast now sat at 0.3% as of Friday.

On the economic docket this week, we have December Construction Spending, ISM’s February Non-Manufacturing Index reading, the latest consumer credit figures and the February reports on job creation and unemployment from ADP (ADP) and the Bureau of Labor Statistics. With Home Depot (HD) reporting relatively mild December weather, any pronounced shortfall in December Construction Spending will likely serve to confirm the economy is on a slowing vector. Much like we did above with ISM’s February Manufacturing Index we’ll be looking into the Non-Manufacturing data to determine demand and inflation dynamics as well as the tone of the services economy.

On the jobs front, while we will be watching the numbers created, including any aberration owing to the recent federal government shutdown, it will be the wage and hours worked data that we’ll be focusing on. Wage data will show signs of any inflationary pressures, while hours worked will indicate how much labor slack there is in the economy. The consumer is in a tighter spot financially speaking, which was reflected in recent retail sales and personal spending data. Recognizing the role consumer spending plays in the overall speed of the U.S. economy, we will be scrutinizing the upcoming consumer credit data rather closely.

In addition to the hard data, we’ll also get the Fed’s latest Beige Book, which should provide a feel for how the regional economies are faring thus far in 2019. Speaking of central bankers, next Wednesday will bring the results of the next European Central Bank meeting. Given the data depicted in the February IHS Markit reports we discussed above, the probability is high the ECB will join the Fed in a more dovish tone.

While the velocity of earnings reports does indeed drop dramatically next week, there will still be several reports worth digging into, including Ross Stores (ROST), Kohl’s (KSS), Target (TGT), BJ’s Wholesale (BJ), and Middle-class Squeeze Thematic Leader Costco Wholesale (COST) will also issue their latest quarterly results. Those reports combined with the ones this week, including solid results from TJX Companies (TJX) last week should offer a more complete look at consumer spending, and where that spending is occurring. Given the discussion several paragraphs above, TJX’s results last week, and the monthly sales reports from Costco, odds are quite good that Costco should serve up yet another report showcasing consumer wallet share gains.

Outside of apparel and home, reports from United Natural Foods (UNFI) and National Beverage (FIZZ) should corroborate the accelerating shift toward food and beverages that are part of our Cleaner Living investing theme. In that vein, I’ll be intrigued to see what Tematica Select List resident International Flavors & Fragrances (IFF) has to say about the demand for its line of organic and natural solutions.

The same can be said with Kroger (KR) as well as its efforts to fend off Thematic King Amazon (AMZN) and Walmart (WMT). Tucked inside of Kroger’s comments, we will be curious to see what the company says about digital grocery shopping and delivery. On Kroger’s last earnings conference call, Chairman and CEO Rodney McMullen shared the following, “We are aggressively investing to build digital platforms because they give our customers the ability to have anything, anytime, anywhere from Kroger, and because they’re a catalyst to grow our business and improve margins in the future.” Now to see what progress has been achieved over the last 90 or so days and what Kroger has to say about the late-Friday report that Amazon will launch its own chain of supermarkets.

Tematica Investing

As you can see in the chart above, for the most part, our Thematic Leaders have been delivering solid performance. Shares of Costco Wholesale (COST) and Nokia (NOK) are notable laggards, but with Costco’s earnings report later this week which will also include its February same-store sales, I see the company’s business and the shares once again coming back into investor favor as it continues to win consumer wallet share. That was clearly evident in its December and January same-store sales reports. With Nokia, coming out of Mobile World Congress 2019 last week, we have confirmation that 5G is progressing, with more network launches coming and more devices coming as well in the coming quarters. We’ll continue to be patient with NOK shares.

Adding significantly to our position in Thematic Leader Dycom Industries

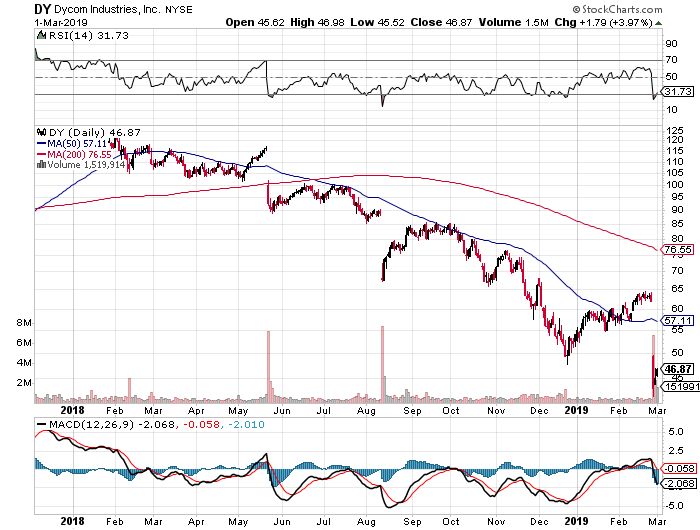

There are two positions on the leader board – Aging of the Population AMN Healthcare (AMN) and Digital Infrastructure Dycom Industries (DY) – that are in the red. The recent and sharp drop in Dycom shares follows the company’s disappointing quarterly report in which costs grew faster than 14.3% year over year increase in revenue, pressuring margins and the company’s bottom line. As we’ve come to expect this alongside the near-term continuation of those margin pressures, as you can see below, simply whacked DY shares last week, dropping them into oversold territory.

When we first discussed Dycom’s business, I pointed out the seasonal tendencies of its business, and that likely means some of the February winter weather brought some added disruptions as will the winter weather that is hitting parts of the country as you read this. Yet, we know that Dycom’s top customers – AT&T (T), Verizon (VZ), Comcast (CMCSA) and CenturyLink (CTL) are busy expanding the footprint of their connective networks. That’s especially true with the 5G buildout efforts at AT&T and Verizon, which on a combined basis accounted for 42% of Dycom’s January quarter revenue.

Above I shared that coming out of Mobile World Congress 2019, commercial 5G deployments are likely to be a 2020 event but as we know the networks, base stations, and backhaul capabilities will need to be installed ahead of those launches. To me, this strongly suggests that Dycom’s business will improve in the coming quarters, and as that happens, it’s bound to move down the cost curve as efficiencies and other aspects of higher utilization are had. For that reason, we are using last week’s 26% drop in DY shares to double our position size in DY shares on the Thematic Leader board. This will reduce our blended cost basis to roughly $64 from the prior $82. As we buy up the shares, I’m also resetting our price target on DY shares to $80, down from the prior $100, which offers significant upside from the current share price and our blended cost basis.

If you’re having second thoughts on this decision, think of it this way – doesn’t it seem rather strange that DY shares would fall by such a degree given the coming buildout that we know is going to occur over the coming quarters? If Dycom’s customers were some small, regional operators I would have some concerns, but that isn’t the case. These customers will build out those networks, and it means Dycom will be put to work in the coming quarters, generating revenue, profits, and cash flow along the way.

In last week’s Tematica Investing I dished on Warren Buffett’s latest letter to Berkshire Hathaway (BRK.A) shareholders. In thinking about Dycom, another Buffett-ism comes to mind – “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” Since this is a multi-quarter buildout for Dycom, we will need to be patient, but as we know for the famous encounter between the tortoise and the hare, slow and steady wins the race.

- We are doubling down on Dycom (DY) shares on the Thematic Leader board and adjusting our price target to $80 from $100, which still offers significant upside from our new cost basis as the 5G and gigabit fiber buildout continues over the coming quarters.

As the pace of earnings slows, over the next few weeks I’ll not only be revisiting the recent 25% drop in Aging of the Population Thematic Leader AMN Healthcare to determine if we should make a similar move like the one we are doing with Dycom, but I’ll also be taking closer looks at wireless charging company Energous Corp. (WATT) and The Alkaline Water Company (WTER). Those two respectively fall under our Disruptive Innovators and Cleaner Living investing themes. Are they worthy of making it onto the Select List or bumping one of our Thematic Leaders? We’ll see…. And as I examine these two, I’m also pouring over some candidates to fill the Guilty Pleasure vacancy on the leader board.