Weekly Issue: As earnings season continues, the market catches a positive breather

Key points in this issue:

- As expected, more negative earnings revisions roll in

- Verizon says “We’re heading into the 5G era”

- Nokia gets several boosts ahead of its earnings report

- USA Technologies gets an “interim” CFO

As expected, more negative earnings revisions roll in

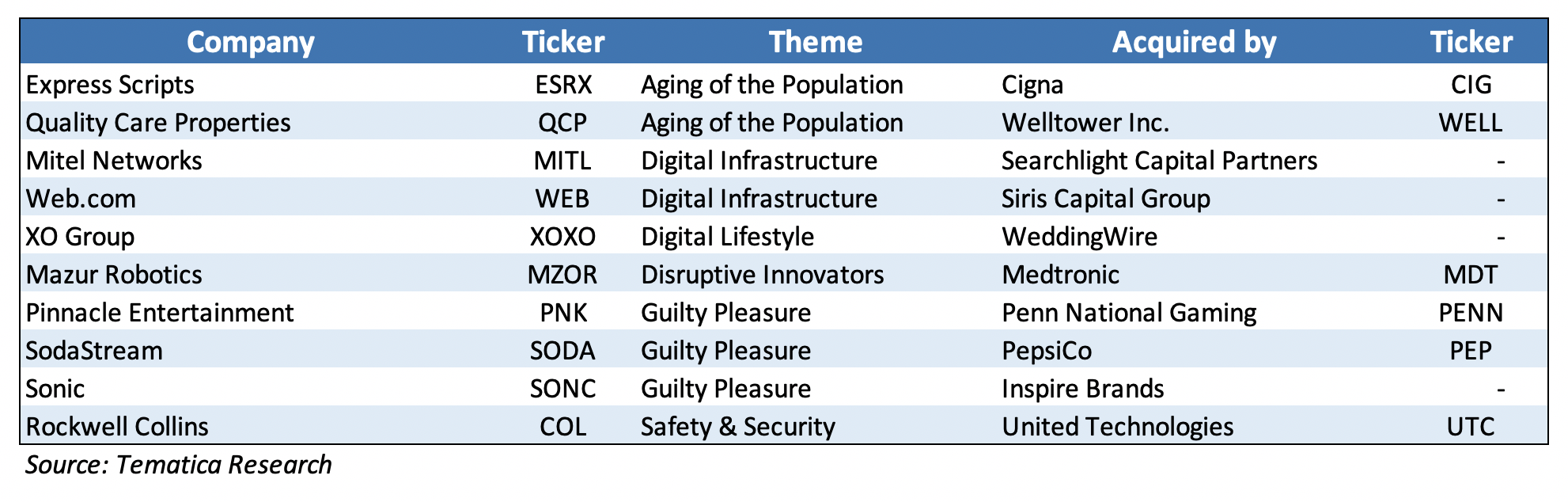

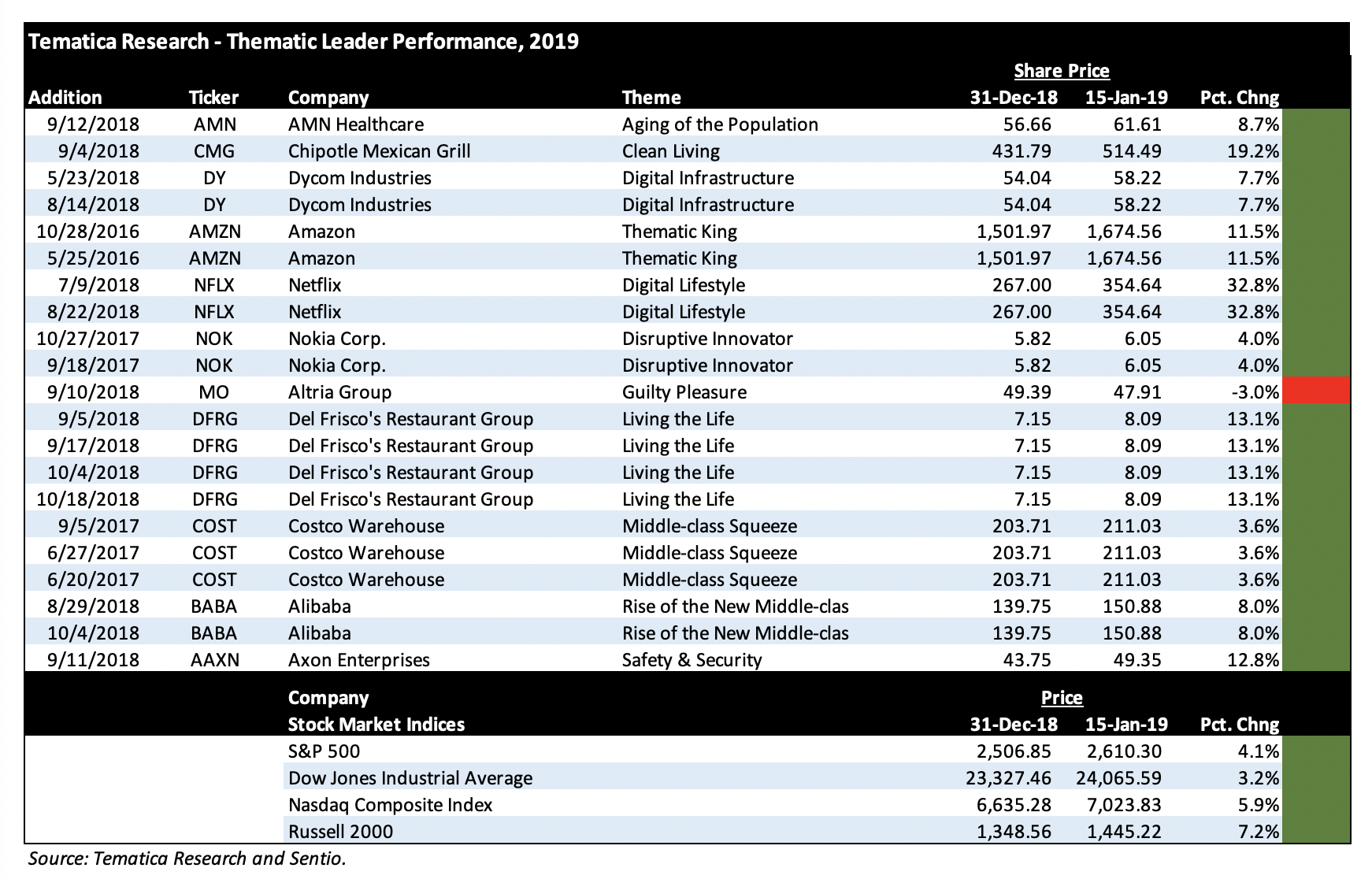

In full, last week was one in which the domestic stock market indices were largely unchanged and we saw that reflected in many of our Thematic Leaders. Late Friday, a deal was reached to potentially only temporarily reopen the federal government should Congress fail to reach a deal on immigration. Given the subsequent bluster that we’ve seen from President Trump, it’s likely this deal could go either way. Perhaps, we’ll hear more on this during his next address, scheduled ahead of this weekend’s Super Bowl.

Yesterday, the Fed began its latest monetary policy meeting. It’s not expected to boost interest rates, but Fed watchers will be looking to see if there is any change to its plan to unwind its balance sheet. As the Fed’s meeting winds down, the next phase of US-China trade talks will be underway.

Last week I talked about the downward revisions to earnings expectations for the S&P 500 and warned that we were likely to see more of the same. So far this week, a number of high-profile earnings reports from the likes of Caterpillar (CAT), Whirlpool (WHR), Crane Co. (CR), AK Steel (AKS), 3M (MMM) and Pfizer (PFE) have revealed December-quarter misses and guidance for the near-term below consensus expectations. More of that same downward earnings pressure for the S&P 500 indeed. And yes, those misses and revisions reflect issues we have been discussing the last several months that are still playing out. At least for now, there doesn’t appear to be any significant reversal of those factors, which likely means those negative revisions are poised to continue over the next few weeks.

Tematica Investing

With the market essentially treading water over the last several days, so too did the Thematic Leaders. Apple’s (AAPL) highly anticipated earnings report last night edged out consensus EPS expectations with guidance that was essentially in line. To be clear, the only reason the company’s EPS beat expectations was because of its lower tax rate year over year and the impact of its share buyback program. If we look at its operating profit year over year — our preferred metric here at Tematica — we find profits were down 11% year over year.

With today’s issue already running on the long side, we’ll dig deeper into that Apple report in a stand-alone post on TematicaResearch.com later today or tomorrow, but suffice it to say the market greeted the news from Apple with some relief that it wasn’t worse. That will drive the market higher today, but let’s remember we have several hundred companies yet to report and those along with the Fed’s comments later today and US-China trade comments later this week will determine where the stock market will go in the near-term.

As we wait for that sense of direction, I’ll continue to roll up my sleeves to fill the Guilty Pleasure void we have on the Thematic Leaders since we kicked Altria to the curb last week. Stay tuned!

Verizon says “We’re heading into the 5G era”

Yesterday and early this morning, both Verizon (VZ) and AT&T (T) reported their respective December quarter results and shared their outlook. Tucked inside those comments, there was a multitude of 5G related mentions, which perked our thematic ears up as it relates to our Disruptive Innovators investing theme.

As Verizon succinctly said, “…we’re heading to the 5G era and the beginning of what many see as the fourth industrial revolution.” No wonder it mentioned 5G 42 times during its earnings call yesterday and shared the majority of its $17-$18 billion in capital spending over the coming year will be spent on 5G. Verizon did stop short of sharing exactly when it would roll out its commercial 5G network, but did close out the earnings conference call with “…We’re going to see much more of 5G commercial, both mobility, and home during 2019.”

While we wait for AT&T’s 5G-related comments on its upcoming earnings conference call, odds are we will hear it spout favorably about 5G as well. Historically other mobile carriers have piled on once one has blazed the trail on technology, services or price. I strongly suspect 5G will fall into that camp as well, which means in the coming months we will begin to hear much more on the disruptive nature of 5G.

Nokia gets several boosts ahead of its earnings report

Friday morning one of Disruptive Innovator Leader Nokia’s (NOK) mobile network infrastructure competitors, Ericsson (ERIC), reported its December-quarter results. ERIC shares are trading up following the report, which showed the company’s revenue grew by 10% year over year due primarily to growth at its core Networks business. That strength was largely due to 5G activity in the North American market as mobile operators such as AT&T (T), Verizon (VZ) and others prepare to launch their 5G commercial networks later this year. And for anyone wondering how important 5G is to Ericsson, it was mentioned 26 times in the company’s earnings press release.

In short, I see Ericsson’s earnings report as extremely positive and confirming for our Nokia and 5G investment thesis.

One other item to mention is the growing consideration for the continued banning of Huawei mobile infrastructure equipment by countries around the world. Currently, those products and services are excluded in the U.S., but the U.K. and other countries in Europe are voicing concerns over Huawei as they look to confirm their national telecommunications infrastructure is secure.

Last week, one of the world’s largest mobile carriers, Vodafone (VOD) announced it would halt buying Huawei gear. BT Group, the British telecom giant, has plans to rip out part of Huawei’s existing network. Last year, Australia banned the use of equipment from Huawei and ZTE, another Chinese supplier of mobile infrastructure and smartphones.

In Monday’s New York Times, there was an article that speaks to the coming deployment of 5G networks both in the U.S. and around the globe, comparing the changes they will bring. Quoting Chris Lane, a telecom analyst with Sanford C. Bernstein in Hong Kong it says:

“This will be almost more important than electricity… Everything will be connected, and the central nervous system of these smart cities will be your 5G network.”

That sentiment certainly underscores why 5G technology is housed inside our Disruptive Innovators investing theme. One of the growing concerns following the arrest of two Huawei employees for espionage in Poland is cybersecurity. As the New York Times article points out:

“American and British officials had already grown concerned about Huawei’s abilities after cybersecurity experts, combing through the company’s source code to look for back doors, determined that Huawei could remotely access and control some networks from the company’s Shenzhen headquarters.”

From our perspective, this raises many questions when it comes to Huawei. As companies look to bring 5G networks to market, they are not inclined to wait for answers when other suppliers of 5G equipment stand at the ready, including Nokia.

Nokia will report its quarterly results this Thursday (Jan. 31) and as I write this, consensus expectations call for EPS of $0.14 on revenue of $7.6 billion. Given Ericsson’s quarterly results, I expect an upbeat report. Should that not come to pass, I’m inclined to be patient and hold the shares for some time as commercial 5G networks launches make their way around the globe. If the shares were to fall below our blended buy-in price of $5.55, I’d be inclined to once again scale into them.

- Our long-term price target for NOK shares remains $8.50.

USA Technologies gets an “interim” CFO

Earlier this week, Digital Lifestyle company USA Technologies (USAT) announced it has appointed interim Chief Financial Officer (CFO) Glen Goold. According to LinkedIn, among Goold’s experience, he was CFO at private company Sutron Corp. from Nov 2012 to Feb 2018, an Associate Vice President at Carlyle Group from July 2005 to February 2012, and a Tax Manager at Ernst & Young between 1997-2005. We would say he has the background to be a solid CFO and should be able to clean up the accounting mess that was uncovered at USAT several months ago.

That said, we are intrigued by the “interim” aspect of Mr. Goold’s title — and to be frank, his lack of public company CFO experience. We suspect the “interim” title could fuel speculation that the company is cleaning itself up to be sold, something we touched on last week. As I have said before, we focus on fundamentals, not takeout speculation, but if a deal were to emerge, particularly at a favorable share price, we aren’t ones to fight it.

- Our price target on USA Technologies (USAT) shares remains $10.