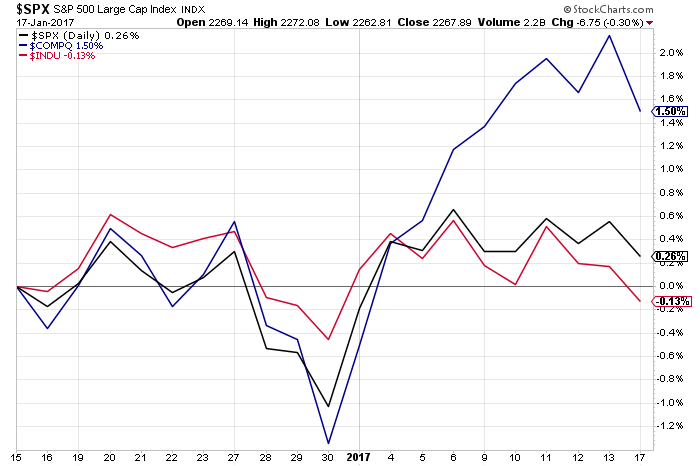

After Gapping Up Following Friday’s January Employment Report, The Market Is Trading Sideways Again This Week

Over the last week, the S&P 500 rose 0.6 percent, with the bulk of that move coming on the heels of the January Employment Report. As we pointed out in this week’s Monday Morning Kickoff, the face of that report was mostly positive, and when paired with other January manufacturing reports out last week, it likely paves the way for the Fed heads to start jawboning about a potential rate hike at the March FOMC meeting.

Over the last week, the S&P 500 rose 0.6 percent, with the bulk of that move coming on the heels of the January Employment Report. As we pointed out in this week’s Monday Morning Kickoff, the face of that report was mostly positive, and when paired with other January manufacturing reports out last week, it likely paves the way for the Fed heads to start jawboning about a potential rate hike at the March FOMC meeting.

Well, we heard just that when Philadelphia Federal Reserve Bank President Patrick Harker on Monday said an interest-rate hike should be on the table at the U.S. central bank’s next meeting, in March. Should other domestic economic data, like the aforementioned January manufacturing data, continue to improve month over month, we expect the herd view to skew toward a March rate hike.

Looking across the Atlantic, however, as expected we are indeed hearing more about Grexit and Frexit this week. Odds are, we have not heard the last of those rumblings as we head into the 7th inning with 4Q 2016 earnings reports. Given where we are in the current earnings season, we have several updates to share on the Amazon (AMZN), CalAmp Corp. (CAMP), Dycom Industries (DY), Facebook (FB), and International Flavors & Fragrances (IFF) positions on the Tematica Select List.

At the same time, we see not only cyber attacks once again taking over the headlines — or at least what non-President Trump headlines there are — but we see impressive order and booking metrics as cyber security companies report their quarterly results.

This sets us up with a new position for the Tematica Select List so without further ado…

And the Hacking Continues!

Issuing a Buy on PureFunds ISE Cyber Security ETF (HACK) shares

as part of our Safety & Security investing theme

Once again cyber hacking is back in the news on several fronts:

- The hospitality giant InterContinental Hotels Group (IHG) has confirmed that payment systems of 12 US hotels were victims of a massive data breach between August and December 2016.

- An anonymous attack took down web-hosting company Freedom Hosting II, which hosts dark websites — sites that require software to access. All told, thousands of dark websites were taken offline in the process.

- Taiwan is investigating an unprecedented case of threats made to five brokerages by an alleged cyber-group seeking payment to avert an attack that could crash their websites.

- Norway’s foreign ministry, army, and other institutions have been targeted in a cyber-attack by a group suspected of having links to Russian authorities, according to Norwegian intelligence.

And that’s just a sampling of the cyber attack related headlines over the last few days. When we add in the growing number of corporate cyber attacks as well as those against government institutions (remember those from last November?), we are reminded that a few years ago former Defense Secretary Leon E. Panetta warned that the United States was facing the possibility of a “cyber-Pearl Harbor” and was increasingly vulnerable to foreign computer hackers who could dismantle the nation’s power grid, transportation system, financial networks, and government.

This earnings season we’ve seen a pickup in orders at a number of cybersecurity companies ranging from Fortinet (FTNT) and Checkpoint Systems (CKP) to Proofpoint (PFPT). Sifting through those reports, we find several common items bubbling to the surface:

There is the secular trend in cybersecurity that includes not only adoption of cyber security solutions for Internet of Things and Cloud, but also customers migrating to integrated solutions over single-point ones.

That migration is driving vendor consolidation, which with hindsight explains some of the extended sales cycles we heard about in the back half of 2016.

One positive is companies like Fortinet are seeing a pronounced pick-up in larger deal size, even as they add more customers. With Fortinet, it added 10,000 customers during 4Q 2016, which left it total customer base to more than 300,000. Meanwhile, Fortinet experienced significant growth in its larger deal sizes, up 31-39 percent for deal sizes above $500,000 and $1 million respectively.

This tells us that corporations and other institutions are stepping up their game for this dark side of our Connected Society investing theme. That bodes very well for cybersecurity stocks, which represent a key aspect of our Safety & Security investing theme.

The issue is deciding which one to place our hard-earned capital in… in our view, the near constant one-upmanship between hacker & attackers and cyber security firms looks an awful lot like the gaming console “wars” from a few years ago. Every time there was a hot new game, gamers would flock to the new platform. As cyber attackers become more creative, we suspect we are likely to see some cyber security firms respond more quickly than others, leading to market share shifts and better revenue and profit growth.

While this may sound like a complex problem, the solution could not be simpler.

Rather than focus on any one or two cyber security companies, instead we’ll place a basket of them onto the Tematica Select List. That basket is PureFunds ISE Cyber Security ETF (HACK), which counts Fortinet, Checkpoint Software, Palo Alto Networks (PAWN), Proofpoint, Symantec (SYMC), Qualys (QLYS), CyberArk Software (CYB) and Imperva (IMPV) among its top holdings. In sum, those eight positions account for just under 41 percent of the ETF’s assets.

Over the last several months HACK shares have been on a tear, but as our Connected Society theme continues to expand to include more devices (the Connected Car, Connected Home, the Internet of Things) across more of the globe (see Facebook’s 4Q 2016 earnings results below for an example of this), odds are the demand for cyber security solutions will remain robust. Just take a look at how often people in restaurants and elsewhere are checking their smartphones — the Connected Society toothpaste is not going to go back into its tube.

- As such, we see long legs ahead for the cybersecurity aspect of our Safety & Security investing theme, which to us makes HACK a core, long-term holding.

- In keeping with that, we are issuing a Buy on PureFunds ISE Cyber Security ETF (HACK), with a long-term price target is $35.

- We’re inclined to use pullbacks below $25 to improve our cost basis.

We would point out that cyber security is one aspect of our Safety & Security investing theme, which also includes personal, homeland and corporate security. President Trump continues to speak about rebuilding the US military, which should spur demand for a variety of defense companies. As more clarity comes to these proposed plans, we’ll look to include the proper exposure should valuations offer a compelling entry point. Stay tuned.

Amazon (AMZN) Connected Society

Since the calendar turned to 2017, Amazon shares have been on a nice trajectory. Following December-quarter results, however, which included weaker-than-expected guidance for the current quarter, largely due to foreign currency issues, Amazon shares slipped just over 3 percent this past week. Given the comments we’ve heard across the earnings spectrum this reporting season about foreign currency, Amazon was bound to disappoint. Excluding the $558 million unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 24 percent compared with fourth quarter 2015 versus the reported 22 percent increase for the quarter.

We also continue to see the company investing for the long term as it builds out its streaming content, expands its Fulfilled By Amazon and other initiatives such as Alexa, its voice digital assistant. Even so, margin expansion at both the North American business, as well as Amazon Web Services, enabled Amazon to handily beat consensus EPS expectations of $1.42 with reported earnings of $1.54 for 4Q 2016. Year over year, EPS improved more than 50 percent despite the stepped-up level of investments in the second half of 2016 and revenue shortfall of nearly $1 billion in the December quarter. To us, this means those who have questioned Amazon’s ability to deliver profitable growth while continuing to invest are likely to rethink their position . . . or they should be.

As investors, our view tends to be skewed to the medium to longer term. It’s that view that recognizes Amazon continues to invest for future growth as it benefits from the accelerating shift to digital shopping and Cloud adoption that led Amazon Web Services (AWS) to grow 47 percent year over year in the December quarter. For 2016 in full, AWS revenue rose 55 percent to more than $12 billion, with margins rising to 30 percent from 23.6 percent in 2015. To put this into context, AWS accounted for just 9 percent of overall Amazon revenue in 2016 but was responsible for just over half of the company’s 2016 operating income.

Turning to Amazon’s North American business, revenues climbed 22 percent in the December quarter, but operating margins in that business rose to 4.7 percent. Doing some quick math, we’d note the incremental margin for the North American business clocked in at 6.8 percent, which tells us the company is indeed realizing volume benefits and other synergies in this business.

Amazon’s international business continues to be a drag on overall profits as it posted operating losses both for the December quarter and for 2016 in full. As we have seen in recent quarters, Amazon will continue to invest for future growth, but it has developed a more disciplined approach, and we suspect that approach will be utilized in the International business as well.

This brings us to the company’s guidance for the current quarter, which fell short of consensus expectations due in part to foreign exchange rates. As Apple (AAPL) CEO Tim Cook noted on that company’s earnings call, foreign exchange will be a “major negative” as the company moves from the December to the March quarter.

The same holds true for Amazon, which shared that it expects foreign currency to impact current quarter revenue by $730 million. Factoring that into the consensus view that expected revenue for the current quarter will land near $36 billion, Amazon’s guidance of $33.25 billion to $35.75 billion, up 14 percent-23 percent year over year, is far more understandable. Stepping back, that year-over-year guidance is in a very challenging retail environment and in our view implies continued share gains at both the North American and AWS businesses. On the operating income guidance, Amazon again offers a range that is wide enough to fly a 747 through.

Stepping back and looking at the company’s competitive positions poised to benefit from their respective Connected Society tailwinds — the shift to digital consumption (shopping, content streaming, grocery) and Cloud adoption — we continue to see favorable revenue and profit growth for AMZN over the long term.

- We’ll continue to monitor retail sales data and Cloud adoption as well as other relevant data points, but for now, are keeping our $975 price target for Amazon shares as well as our Buy rating.

- To be blunt, Amazon is a stock to own, not trade. We’d suggest subscribers who are underweight in the shares use the recent pullback to their long-term advantage.

The Walt Disney Company (DIS) Content is King

Last night Content is King company Walt Disney reported December quarter earning of $1.55 per share, $0.06 per share better than consensus expectations. Offsetting that upside surprise, which was partly fueled by the company’s share buyback efforts given the near 4% drop in the share count year over year, revenue for the December quarter came in lighter than expected at $14.78 billion vs. the consensus that was looking for $15.29 billion.

In our view, even though revenue and earnings fell compared to the December 2015 quarter we have to remember the year-ago quarter was one for the record books due in part to the impact of Star Wars: the Force Awakens on several Disney businesses.

- Given the tone of the underlying business, which should improve throughout the year, and prospects for Disney to further shrink its share count in the coming quarters thereby enhancing EPS metric in the process, we are keeping our $125 price target intact even as several Wall Street firms are boosting their price targets to levels higher or inline with ours.

- We continue to rate the shares a Buy, but would advise subscribers that are underweight the shares to be more aggressive at price below $105 should they arise in the coming weeks.

Let’s Dig into the Details of Disney’s Latest Quarter

For a year at the company that had been described as one starting off slow and building throughout the year, the December quarter was, in our view, a solid one, especially after factoring in the results from the latest installment of the Star Ware franchise, The Force Awakens.

Without question, the standout-out performance was had at the company’s Parks and Resorts business which delivered a 13% increase in operating income on “just” a 6% revenue increase year over year. That business continues to benefit from tight cost controls as well as price hikes taken during calendar 2016. As we get ready for spring break travel season, we’ll be watching for potential 2017 price hikes at the domestic parks. In late May, Pandora: The World of Avatar will open at Disney’s Animal Kingdom in Orlando, Florida. This follows the roll out of Frozen across several parks, and longer-term yet-to-be-named Star Wars-themed lands at Walt Disney World and Disneyland in 2019.

Near-term, the Parks business will benefit from an extra week in the current quarter, but with the Easter holiday falling later than usual this year and landing in the June quarter that timing issue is expected to weigh on current quarter prospects. Timing will also impact the Studio business, which has just one major release in the current quarter — Beauty & the Beast — which looks to be a strong performer, but will be forced into comparisons to The Force Awakens and Zootopia in the year ago quarter.

Moving past the current quarter, the Studio business has a number of Marvel, Pixar and Star Wars films in the pipeline that include a new Spider-Man movie, a sequel to the Cars film, Guardians of the Galaxy 2 and the next Star Wars installment, all of which makes for a very strong second half of the year.

That brings us to the company’s Media Networks business, which is composed of Cable Networks and Broadcasting. This segment has been one investors have been watching closely given the performance of ESPN over the last several quarters and questions about the broadcasting business as streaming alternative become more robust. Case in point, our own AT&T’s DirecTV Now and a similar service soon to be launched by Hulu. During the yesterday’s earnings conference call, Bob Iger reminded participants of initiatives to bring ESPN content to various streaming platforms (Sling TV, PlayStation Vue, DirecTV Now, and Hulu). After the call, The Wall Street Journal reported a new unannounced but signed deal with YouTube. Combined with its BAMTech acquisition, Disney continues to move in the right direction to reposition the Media Networks business to deliver content to consumers when and where they want it. We’ll be looking for additional color on the YouTube relationship, including advertising revenue potential.

Outside of the company’s performance and business outlook, the biggest news that likely has investor tongues wagging this morning is the news that CEO Bob Iger is open to staying after his contract expires in 2018. We see that helping to calm the transition concerns and reassures investors that Iger is likely to remain on board to groom his successor.

On the housekeeping front, Disney repurchased about 15 million shares for about $1.5 billion during the December quarter. Including the current quarter, Disney has bought back some 22 million shares for approximately $2.2 billion leaving $5-$6 billion to go on its announced plan to spend $7-$8 billion on buying back shares this year.

CalAmp (CAMP) Connected Society

CAMP shares rose modestly last week, bringing the year-to-date return to 5.0 percent, which is well ahead of the major market indices on the same basis. As we’ve shared, one of the key near-term catalysts for CAMP shares is the electronic logging device (ELD) mandate, which requires trucking companies to move from paper logbooks to electronic logs to record drivers’ hours of service by Dec. 18, 2017.

Last week, freight transportation companies Landstar (LSTR) and Hub Group (HUBG) reported quarterly earnings and inside those conference calls was some bullish commentary for CalAmp. Landstar shared that it has programs to migrate the non-complaint portion of its truck fleet to ELDs before year-end and it’s “beginning those conversations now in order to make that occur.” While Hub Group did not call out ELD spending specifically, it acknowledged that its capital spending would trend higher year over year in 2017 due in part to technology-related investments. Given the ELD mandate, we suspect there at least a portion of that spending will be to ensure its vehicles comply by the current deadline.

Industry estimates suggest more than one million ELDs will be deployed in the U.S. this year to comply with that mandate. This bodes very well for CalAmp’s core telematics systems business (57 percent of revenue) in the coming quarters. Longer term, we continue to see the company’s business model benefiting from the connected vehicle market, which includes autos, trucks and other equipment like that from customer Caterpillar (CAT).

- We continue to rate CAMP shares a Buy with a $20 price target.

Dycom Industries (DY) Connected Society

As we noted in last week’s Tematica Investing, several of Dycom’s key customers recently reported quarterly earnings and the combined capital spending plans of those customers — AT&T, Verizon, and Comcast — look to be flat to up year over year, with a greater portion of spending on network capacity and new technologies (5G, Gigabit fiber). This week we’ll get quarterly results from CenturyLink (CTL) and given the prevailing trends we expect it, too, will offer a favorable capital spending outlook for 2017 and beyond. Having said that, we will listen for any positive or negative impact in CenturyLink’s $34 billion plan to buy Level 3 Communications (LVLT).

We continue to see Dycom as a prime beneficiary of that wireless and wireline capital spending required to keep feeding our data-hungry Connected Society investment theme. In our view, the current share price offers subscribers who are underweight in Dycom an excellent opportunity to pick up the shares at better prices than we’ve seen recently.

- We continue to rate Dycom shares a Buy with a $110 price target.

Facebook (FB) Connected Society

Despite delivering better-than-expected December-quarter earnings with strong user metrics and average revenue per user (ARPU), FB traded modestly lower following those quarterly results. To us, the one statistic that jumped out at us was the company’s ability to get nearly 30 percent more revenue per user during the quarter.

- With advertising dollars continuing to shift to digital platforms, we continue to see Facebook’s efforts paying off in the coming quarters.

- As such, we continue to rate shares a Buy. As we do this, we’re boosting our price target to $155 from $150.

Now onto the quarter results . . .

Facebook reported December quarter EPS of $1.41, well ahead of the $1.31 per share consensus forecast. Revenue for the quarter climbed more than 50 percent, year over year, to $8.63 billion, besting revenue expectations of $8.49 billion. Sifting through the various metrics from daily active users to mobile daily active users, all the metrics were trending in the right direction with both up 17 to 18 percent year over year.

We continue to see the growing influence of mobile on Facebook’s business with 1.74 billion mobile monthly active users, roughly 93 percent of the company’s monthly active user base. As we mentioned above, we continue to see Facebook capturing advertising share, and it did just that in the December quarter as mobile advertising accounted for roughly 84 percent of its advertising revenue in the quarter. We chalk this up to Facebook monetizing more of its platforms (Facebook, Instagram and now Messenger) as well as the greater use of video. As the company continues to improve its ad targeting across users, we would expect some lift in pricing, which should benefit margins.

Part of our initial investment thesis for Facebook was not only the social network company’s ability to not only expand its reach across the globe, but also improve average revenue per user (ARPU) metrics as it does this. During the quarter, the company’s ARPU climbed more than 30 percent, year over year, on a global basis. As one might expect, ARPU remains skewed heavily to the U.S. and Canada, which clocked in at $80, up some 47 percent year over year. As a result, U.S. and Canada accounted for just over 50 percent of revenue followed by Europe (23 percent), Asia-Pac (15 percent) and Rest of World (10 percent). Even so, all geographies were up double-digits, year over year, from a low of 17 percent (Asia-Pac) to a high of 28.7 percent (Europe).

The bottom line is our thesis on the shares remains intact, and we continue to see the tailwinds blowing hard as advertisers continue to focus on digital advertising. We liken this to the shift to digital shopping by consumers that is benefiting our Amazon (AMZN), $839.40, 5.54 percent) shares. Much like that shift, we do not see the one behind Facebook slowing in the near-term.

International Flavors & Fragrances (IFF)

Rise & Fall of the Middle Class

In a quiet week of trading, with no company-specific news, IFF shares were down 1.6 percent, keeping them in the same range they’ve been in over the last several weeks. We continue to see ample upside to our $145 price target over the coming quarters fueled by rising disposable income, particularly in the emerging markets, but also from the shift in consumer preferences to natural and organic flavors. We saw confirmation in this from competitor Givaudan, which as part of its December-quarter earnings report last week shared that, “Natural flavors have been going at an average of 8 percent over the last two years… and represent more than 40 percent of our flavor sales.”

For its fragrance business, Givaudan achieved double-digit growth in North America and a solid performance in Latin America and the Middle East. We see these results as a positive for IFF when it reports its quarterly results on Feb. 15, but we will remind subscribers that given IFF’s international exposure, currency is likely to weigh on its results as well as its near-term outlook. But as we have said before, we see that largely reflect in the share price. We continue to focus on the growing shift to organic flavors and fragrances, the former of which has soda companies such as Coca-Cola (KO) and PepsiCo (PEP) looking to reformulate their products to exclude sugar.

Longer term, the outlook remains bright for this market as the Freedonia Group’s forecast calls for global demand for flavors and fragrances to reach $26.3 billion by 2020, which would be a 21 percent increase from $21.7 billion in 2015.

- We continue to rate IFF shares a Buy at current levels.

Over the last week, the S&P 500 rose 0.6 percent, with the bulk of that move coming on the heels of the January Employment Report. As we pointed out in this week’s Monday Morning Kickoff, the face of that report was mostly positive, and when paired with other January manufacturing reports out last week, it likely paves the way for the Fed heads to start jawboning about a potential rate hike at the March FOMC meeting.

Over the last week, the S&P 500 rose 0.6 percent, with the bulk of that move coming on the heels of the January Employment Report. As we pointed out in this week’s Monday Morning Kickoff, the face of that report was mostly positive, and when paired with other January manufacturing reports out last week, it likely paves the way for the Fed heads to start jawboning about a potential rate hike at the March FOMC meeting.