Costco vs Amazon? We see opportunity for both

In this Week’s Issue:

- Amazon (AMZN) to Buy Whole Foods (WFM) and We Add Costco Wholesale (COST) Shares Back to the Tematica Select List

- Investor Short-Sightedness Triggers United Natural Foods (UNFI) Stop-Loss

- Checking in on Dycom (DY) Shares

- While Disney’s (DIS) Summer Movie Slate Hasn’t Lived Up to Expectations, We Still See Some Bright Spots

We’ve given each other some hard lessons lately, but we ain’t learnin’

The quote above is a lyric by Bruce Springsteen, and it came to mind as we look at this week’s market. So far, we took one step up on Monday, and then one step back on Tuesday, essentially wiping out any gains. Let’s hope we don’t end up following Springsteen’s full lyrics and taking “one step up and two steps back” as the rest of the week plays out.

The biggest hit so far this week was had in the energy “sector” as oil prices continued their move down, officially moving into bearish territory. Crude’s slide is due not only to growing supply, but also weak demand. Not to sound like a know it all, but supply-demand dynamics are pretty much economics 101, and when we see ramping US supply alongside a slowing domestic economy, it hasn’t been hard to guess where the price of oil is headed.

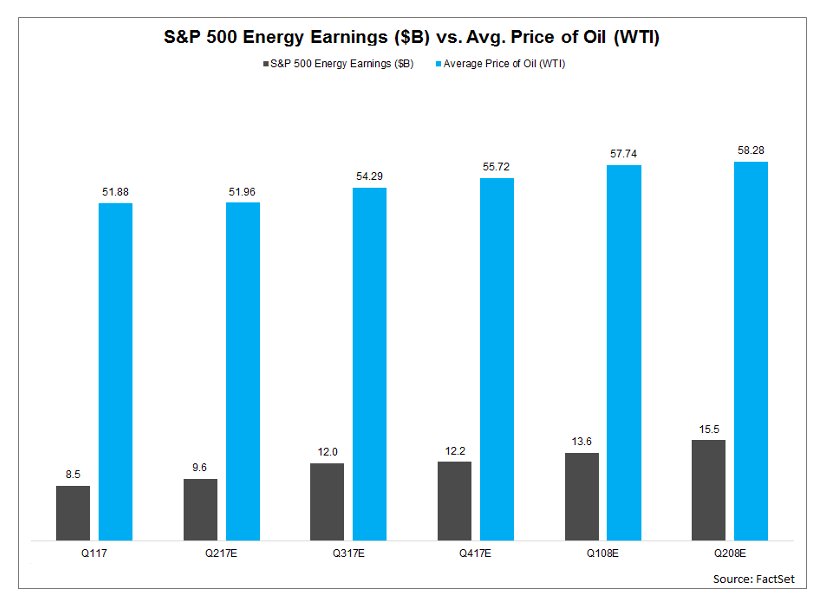

The proverbial second shoe to watch is earnings. We mention this because according to FactSet the energy sector is expected to be the biggest contributor to EPS growth for the S&P 500 in the current quarter. Oil, however, closed last night at $43.34, well below the $51 level it averaged in 1Q 2017 and the $52 mean estimate for the average price of oil for Q2 2017.

What this likely means is we are going to see negative revisions for energy earnings if not for the current quarter then for the back half of 2017. As those revisions happen, the ripple effect will bring down expected earnings growth for the S&P 500 as well. And that’s before we share the New York Fed’s Nowcast for 2Q 2017 GDP hit 1.9 percent this week with 3Q 2017 falling to 1.5 percent.

Then there is the upcoming health care battle in the Senate and the rest of the Trump agenda (repatriation, tax reform, infrastructure), which as we’ve been saying is far more likely to begin anew after the 2017 elections.

The bottom line is, it looks like the market is bound to have a bout of indigestion come 2Q 2017 earnings season that kicks off soon after the July 4th holiday. Of course, here at Tematica, we don’t “buy the market,” but rather capitalize on our multi-year thematic tailwinds. With that in mind, in this week’s issue of Tematica Investing we’re bringing an old favorite back into the fold – Cash-Strapped Consumer play Costco Wholesale (COST). We also share our thoughts on Amazon (AMZN) buying Whole Foods Market (WFM), and check in on both Dycom (DY) and Disney (DIS).

Amazon (AMZN) to Buy Whole Foods (WFM) and We Add Costco Wholesale (COST) Shares Back to the Tematica Select List

If you were pulling an abbreviated Rip Van Winkle over the last few days and missed the headlines, Amazon (AMZN) is back in the news as it once again looks to implement what we can only be viewed as an amping up of its creative destruction on the grocery industry. Friday morning the company announced it has a definitive agreement to acquire Whole Foods Market (WFM) for $42 per share in all cash transaction valued at $13.7 billion. With $21.5 billion in cash and just $7.7 billion in total debt on a balance sheet with $21.7 billion in equity, we see little if any financing challenges for Amazon.

Per usual, Amazon was scant on details, but we see this acquisition catapulting its position in grocery, particularly organic and natural that continues to be one of the fastest growing grocery categories. Amazon should also be able to utilize Whole Foods warehouse and stores to expand the reach of its Amazon Fresh business at a time when more consumers are embracing online grocery delivery. With companies like Panera Bread (PNRA) sharing that 26% of its weekly orders are now generated digitally, we suspect we are at or near the tipping point for digital grocery. For those unfamiliar with Whole Foods’s existing online delivery offering, it currently offers delivery in under 1 hour from a growing number of locations, which strategically fits with Amazon’s Prime Now offering.

According to the “The Digitally Engaged Food Shopper” report from Nielsen (NLSN), currently a quarter of American households buy some groceries online, up from 19% in 2014. The report goes on to forecast that more than 70 percent will engage with online food shopping within 10 years resulting in online grocery capturing 20 percent share up from 4.3 percent in 2016. When dealing with percentages, we prefer to consider the actual dollar amounts and in this case, it means online grocery jumping to more than $100 billion by 2025, up from $20.5 billion in 2016.

Now, a quick word on this decade forecasts. We tend to ignore the actual numbers, preferring instead to note the vector, which in this case is solidly higher and fits with our increasingly connected society. That said, we know Amazon tends to play the long game, and we see them once again doing this by entering into this transaction with Whole Foods, a deal that offers a solid base from which to flex its logistical muscles. We find this move far more appealing than if Amazon opted to build it from scratch, given the existing infrastructure as well as the simple fact that for the duration Whole Foods management team will continue to run the chain after the deal closes and stores will continue to operate under the Whole Foods brand.

In a nutshell, we see this as a win-win for Amazon as it looks to battle Kroger (KR), Sprouts Farmer (SFM), Wal-Mart (WMT) and others that have ventured into the grocery space like Target (TGT) for consumer wallet share.

We would point out that we are not as negative as some over the potential impact on Costco Wholesale (COST), which derives a significant percentage of its operating profit from membership fees. Costco continues to expand its warehouse footprint, which bodes well for growing its all-important membership fee income.

Following the Amazon-Whole Foods news, Costco shares are off roughly 9 percent and we see this as more than just an overreaction. Rather we see this as an opportunity to get back into COST shares, as the company continues to both expand its footprint as well as continue to help the Cash-Strapped Consumer stretch their disposable income. For those subscribers that have been with us a while, you’ll remember Costco was added to the Tematica Select List last September and we ended up selling half the shares and were stopped out of the second half on a dip of the shares. All told, our positions generated a 14.6 percent return and given the recent dip in the shares, we’re ready to add another batch of shares to our cart:

- We are adding back shares of Costco Wholesale (COST) back to the Tematica Select List with a price target of $190.

- As we will look to opportunistically improve the cost basis of this position, there is no recommended stop loss at this time.

Getting back to Amazon, there has been no shortage of headlines speculating what may or may not happen in the grocery sector with the move. Our position is we see Amazon using Whole Foods as a platform that not only expands its Amazon Fresh footprint, it also improves Amazon’s position within our Food with Integrity investing theme. That brings the number of thematic tailwinds pushing on Amazon to 6 – Connected Society, Cash-Strapped Consumer, Content is King, Cashless Consumption, Rise & Fall of the Middle Class and now Food with Integrity. As we share this we once again we find ourselves once again thinking Amazon is business and a stock to own, not trade as it continues to be a disruptor to be reckoned with.

- We are boosting our price targets on Amazon (AMZN) shares to $1,150 from $1,100 to factor in the existing Whole Foods business.

- We continue to rate AMZN shares a Buy.

Investor Short-Sightedness Triggers UNFI Stop-Loss

From time to time, we say our goodbyes to a position on the Tematica Select List. The reasons can be a position has reached its price target, original thematic tailwinds may give way to headwinds or the stop-loss gets triggered.

This last one is what happened with United Natural Foods (UNFI) when the shares crossed below the $38.50 stop loss that was set last week. Interestingly enough, they passed through that stop loss level on the news of Amazon (AMZN) acquiring Whole Foods Market (WFM), which would likely do more good for UNFI’s business than harm. This isn’t the first nor is it likely to be the last of the herd shooting first and asking questions later.

- We’ll place UFNI shares on the Thematic Contender’s list, and look for a compelling re-entry point should one emerge like it did with Costco shares.

Checking in on Dycom Shares

We remained patient with shares of Dycom (DY) after the company offered weaker than expected guidance inside its March quarter earnings. Over the last few weeks, we have been rewarded for that patience as DY shares have rebounded 15 percent to current levels. Granted, we’re still a ways off the $105-$100 level high we saw prior to the dip, but flipping that around, it is still an opportunity for subscribers that missed out on Dycom’s sharp move higher from late March through most of April to add to their position. We say this because, over the last few weeks, Dycom and other specialty contractors have been making the conference rounds sharing upbeat comments regarding the accelerating deployment of 5G wireless technologies and gigabit Ethernet over the coming years.

From a thematic perspective, we see the increasing amount of screen time we are all accumulating across our desktops, tablets and smartphones, as well as other burgeoning connected applications (car, home, Internet of Things) choking network capacity. Part of the solution is to roll out these next generation solutions, but also for the carriers to expand existing network capacity – all of which bodes well for Dycom, given its customer base that includes AT&T (T), Comcast (CMCSA), Verizon (VZ) and CenturyLink (CTL).

Hindsight being 20/20, DY shares were more than likely overextended, and odds are no matter what the management had provided as an outlook for the current quarter, it would have fallen short of expectations. That’s the downside of a quick rocket ride higher like the one we’ve enjoyed in Dycom shares, but we recognized this when we opted to keep the position on the Tematica Select List and now we’re reaping the rewards of that decision.

- Our price target on DY remains $115, which offers more than 25% upside from current levels.

While Disney’s Summer Movie Slate Hasn’t Lived Up to Expectations, We Still See Some Bright Spots

Since peaking in late April, shares of Walt Disney (DIS) have fallen 10 percent as some of the company’s movies fell short of expectations, especially the new installment of the Pirates of the Caribbean franchise. Granted, Guardians 2 still took the box office, and we’re still determining how successful the latest Pixar film, Cars 3, will be, but it is probably safe to say that Disney’s not hitting it out of the park like it has in recent years. That reflects the thin by comparison movie slate the company has this year and with no new films until Thor: Ragnarok (Oct. 21), Coco (Nov. 22) and Star Wars: The Last Jedi (Dec. 22) it means a relatively quiet summer for Disney’s film business.

The next major event to watch is the Disney-run D23 Expo from July 14-16 at the Anaheim Convention Center in California, which should provide a number of updates on the company’s various businesses. Historically, it’s been a showcase for Disney’s films, including clips of those soon to be released. This year, we expect more details on its extended Marvel and Star Wars franchise plans as well as likely timing for Frozen 2 and The Incredibles 2 from Pixar. After D23 Expo, however, as we mentioned above, it’s likely to be a relatively quiet summer for Disney. With a $10 billion buyback in place and declining capital spending, we see support for the stock near current levels, with upside likely nearing the last few months of the year as Disney returns to the box office.

As we remain patient with this Content is King company, we’ll continue to monitor ongoing at ESPN as well as the parks business. The Parks & Resorts segments is one of Disney’s most profitable business segments and while the business tends to benefit from price increases, there is another reason we see better margins ahead. The factor behind this is Disney’s Shanghai theme park, after 11 million visitors, is close to breaking even after its first full year of operations. Based on performance at other non-US parks, this is far faster than anyone expected and also serves to confirm the power of Disney’s content. As that drag on profitability continues to fade, we see it becoming a positive contributor to Disney’s bottom line and increases confidence in current consensus expectations for the company to deliver EPS of $5.94 this year and $6.75 next year.

- Our price target on Walt Disney (DIS) share remains $125, which at current levels keeps the shares a Buy.

- We would be buyers of DIS shares up to $108, which leaves 15 percent upside to our price target.

We’ve had other reminders in the last few days of the profound impact of these themes, including Sears (SHLD) closing an additional 72 locations on top of the 180 it announced earlier this year. In sum, these closures will shrink the Sears footprint to roughly 1,200 locations compared to 2,073 five years ago. One-time high flying Affordable Luxury investment theme retailer Michael Kors (KORS) not only recently shared it would shut 125 full-price locations over the next two years, but it guided same-store comps and revenues lower for the coming quarters due to decreased mall traffic and increased promotional activity.

We’ve had other reminders in the last few days of the profound impact of these themes, including Sears (SHLD) closing an additional 72 locations on top of the 180 it announced earlier this year. In sum, these closures will shrink the Sears footprint to roughly 1,200 locations compared to 2,073 five years ago. One-time high flying Affordable Luxury investment theme retailer Michael Kors (KORS) not only recently shared it would shut 125 full-price locations over the next two years, but it guided same-store comps and revenues lower for the coming quarters due to decreased mall traffic and increased promotional activity.