- We are issuing a Buy on Dycom Industries (DY) shares with a $125 price target as part of our Connected Society investing theme.

- We are adding LendingClub (LC) shares to the Tematica Investing Contender List and will revisit the shares following the resolution of the current FTC complaint.

- Our price target on Costco Wholesale (COST) and Amazon (AMZN) shares remain $210 and $1,750, respectively.

- Our long-term price target on shares of Applied Materials (AMAT) remains $70.

As we inch along in the second half of the current quarter, the stock market is once again dealing with the flip-flopping on foreign trade. Last week there appeared to be modest progress between China and the US but following comments from President Trump on the pending summit with North Korea and “no deal” regarding China’s bankrupt ZTE, trade uncertainty is once again gripping the markets. Several weeks ago, I cautioned we were likely in for some turbulent weeks – some up some down – as these negotiations got underway. In my view, there will be much back and forth, which will keep the stock market on edge. I’ll continue to utilize our thematic lens and look for compelling long-term opportunities in the coming weeks, just like the one we are about to discuss…

Adding back shares of Dycom (DY) to the Tematica Investing Select List

Late last summer, we exited our position in specialty contractor and Connected Society food chain company Dycom Industries (DY) that serves the mobile and broadband infrastructure markets. Yesterday, following an earnings miss and reduced guidance from the company, its share dropped 20% to $92.64. The reason for the miss and outlook revisions stemmed from weather-related concerns during the February and March months as well as protracted timing associated with key next-gen network buildouts.

Clearly disappointing, but we have seen such timing issues before in the buildouts of both 3G and 4G/LTE networks before. In today’s stock market that double disappointment hit DY shares, no different than it has other companies that have come up short this earnings season.

We’ve often used pronounced pullbacks in existing positions to sweeten our average cost basis, and today we’re going to use this drop in DY shares to add them back to the Tematica Investing Select List.

Why?

Two reasons.

First, the inevitability of 5G network deployments from key customers (AT&T) and Verizon (VZ). Those two alongside their competitors have Sprint (S) and T-Mobile (TMUS) have committed to launching 5G networks by year-end, with a buildout to a national footprint to follow over the ensuing quarters. AT&T and Verizon accounted for 24% and 16% of the quarter’s revenue with Comcast (CMCSA) clocking in at just under 22% and Centurylink (CTL:NYSE) around 12%. This positions Dycom extremely well not only for the pending 5G buildout, but also the gigabit fiber one that is underway at cable operators like Comcast. Amid the timing disruptions with AT&T and Centurylink that led to the earnings disappointment and outlook cut, Dycom called out solid progress with Verizon, as its revenue rose more than 80% year over year. There’s also an added bonus – Dycom has little exposure to Sprint and T-Mobile, which are planning to merge and based on what we’ve seen in the past that means spending cuts are likely to be had as they consolidate existing assets and capital expansion plans.

Here’s the thing, while it is easy to get caught up in yesterday’s DY share price drop, it’s akin to missing the forest for the trees given the network upgrades and next-gen buildouts that will occur not over the coming months, but over the coming quarters.

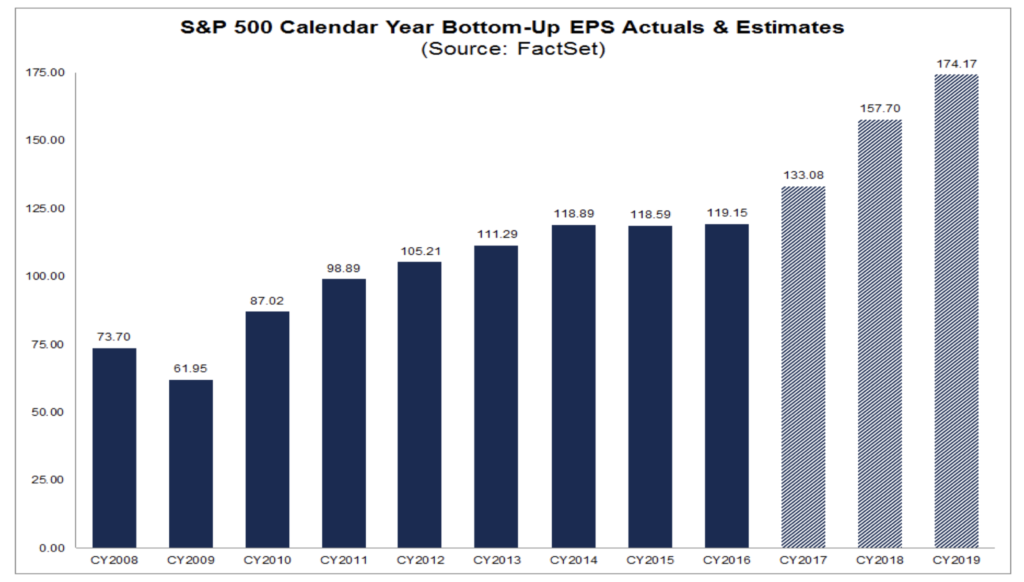

Dissecting Dycom’s quarterly earnings and revised outlook that calls for EPS of $1.78-$1.93 in the first half of the year, to hit its new full-year target EPS of $4.26-$5.15 it means delivering EPS of $2.98-$3.22 in the back half of the year. In other words, a pronounced pick up in business activity that likely hinges on a pickup in network buildout activity from its customers.

I do expect Wall Street price target revisions and analyst commentary to weigh on DY shares in the near-term. Even I am cutting my once $140 price target for the shares to $125. That $140 target was based on 2019 EPS of $7.10 per share and given the company’s comments yesterday I expect 2019 EPS forecasts to be revised down to the $6.00-$6.50 range.

As the 5G buildout gets under way, the reality is that several quarters from now, such EPS and price target cuts could prove to be conservative, but I’d rather be in the position to raise our price target as the company beats EPS expectations. That revised 2019 EPS range derives a price target for DY shares of $120-$130. For now, we’ll split the difference at $125, which still offers almost 35% upside from current share price levels.

- We are issuing a Buy on Dycom Industries (DY) shares with a $125 price target as part of our Connected Society investing theme.

Putting LendingClub shares onto the Contender List

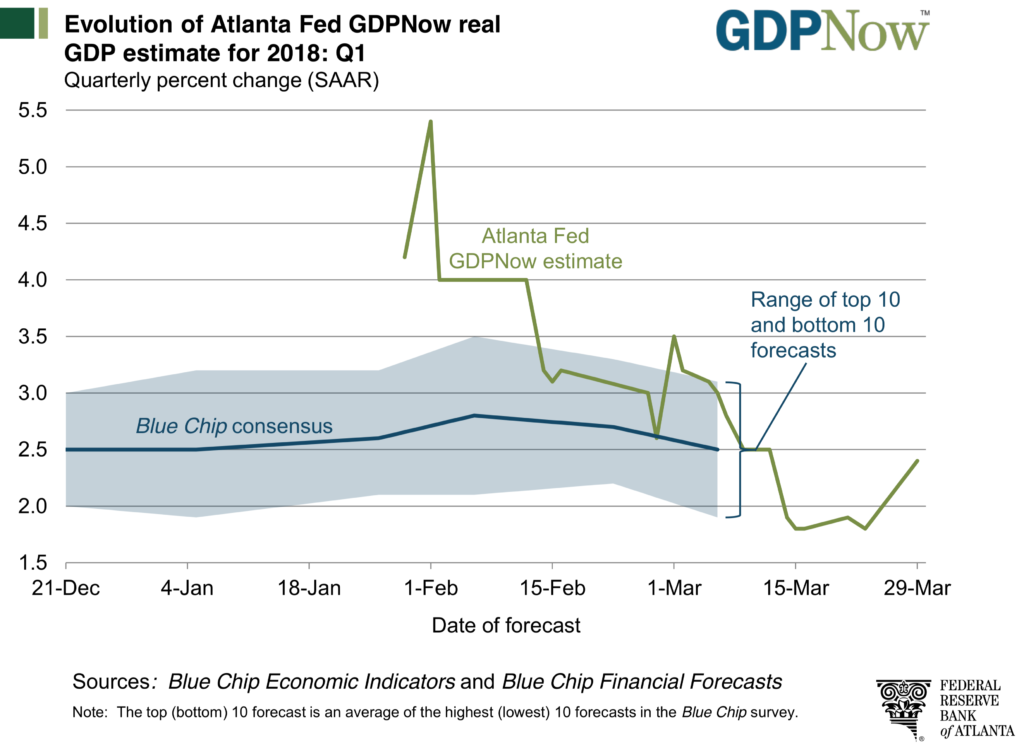

As team Tematica has been discussing over the last several weeks in our writings and on our Cocktail Investing Podcast, we’re seeing increasing signs of inflation in the systems from both hard and soft data points. This likely means the Fed will boost rates four not three times in 2018 with additional rate hikes to be had 2019. That’s what’s in the front windshield of the investing car, while inside we are getting more data that points to a stretched consumer.

- Per the May 2018 Consumer Debt Outlook report from Lending Tree (TREE), Americans are on pace to amass a collective $4 trillion in consumer debt by the end of 2018. This means Americans are spending more than 26% of their income on consumer debt, up from 22% in 2010 with the bulk of that increase due to non-house related borrowing.

- The Charles Schwab’s (SCHW) 2018 Modern Wealth Index that reveals three in five Americans are living paycheck to paycheck.

- A new report from the Federal Reserve finds that 40% of Americans could not cover an unexpected $400 expense and 25% of Americans have no retirement savings.

As consumer debt grows, it’s going to become even more expensive to service as the Fed further increases interest rates. On its recent quarterly earnings conference call, LendingClub’s (LC) CFO Tom Casey shared that “Borrowers are starting to see the increased cost of credit as most credit card debt is indexed to prime, which has moved up 75 basis points from a year ago…We have observed a number of lenders increase rates to borrowers…We know that consumers are feeling the increase in rates.”

Again, that’s before the Fed rate hikes that are to come.

The bottom line is it likely means more debt and higher interest payments that lead to less disposable income for consumers to spend. Unfortunately, we see this as a tailwind for our Cash-strapped Consumer investing theme as well as a headwind for consumer spending and the economy. We’ve seen the power of this tailwind in monthly retail same store sales from Costco Wholesale (COST), which have simply been off the charts, and in monthly Retail Sales reports that show departments stores, sporting goods stores and others continue to lose consumer wallet share at the expense of non-store retailers like Amazon (AMZN). The drive is the need to stretch what disposable spending dollars a consumer has.

The reality is, however, that those that lack sufficient funds will seek out alternatives. In some cases that means adding to their borrowings, often times at less than attractive rates.

With that in mind, above I mentioned LendingClub. For those unfamiliar with the company, it operates an online credit marketplace that connects borrowers and investors in the US. It went public a few years ago and was heralded as a disruptive business for consumers and businesses to obtain credit based on its digital product platform. That marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, unsecured education and patient finance loans, auto refinance loans, and unsecured small business loans. The company also provides an opportunity to the investor to invest in a range of loans based on term and credit.

Last year 78% of its $575 million in revenue was derived from loan origination transaction fees derived from its platform’s role in accepting and decisioning applications on behalf of the company’s bank partners. More than 50 banks—ranging in total assets of less than $100 million to more than $100 billion—have taken advantage LendingClub’s partnership program.

LendingClub’s second largest revenue stream is derived from investor fees, which include servicing fees for various services, including servicing and collection efforts and matching available loans with capital and management fees from investment funds and other managed accounts, gains on sales of whole loans, interest income earned and fair value gains/losses from loans held on the company’s balance sheet.

The core loan origination transaction fee business along with the consensus price target of $5.00, which offers compelling upside from the current share prices, has caught my interest. However, there is one very good reason for why I am recommending we wait on LC shares.

It’s because the Federal Trade Commission (FTC) has filed a complaint against LendingClub, charging that it has misled consumers and has been deducting hidden fees from loan proceeds issued to borrowers. Moreover, as stated in the FTC’s complaint, Lending Club recognized that its hidden fee was a significant problem for consumers, and an internal review by the company noted that its claims about the fee and the amount consumers would receive “could be perceived as deceptive as it is likely to mislead the consumer.”

Given the potential fallout, which could pressure LC shares, we’ll sit on the sidelines with LendingClub and look for other companies that are positioned to capitalize on this particular Cash-strapped Consumer pain point.

- We are adding LendingClub (LC) shares to the Tematica Investing Contender List and will revisit the shares following the resolution of the current FTC complaint.

- Our price target on Costco Wholesale (COST) and Amazon (AMZN) shares remain $210 and $1,750, respectively.

Sticking with shares of Applied Materials

Last week Disruptive Technology company Applied Materials (AMAT) reported quarterly results that once again topped expectations but guided the current quarter below expectations. As I mentioned above with Dycom shares, the current market mood is less than forgiving in these situations and that led AMAT shares to give back much of the gains made in the first half of May.

The shortfall relative to expectations reflected reported weakness in high end smartphones, which is slowing capital additions for both chips and organic light-emitting diode display equipment. This is the latest in a growing number of red flags on smartphone demand, which in my view is likely to be the latest transition period in the world of smartphones. For those wondering about our Apple (AAPL) shares, the company already issued a sequentially down iPhone forecast when it reported its own earnings several weeks back as it upsized its own buyback program.

Again, looking back on my Dycom comments above, mobile carriers are about to embark on building out their 5G networks, which will drive incremental RF semiconductor chip demand as well as drive demand for new applications, such as semi-autonomous and autonomous cars. I see 5G devices with near broadband data speeds driving the next smartphone upgrade cycle. When that happens, there are also other technologies, such as artificial intelligence, augmented reality, and virtual reality that will be moving into a greater number of these and other devices. On its earnings call, Applied shared it’s starting to see ramping demand for artificial intelligence, big data a cloud related applications. I see more of this happening in the coming quarters… again, the long-term forest vs. the quarterly tree… and I haven’t even mentioned the internet of things (IoT).

Another driver I’m watching for Applied’s semi-cap business is the ongoing buildout of in-China semiconductor capacity. The item to watch for this is The National Integrated Circuitry Investment Fund, which represents the Chinese government’s primary vehicle to develop the domestic semiconductor supply chain and become competitive with the U.S. chip industry leader the US. That fund is reportedly closing in on an upsized 300 billion-yuan fund ($47.4 billion) fund vs. the expected 120 billion-yuan ($18.98 billion) to support the domestic chip sector. As we have seen in the headlines with ZTE as well as the Broadcom (AVGO) bid for Qualcomm (QCOM), the semiconductor industry has taken a leading role in the current U.S.-China trade conflict. As I continue to watch these trade discussions play out, I’ll only be assessing implications for the National Integrated Circuitry Investment Fund and our Applied Materials shares.

In terms of organic light emitting diode displays and revisiting shares of Universal Display (OLED), the industry is still in a digestion period given the capacity ramp for that technology and the smartphone transition I touched on above. We’ve got OLED shares on the Tematica Investing Contender List and I’ll be watching them and signs of ramping demand as we move through the summer months.

While we wait, I expect Applied will continue to put its robust share repurchase program to use. As we learned in its quarterly earnings report last week, during the quarter, Applied used $2.5 billion of its $8.8 billion share repurchase authorization to repurchase 44 million shares, roughly 4% of the outstanding share count coming into the quarter. I suspect that once the post-earnings quiet period is over, Applied will be putting more of that program to work. I see that as limiting downside from current levels.

Finally, a quick reminder that come June, Applied will be paying its first $0.20 per share dividend.

- Our long-term price target on shares of Applied Materials (AMAT) remains $70.

- As we monitor signs of organic light emitting diode display demand, we continue to have shares of Universal Display on the Tematica Investing Contender List