Even though our concerns over the underlying fundamentals of the market remain — especially amidst this most recent rebound — thematic tailwinds continue to propel several of our positions on the Tematica Select List, particularly those tailwinds for the Cash-Strapped Consumer and Connected Society investment themes.

The week started off in rebound mode for the stock market. The damage from Hurricane Irma, while severe with several million people still without power, was far less than the devastation many forecaster models had been predicting. That sigh of relief sent stocks climbing on Monday and put the major market indices back to new record highs. While many likely cheered that rebound — especially those investors that have only recently returned to the market — several underlying dynamics remain, which could make for potential trouble in the coming weeks.

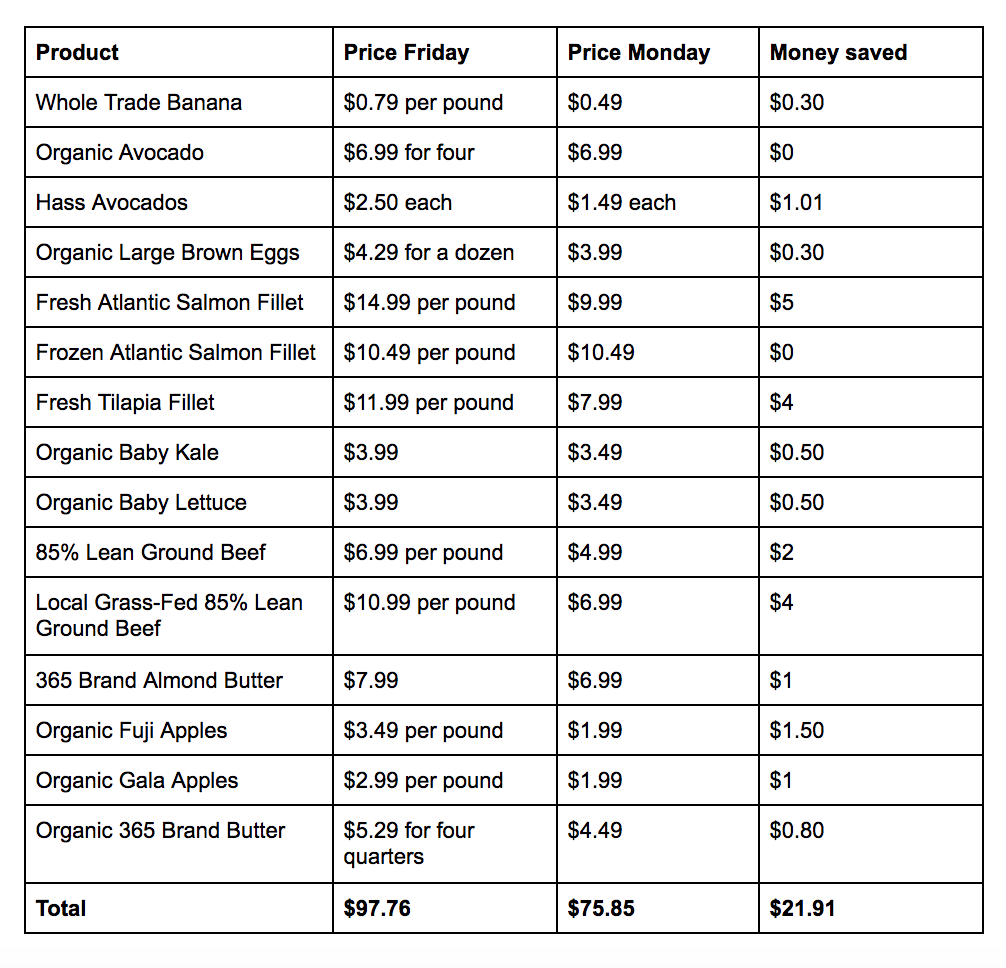

Those concerns are the same items we recapped earlier this week as part of our thought process behind Goldman Sachs (GS) CEO Lloyd Blankfein sharing the current market environment has him “unnerved”. Unfortunately, these items did not fade with the passing of Irma, nor are they likely to and in the case of market’s stretched valuation, the rebound is only exacerbating things further. Furthermore, we have yet to see any markedly downward revisions into GDP forecasts for the current quarter, despite the tens of billions in hurricane damages and business interruptions. Hardly surprising, given the regional Federal Reserve banks adjust their forecasts to published economic data and the impact of the two storms has yet to turn up in the data. But it will in the coming weeks, just the way it did in the August auto & truck data, and will in the August Retail Sales data out later this week.

From the perspective of the Tematica Select List, we continue to see the August Retail Sales report putting some much-needed perspective around Costco Wholesale (COST) shares given the simply stellar monthly comparable sales figures the company has been delivering.

- We continue to rate Costco Wholesale (COST) shares a Buy with a $190 price target.

When Market Concerns Arise, Relying on a Thematic Approach is Even More Crucial

Amid the noise in that retail sales data, we suspect our Connected Society theme and our Amazon (AMZN) shares will be share gainers from the recent Back to School shopping season. That’s also a positive for the position in United Parcel Service (UPS) that is on the Tematica Select List, and we see those shares being strong performers once again in the upcoming holiday shopping season that increasingly includes Halloween.

As crazy as it may seem, in 2016 American spent roughly $8.4 billion on Halloween. We’re already seeing rows and rows of Halloween candy line our grocery stores, even though soda manufacturers like Coca-Cola (KO) and PepsiCo (PEP), and now sports drinks companies, are looking to reduce sugar content in their offerings. We see the unsweetening of the beverage category continuing to benefit our position in International Flavors & Fragrances (IFF) as manufacturers look to replace that oh so yummy sugar taste with other appealing, yet healthier, solutions. Should the move to limit sugar spill over into candy and other confections, it would be another shot in the arm for IFF shares and potentially McCormick & Co. (MKC) as well. We’ll be talking more on this during this week’s Cocktail Investing Podcast.

- We continue to rate shares of Amazon (AMZN) a Buy at current levels, and our price target remains $1,150.

- United Parcel Service (UPS) shares, up more than 14% since being added to the Tematica Select List, are now less than a handful of dollars away from our $122 price target. As such, we rate UPS shares a Hold at current levels. As a reminder, that’s a true Hold, not Wall Street speak to exit the shares.

- The same can be said with International Flavors & Fragrances (IFF) shares, which are up nearly 17% on a blended basis. Our price target on IFF shares remains $145, however, we are revisiting this target with an upward bias.

- Our price target on McCormick & Co. (MKC) shares remains $110.

Looking Ahead to the End of the 3rd Quarter

When we exit this week, we will have two weeks left, not only in September, but in 3Q 2017 as well. It means in roughly a month’s time, we will once again be back in the quarterly earnings deluge. Given what I discussed above, I’ll be watching and listening as companies issue business updates over the next few weeks due in part to Harvey and Irma, and putting it into perspective for Tematica Select List positions. While the debt ceiling conversation has been kicked down the road until December, next week’s Federal Reserve monetary policy meeting, which is likely to leave interest rates unchanged, should clue us a bit more into the Fed’s balance sheet unwinding timetable.

Finally, while you start preparing your holiday shopping lists, I expect the political battles in Washington will once again flare up as the 2017 election season kicks into gear, just as Team Trump looks to make its case, hopefully with some concrete details, for tax reform. Giving a shot in the arm to potential political uncertainty, this morning North Korea showed trademark defiance over new U.N. sanctions imposed after its sixth and largest nuclear test.

The bottom line is we’ve seen volatility return to the market in September, and there are reasons to think we will see more of it before we enter 4Q 2017 in just a few weeks. While we continue to turn over new candidates for the Tematica Select List, we’ll continue to be patient until those potential positions have the right mix between potential upside vs. downside. Like always, our thematic lens will continue to be our North Star.

The Silver Lining in Apple’s Otherwise Lame Special Event

Some quick words on Apple’s (AAPL) special event yesterday – it was lame!

As we feared, not only did the company’s latest products show off iterative at best features, the presentation was less than enthusiastic, as was the reception by attendees at the new Steve Jobs Theater. Candidly when Apple began talking about its new retail footprint and then started the iPhone conversation with new colors, we had a feeling it was all about to go downhill. And we were right. What ensued was a noticeable groan be it for the lack of compelling new features or the fact that Apple’s “one more thing” – the iPhone X – and its $1,000 price point won’t begin shipping until early November, far later than anyone had expected.

While we missed the move in Apple shares in recent months, we see yesterday’s underwhelming event serving as a reminder that at least for now, Apple’s business remains reliant on the slower growing smartphone market. Odds are Apple will continue to gain incremental share and generate significant cash, but the opportunity for real growth from here hinges on either a new business category or a new must-have product from an existing one. As we shared earlier this week, neither of those appears to be on the near-term horizon. Given several thematic tailwinds that power its various businesses, we’ll continue to look for an opportune entry point, but for now, it looks like the shares will fall victim to “buy the rumor, sell the news.”

Now for the better news…

Just because growth is lacking at Apple, there were several announcements yesterday that bode rather well when it comes to growth for Universal Display (OLED) and AXT Inc. (AXTI). Regarding Universal Display, Apple did announce it is adopting organic light emitting diode displays in the iPhone X with its Super Retina Display, however, again, that product is not set to ship until early November. This likely means a modest push out in expectations. We see that, however, as a modest bump in the road for the capacity constrained organic light emitting diode industry that is hog tied due to demand from not only Apple but other smartphone vendors as well as other applications (TVs, wearables, interior automotive lighting). If Apple follows its historical pattern, and we think it will, we expect the Super Retina Display to make its way down the lineup into other iPhone models as well as those for iPads as supply eases and newer iterations are introduced.

While Apple’s didn’t specifically point to a display capacity shortage as the culprit behind the later than expected ship time for the iPhone X, its timetable when paired with recent comments from Applied Materials (AMAT) certainly suggest the industry remains constrained relative to demand. Moreover, with applications such as TVs calling for larger display sizes vs. those for smartphones and wearables, the industry is likely to be constrained for some time, especially as more TV vendors look to bring more models featuring that technology to market over the coming quarters. We see that as a good problem for Applied Materials and its display equipment business. The next update from Applied will be at its 2017 Analyst Day on September 27, and we expect an upbeat tone not only for its display business but from its semiconductor capital equipment one as well.

- Currently, Universal Display (OLED) shares are up a whopping 149% since we initiated the position in October, and in many respects, the outlook continues to brighten.

- As we move into 4Q 2017 and with increasing clarity on the growing number of applications we will be revisiting our $135 price target, odds are with an upward bias.

- We continue to be bullish on Applied Materials (AMAT) shares and our price target remains $55.

Turning to AXT Inc (AXTI), Apple did announce it was bringing standalone wireless connectivity to its latest Apple Watch. In order for that to happen, Apple has to pack the device with cellular technology, which means RF semiconductors that are based on AXT’s compound substrates. This is one more step in the expanding array of connected devices under the Internet of Things umbrella. From our perspective, the untethering of Apple Watch from the iPhone makes this newest model the one consumers are most likely to desire. While it’s still not enough to move the needle for Apple, it does move it for AXT.

- We will use this incremental demand to bump our price target on AXT (AXTI) shares to $11 from $10.50. The added upside keeps our Buy rating on the shares in place.

On a disappointing note . . .

There was no update on Apple Pay in yesterday’s event, other than how with its new iPhone X it is utilizing its new Face ID technology as part of the payment process with Apple Pay. We were hoping for a more meaningful update given our position in USA Technologies (USAT), but we’ll happily settle for the news coming out of CVS Health (CVS) that it is utilizing new vending machines at “select landmark locations to outside of its store footprint. These machines will be stocked with things like over-the-counter medications, beauty and personal care products, eye care and oral health care products, first aid items, batteries, phone chargers, earbuds, and healthy snacks and beverages. We see this as yet another expansion in the unattended retail market that hinges on cashless consumption that is enabled by USA’s products and services.

- Our price target on shares of USA Technologies (USAT) remains $6.