Weekly Issue: Among the Volatility, We See Several Thematic Confirming Data Points

Key points inside this issue:

- As expected, news of the day is the driver behind the stock market swings

- Data points inside the September Retail Sales Report keep us thematically bullish on the shares of Amazon (AMZN), United Parcel Service (UPS) and Costco Wholesale. Our price targets remain $$2,250, $130 and $250, respectively.

- We use the recent pullback to scale further into our Del Frisco’s Restaurant Group (DFRG) shares at better prices, our price target remains $14.

- Netflix crushes subscriber growth in the September quarter; Our price target on Netflix (NFLX) shares remains $500.

- September quarter earnings from Ericsson (ERIC) and Taiwan Semiconductor (TSM) paint a favorable picture from upcoming reports from Nokia (NOK) and AXT Inc. Our price targets on Nokia and AXT shares remain $8.50 and $11, respectively.

- Walmart embraces our Digital Innovators investment theme

- Programming note: Much commentary in this week’s issue centers on the September Retail Sales Report. On this week’s Cocktail Investing podcast, we do a deep dive on that report from a thematic perspective.

As expected, news of the day is the driver behind the stock market swings

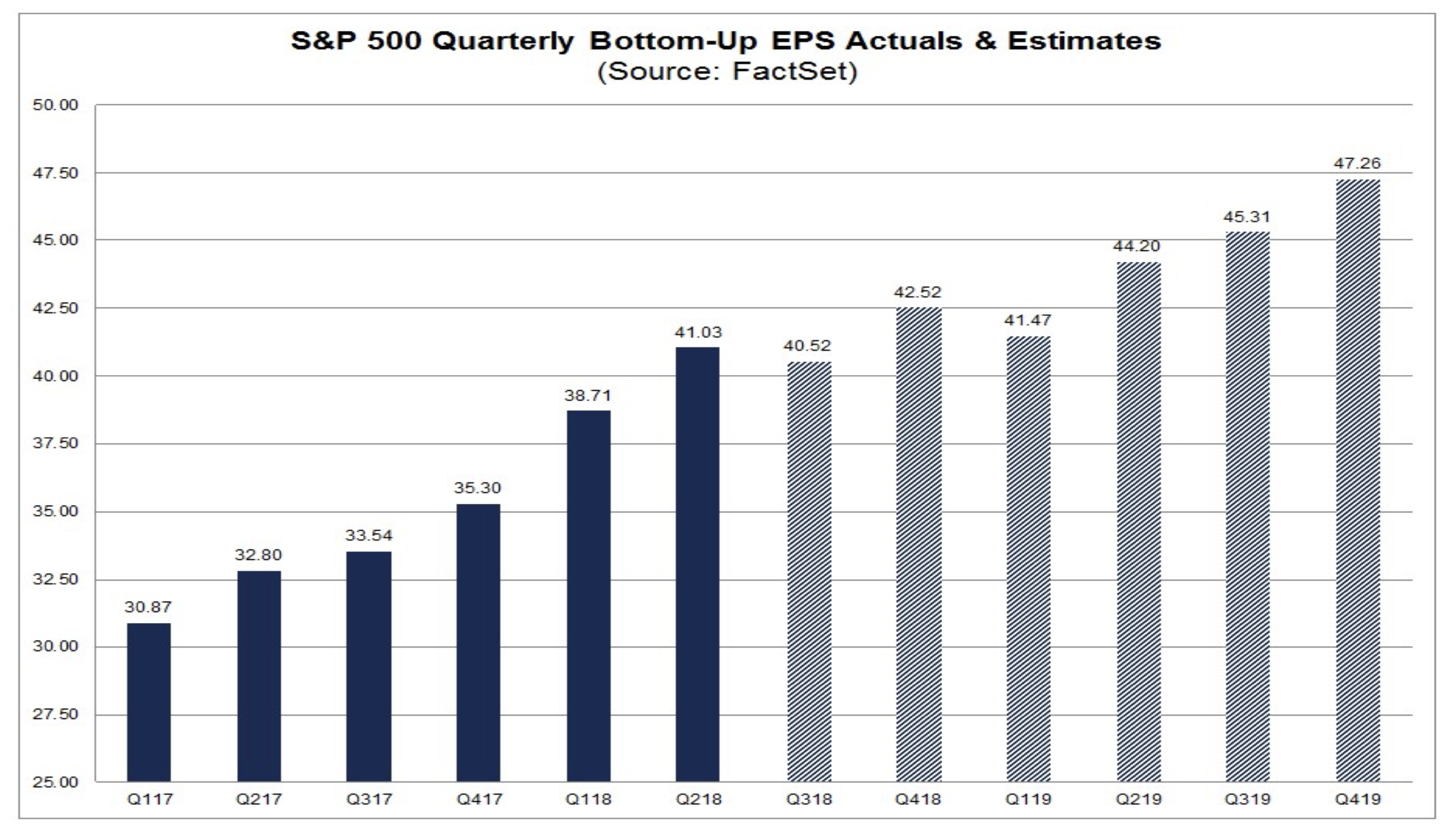

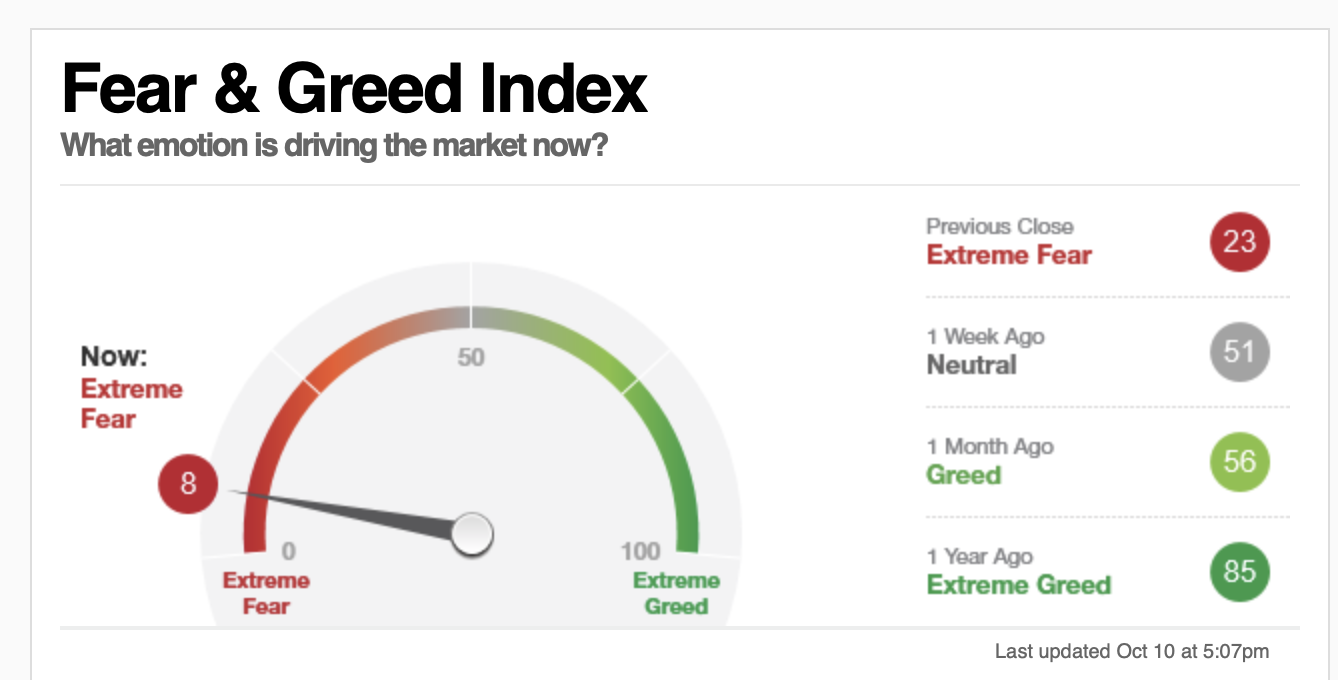

If there is one thing we can say about the domestic stock market over the last week, it remains volatile. While there are other words that one might use to describe the down, up, down move over the last week, but volatile is probably the most fitting. Last week I shared the market would likely trade based on the data of the day — economic, earnings or political — and that seems to have been the case. While we’ve received several solid earnings reports, including one from Thematic Leader Netflix (NFLX), several banks and even a few airlines, the headline economic data came up soft for September Retail Sales and Housing.

And then there was yesterday’s FOMC minutes from the Fed’s September monetary policy meeting, which showed that even though the Fed expects to remain on its tightening path, subject to the data to be had, several members of the committee see “a period where the Fed even will need to go beyond normalization of rates and into a more restrictive stance.”

Odds are we can expect further tweets from President Trump on this given his prior comments that the Fed is one of his greatest risks. I also expect this to reignite concerns for the current expansion, particularly since the Fed has historically done a good job hiking interest rates into a recession. From a thematic perspective, continued rate hikes by the Fed is likely to put some added pressure on Middle-Class Squeeze consumers. Before you freak out, let’s check the data. The economy is still growing, adding jobs, benefiting from lower taxes and regulation. It’s not about to fall off a cliff in the near term, but yes, the longer the current expansion goes, the greater the risk of something more than just a slower economy. More reasons to keep watching the monthly data.

Here’s the good news, inside that data and elsewhere we continue to receive confirming signals for our 10 investing themes as well as favorable data points for the Thematic Leaders and other positions on the Tematica Investing Select List.

Several positives in the September Retail Sales report for AMZN, UPS & COST

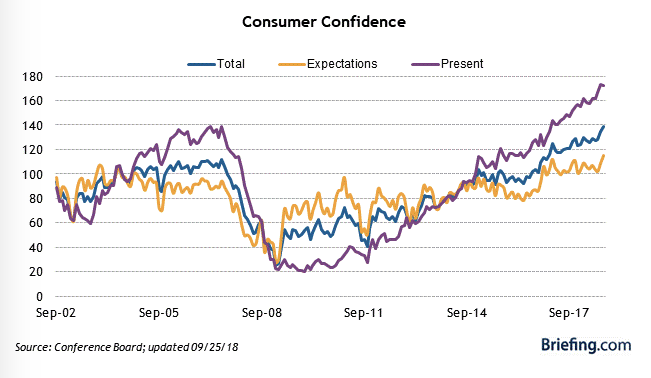

With the consumer directly or indirectly accounting for nearly two-thirds of the domestic economy and the average consumer spending 31% of his or her paycheck on retails goods, this monthly report is one worth monitoring closely.

Let’s take a closer look at this week’s September 2018 Retail Sales report. First, let’s talk about the headline miss that was making the rounds yesterday. Yes, the month over month comparison Total Retail & Food Services excluding motor vehicles & parts fell 0.1%, but Retail rose 0.4% on the same basis. The thing is, most tend to focus on those sequential comparisons, but as investors, we examine year over year comparisons when it comes to measuring revenue, profit and EPS growth. On that basis, Total Retail & Food Services rose 5.7% year over year while Retail climbed 4.4% compared to September 2017. That sounds pretty solid if you ask me. Now, let’s dig into the meat of the report and what it means for several of our thematic holdings.

Right off the bat, we can’t ignore the 11.4% year over year increase in gas station sales during September, which capped off a 17.2% increase for the September 2018 quarter. With such an increase owing to the rise in oil and gas prices, we would expect to see weakness in several of the retail sales categories as the cost of filling up the car saps spending at the margin and confirms our Middle-Class Squeeze investing theme. And we saw just that. Department stores once again fell in September vs. year ago levels as did Sporting goods, hobby, musical instrument, & bookstores. Given recent construction as well as housing starts data, the Building material & garden eq. & supplies dealer category posted slower year over year growth, which was hardly surprising.

Other than gas station sales, the other big gainer was Nonstore retailers – Census Bureau speak for e-tailers and digital commerce that are part of Digital Lifestyle investing theme, which saw an 11.4% increase in September retail sales vs. year ago levels. That strong level clearly confirms our investment thesis that digital shopping continues to take consumer wallet share, which bodes well for our Amazon (AMZN), United Parcel Service (UPS), and to a lesser extent our Costco Wholesale (COST). With consumers feeling the pressure of our Middle-Class Squeeze investing theme, I continue to see them embracing the Digital Lifestyle to ferret out deals and bargains to stretch their after-tax spending dollars, especially as we head into the holiday shopping season.

Sticking with Costco, the company recently reported its U.S. same-store-sales grew 7.7% for September excluding fuel and currency. Further evidence that Costco also continues to gain consumer wallet share compared to retail and food sales establishments as well as the General Merchandise Store category.

- Data points inside the September Retail Sales Report keep us thematically bullish on the shares of Amazon (AMZN), United Parcel Service (UPS) and Costco Wholesale. Our price targets remain $2,250, $130 and $250, respectively.

Scaling deeper into Del Frisco’s shares

Now let’s dig into the report as it relates to Del Frisco Restaurant Group, our Thematic Leader for the Living the Life investing theme. Per the Census Bureau, retail sales at food services & drinking places rose 7.1% year over year in September, which brought its year-over-year comparison for the September quarter to 8.8%. Clearly, consumers are spending more at restaurants, than eating at home. Paired with beef price deflation that has been confirmed by Darden Restaurants (DRI), this bodes well for profit growth at Del Frisco.

Against those data points, I’m using the blended 12.5% drop in DFRG shares since we added them to our holdings to improve our costs basis.

- We are using the recent pullback to scale further into our Del Frisco’s Restaurant Group (DFRG) shares at better prices, our price target remains $14.

Netflix crushes subscriber growth in the September quarter

Tuesday night Netflix (NFLX) delivered a crushing blow to skeptics as it served up an EPS and net subscriber adds beat that blew away expectations and guided December quarter net subscriber adds above Wall Street’s forecast. This led NFLX shares to pop rather nicely, which was followed by a number of Wall Street firms reiterating their Buy ratings and price targets.

Were there some investors that were somewhat unhappy with the continued investment spend on content? Yes, and I suppose there always will be, but as we are seeing its that content that is driving subscriber growth and in order to drive net new adds outside the US, Netflix will continue to invest in content. As we saw in the company’s September quarter results, year to date international net subscriber adds is 276% ahead of those in the US. Not surprising, given the service’s launch in international markets over the last several quarters and corresponding content ramp for those markets.

Where the content spending becomes an issue is when its subscriber growth flatlines, which will likely to happen at some point, but for now, the company has more runway to go. I say that because the content spend so far in 2018 is lining its pipeline for 2019 and beyond. With its international paid customer base totaling 73.5 million users, viewed against the global non-US population, it has a way to go before it approaches the 45% penetration rate it has among US households. This very much keeps Netflix as the Thematic Leader for our Digital Lifestyle investing theme.

One other thing, as part of this earnings report Netflix said it plans to move away from reporting how many subscribers had signed up for free trials during the quarter and focus on paid subscriber growth. I have to say I am in favor of this. It’s the paying subscribers that matter and will be the key to the stock until the day comes when Netflix embraces advertising revenue. I’m not saying it will, but that would be when “free” matters. For now, it’s all about subscriber growth, retention, and any new price increases.

That said, I am closely watching all the new streaming services that are coming to market. Two of the risks I see are a recreation of the cable TV experience and the creep higher in streaming bill totals that wipe out any cord-cutting savings. Longer-term I do see consolidation among this disparate services playing out repeating what we saw in the internet space following the dot.com bubble burst.

- Our price target on Netflix (NFLX) shares remains $500.

What earnings from Ericsson and Taiwan Semiconductor mean for Nokia and AXT

This morning mobile infrastructure company Ericsson (ERIC) and Taiwan Semiconductor (TSM) did what they said was positive for our shares of Nokia (NOK) and AXT Inc. (AXTI).

In its earnings comments, Ericsson shared that mobile operators around the globe are preparing for 5G network launches as evidenced by the high level of field trials that are expected to last at such levels over the next 12-18 months. Ericsson also noted that North America continues to lead the way in terms of network launches, which confirms the rough timetable laid out by AT&T (T), Verizon (VZ) and even T-Mobile USA (TMUS) with China undergoing large 5G field trials as well. In sum, Ericsson described the 5G momentum as strong, which helped drive the company’s first quarter of organic growth since 3Q 2014. That’s an inflection point folks, especially since the rollout of these mobile technologies span years, not quarters.

Turning to Taiwan Semiconductor, the company delivered a top and bottom line beat relative to expectations. Its reported revenue rose just shy of 12% quarter over quarter (3.3% year over year) led by a 24% increase in Communication chip demand followed by a 6% increase in Industrial/Standard chips. In our view, this confirms the strong ramp associated with Apple’s (AAPL) new iPhone models as well as the number of other new smartphone models and connected devices slated to hit shelves in the back half of 2018. From a guidance perspective, TSM is forecasting December quarter revenue of $9.35-$9.45 billion is well below the consensus expectation of $9.8 billion, but before we rush to judgement, we need to understand how the company is accounting for currency vs. slowing demand. Given the seasonal March quarter slowdown for smartphone demand vs. the December quarter and the lead time for chips for those and other devices, we’d rather not rush to judgement until we have more pieces of data to round out the picture.

In sum, the above comments set up what should be positive September quarter earnings from Nokia and AXT in the coming days. Nokia will issue its quarterly results on Oct. 25, while AXT will do the same on Oct. 31. There will be other companies whose results as well as their revised guidance and reasons for those changes will be important signs posts for these two as well as our other holdings. As those data points hit, we’ll be sure to absorb that information and position ourselves accordingly.

- September quarter earnings from Ericsson (ERIC) and Taiwan Semiconductor (TSM) paint a favorable picture from upcoming reports from Nokia (NOK) and AXT Inc. Our price targets on Nokia and AXT shares remain $8.50 and $11, respectively.

Walmart embraces our Digital Innovators investment theme

Yesterday Walmart (WMT) held its annual Investor Conference and while much was discussed, one of the things that jumped out to me was how the company is transforming itself to operate in the “dynamic, omni-channel retail world of the future.” What the company is doing to reposition itself is embracing a number of aspects of our Disruptive Innovators investing theme, including artificial intelligence, robotics, inventory scanners, automated unloading in the store receiving dock, and digital price tags.

As it does this, Walmart is also making a number of nip and tuck acquisitions to improve its footing with consumers that span our Middle-Class Squeeze and in some instances our Living the Life investing theme as well our Digital Lifestyle one. Recent acquisitions include lingerie company Bare Essentials and plus-sized clothing startup Eloquii. Other acquisitions over the last few quarters have been e-commerce platform Shoebuy, outdoor apparel retailer Moosejaw, women’s wear site Modcloth, direct-to-consumer premium menswear brand Bonobos, and last-mile delivery startup Parcel in September.

If you’re thinking that these moves sound very similar to ones that Amazon (AMZN) has made over the years, I would quickly agree. The question percolating in my brain is how does this technology spending stack up against expectations and did management boost its IT spending forecast for the coming year? As that answer becomes clear, I’ll have some decisions to make about WMT shares and if we should be buyers as we move into the holiday shopping season.